By Michael Roberts

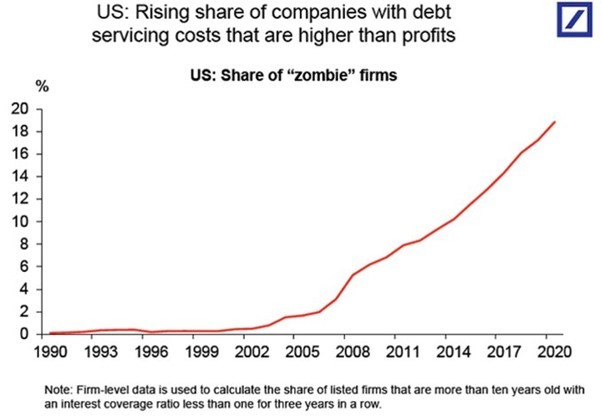

In several previous posts, I have highlighted what are called ‘zombie’ companies (companies whose regular profits do not even cover the cost of servicing their outstanding debts) and so must, to paraphrase former BoE governor Mark Carney, depend on the kindness of their creditors”. An OECD study found that such zombies take up a frighteningly large part of the economy. Across the nine European countries they studied, the share of the total private capital stock ‘sunk’ in zombie companies ranges from 5 to 20 per cent. The suggestion is that such businesses hog capital and crowd the market for newcomers, make it harder for more promising companies to expand and hold back the reallocation of labour and capital to more productive and faster-growing companies.

The OECD concludes that “the prevalence of, and resources sunk in, zombie firms have risen since the mid-2000s, which is significant given that recessions typically provide opportunities for restructuring and productivity-enhancing allocation” and that “a higher share of industry capital sunk in zombie firms tends to crowd out the growth—measured in terms of investment and employment—of the typical non-zombie firm.” All in all “a 3.5% rise in the share of zombie firms—roughly equivalent to that observed between 2005 and 2013 on average across the nine OECD countries in the sample—is associated with a 1.2% decline in the level of labour productivity across industries.”

Prevalence of zombie companies slows economic recovery

The ECB also did a report on zombies and found that (whatever-it-takes ) “industries with a prevalence of zombie firms suffered significantly from the credit misallocation, which slowed down the economic recovery.”

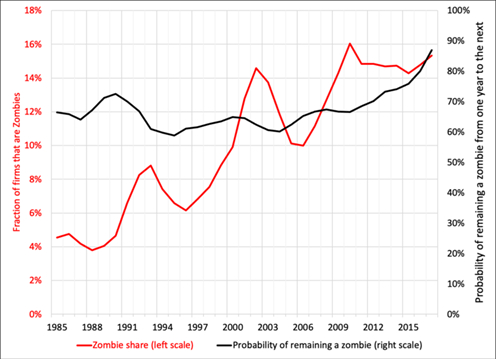

These are somewhat old reports, but the incidence of zombies has not receded since 2017, on the contrary. Since the Great Recession of 2008-9 there has been no clearing out of corporate ‘deadwood’. Indeed, the so-called zombie companies were growing in numbers before the COVID pandemic slump hit. And during that slump, all the zombies were put on life support by fiscal and monetary largesse from the governments of the advanced capitalist economies. Here is the estimate from the Bank for International Settlements (BIS).

