By Michael Roberts

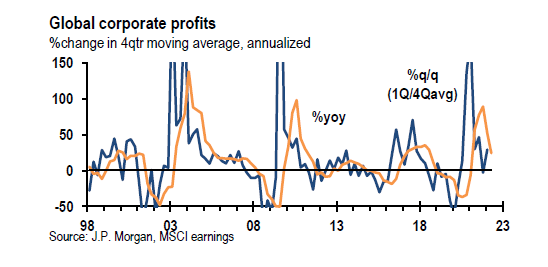

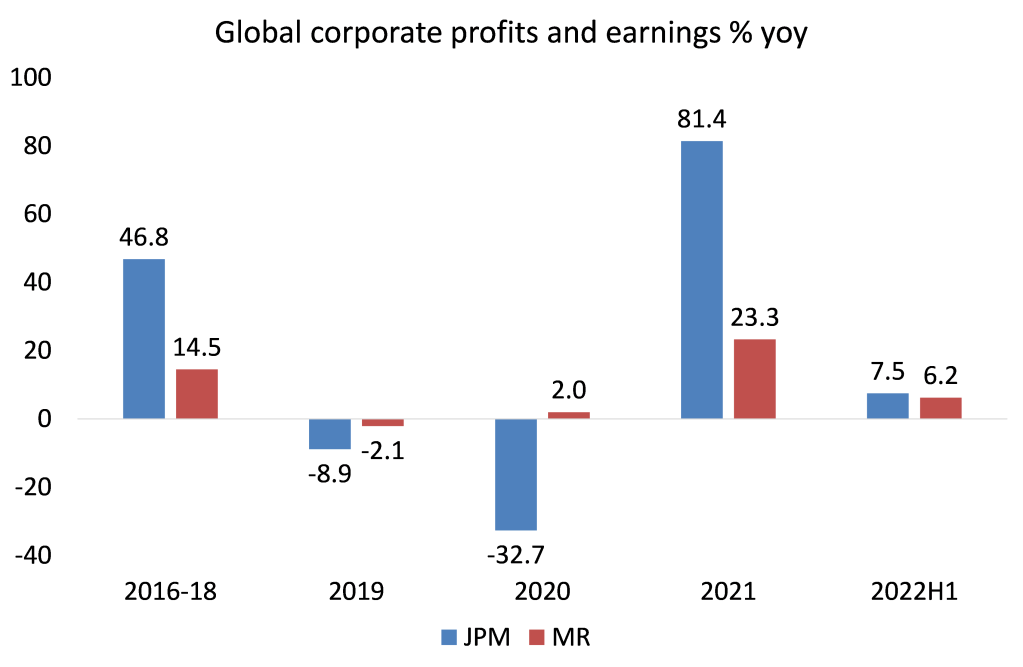

Global corporate profits growth is heading south, according to analysis by JP Morgan economists. JP Morgan estimates that, after surging a humungous 89% (4 quarter moving average) in 2021, global corporate profits moderated to a still-solid 24% in the year ending in 2Q22. And they reckon that “on net, the level of profits is 17% above its pre-pandemic trend, but still making up for lost earnings through the pandemic.” However, JP Morgan expects “slowing in profit growth in the coming quarters as inflation cools while labor markets remain tight. Additional pressure is coming from rising corporate borrowing rates as central banks press on with the steepest tightening cycle in decades.” The scissors of a future slump (falling profits and rising interest rates) are beginning to close.

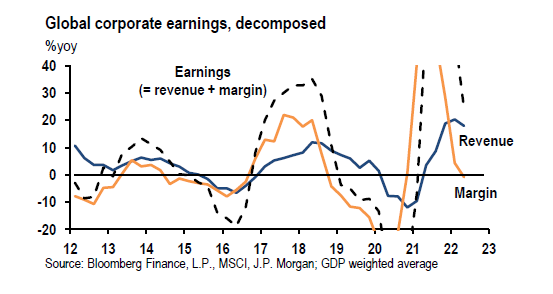

The rise and fall of corporate profit margins

During the post-pandemic recovery, corporate profit margins (that’s the difference between revenues and costs per unit of production) reached multi-decade highs as the surge in inflation boosted corporate pricing power while wages languished.

But things are changing in 2022. Profit margins are sliding down as costs of production rise and revenue growth slows.

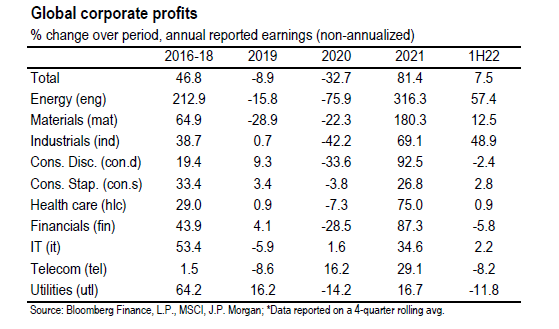

Energy and raw materials profits rising and falling the most

When broken down by sector, JP Morgan finds that each of the 10 sectors comprising the total economy show a slowing in earnings growth from multi-decade highs posted in 2021, although only four have experienced outright contraction since the beginning of the year. Although the profits boom in 2021 was broad-based in all sectors, it is clear from the data that the bulk of profit gains were in energy and raw materials including food. And that’s where the biggest falls are coming.

