By Michael Roberts

In many previous posts, I have argued the current sharp rise in inflation rates in all the major economies does not derive from so-called ‘excessive demand’; or from excessive money supply growth; or wage demands forcing companies to raise prices. It primarily relies on the failure of supply to match demand.

Supply was drastically squeezed during the COVID pandemic slump of 2020 and the productivity of labour contracted sharply. Capitalist investment and the production revival during the economic recovery in 2021 were inadequate to meet to renewed spending by consumers and companies. That failure was exacerbated by supply-chain blockages (loss of employees in key industries and the collapse of trade and transport connections). And the Russia-Ukraine conflict then added to that in reducing energy and food supply and exports, causing rocketing food and energy prices.

Mainstream theories on inflation exposed

What does this show about mainstream economic theories on inflation and policies to reduce inflation? The answer is that they have been exposed as wrong or irrelevant in theory; and downright damaging in policy. In particular, central banks, separated from democratic control by their governments and mandated to meet some arbitrary inflation rate target using changes in basic interest rates and in the amount of monetary injections or withdrawals, are proving to be totally useless in bringing inflation under control. Instead, central bank monetary tightening is just driving economies into recession faster and deeper.

Let’s remind ourselves of the two main theories of inflation offered to us: the monetarist and the Keynesian wage-push theories.

The relation between money supply growth and inflation

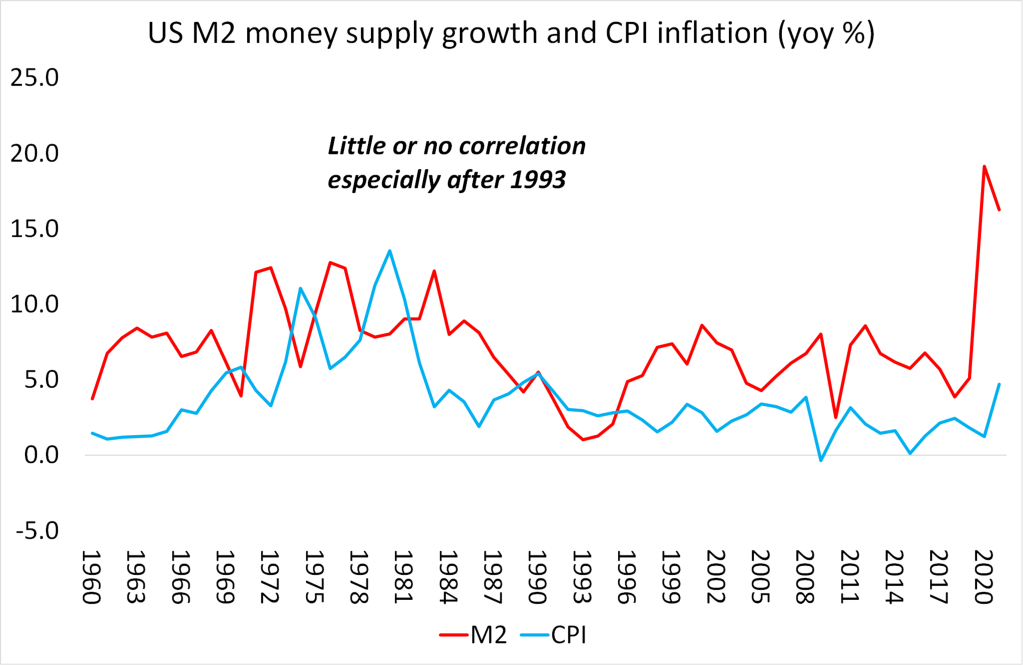

On the first, the evidence is clear. The relation between money supply growth and CPI inflation is not significant. Indeed, from the mid-1990s, money supply growth has accelerated and yet CPI inflation has slowed – something mainstream economics and central bankers have not been able to explain or deal with. I find that the correlation between money supply growth and CPI inflation from 1960 to 1992 was just 0.11 and from 1993 there was no positive correlation whatsoever!

In an interesting paper by Louis-Philippe Rochon, he provides many sources that show the inadequacies of both the monetarist and classical Keynesian theories of inflation. Rochon quotes Cynamon, Fazzari and Setterfield: “The transmission mechanism from monetary policy to aggregate spending in new consensus models relies on the interest sensitivity of consumption. It is difficult, however, to find empirical evidence that households do indeed raise or lower consumption by a significant amount when interest rates change.” And nor do interest rates change investment much.

Even arch Keynesian Paul Krugman acknowledged this: “It’s a dirty little secret of monetary analysis that … any direct effect on business investment is so small that it’s hard even to see it in the data.” (November 15, 2018, New York Times blog). Of course, he went on to argue that “what drives such investment is, instead, perceptions about market demand.” I shall return to that point later; but clearly in the post-pandemic period, demand does not seem to have driven investment and production up, which is why we have inflation rising from supply blockages. Even the Federal Reserve economists have admitted that “a large body of empirical research offers mixed evidence, at best, for substantial interest-rate effects on investment. [Our research] find that most firms claim their investment plans to be quite insensitive to decreases in interest rates, and only somewhat more responsive to interest rate increases.” (Sharpe and Suarez).

The wage push theory falls theoretically and empirically

As for the wage push theory of the Keynesians, it also falls theoretically and empirically. It only compares wages to prices, which is just part of total value creation. What about profits? The size or share of profits is totally ignored. This is ideological bias and theoretically false. It is well documented that wages as a share of GDP have fallen in the US over the last 50 years as a trend – or at the very least has not risen as a share of new value.