‘Fallen angels’ a new category of vulnerable company

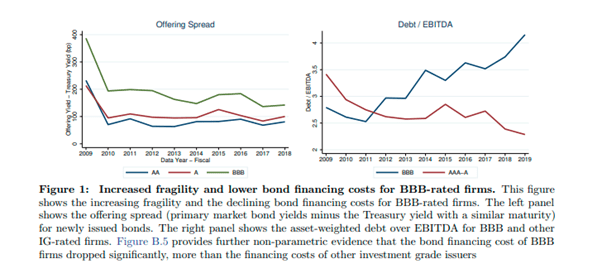

Now in a new study, BIS economists have discerned a new category of vulnerable companies in the major economies, which they have designated as ‘fallen angels’. These are companies that have run up large debts at very low rates of interest (based on the injection of credit by central banks in their ‘quantitative easing’ programmes. These firms used cheap credit not to invest in productive capital but to fund risky acquisitions and increase market share. They issued bonds to do so. Between 2008 and 2020, the amounts outstanding of BBB-rated bonds (these are lower grade bonds) have more than tripled in size to $3.5 trillion, representing 55% of all investment-grade debt, up from 33% in 2008. But the profitability of BBB-rated firms did not keep up with their increased indebtedness (see right hand panel in figure below).

Prospective ‘fallen angels’ are firms on the cusp of losing their ‘investment-grade’ credit status because they have accumulated more debt than they can handle. So they are vulnerable to ‘downgrades’ in their credit status which would sharply raise their debt servicing costs. Indeed, these prospective fallen angels have been able to obtain cheaper funding than even their safer counterparts. The BIS estimates that the credit subsidy accruing to prospective fallen angels amounted to $307 billion between 2009 and 2019.

