By Michael Roberts

“The economy has made progress toward employment and inflation goals and if progress continues broadly as expected, a moderation in the pace of asset purchases may soon be warranted”, the US Federal Reserve officials said in their September monetary policy statement. The Fed also signalled interest rate increases may follow more quickly than expected, with 9 of 18 policymakers projecting borrowing costs will need to rise in 2022.

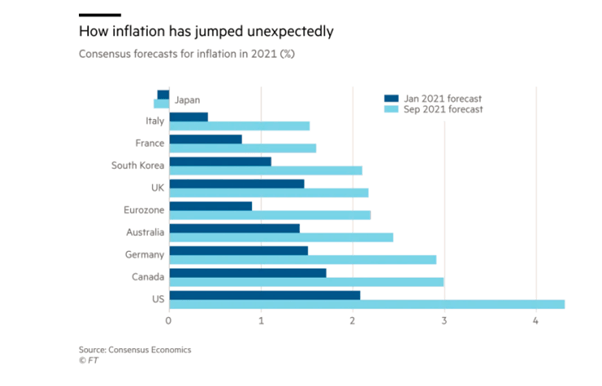

The Fed reduced its real GDP growth forecast for this year to 5.9% from 7% in its June projection, but raised its forecast for next year to 3.8% from 3.3% in the June projection). More concerning for investment markets and for wage workers, inflation is expected to average 4.2% this year before dropping back to 2.2% next year; and the unemployment rate will stay above pre-pandemic levels this year and next.

The big question for the Fed is whether it should stop injecting huge amounts of cash into the banking system supposedly to support business during the COVID slump. At its meeting, it made it clear that a ‘tapering’ of its monthly purchase of government and mortgage bonds was imminent (next meeting). Slowing its asset purchases “may soon be warranted.”

Fed split on timing of cash injection reductions

However, the Fed is split on when to do this. Fed Chair Powell noted that some FOMC participants think the “substantial further progress” criteria has already been met, while he characterized conditions in the labour market as having “all but met” his own view of this criteria. In questioning, Powell said the consensus view on the Committee was to end purchases around mid-year—about a quarter earlier than their previous forecast. He also stressed that the Fed could adjust the pace of tapering as needed, but that tapering would likely be speeded up if it looked like conditions warranted hiking sooner than currently expected.

As for interest rate hikes, that was still some way away. The Fed officials are evenly split between hiking and holding by the end of 2022 and remain divided between 3 and 4 hikes cumulatively by end-2023 and 6 to 7 hikes in total by end-2024. Powell continued to argue that the current elevated inflation was largely due to “transitory factors” that would fade by next year, and that longer-term inflation expectations remain broadly contained.

Interest rates to remain low

So even if ‘quantitative easing’ begins to tail off next year, interest rates will stay very low or near zero for at least another year. The Fed is in a quandary. Low interest rates are bad because too much borrowing at cheap rates could lead to higher and sustained inflation if supply cannot match accelerating demand, while borrowing for speculation in financial assets and property will continue. On the other hand, hiking interest rates will raise the cost of servicing existing debt, now at record levels, which could eventually lead to defaults, bankruptcies and a financial crash. The Fed is not sure which way to go.

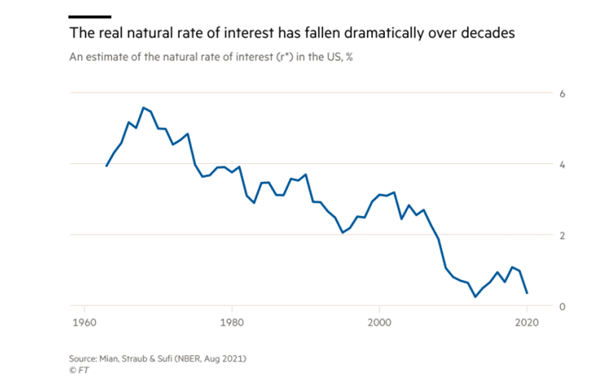

But then neither is mainstream economics. That’s partly because mainstream economics has no clear explanation for low interest rates. The neo-classical/Austrian view is that market interest rates depend on the supply and demand for savings and investment. When the former is higher than the latter, interest rates will fall to reach a new equilibrium. This is called the natural rate of interest or r*. The Austrian school adds that if the central bank intervenes in this market for capital by pumping in money credit, it distorts the market rate below the natural rate which will eventually lead to a credit crunch. And this is what is happening now.

But is there a natural rate of interest? Does this concept help us understand what is happening in an economy, especially in the major capitalist economies, right now? Keynes dismissed the idea arguing that there was not one static natural rate but a series of rates depending on the level of investment, consumption and saving in an economy and the desire to hoard money (liquidity preference).

