By Michael Roberts

At the beginning of January, I posted my economic forecast for the world economy in 2022. I argued that, although the major capitalist economies were likely to expand during 2022, real GDP, investment and income growth was likely to be much slower than the fast rebound in 2021 from the global pandemic slump of 2020. Last year had seen a leap back, as economies reopened after the first and second COVID waves of 2020. In the major economies, especially the US, that rebound had been helped by a significant injection of easy credit, zero interest rates and considerable fiscal spending. This rebound was akin to the ‘sugar rush’ that we get if we ingest a large dollop of sweet things to get ourselves going. There is a big boost, but it does not last.

And that seems to be the case as we go into 2022. Much was made of US annualized 6.9% real GDP growth in Q4 2021, much higher than 2.3% in Q3 and well above forecasts of 5.5%. It was the strongest GDP growth in five quarters. But this headline figure hid some serious holes in the ‘growth story’. The biggest contribution to that 6.9% points came from inventory stocking (4.9% points) – apparently car dealers restocking vehicles still to sell. Household spending contributed 2.2% points and business investment just 0.28% points. Net exports (exports minus imports) contributed nothing; and government spending made a negative contribution of 0.5% points (as taxes outstripped spending). Leaving out inventories, the US economy expanded by just 2% in Q4. Over the whole of 2021, the US economy jumped 5.7% after contracting 3.4% in 2020. US real GDP is now 3.1% higher than in pre-COVID 2019, but still 1.2% points behind where GDP would have been if there had been no COVID slump.

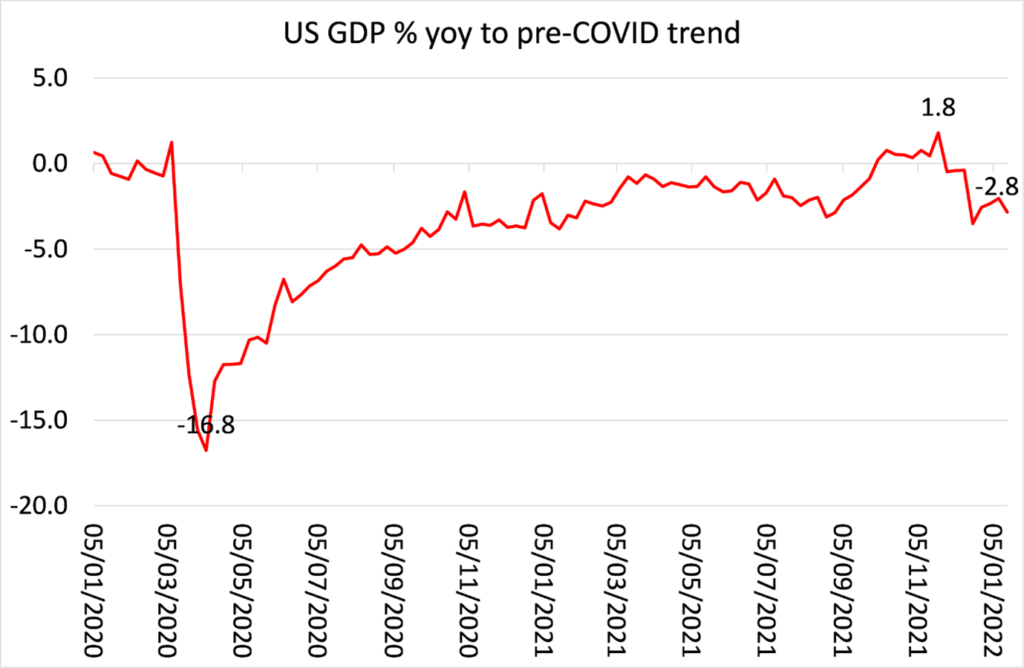

US real GDP falls back in January

Indeed, if you consult the new OECD weekly GDP tracker based on Google activity indexes, US real GDP was falling back going into January and the gap between current growth and the pre-COVID trend was widening, to -2.8% below pre-COVID trend growth. And it’s been slipping back since November 2021 under the pressure of the Omicron wave.