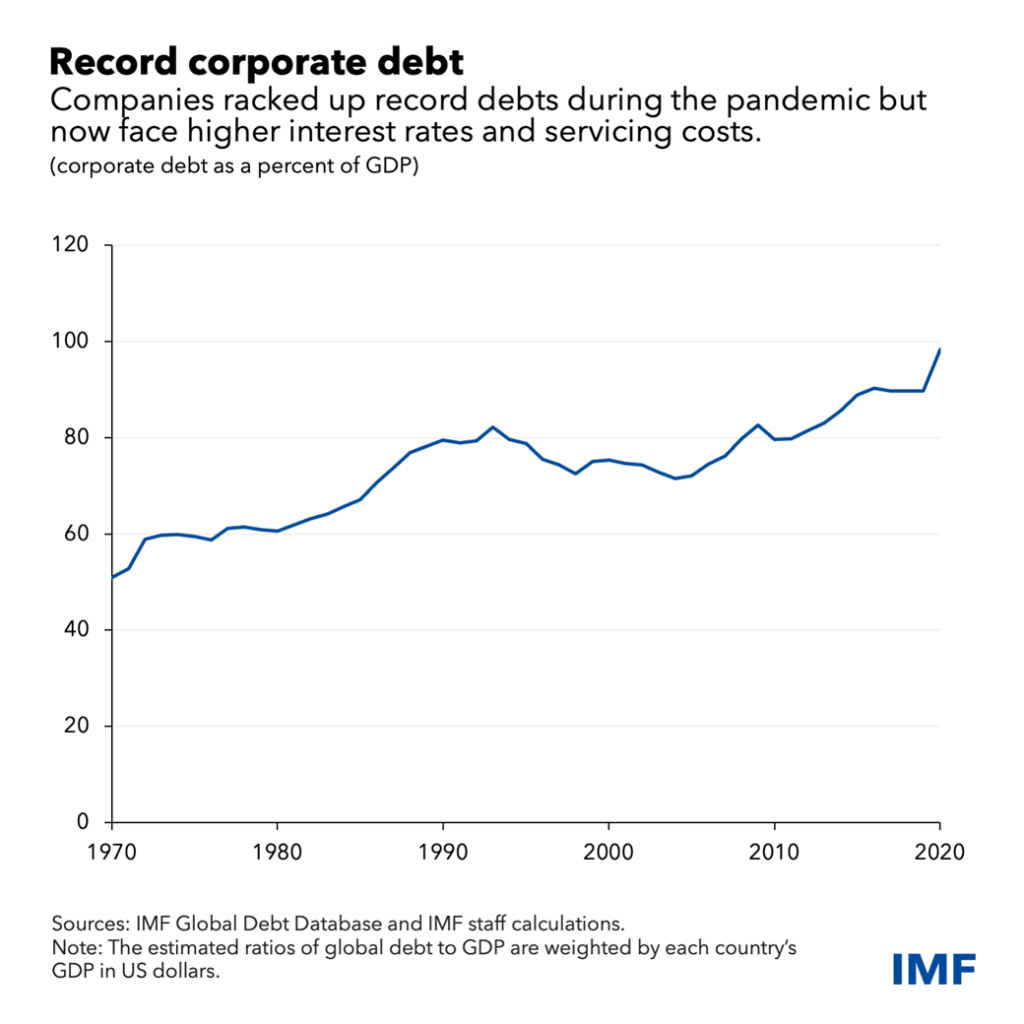

Massive growth in non-financial business debt

The steady increase of non-financial business debt over the past 10 years has made it the largest private debt category today, equivalent to 82% of GDP in 2020. The last credit cycle has been entirely driven by non-financial business debt, which increased from $10 trillion in 2008 to $17 trillion in 2020. The increase in non-financial corporate debt has been mostly driven by corporate bonds, with the stock outstanding increasing from around $3 trillion in 2009 to around $6 trillion in 2020. This increase, in turn, is almost entirely driven by bonds issued by BBB-rated firms, the potential ‘fallen angels’, the lowest rated segment of the investment-grade bond market. This segment has tripled in size from around $0.7 trillion in 2009 to more than $2 trillion in 2018 and represents around 52% of all Investment Grade (IG) bonds outstanding, up from 33%. Since 2009, their stock of bonds outstanding tripled in size to $1.5 trillion in 2018. During the same period, the safer corporate debt increased only from $0.2 to $0.5 trillion.

Why does this matter? It matters if interest rates on corporate debt were to rise sharply at the same time as the profitability of these companies were to fall. That would create the conditions for bankruptcies and debt defaults ricocheting across the corporate sector and provoking financial market crash and an economic recession. The identification of fallen angels as well as zombie companies reveals that risk is now much higher than previously thought.

Rising debt will not be enough to cause a slump; it also requires falling profitability of capital invested. In a recent paper, Argentine economists Grana and Aquina show that 1) these zombie firms have increased in number since the 1980s and 2) the cause is not the rising cost or the size of their debt but because these firms have much lower rates of profit from production, forcing them to borrow more. So zombies and fallen angels have a Marxist, not a Minskyean cause.

Additional effect from the Russia-Ukraine conflict

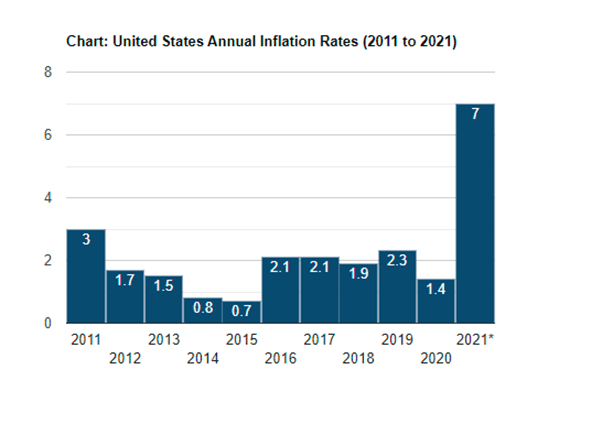

And as we review the current state of the major economies amid the Russia-Ukraine conflict, the conditions for this corporate meltdown are rising significantly. First, there is accelerating inflation. Global commodity prices hit the highest level since 2008 this week as the Ukraine crisis intensified worries about global supplies of raw materials. West Texas Intermediate, the US oil benchmark, rose as high as $115 a barrel, a level it last struck 14 years ago.

Wheat, corn, and sunflower are all at risk in Russia and Ukraine. Beyond that, however, the surge in natural gas prices is making it cost-prohibitive to produce ammonia while potash exports from Russia and Belarus (together comprising one-third of global traded product) are at risk. Both are essential ingredients to fertilizers. This could disrupt agriculture broadly throughout this year and into next year.

Raw material, food and energy price rises are feeding through to prices in the shops and in utility tariffs in the major economies.

