By Michael Roberts

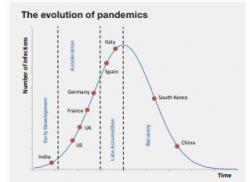

If all country pandemics were the same, then the figure in the graph (left) would show how this pandemic will come to an end. The start-to-peak ratio of Covid-19 infections for all countries would be 40-50 days. Many countries are not yet near the peak point and there is no guarantee that the peak will at the same time point, if mitigation and suppression methods (testing, self-isolation, quarantine and lockdowns) are not working similarly. But ultimately, there will be a peak everywhere and the pandemic will wane – if only to come back next year, maybe.

What is clear is that the lockdowns in so many major economies have and will deliver a humungous slump in production, investment, employment and incomes in most economies. The OECD sums up the picture best. The impact effect of business closures could result in reductions of 15% or more in the level of output throughout the advanced economies and major emerging-market economies. In the median economy, output would decline by 25%: “For each month of containment, there will be a loss of 2 percentage points in annual GDP growth”.

Major economies locked down

Looking back in my book, The Long Depression, I found that the loss of GDP from the beginning of Great Recession in 2008 through the 18 months to the trough in mid-2009 was over 6% of GDP in the major economies. Global real GDP fell about 3.5% over that period, while the so-called emerging market economies did not contract (because China continued to expand). In this pandemic, if the major economies are locked down for two months and maybe more (China’s Wuhan lockdown will not be relieved until next week; so that’s more than two months), then global GDP is likely to contract in 2020 by more than in the Great Recession.

Of course, the hope is that the lockdowns will be short-lived. As OECD general secretary Gurria said, “we don’t know how long it’s going to take to fix unemployment and the closures of millions of small businesses: but it’s wishful thinking to talk about a quick recovery.” Clearly the idea of President Trump that America can get back to business by Easter Sunday [now ditched – Ed] is not realistic.

Throwing the kitchen sink

Nevertheless, on that hope that lockdowns will be short-lived and because they have no other choice if the pandemic is to be suppressed, pro-capitalist governments have thrown the kitchen sink at their economies in order to avoid the worst. The first priority has been to save capitalist businesses, especially the large companies. So central banks have cut their policy interest rates to zero or below; and they have announced a myriad of credit facilities and bond-purchasing programmes that dwarf the bailouts and quantitative easing measures of the last ten years. Governments have announced loan guarantees and grants for businesses at amounts never seen before.

Globally, I calculate that governments have announced fiscal ‘stimulus’ packages of around 4% of GDP and another 5% of GDP in credit and loan guarantees to the capitalist sector. In the Great Recession, fiscal bailouts totalled only 2% of world GDP.

Most aid going to business

If we take the $2trn package agreed by the US Congress, way more than during the global financial meltdown in 2008-9, two-thirds of it will go in outright cash and loans that may not be repaid to big business (travel companies etc) and to smaller businesses, but just one-third to helping the millions of workers and self-employed to survive with cash handouts and tax deferrals.

It’s the same in the UK and Europe with the pandemic packages: first, save capitalist business; and second, tide over working people. The payments for workers laid off and the self-employed are only expected to be in place for two months and often people won’t receive any cash for weeks, if not months. So these measures are way short of providing sufficient support for the millions that have already been locked down or have seen their companies lay them off.

It really is naïve, if not ignorant, of Nobel prize winning economists like Joseph Stiglitz, Chris Pissarides or Adam Posen, to praise such schemes as the UK’s governments, just because it is “more generous” than the one in the US. “The U.K. deserves credit for really reversing its austerity and being very ambitious and coherent,” said Posen, who was a financial crisis-era policy maker at the Bank of Englan. “The wish-list in terms of design, size, content and coordination — all is terrific.” British arch-Keynesian Will Hutton summed up the mood: “a Rubicon has been crossed. Keynesianism has been restored to its proper place in British public life.” Even the erstwhile Austerians joined the chorus of praise, including former austerity UK Chancellor, George Osborne.