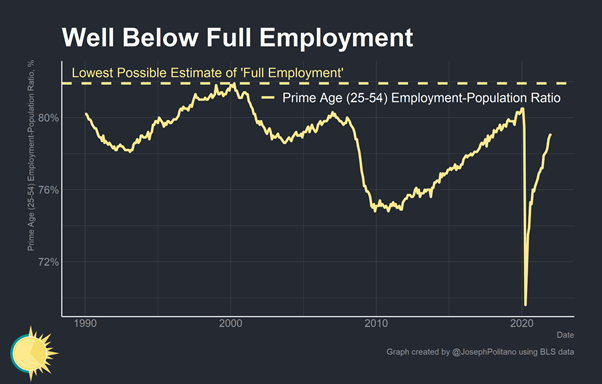

Last week, the US jobs market rose by 467,000 more employees according to official estimates– much more than expected and completely in contrast with a survey of private sector employment (called the ADP) which fell 301,000. Again, the cry was that the US economy was making great strides in recovering from the pandemic slump. But again, the headline figure hid some of truth. The reason for the sharp jump in the official figure was a revision of the census data which had been underestimating the number of Americans already at work in 2021. That was adjusted for by upping the November and December estimates. After accounting for this one-off census adjustment, jobs in January actually fell by 272k, while the household survey (another measure of jobs) showed a fall of 90k – the worst drop since the beginning of the pandemic. The reality is that only 80% of those Americans in the prime working age group (25-54 years) who had jobs before COVID have them now.

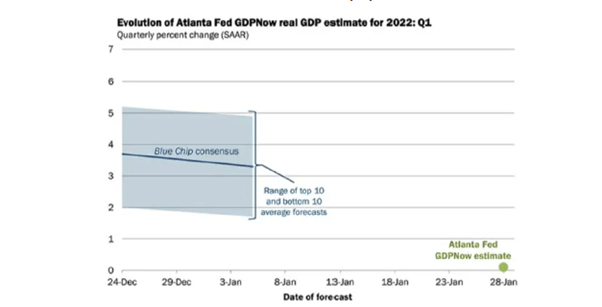

And consensus forecasts for US real GDP growth in this first quarter of 2022 have been drastically cut back. The Atlanta Fed GDPNow forecast currently stands at near zero for the current quarter (although that forecast will no doubt rise as more data come in) and the consensus forecast is just for 2.5%.

Leading investment bank Goldman Sachs (GS) reckons US economic growth will slow to just 0.5% year on year (yoy) in Q1 2022. That’s down from its previous estimate of 2.2% and GS has also cut its forecast for the whole of 2022 from 3.8% to 3.2%.

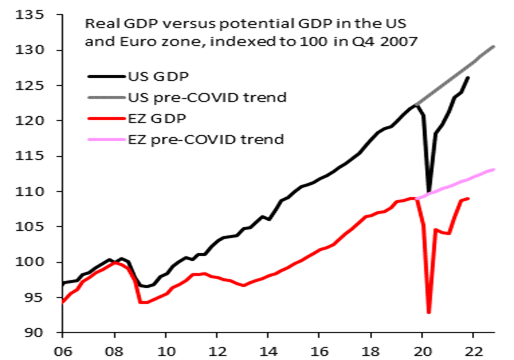

The Eurozone is suffering a worse fate

It’s a similar but worse story for the Eurozone. Eurozone real GDP rose 0.3% in Q4 2021. This was the slowest quarterly growth in 2021 as the Omicron wave hit. That meant Q4 2021 real GDP rose 4.6% compared to Q4 2020. For the year as a whole, real GDP rose 5.2% after a 6.4% contraction in 2020. This was the fastest expansion since 1977 but still slower than the US rise of 5.7%. But as in the case of the US, the rise in Q4 GDP was mostly from inventory stocking and not from sales, so the rate of growth will drop sharply in Q1 2022. Eurozone growth continues to lag the US. The US is closer to its pre-COVID GDP trend (which was already a weak 2.2% annual growth). The Euro zone is 2.5% below a much weaker 1.2% trend.

