By Michael Roberts

Shock therapy was the term used to describe the drastic switch from a planned publicly owned economy in the Soviet Union in 1990 to a full-blown capitalist mode of production. It was a disaster for living standards for a decade. Shock doctrine was the term used by Naomi Klein to describe the destruction of public services and the welfare state by governments from the 1980s. Now the major central banks are applying their own ‘shock therapy’ to the world economy, intent on driving up interest rates in order to control inflation, despite the growing evidence that this will lead to a global recession next year.

That’s what they say. The Federal Reserve board member Chris Waller makes it clear “I am not considering slowing or stopping rate increases due to financial stability concerns.” So even if rising interest rates begin to crack holes in financial institutions and their speculative assets, no matter. Similarly, Bundesbank chief Nagel is resolute, despite the Eurozone and Germany in particular already slipping into recession: “Interest rates must continue to rise – and significantly so”. Nagel does not just want higher interest rates; he wants the ECB to cut back on its balance sheet ie not just stop buying government bonds to keep bond yields down but actually to sell bonds, leading to rising yields.

Nagel goes on: “there is an energy price shock, the effects of which the central bank cannot change much in the short term. However, monetary policy can prevent it from leapfrogging and broadening. In this way, we are cracking the inflation dynamic and bringing the price development to our medium-term target. We have the instruments for this, especially interest rate hikes.”

Macho talk by the central bankers

All this macho talk by central bankers hides the reality. Hiking interest rates will not work in bringing inflation rates down to target levels without a major slump. That is because the current 40-year inflation rates have been mainly caused not by ‘excessive demand’ ie spending by households and governments, but ‘insufficient supply’, particularly in food and energy production, but also in wider manufacturing and tech products. Supply growth has been constrained by low productivity growth in the major economies, by the supply chain blockages in production and transport that emerged during and after the COVID slump and then accelerated by the Russian invasion of Ukraine and economics sanctions imposed by Western states.

Indeed, empirical studies have confirmed that the inflation spiral has been supply-led. In a new report, the ECB found that even the rise in core inflation, which excludes the supply factors of food and energy, was driven mainly by supply constraints. “Persistent supply bottlenecks for industrial goods and input shortages, including shortages of labour due in part to the effects of the coronavirus (COVID-19) pandemic, led to a sharp increase in inflation…Components in the HICP basket that anecdotally are strongly affected by supply disruptions and bottlenecks and components that are strongly affected by the effects of reopening following the pandemic together contributed around half (2.4 percentage points) of HICPX inflation in the euro area in August 2022.”

And in its latest Trade and Development report, UNCTAD reaches a similar conclusion. UNCTAD reckoned that every percentage point rise in the Fed’s key interest rate would lower economic output in rich countries by 0.5 percent and by 0.8 percent in poor countries over the next three years; and more drastic rises of 2 and 3 percentage points would further depress the “already stalling economic recovery” in emerging economies. In presenting the report, Richard Kozul-Wright, head of the UNCTAD team which prepared it, said: “Do you try to solve a supply-side problem with a demand-side solution? We think that’s a very dangerous approach.” Exactly.

“We understand better now how little we understand about inflation.”

Clearly, central banks do not know the causes of rising inflation. As Fed Chair Jay Powell put it: “We understand better now how little we understand about inflation.” But it is also an ideological approach by central bankers. All the talk from them is fear of a wage-price spiral. So their argument goes that, as workers try to compensate for price rises by negotiating higher wages, that will spark further prices and drive up inflation expectations.

This theory of inflation was summed up by Martin Wolf, the Keynesian guru of the Financial Times: “What [central bankers] have to do is prevent a wage-price spiral, which would destabilise inflation expectations. Monetary policy must be tight enough to achieve this. In other words, it must create/preserve some slack in the labour market.” So keep wages from rising and let unemployment rise. Fed chief Jay Powell reckons that the task of the Fed is “in principle …, by moderating demand, we could … get wages down and then get inflation down without having to slow the economy and have a recession and have unemployment rise materially. So there’s a path to that.”

Bank of England Governor calls for pay restraint

As the governor of the Bank of England, Andrew Bailey put it: “I’m not saying nobody gets a pay rise, don’t get me wrong. But what I am saying is, we do need to see restraint in pay bargaining, otherwise it will get out of control”. Or take this statement from leading mainstream macro economist Jason Fulman, “When wages go up that leads prices to go up. If airline fuel or food ingredients go up in price then airlines or restaurants raise their prices. Similarly, if wages for flight attendants or servers go up then they also raise prices. This follows from basic micro & common sense.”

But both this ‘basic micro’ and ‘common sense’ are false. The theory and empirical support for wage cost-push inflation and inflation expectations theory are fallacious. Marx answered the claim that wage rises lead automatically to price rises some 160 years ago in a debate with trade unionist Thomas Weston who claimed that wage rises were self-defeating as employers would just hike prices and workers would be back to square one. Marx argued that (Value, Price and Profit) that “a struggle for a rise of wages follows only in the track of previous changes in prices”. Many other things affect price changes: “the amount of production, the productive powers of labour, the value of money, fluctuations of market prices, different phases of the industrial cycle”.