Polls suggest pick-up of support

The British and American public also seem to be convinced that the packages are generous, as the latest polls suggest a pick-up in support for the mendacious President Trump and ‘Operation Last Gasp’ Prime Minister Johnson. It seems everywhere incumbent rulers have gained support during the crisis. That may not last, however, if the lockdowns continue and slump begins to bite deep.

The reality is that the money being shifted towards working people compared to big business is minimal. For example, the UK package offers an 80% of wages pay-out for employees and self-employed. But that is actually no more than the usual unemployment benefits ratio offered by many governments in Europe. The UK had a very low benefit ratio that is now being raised to the European average and then only for a few months. And even then there are millions who will not qualify.

The shape of the recovery

Moreover, none of these measures will avoid the slump and they are way insufficient to restore growth and employment in most capitalist economies over the next year. There is every possibility that this pandemic slump will not have a V-shaped recovery as most mainstream forecasts hope for. A U shaped recovery (ie a slump lasting a year or more) is more likely. And there is a risk of a very slow recovery, more like a bent L-shape, as is appearing in China, so far.

Indeed, mainstream economics is not sure what to do. The Keynesian view is presented to us by Lord Skidelsky, Keynes’ biographer. Skidelsky pointed out that the lockdowns were the opposite of the typical Keynesian problem of ‘deficient demand’. Indeed, it is a problem of deficient supply as most productive workers have stopped work. But Skidelsky does not see it that way. You see, he reckons that it is not a ‘supply shock’ but a problem of ‘excess demand’. But ‘excess demand’ is the mirror of ‘scarce supply’. The question is where do we start: surely it starts with the loss of output and value creation, not with ‘excess demand’?

Skidelsky tells us that “a recession is normally triggered by a banking failure or a collapse in business confidence. Output is cut, workers are laid off, spending power falls and the slump spreads through a multiplied reduction in spending. Supply and demand fall together until the economy is stabilised at a lower level. In these circumstances, Keynes said, government spending should rise to offset the fall in private spending.”

Why do some banking failures not cause slump?

Readers of my blog know well that I consider, that while a recession may be “triggered” by a banking failure or “a collapse in business confidence”, these triggers are not the underlying cause of recurring crises in capitalism. Why do banking failures sometimes not cause a slump and why do businesses suddenly have a collapse in confidence? Keynesian theory cannot tell us.

Skidelsky goes on that if the crisis is one of “excess demand”, then we need to reduce demand to meet supply! I would have thought it would be better to get out of this slump by raising output to meet demand, but there we go. Skidelsky points out that “It is not that business wants to produce less. It is forced to produce less because a section of its workforce is being prevented from working. The economic effect is similar to wartime conscription, when a fraction of the workforce is extracted from civilian production. Production of civilian goods falls, but aggregate demand remains the same: it is merely redistributed from workers producing civilian goods to workers conscripted into the army or reallocated to producing munitions. What happens today will be determined by what happens to the spending power of those made compulsorily idle.”

Biggest rise in unemployment in a short time

Really? In the war economy, everybody is still working – indeed during the second world war, there was in effect full employment as the war machine was pumped up. Currently we are heading for the biggest rise in unemployment in a few quarters in economic history. This is no war economy.

Skidelsky reminds us that Keynes’s solution in the war economy of ‘excess demand’ was to propose an increase in taxation. “In his pamphlet How to Pay for the War (1940). civilian consumption, he said, had to be reduced to release resources for military consumption. Without an increase in voluntary saving, there were only two ways to reduce civilian consumption: inflation or higher taxes.” “The solution he and the Treasury jointly hit on was to raise the standard rate of income tax to 50 per cent, with a top marginal rate of 97.5 per cent, and lower the threshold for paying taxes. The latter would bring 3.25m extra taxpayers into the income tax net. Everyone would pay the increased taxes which the war effort demanded, but the tax payments of the three million would be repayable after the war in the form of tax credits. There would also be rationing of essential goods.”

More austerity and higher taxes

Wow! So Skidelsky’s answer to the current slump is to raise taxation, even for those at the bottom of the income scale in order to stop them spending too much and causing inflation! He finishes by saying that the pandemic “should deepen our understanding of what it is to be a Keynesian.” Indeed.