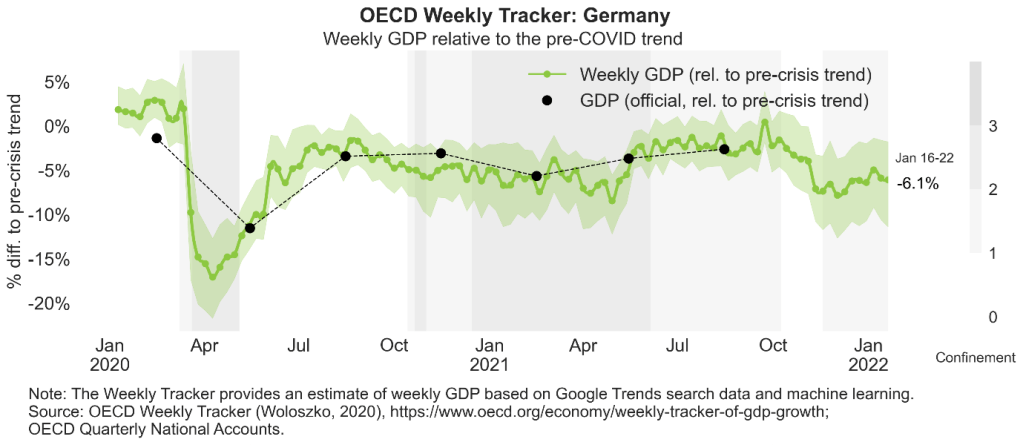

For example, Germany is some 6% points below its pre-COVID trend according to the OECD.

So the prospects for the recovery in 2022 now look worse than the IMF forecast last October: the main culprits, the IMF argues, being the Omicron Covid-19 variant, supply shortages and unexpectedly high inflation. The global economy remains 2.5% points below its pre-COVID trend and the IMF now expects global growth to be about 4.4%, with US at just 4% (but note the GS forecast above) and China at 4.8%. Given the current data, these forecasts look optimistic.

The reasons behind this faltering of the economy

Why is the ‘sugar rush’ fading? It’s not just the impact of the Omicron wave. The main reasons I outlined in my January post. First, there had been a significant ‘scarring’ of the major economies from the COVID pandemic in jobs, investment and productivity of labour that can never be recovered. This was exhibited in a huge rise in debt, both public sector and private, that weighs down on the major economies like the permanent damage of ‘long COVID’ on millions of people.