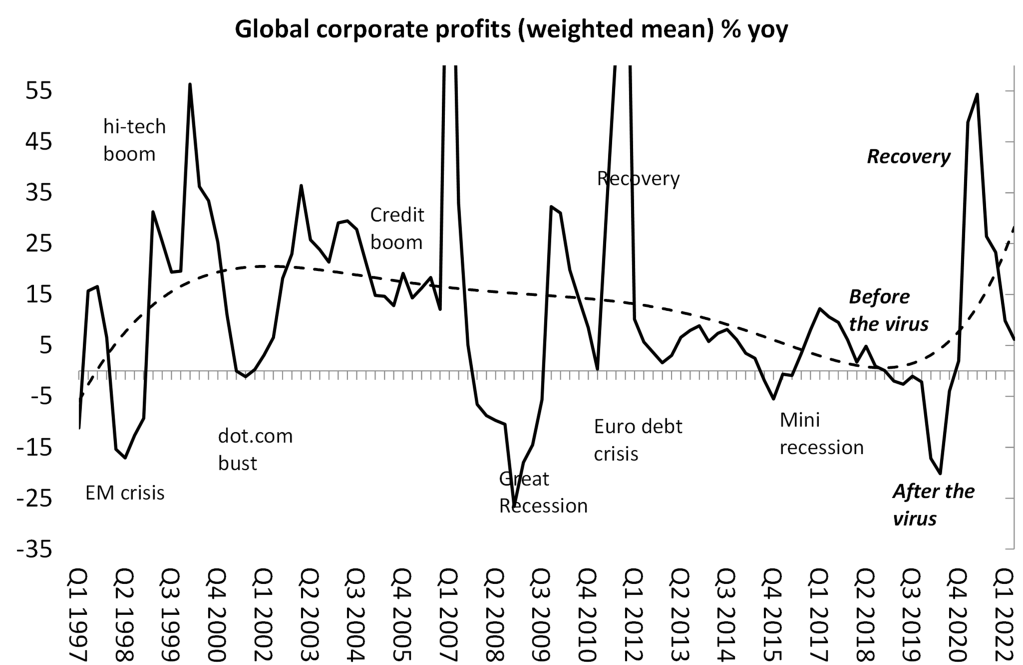

In the past, I have constructed a measure of global corporate profits. My measure is a GDP-weighted average of year-on-year corporate profits from five countries (US, Japan, China, Germany and the UK). This is a smaller universe than that compiled by JP Morgan economists. They track MSCI corporate earnings from 29 countries. That sounds better but there are some serious caveats to the JP Morgan measure. First, it is based on reported earnings in company accounts that always exaggerate earnings. My measure relies on more accurate national government measures of profit. And second, JP Morgan measures the change in those profits on a 4 quarter moving average, not year-on-year for each quarter. That tends to make the up and down changes more exaggerated than year-on-year measures.

Year on year view of corporate profits

On my model, the change in global corporate profits to H1 2022 looks like this:

Several things emerge from this figure. First, global corporate profit growth had ground to a halt even before the COVID pandemic broke and lockdowns and the collapse of international trade ensued (-2.1% year on year in Q4 2019). Second, the huge statistical recovery in 2021 (peaking at 54.4% in Q2 2021) has now given way to a fast slowdown in year on year profits in 2022 (to just 6.2% in H1 2022).

How does the JP Morgan model compare with mine?

Considering the differences in the data between the two models, there is still quite a similar trend found. There was a boom in profits after the mini-recession of 2016, then a fall in 2019 (heralding a new slump in investment and GDP in the major economies), and then the fall in the pandemic (although my figures show a small rise). The recovery of 2021 is more moderate with my data than JP Morgan’s. The first half of 2022 is comparable.

Both data show what JP Morgan concludes, “relative to its pre-pandemic trend, cumulative global profits since the pandemic are still over 20% depressed.” And now profits growth is disappearing. JP Morgan forecasts that “pricing power is expected to ease––particularly in energy––while wage pressures are unlikely to moderate as quickly. Combined with rising interest rates, profit margins will fall, dampening overall earnings.” What I have called in the past, the scissors of slump (rising interest rates and falling profits), are beginning to close.

The importance of tracking corporate profit trends

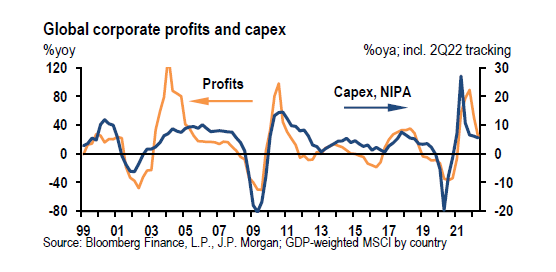

Why does tracking the change in the profits of the capitalist sector globally matter? As I have argued in numerous places, profits are the driving force of capitalist investment and therefore employment and income growth. If the profitability of capitalist investment falls and eventually leads to a fall in total profits, it is the strongest indicator of an impending slump in capitalist production. The close (if lagged) relationship between profits and investment is well established by several studies including my own.

JP Morgan is certainly convinced of the relationship between profits and investment, with the former leading the latter: “we expect corporate profit growth to slow further in coming quarters. This weakness will negatively feed back on business capex.”

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.