The current situation is not a war economy, as James Meadway says. When the so-called Spanish flu pandemic hit, it was right at the end of the first world war. That pandemic claimed 675,000 lives in the US and at least 50 million worldwide. The flu did not destroy the US economy. In 1918, the year in which influenza deaths peaked in the US, business failures were at less than half their pre-war level, and they were lower still in 1919 Driven by the wartime production effort, US real GDP rose by 9% in 1918, and by around 1% the following year, even as the flu raged.

The sick were left to die

Of course, then there were no lockdowns and people were just left to die or live. But the point is that, once the current pandemic lockdowns end, what is needed to revive output, investment and employment is something like a war economy; not bailing out big business with grants and loans so that they can return to business as usual. This slump can only be reversed with war time-like measures, namely massive government investment, public ownership of strategic sectors and state direction of the productive sectors of the economy.

Remember, even before the virus hit the global economy, many capitalist economies were slowing fast or already in outright recession. In the US, one of the better performing economies, real GDP growth in Q4 had fallen to under 2% a year with forecasts of further slowdown this year. Business investment was stagnating and non-financial corporate profits had been on downward trend for five years. The capitalist sector was and is in no shape to lead an economic recovery that can lead back to full employment and rising real incomes. It will require the public sector to lead.

Andrew Bossie and J.W. Mason have just published a perceptive paper on the experience of that public sector role in the war-time US economy. They show that all sorts of loan guarantees, tax incentives etc were offered by the Roosevelt administration to the capitalist sector to begin with. But it soon became clear that the capitalist sector could not do the job of delivering on the war effort as they would not invest or boost capacity without profit guarantees. Direct public investment took over and government-ordered direction was imposed.

Public sector dominated investment

Bossie and Mason found that from 8 to 10 percent of GDP during the 1930s, federal spending rose to an average of around 40 percent of GDP from 1942 to 1945. And most significant, contract spending on goods and services accounted for 23 percent on average during the war. Currently in most capitalist economies, public sector investment is about 3% of GDP, while capitalist sector investment is 15%-plus. In the war that ratio was reversed.

I had shown the same result in a post of mine back in 2012. I quote: “What happened was a massive rise in government investment and spending. In 1940, private sector investment was still below the level of 1929 and actually fell further during the war. So the state sector took over nearly all investment, as resources (value) were diverted to the production of arms and other security measures in a war economy.” Keynes himself said that the war economy demonstrated that “It is, it seems, politically impossible for a capitalistic democracy to organize expenditure on the scale necessary to make the grand experiments which would prove my case — except in war conditions.”

The war economy did not stimulate the private sector, it replaced the ‘free market’ and capitalist investment for profit. To organize the war economy and to ensure that it produced the goods needed for war, the Roosevelt government spawned an array of mobilization agencies which not only often purchased goods but closely directed those goods’ manufacture and heavily influenced the operation of private companies and whole industries.

Bossie and Mason conclude that: “the more—and faster—the economy needs to change, the more planning it needs. More than at any other period in US history, the wartime economy was a planned economy. The massive, rapid shift from civilian to military production required far more conscious direction than the normal process of economic growth. The national response to the coronavirus and the transition away from carbon will also require higher than normal degrees of economic planning by government.”

Grinding and deep destruction

What the story of the Great Depression and the war showed was that, once capitalism is in the depth of a long depression, there must be a grinding and deep destruction of all that capitalism had accumulated in previous decades before a new era of expansion becomes possible. There is no policy that can avoid that and preserve the capitalist sector. If that does not happen this time, then the Long Depression that the world capitalist economy has suffered since the Great Depression could enter another decade.

The major economies (let alone the so-called emerging economies) will struggle to come out of this huge slump unless the law of market and value is replaced by public ownership, investment and planning, utilising all the skills and resources of working people. This pandemic has shown that.

March 31, 2020.

From the blog of Michael Roberts. The original, with all hyperlinks and charts, can be found here.