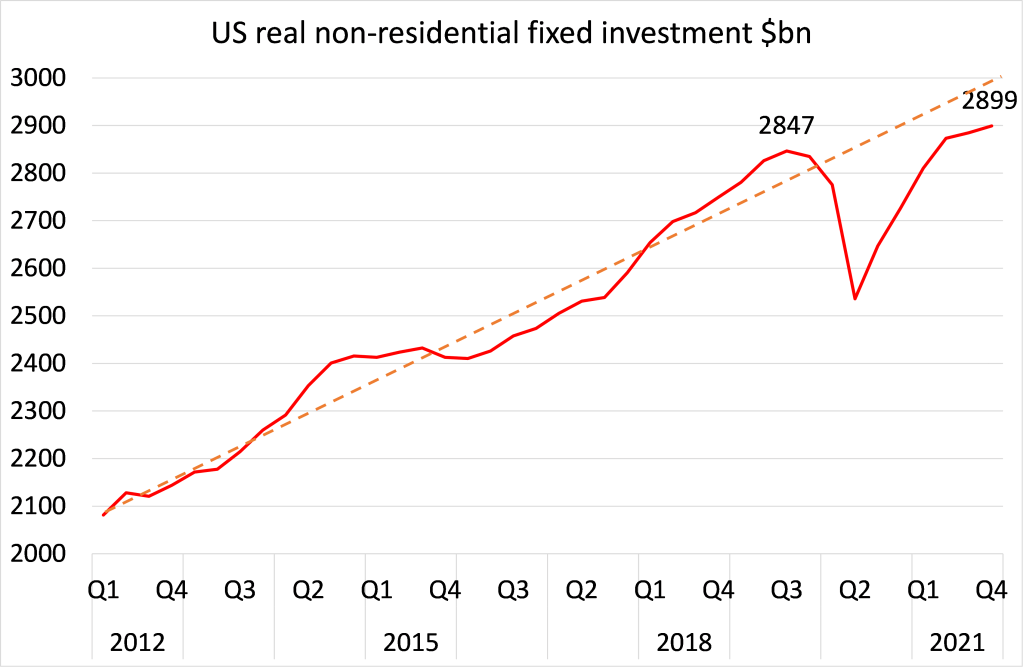

This ‘scarring’ was also exhibited in a fall in average profitability of capital in the major economies in 2020 to a new low, the revival of which in 2021 was not sufficient to restore profitability even to the level of 2019. With average profitability in the major economies at lows, there is no incentive to increase investment sufficiently to boost supply. US productive investment, although recovered from the pandemic slump is still below the pre-COVID trend.

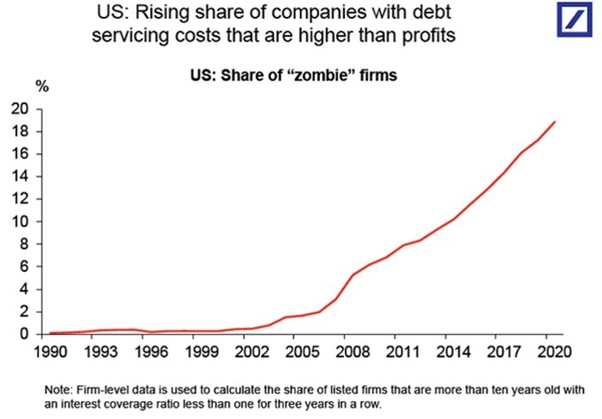

This raises an increased risk of a debt crisis in 2022 that will implode the bubble in financial assets, fuelled by cheap credit for the last two years. Such is the size of corporate debt and the large number of so-called ‘zombie companies’ that were not even making enough profit to cover the servicing of their debts (despite very low interest rates), a financial crash could ensue.

Bubbles starting to burst

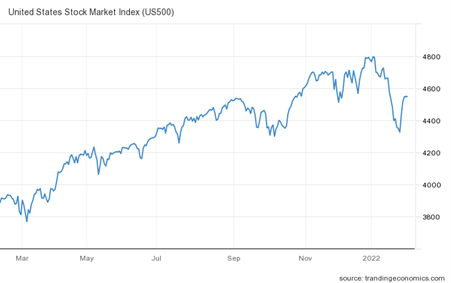

Already in January the huge stock market boom has ‘corrected’. In particular, the tech and media stocks that have driven the boom: Facebook, Alphabet, Microsoft and Netflix have taken a tumble along with the electric car phenomenon of Tesla.

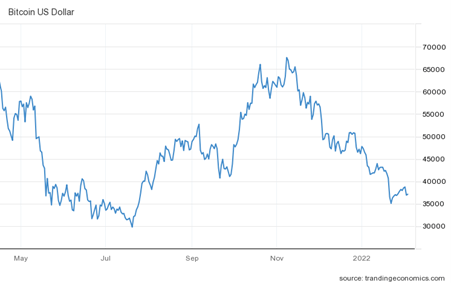

And that other crazy bubble of the COVID period, cryptocurrencies, has also taken a hit.