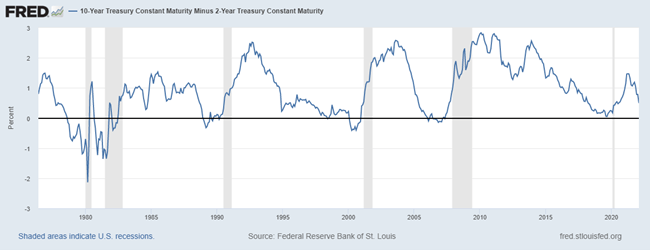

Before the Ukraine crisis, central banks were talking tough about hiking interest rates. They had no choice even though the debt risk from vulnerable companies was rising. They had to control inflation. As a result, the US government bond yield curve has been flattening. The difference between 2-year and 10-year bond yields is now less than 0.3 percentage points. As I have pointed out before, a flat or ‘inverted’ yield curve (where interest rates are higher on 2yr bonds than on 10yr bonds) usually signals an oncoming slump. That’s because bond investors start to buy longer maturity bonds while central banks hike rates. A negative or inverted yield curve has presaged a slump (shaded areas) on several occasions.

Potential for recession ahead

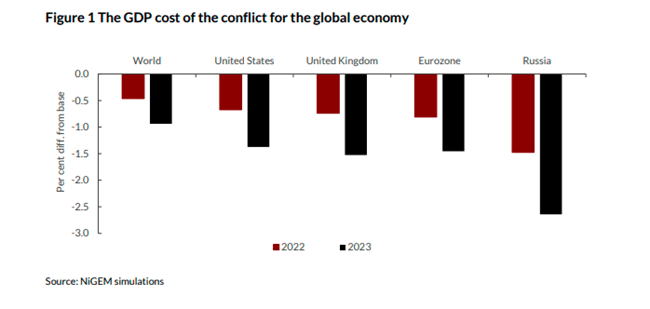

So the Fed and other central banks are now in even more of a dilemma. That’s because of the other blade in the scissors cutting into the major capitalist economies: slowing growth and even recession ahead. Several forecasts of the impact of the Russian invasion of Ukraine reckon that the world economy will lose about 1% point on expected real GDP growth this year and next.

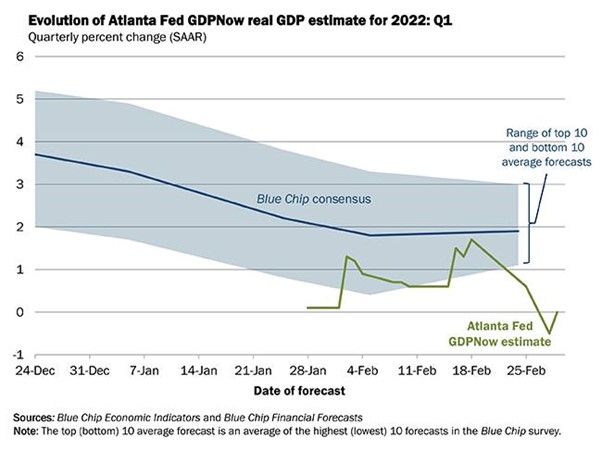

Even the US economy, the best performer of the G7 economies during the pandemic slump looks like grinding to halt, notwithstanding the supposed jobs recovery towards ‘full employment’ claimed. The Atlanta Fed GDP Now estimate for this current quarter is for zero real GDP growth.

And another ‘leading’ measure of US economic activity, the ECRI also forecasts zero growth.

