By Michael Roberts

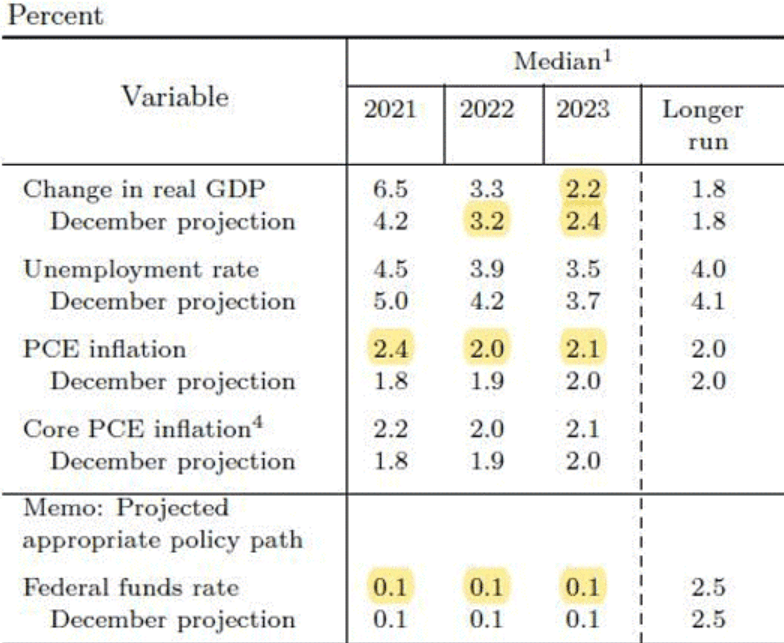

Last week the US Federal Reserve raised its growth forecasts for the US economy for this year and next. Fed officials now reckon the US economy with expand in real terms by 6.5%, the fastest pace since 1984, a few years after the slump of 1980-2. This is a significant rise from the Fed’s previous forecast.

Also, the unemployment rate is expected to drop to just 4.5% by year-end, while the inflation rate ticks up to 2.2%, above the official target rate set by the Fed.

Driving this new optimism on growth is the fast roll-out of vaccines to protect Americans from COVID-19, plus the huge fiscal stimulus package put through Congress that most mainstream forecasters expect to add at least 1% point to economic growth and bring down unemployment.

Any rise in inflation will be “transitory”

But Fed chair, Jay Powell, made it clear that the Fed had no intention of raising its target interest rate until 2023 at the earliest, even if inflation accelerates. He wants to see the unemployment rate drop to 3.5% and inflation averaging 2% or so. He would tolerate the economy “running hot” until that happens, because he reckons that any rise in inflation would be transitory.

The implication of Powell’s view was that the US economy was going to have a ‘sugar rush’ from the fiscal stimulus and from the ‘pent-up’ demand of consumers with cash savings ready to spend on restaurants, leisure, travel, etc, once the pandemic restrictions were relaxed. But as every parent knows, giving a child too much sugar leads to a rush of energy. And then comes the let down and sleep. That is what Powell worries about, namely that after this burst of energy on the ‘sugar high’ of government pay cheques and restaurants meals, the US economy will slip back into the low growth trajectory that applied before the pandemic slump.

Powell is also concerned about a potential relapse in the fight against the virus and expects fiscal support from the stimulus starting to fade next year and worries that the labour market will continue to struggle. So he expects ‘core inflation’ (excluding food and energy prices) will fall back to 2 per cent next year and 2.1 per cent in 2023. So, no inflationary spiral.

It is significant that the long-term growth forecast by the Fed is just 1.8% a year, which is hardly any higher than the average real GDP growth of 1.7% since the end of the Great Recession and before the pandemic.

It is investment that matters, not sugar treats

This implies that the Fed reckons the US economy is going to drop back to the rate of growth experienced in the Long Depression since 2009, and the ‘sugar rush’ is just that.

What this also implies is that contrary to the views of the Keynesians, the multiplier effect of the fiscal stimulus will soon dissipate and then the US economy will depend, not on consumers’ pent-up demand, but on the willingness and ability of the capitalist sector to invest. It’s investment not consumer demand that will matter in sustaining any significant recovery; not sugar treats but on new energy in the form of new surplus value (to use Marx’s term for profits).

