By Michael Roberts

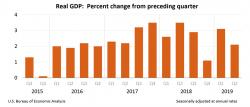

Last Friday, the US real GDP growth figures for the second quarter of 2019 were released. The annualised rate of real GDP growth slowed in the second quarter to 2.1% from 3.1% in the first. This was the slowest growth rate since the end of 2016.

US real GDP was 2.3% higher than in the same quarter last year ie (Q2 2018), down from 2.7% year on year (yoy) in Q1 2019 and recording the lowest yoy growth rate for two years.

So it seems that the boost to US growth, supposedly promoted by President Trump’s corporate tax cuts and exemptions, has run its course and US growth is back to the average of the last ten years, with the prospect of further slowing in the second half of this year.

And why is a further slowdown likely, perhaps even to the point of recession? We can find clues in the second quarter data. The main contributors to the slowdown came from weakening investment, particularly productive investment in equipment and structures; and from falling net exports or trade, as the trade war with China bites.

Investment in factories and buildings down

The 0.6% drop in business investment was the first decline since the first quarter of 2016. And that drop was led by a 10.6% decline in investment in structures, ironically the category of investment that should have received the largest boost from the tax cut.

Investment in new buildings and factories is now down by 4.6% from its year ago level. Equipment investment rose by just 0.7% after a 0.1% fall in the first quarter. The pace of investment in so-called intellectual products or computer software also slowed sharply, slowing to 4.7%, after double-digit increases in the prior two quarters (driven by Trump’s tax exemptions). Exports fell at a 5.2% annual rate.

But the most interesting part of the GDP report was the revision to the past three years’ data. The revised data showed that real GDP growth was substantially slower for 2018 than previously reported, with the growth from the fourth quarter of 2017 to the fourth quarter of 2018 just 2.5%, well below the administration’s projection at the time of the Trump tax cut.

But most important in my mind were the downward revisions to corporate profits. Instead of corporate profits rising by some 20% in the last three years, it seems that profits have actually fallen and are now lower than they were in 2014! Corporate profits were revised up $1.4 billion, or 0.1% for 2014, revised up $4.3 billion, or 0.2% for 2015, but revised down $23.5 billion, or -1.2%, for 2016, and a whopping $93.3 billion, or -4.4% for 2017, and $188.1 billion, or -8.3% for 2018.

Speculation and fictitious profits

Overall corporate profits have suffered two successive quarterly declines, both before and after tax up to Q1 2019 (the second quarter figures will be released at the end of August). US corporate profits are now 2% below where they were at the beginning of 2018.

Even before these revisions, non-financial sector corporate profits have been falling over the last five years. What this means is that while speculative or fictitious profits from investment in financial assets have increased sharply, especially with Trump’s tax cuts, profits in the productive sector of the US economy have stagnated at best.

Now I have argued in this blog and in many papers that there is a strong correlation between profits and investment in modern capitalist economies – after all, capitalist production is for profit not need and so investment in production must be profitable or it will eventually slow or stop. And there is plenty of evidence that this simple idea is correct. Not only is the correlation between profit growth and investment growth high, but the causal direction from profits to investment with a lag (on average of about a year) is also supported in empirical research.

When profits dropped in the ‘mini-recession’ of 2015-16 (mainly due to the collapse in oil prices), investment followed.

Unproductive sectors beginning to suffer

Now it seems that profits in unproductive sectors like finance and real estate are beginning to suffer. Financial profits are about 25% of total corporate profits and they have been broadly stagnant over the last year. If they should fall, as well as non-financial sector profits, that may well generate a stock market collapse in the second half of this year.

Up to now, the Trump tax cuts and the prospect that the Federal Reserve is going to cut its interest rate (probably this week) – the so-called ‘Powell put’ – has buoyed the US stock market to new record highs.

But the effect of that may wear over the next few months as investors begin to see the earnings results of the major companies. And any stock market ‘correction’ typically leads the ‘real economy’ by up to three quarters.

July 29, 2019

For original blog with all hyperlinks and charts, go to Michael Robert’s blog at:

https://thenextrecession.wordpress.com/2019/07/