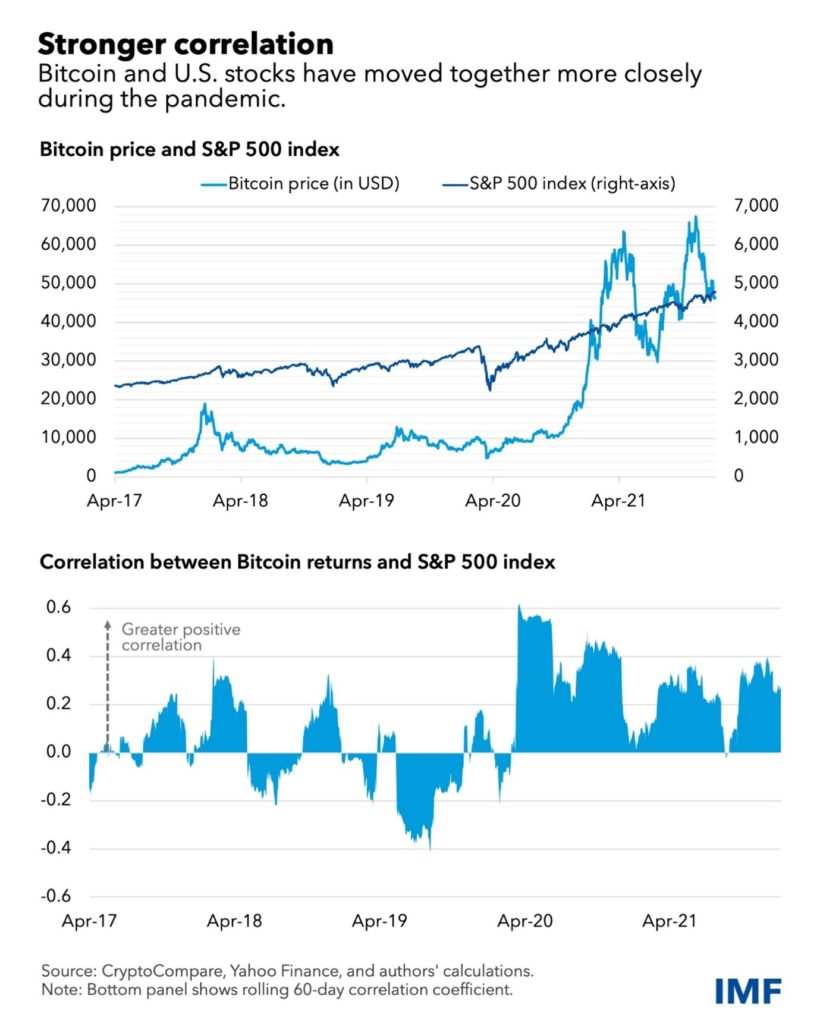

The IMF has pointed out that the correlation between crypto and equity markets has been trending up strongly. “Crypto is now very closely tied to what is happening in equities. We can’t just dismiss it,” said IMF director of monetary and capital markets, Tobias Adrian. What this shows is that cryptocurrencies are not a new form of money but merely another speculative financial asset that will go up and down with stocks and bonds.