Financial investors are less convinced that Powell is right. After all, getting the US economy to achieve a 3.5% unemployment rate and 2% inflation has been achieved only twice since 1960! So ‘inflation expectations’ among investors have been rising, suggesting an inflation rate of 2.6% on a five-year view. As a result, US government bond yields have also risen significantly, as bond yields suffer in real terms, if inflation rises.

The view that the US economy may ‘overheat’ has been argued by Larry Summers, the arch-Keynesian of several administrations. He fears that the fiscal and monetary stimulus will lead to ‘excess demand’ and so drive up prices across the board, eventually forcing the Fed to raise interest rates.

Little long-lasting impact on the economy

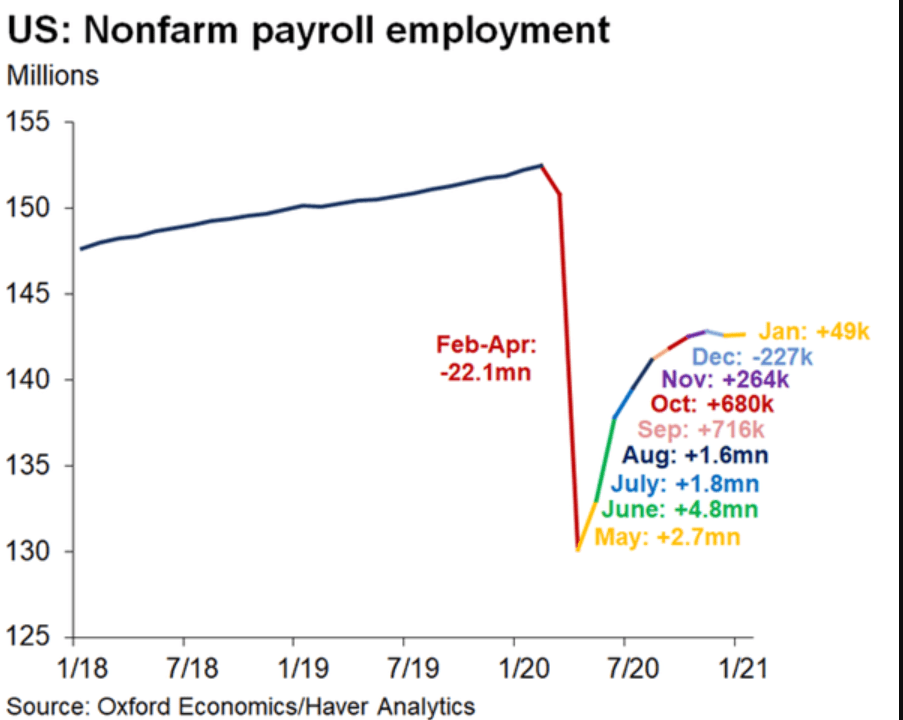

Summers argues this, because this time last year, he was telling the world that the COVID pandemic would have little long-lasting impact and the economy would bounce back once it was over, just like seaside towns go to sleep in the winter and then waking up when the tourist season starts. He seems to think that the US economy will revive of its own accord and fiscal stimulus is unnecessary. But the experience of the last year has been much longer and more damaging than a ‘winter break’.