There was no reason to assume that the capitalist economy would ‘correct’ any mismatch between investment and savings, particularly in a depression, by market interest rates adjusting back to the ‘natural rate’ in some automatic market process. That’s because in a depression where investment returns are too low compared to the money rate of interest, capitalists will hoard their money rather than invest in a ‘liquidity trap’.

Is there a ‘natural rate of interest’?

Both Keynes and Marx looked not to a concept of a ‘natural rate of interest’ but to the relation of interest rate for holding money to the profitability (or return) on productive capital. Actually, so did the author of the natural rate, Wicksell. According to Wicksell, the natural rate is “never high or low in itself, but only in relation to the profit which people can make with the money in their hands, and this, of course, varies. In good times, when trade is brisk, the rate of profit is high, and, what is of great consequence, is generally expected to remain high; in periods of depression it is low, and expected to remain low.”

Marx denied the concept of a natural rate of interest. For him, the return on capital, whether exhibited in the interest earned on lending money, or dividends from holding shares, or rents from owning property, came from the surplus-value appropriated from the labour of the working class and appropriated by the productive sectors of capital. Interest was a part of that surplus value. The rate of interest would thus fluctuate between zero and the average rate of profit from capitalist production in an economy. In boom times, it would move towards the average rate of profit and in slumps it would fall towards zero. But the decisive driver of investment would be profitability, not the interest rate. If profitability was low, then holders of money would increasingly hoard money or speculate in financial assets rather than invest in productive ones. What matters is not whether the market rate of interest is above or below some ‘natural’ rate but whether it is so high that it is squeezing any profit for investment in productive assets.

Savings and spending – demographics and inequality

The post-Keynesian thesis is to argue that interest rates reach lows because savings outstrips spending. It’s households that start to hoard money rather than spend. One explanation for this up to now has been based on demographics; namely the older people tend to spend less and save more – and everywhere the advanced capitalist economies are ageing. However, the latest explanation is that it is rising inequality that is a creating a ‘savings glut’ because richer people tend to save more than poorer people. This is an argument that has been presented for some time, particularly on an international plane, where Keynesians have argued that there has been a ‘global savings glut’ in trade surplus countries like China, Japan or Germany and their surplus capital has been transferred into the US, driving down interest rates.

Now a new paper was presented by Mian and Sufi (mss_jh_word.pdf (kansascityfed.org) at the Jackson Hole Federal symposium this year, which has excited the likes of Martin Wolf, the Keynesian economics columnist of the Financial Times. Mian and Sufi have argued something similar before in their book, House of Debt. Now they conclude, already suggested in their earlier work that the principal explanation for the decline in real interest rates has been high and rising inequality and not demographic factors, such as the savings behaviour of the “baby-boom” generation over their lifetimes.

Their main point is that savings rates vary far more by income within age cohorts than they do across age cohorts. The differences are also huge: in the US, the top 10 per cent of households by income have a savings rate between 10 and 20 percentage points higher than the bottom 90 per cent. Given this divergence, the shift in the distribution of income towards the top inevitably raised the overall propensity to save. So low interest rates are the result of hoarding by the rich. So the Fed can never get interest rates up as long as inequality stays high. Meanwhile households will run up bigger debts by borrowing at cheap rates to buy homes – risking a future implosion in debt.

The underconsumption theory

But is this explanation right? The weakness in this explanation is the theory that it is the low consumption of households that is the problem, leading to a lack of ‘aggregate demand’ necessary to get capitalist economies on a sustained path of higher growth and thus enabling interest rates to rise without a crash. Thus underconsumption theory misses what is missing from all underconsumption theories; what the capitalist sector is doing. Consumption is not the only category of ‘aggregate demand’; there is also investment demand by capitalists. Indeed, Marx argued that this was the most important factor in driving growth of production in a capitalist economy – and even Keynes sometimes agreed. I have shown in several posts and papers that it is capitalist investment that is the ‘swing factor’ in booms and slumps – a fall in investment leads capitalist economies into slumps and leads them out. Consumption is a lagging factor, and indeed changes in consumption are small during the cycle of boom and slump compared to investment.

