By Gauthier Hordel of La Riposte

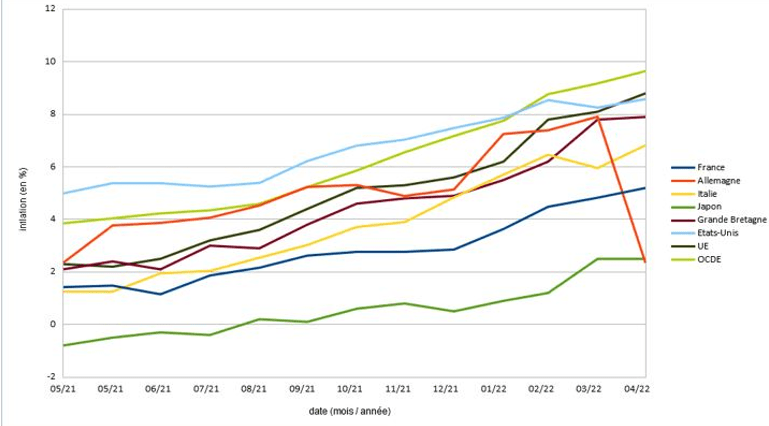

Since the middle of 2021, inflation has continued to rise “uncontrollably”. This increase has very serious consequences for the stability of the world and especially for countries with weak means of subsistence. Rising food and energy prices are a direct threat to the livelihoods of people in poor countries and generally undermine the standard of living of all of the world’s population.

The war in Ukraine has compounded the problem. Russian gas imports represent 40% of the total consumption of European countries. On the one hand, Putin and the Russian capitalists are putting pressure on the gas supply. They recently turned off the taps for Poland, Bulgaria, Finland, Latvia and France, and drastically reduced exports to Germany, Austria and Italy.

On the other side, Europe has sought alternative sources of supply, such as the United States with LNG (liquefied natural gas) or shale gas. Capitalists in the energy sector are taking advantage of this destabilisation to speculate on prices. As a result, the price of energy essential for the production and transport of goods drives inflation.

The food sector is also under pressure. Ukraine is the fourth largest grain exporter in the world. The war and Russian control of the main Black Sea seaports caused a collapse in exports on which some countries are largely or totally dependent. This is the case of Egypt, Tunisia, Algeria, Morocco and Syria.

Cereal producers are taking advantage of the situation to speculate on prices to the point of jeopardising part of the world’s population. The capitalists increase their profits at the expense of the living conditions of the mass of the population. But if the price of energy and the Russian-Ukrainian war contribute to inflation, they are not the only factors at play.

Too much hoarding would decrease investment

In normal times, the inflation target set by central banks is 2%. This rate, considered ideal, favours consumption over hoarding. Too much hoarding would cause a decrease in investments and, consequently, in the growth rate. Saving would become more profitable than investing.

The problem arises when inflation greatly exceeds wage increases. This scenario risks provoking a rise in general discontent, strikes and revolts. For countries with the lowest standard of living, food riots can occur.

Normally, social and economic stability is more convenient for the ruling classes and their governments. Periods of economic instability open up the possibility of a challenge to the economic and political domination of the capitalists. In general, periods of growth and economic stability are more comfortable for the exploiters, offering them not only profits, but social peace.

Depending on the school to which they belong, economists do not analyse the causes of inflation in the same way. This results in different policies to contain inflation. For orthodox Keynesians, the classic explanation for the rise in prices would result from a sharp rise in demand and full employment. This is the dominant analysis and is adopted as a theoretical model by a large majority of political parties, including left-wing reformists.

Supply chains cannot respond immediately

The Covid period would have forced companies and households to moderate their consumption and then to compensate for it with a sharp increase in demand when emerging from the “crisis”. Supply chains would not have been able to immediately respond to this sudden surge in demand. On the other hand, the so-called “full employment” would generate pressure on employers for wage increases which would be passed on to the price of commodities.

So if one fully embraced the Keynesian theory, then one would have to call for “wage moderation” . These are the recommendations that have been applied since 1982 in France under the so-called ‘socialist’ Mitterrand presidency with the de-indexation of wages to inflation.

However, this thesis is refuted by the facts. After the pandemic lockdown period, if there was a certain recovery in demand, it was above all the supply that was lacking. We demonstrated in a previous text on the issue of public debt that the economic slowdown of the pre-covid period was linked to insufficiently high profit rates in the productive sector. In other words, the investments do not generate enough profit in return. As a result, companies limit their investments even if the demand exists, because it is mainly the rate of profit that drives investment.