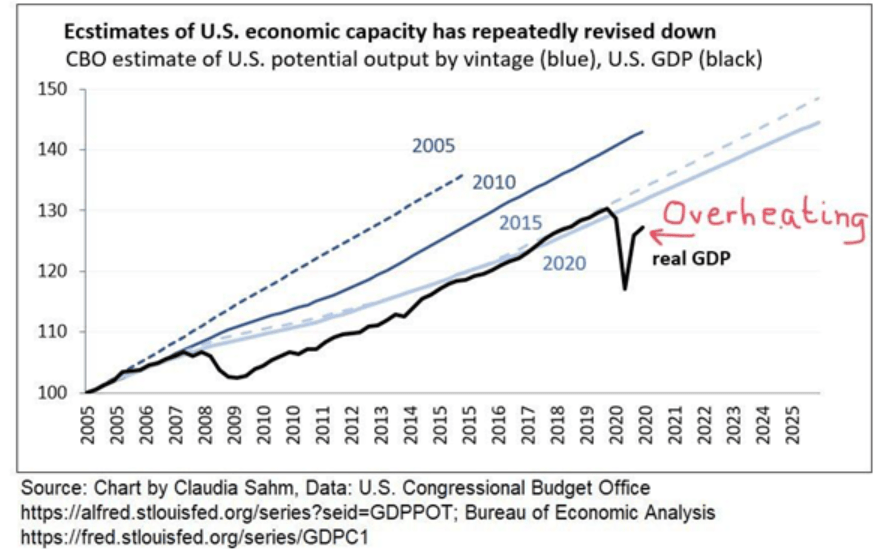

At the other end of the argument, Summers has been scathingly attacked by post-Keynesians and leftists who reckon there is no danger of ‘overheating’ and rising inflation, because there is plenty of ‘slack’ in the economy ie workers needing jobs and businesses needing to start up. But what this view ignores is the ‘hysteresis’ effect on the economy from the pandemic slump; namely that many workers have been forced to leave the workforce for good over the last year and many small to medium businesses will never return. The Long Depression has seen a steady reduction in estimates of US productive capacity.

That means the room for economic recovery is reduced, unless investment in new means of production and employment rises significantly. So there could be ‘overheating’ and higher inflation, not because of pent-up consumer demand, but because of weak productive capacity – not ‘too much demand’ but ‘not enough supply’.

Cash-rich companies speculating in financial assets

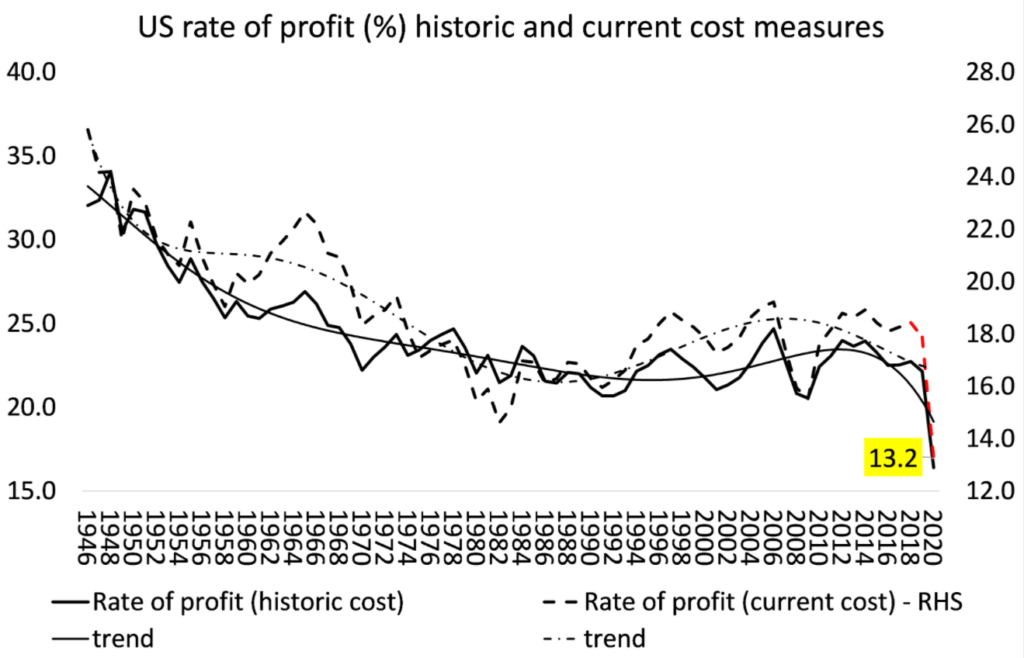

What the last ten years has shown is that business investment growth has slowed as the profitability of productive capital has fallen in the US. Cash-rich companies and investors, borrowing at record-low interest rates, have preferred to speculate in financial assets. The huge tally of bailouts by central banks and cuts in corporate taxation have been spent on driving the stock and bond markets to all-time highs while the ‘real economy’ has stagnated. The bottom 80% of American households, who drive the bulk of personal consumption expenditures (PCE), continue to struggle to make ends meet.