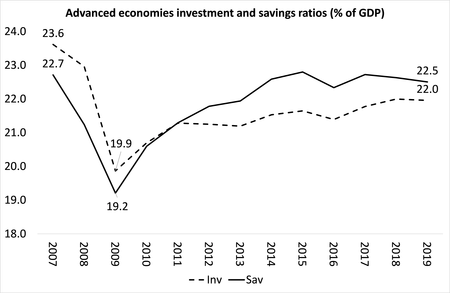

There is no global or national ‘savings glut’. Instead the problem is an ‘investment dearth’. If we look at investment rates (as measured by total investment to GDP in an economy), we find that in the last ten years, total investment to GDP in the major economies has been weak; indeed in 2019, total investment (government, housing and business) to GDP is still lower than in 2007. In other words, even the low real GDP growth rate in the major economies in the last ten years has not been matched by total investment growth. And if you strip out government and housing, business investment has performed even worse.

The national savings ratio of the advanced capitalist economies in 2019 is no higher than in 2007, while the investment ratio has fallen 7%. There has been an investment dearth not a savings glut.

As one mainstream scholar from the Breugel Institute pointed out in a letter to Martin Wolf. “While I do not deny that wealthier households save more, it cannot explain declining real interest rates. The reason is simple: the gross savings rate (expressed as a percentage of gross domestic product) did not increase in the US. On the contrary, it has declined for the last 40 years, especially in the 1980s and early 1990s, when income inequality grew rapidly. This means other factors outweighed the impact of higher income inequality on the savings rate. Beyond the savings rate, we should look to the other side of the current account identity — at investment. The total investment rate-to-GDP ratio is on a declining trend in all G7 economies, except Canada and France. Perhaps an analysis of the causes of the declining investment rate would bring us closer to explaining why real interest rates are so low.”

In my view, low interest rates are not the result of a lack of aggregate demand caused by rising inequality and the inability of workers to buy back their own production. It is the result of the declining profitability of capital in the major capitalist economies, forcing companies to look overseas to invest where profitability is higher (the investment ratio in emerging economies is up 10% in the last ten years – something that these Keynesian and post-Keynesian analyses ignore.

Low profitability leads to low investment

The ‘savings glut’ is really just a failure to invest in the real economy. Why was and is there a failure to invest at levels that would drive growth up and interest rates with it? The profitability of the productive sectors is too low. In the US, profitability of the non-financial sector began to fall back after the 1990s, generating the hi-tech bust and forcing investors to switch to property investment, generating the housing bubble. Behind the rise in debt and the subsequent collapse is a crisis in the profitability of capitalist production. None of this is explained, naturally, in Mian and Sufi’s House of Debt.

Indeed, the empirical evidence for a causal connection between inequality and crises remains questionable. In contrast, recent work by Marxist economists as presented at this year’s International Initiative for Promoting Political Economy (IIPPE) conference. (I shall report on the conference in a future post), shows that market (both short and long term) interest rates are closely correlated with changes in the profitability of capital. Karl Beitel finds such a correlation and connection and Nikos Stravelakis presents an explanatory and empirical support for this (download presentation).

So if market interest rates are ultimately determined by the profitability of capital and not by the relation between ‘savings and investment’ or the level of inequality and household consumption, then if profitability of capital stays low, interest rates will do likewise, whatever the Fed or other central banks do. Or to be more precise, if the Fed opts not only to end quantitative easing but to hike its policy rate significantly, then it is more than likely to engender debt crisis because the profitability of productive capital has not been raised.

Inflation and interest rates

I think this lays out the landscape for the debate between those like Larry Summers who fear that the current rise in the inflation in the price of goods and services in the US is not transitory and so the Fed will be forced to raise interest rates and those who think it is transitory and so there is no need to turn the liquidity tap off and squeeze credit – yet.

There is a worse scenario that could happen. Nouriel Roubini, or Dr Doom as he used to be called because he regularly forecast financial crashes which came right in 2008, now thinks that ultra-high debt, ultra-low interest rates and a range of pressures on global supply mean that capitalist economies are headed directly for another crisis, this one culminating in a combination of low growth and high inflation.

It’s true that debt, both private and public, in the global economy is at record levels. Globally, in 1999 it was 220 per cent of GDP. Today, it is 360 per cent and rising. In advanced countries, 420 per cent and rising. In China 330 per cent and rising. In emerging markets, 250 per cent and rising and most of that in foreign currency. Roubini reckons this debt burden cannot be reduced except through a huge increase in inflation that lowers its real burden for the debtors. But such a development will destroy the currencies of emerging markets and force them to default. Thus the major economies could head into a period of ‘stagflation’ ie stagnant growth along with inflation. The last time that happened was in the profitability crisis of the 1970s, when the profitability of capital dropped sharply leading to the slumps of 1974-5 and 1980-82.

Accelerating inflation may be an issue right now in the US and other recovering capitalist economies, and it certainly bites into any recovery in labour incomes; but for capitalism, profitability is the real benchmark and that can be hit by wage rises on the one hand and interest rises on the other. If it is, that is the basis for a new slump.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.