We were precisely in this situation before 2020, but the Covid crisis more or less masked it. Today, we have resumed the “normal” course of things, that is to say, that we observe an imbalance between supply and demand to the detriment of the first, which has resulted in an increase in prices.

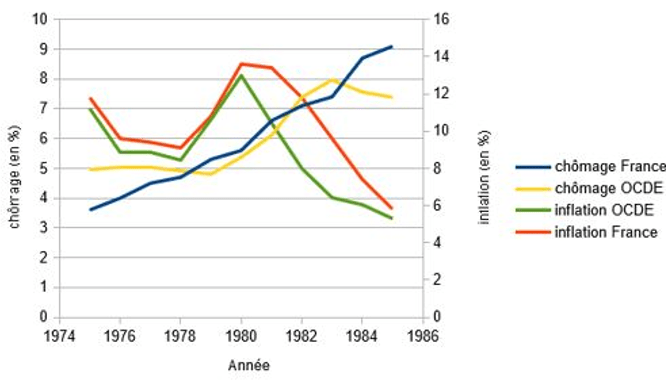

With regard to the assumed link between full employment (increase in wages) and general inflation, this is not demonstrated by the historical reality of capitalism. In the 1970s, for example, we observed the opposite situation. Despite a steady rise in unemployment and depressed wages, inflation was very high (see Figure 2).

Marx debunked the idea that wage rises cause inflation

Already in 1865, in Salary, price and profit, Marx was trying to debunk the idea put forward by Thomas Weston (a member of the First International) that one could not push for a substantial increase in wages without leading to an increase in the prices of commodities. Marx demonstrated that the exchange value of a commodity depends not on the level of wages, but on the labour time socially necessary for its production. Competition between capitalists makes the price of a commodity necessarily oscillate around this exchange value.

The struggle for higher wages under capitalism is a struggle for the distribution of surplus value between capital and labour. A change in this distribution which would be more favourable to the workers does not lead to a rise in prices which competition does not authorize,

In an attempt to thwart the rise in inflation, the European Central Bank and the US FED typically subscribe to the Keynesian vision. After the 2008-2009 financial crisis, they lowered their key rates to encourage investment and consumption. At that time, the level of inflation was very low. Today, key rates are being revised upwards with the aim of curbing demand and returning to a more bearable level of inflation.

However, as we have shown, inflation is the result of a situation that is endogenous to the economy and not exogenous (economic policy, consumer behaviour, etc.). This policy will then have no influence on inflation. However, it will have the effect of undermining demand and accentuating economic stagnation.

Energy speculation causes massive profit rises

In the United States, between 2012 and 2019, relatively constant corporate profit was $3,081 per year per employee. In 2021, this profit reached $5,207. This rise in profits accounts for 44% of the rise in US prices. In France, 2021 is a record year for profits. Energy speculation allowed Total to reap 14 billion euros in profit, 24% more than in 2019.

The profits of the CAC40 [French stock exchange top] companies reached 137 billion euros, an increase of 71% compared to 2019. According to an Oxfam report published in January 2022, the five richest families in France saw their capital increase by 173 billion euros, which is the equivalent of the additional State expenditure linked to covid (see table 1) and an additional 231 billion for French billionaires.

Incidentally, it is quite easy to understand that the Macron government’s entire business aid policy, practically without conditions, contributed to this dizzying leap, while passing off these aids as a means of saving jobs. While the biggest capitalists got richer through state aid, the situation of the more precarious workers got worse.

Sooner or later, inflation catches up with all sectors

Inflation is the result of two phenomena. On the one hand, the bottleneck in supply chains has caused a supply shock. On the other hand, excessive speculation to maximise profits drove prices up. Businesses that had stockpiled before runaway inflation sold their goods afterwards and helped push up prices.

But this policy has its limits. First, sooner or later inflation catches up with all sectors and therefore what capitalists gain as sellers they risk losing as buyers. Second, fierce competition puts pressure on prices that will come down at some point. These speculative operations are perfectly visible in the energy sectors, particularly oil and food, in particular cereals or producers use and abuse it. It is these two sectors in particular that are currently under pressure.

The greed of the capitalists is limitless. The capitalist mode of production is anarchic. It is made of sudden ups and downs and drags people into unbearable precariousness. The collectivisation of the means of production and economic planning would put an end to speculative operations and would make it possible to have a more harmonious mode of production and in adequacy with the great challenges of humanity. This requires breaking the hold of the capitalists on the economy.

This is based on an article in the French Marxist website, La Riposte, which can be found here.