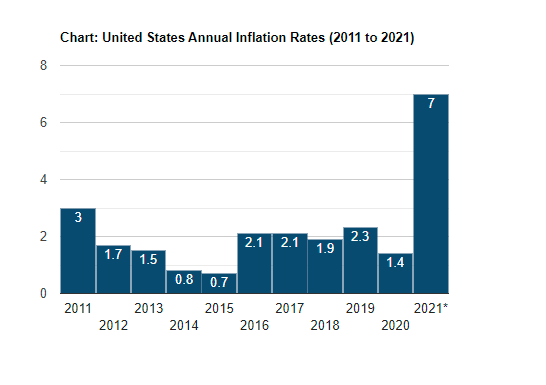

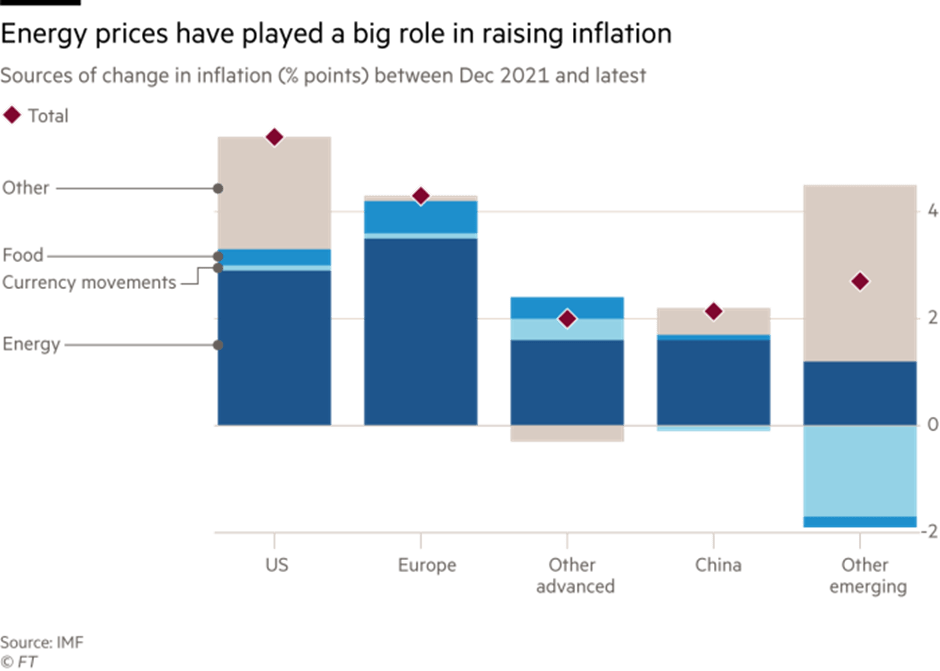

In my view, it’s the slowing down of the major economies and the continued supply bottlenecks in meeting consumer demand that has led to the huge spike in inflation rates.

That is revealed particularly in energy prices, the main driver of inflation.

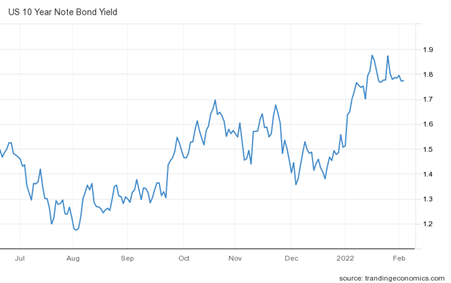

And as I have discussed before, this puts central banks in a dilemma. Do they hike their policy interest rates to try and control inflation but risk a financial market crash and a recession; or do they hope that inflation rates will subside during this year and they can avoid provoking a crisis? The answer is that they do not know. But with inflation rates still rising, the leading central banks are grudgingly reversing their easy money policies of the last ten years. The Fed is ‘tapering off’ its bond purchases and preparing to hike interest rates several times this year. The Bank of England has already raised its policy rate twice while forecasting inflation to reach well over 7%. And even the European Central Bank (ECB) is talking about ‘tightening’ policy later this year.

Central banks and inflation

The reality is that central banks have no real control over inflation anyway. But even so, they are trying. As a result, already market interest rates are rising. The US treasury bond, the benchmark floor for corporate borrowing, is on the rise with yields up 50 basic points (bp).

This increases the risk of a corporate debt crisis with such a large section of companies in the major economies already in a ‘zombie’ state (ie not making sufficient profits to ‘service’ their existing debts).

As for the so-called emerging economies – they are already in a dire state. According to the IMF, about half of Low Income Economies (LIEs) are now in danger of debt default. Global debt has now reached $300trn, or 355% of world GDP. It is estimated that a 1% point rise in interest rates increases global interest payments from $10trn a year to $16trn, or 15% of world GDP. And with a 2% point rise, interest costs of $20trn or 20% of GDP. Then not only will several poor countries be forced to default, so will many weaker companies in the advanced economies – causing a ricochet effect through the corporate sector.

Prospects for a recession

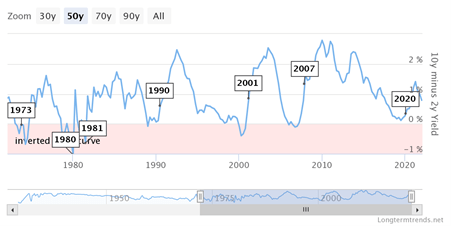

In the last 70 years, whenever the US inflation rate rose above 5% a year, a recession was necessary to get it down. And financial investors are taking note. That is revealed in what is called the ‘yield curve’ in government bonds, ie the gap between the interest rate on long-term bonds (10yr) and short-term ones (3m or 2yr). That ‘curve’ has been flattening.

Historically, whenever the curve completely flattens or even ‘inverts’ ie the interest rate on long-term bonds is lower than that on short-term bonds, a recession usually follows. The curve is flattening now because investors are expecting the Federal Reserve to hike interest rates sharply this year. If investors start to think that the economy is also slowing towards stagnation, they will then buy safe long-term bonds and the interest rate will fall on those. The yield curve will invert. It will be an indicator of a slump coming.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.