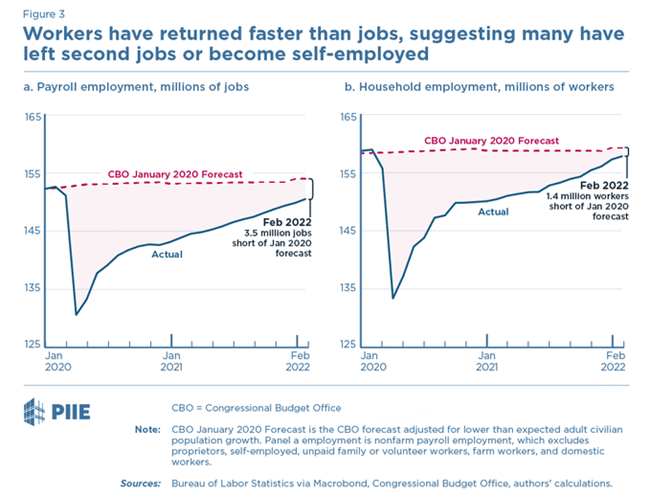

Much has been made of the strong jobs figures in the US as workers there get back to work now that restrictions on the COVID pandemic have been abandoned. But there are 3.5 million fewer jobs now compared to the number that would have been available without the pandemic slump. What’s happened is that many workers have left second jobs or have become self-employed (which always pays less than full-time employment).

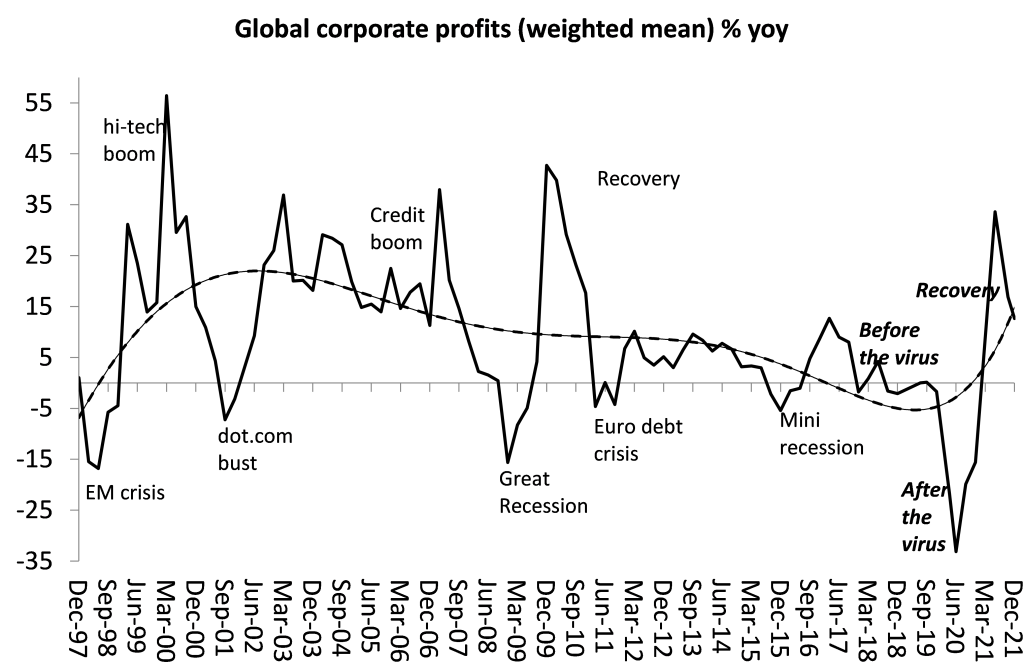

Corporate profits globally have risen sharply during 2021 after being hugely negative in 2020. But the pace of profits recovery is waning and global profits are still 3% below the level achieved at the end of 2019 before the pandemic.

As the IMF commented before the Ukraine crisis broke: “Companies entered the COVID-19 crisis with record debts they racked up after the global financial crisis when interest rates were low. Corporate debt stood at $83 trillion, or 98 percent of the world’s gross domestic product, at the end of 2020. Advanced economies and China accounted for 90 percent of the $8.9 trillion increase in 2020. Now that central banks are raising rates to check inflation, firms’ debt servicing costs will increase. Corporate vulnerabilities will be exposed as governments scale back the fiscal support that they extended to stricken firms at the height of the crisis.”

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.