Getting wages down is the answer of the central banks. But wages are not rising as a share of output; on the contrary it is profit share that has been increasing during and since the pandemic.

And yet, according to the UNCTAD report, between 2020 and 2022 “an estimated 54 percent of the average price increase in the United States non-financial sector was attributable to higher profit margins, compared to only 11 percent in the previous 40 years.” What has been driving rising inflation has been the cost of raw materials (food and energy in particular) and rising profits, not wages. But there is no talk from central banks about a profit-price spiral.

Wage rises would lower profits not increase prices

Indeed, that was another point made by Marx in the debate with Weston: “A general rise in the rate of wages will result in a fall of the general rate of profit, but not affect the prices of commodities.” That is what really worries central bankers – a fall in profitability.

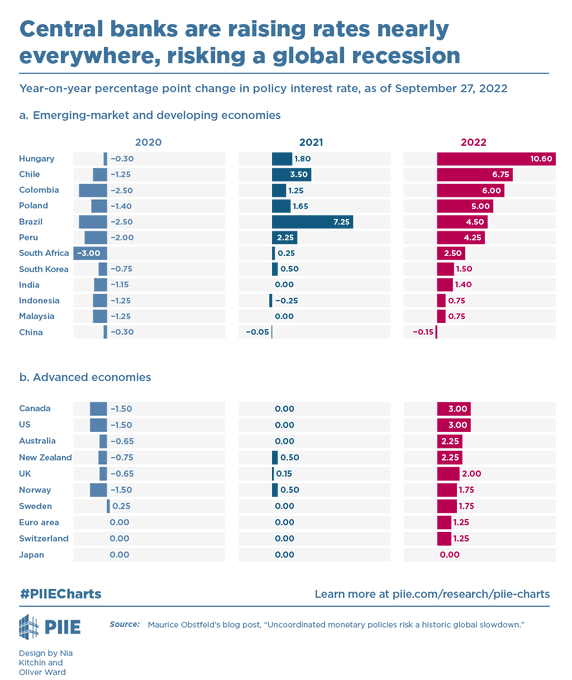

So central banks plough on with hiking interest rates and switching from quantitative easing (QE) to quantitative tightening (QT). And they are doing this simultaneously across continents. This ‘shock therapy’, first employed in the late 1970s by the then US Fed chair Paul Volcker, eventually led to a major global slump in 1980-2.

The way in which central banks are fighting inflation by simultaneously hiking interest rates is also putting massive stress on the global financial system, with actions in advanced economies affecting low-income countries.

What is spreading the impact of rising interest rates on the world economy is the very strong US dollar, up around 11% since the start of the year and – for the first time in two decades – reaching parity with the euro. The dollar is strong as a safe-haven for cash from inflation, with the US interest rate up and from the impact of sanctions and war in Europe.

Effects of the strong dollar on poorer countries

A huge number of major currencies have depreciated against the dollar. This is disastrous for many poor countries around the world. Many countries – especially the poorest – cannot borrow in their own currency in the amount or the maturities they desire. Lenders are unwilling to assume the risk of being paid back in these borrowers’ volatile currencies. Instead, these countries usually borrow in dollars, promising to repay their debts in dollars – no matter the exchange rate. Thus, as the dollar becomes stronger relative to other currencies, these repayments become much more expensive in terms of domestic currency.

The Institute of International Finance, recently reported that, “foreign investors have pulled funds out of emerging markets for five straight months in the longest streak of withdrawals on record.” This is crucial investment capital that is flying out of emerging markets (EMs) towards ‘safety’.

Also as the dollar strengthens, imports become expensive (in domestic currency terms), thus forcing firms to reduce their investments or spend more on crucial imports. The threat of debt default is mounting.

All this because of the attempt of central banks to apply ‘shock therapy’ to rising global inflation. The reality is that central banks cannot control inflation rates with monetary policy, especially when it is supply-driven. Rising prices have not been driven by ‘excessive demand’ from consumers for goods and services or by companies investing heavily, or even by uncontrolled government spending. It’s not demand that is ‘excessive’, but the other side of the price equation, supply, is too weak. And there, central banks have no traction. They can hike policy interest rates as much as they deem, but it will have little effect on the supply squeeze, except to make it worse. That supply squeeze is not just due to production and transport blockages, or the war in Ukraine, but even more so to an underlying long-term decline in the productivity growth of the major economies – and behind that growth in investment and profitability.

Earnings forecasts have been revised downwards

Ironically, rising interest rates will squeeze profits. Already, forecasters have slashed their expectations for third-quarter earnings of big US companies by $34bn over the past three months, with analysts now anticipating the most feeble rise in profits since the depths of the Covid crisis. They are expecting companies listed on the S&P 500 index to post earnings-per-share growth of 2.6 per cent in the July to September quarter, compared with the same period a year earlier, according to FactSet data. That figure has fallen from 9.8 per cent at the start of July, and if accurate would mark the weakest quarter since the July to September period in 2020, when the economy was still reeling from coronavirus lockdowns.

It’s shock therapy on the global economy but not on inflation. Once the major economies slip into a slump, inflation will then fall as a result.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.