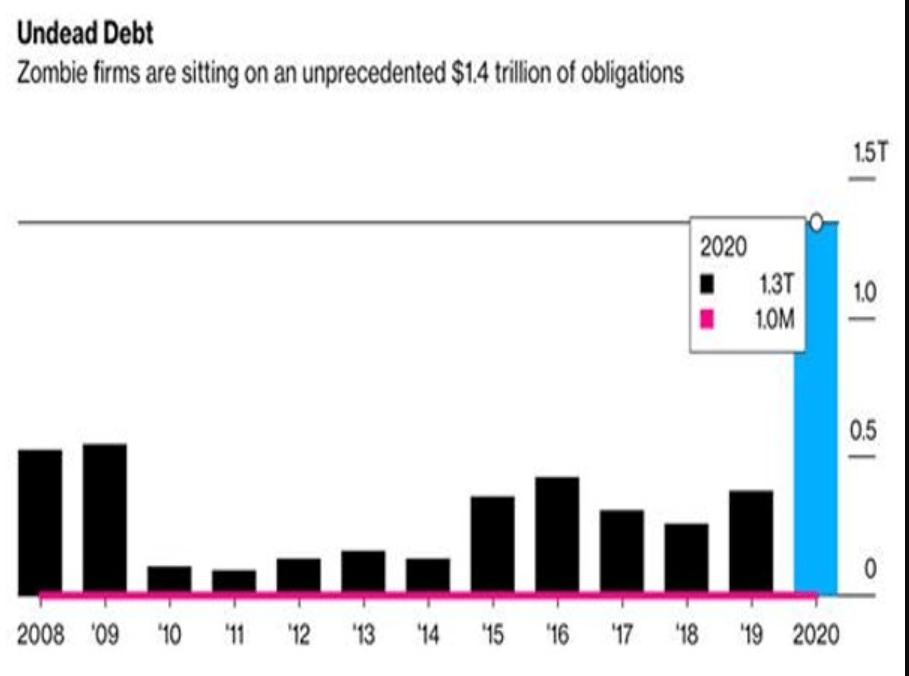

And down the road, rising debt cannot be ignored. And it is not so much public sector debt, which in the US is now well above 100% of GDP; more important is corporate debt. If interest rates for firms do start to rise because of increased inflation, then debt servicing costs for a whole swathe of so-called ‘zombie’ companies will become an excessive burden and bankruptcies will ensue.

According to Bloomberg, In the US, almost 200 big corporations have joined the ranks of so-called zombie firms since the onset of the pandemic and now account for 20% of top 3,000 largest publicly traded companies. With debts of $1.36 trillion. That’s 527 of the 3000 companies that didn’t earn enough to meet their interest payments!

Stagflation – low growth and inflation

As before, the Fed is caught. If it does not end the monetary largesse at some point, then inflation could rise, which will eat into real incomes and drive up corporate debt costs. But if it acts to curb inflation, it could provoke a stock market crash and corporate bankruptcies. That is what happens when an economy is in ‘stagflation’: namely rising inflation and low growth.

A stock market crash caused by rising interest rates does not always lead to an economic recession. Mainstream economist, Paul Samuelson, used to joke that the stock market has predicted 12 out of the last 9 recessions. Indeed, as Marx argued, financial crashes have a law of their own, and do not always coincide with ‘commercial crises’.

For example, the very sharp fall in stock prices in 1987 did not lead to economic recession and prices recovered quickly. The reason then was that the profitability of capital in the major economies had been rising for over five years and was at a relatively high level in 1987 and profitability continued to rise for another decade.

But that is not the situation now. The profitability of capital is near all-time lows, and even a recovery in 2021 and 2022 will not put levels back to that before 1997 or 2006. And corporate debt has never been higher historically. These underlying forces suggest that the ‘sugar rush’ will be just that – a short burst followed by slumber, at best.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.