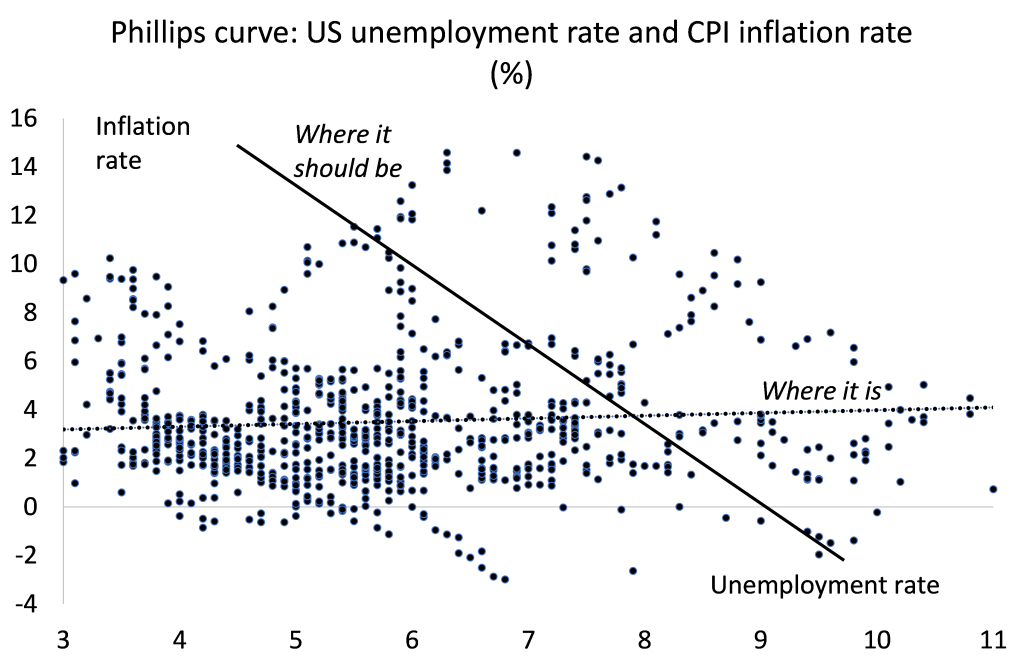

Also, there appears to be no inverse correlation between changes in wages, prices and unemployment. The classic Phillips curve that claimed such a relation has shown to be false. Indeed, this was found out in the late 1970s when unemployment and prices rose together. And the latest empirical estimates on the Phillips curve show it to be broadly flat – in other words there is no correlation between wages, prices and unemployment.

Mainstream economists have been forced to recognise this. A labour specialist at the US Bureau of Labor Statistics, Politano concluded that “Over the last 20 years, the Phillips curve relationship has nearly completely broken down in the United States”. And Mary C. Daly, President of the Federal Reserve Board of San Francisco, also concluded that “As for the Phillips curve … most arguments today center around whether it’s dead or just gravely ill. Either way, the relationship between unemployment and inflation has become very difficult to spot.”

Uncomfortable conclusion for mainstream economists

Naturally Austrian school BIS economist Borio agreed: “the response of inflation to a measure of labour market slack has tended to decline and become statistically indistinguishable from zero. In other words, inflation no longer appears to be sufficiently responsive to tightness in labour markets” and again more recently he concluded that “inflation has proved unexpectedly unresponsive to economic slack – the Phillips curve is very flat.” The current Fed Chairman, Jerome Powell, has acknowledged the problem: “We are also aware that, over time, inflation has become much less responsive to changes in resource utilization” (Powell, 2018).

This uncomfortable conclusion was also reached by two prominent mainstream economists in two papers, published in the Review of Keynesian Economics. Robert Solow remarked that “The slope of the Phillips curve itself has been getting flatter, ever since the 1980s, and is now quite small. … there is no well-defined natural rate of unemployment, either statistically or conceptually.” And Robert Gordon echoed: “The slope of the short-run inflation–unemployment relationship has flattened.”

So why do economists and central bankers continue to peddle a theory that has no empirical support? Gavin Davies, a Keynesian and former chief economist at Goldman Sachs, explained: “without the Phillips Curve, the whole complicated paraphernalia that underpins central bank policy suddenly looks very shaky. For this reason, the Phillips Curve will not be abandoned lightly by policy makers”.

Failure to manage booms and slumps in production

When theories are incorrect, the policies that flow from them won’t work. Macro management of the capitalist economy, either based on monetarist theory or Keynesian fiscal fine-tuning, has failed to avoid or ameliorate booms and slumps in capitalist production.

As Richon says: “Belief in fine-tuning and the existence of a natural rate of interest often leads central banks to increase interest rates repeatedly until they engineer a recession, which then slows economic activity, raises unemployment, and inflation finally collapses. This perfectly illustrates the asymmetric power of central banks and monetary policy: lowering rates may have no impact on launching investment (you can bring a horse to water but you can’t force it to drink), but can certainly do considerable damage, if central banks stubbornly raise interest rates high enough: this is akin to using a sledgehammer to kill a fly: you will kill the fly, but also the table on which it was resting. This is precisely what Keynes had in mind when he stated that fine-tuning “belongs to the species of remedy which cures the disease by killing the patient” (Keynes 1936, p. 323). And yet, macro management of fiscal and monetary policy is the reason for the existence of inflation targets for central banks and deficit and debt targets for governments.

So what does cause inflation rates to accelerate or disinflate? The mainstream does not know. The post-Keynesians turn to profit mark-ups. “From the viewpoint of the post-Keynesian theory of distribution, the functional redistributional effect of changes in interest rates centres directly on the responsiveness of the mark-up to interest rates … [which] will presumably depend both on the magnitude and expected permanence of interest rate changes.” Richon. So it’s the ability of (monopoly) corporations to mark up prices and engage in price gouging that causes inflation.

Profits the biggest contributor to post-pandemic price rises

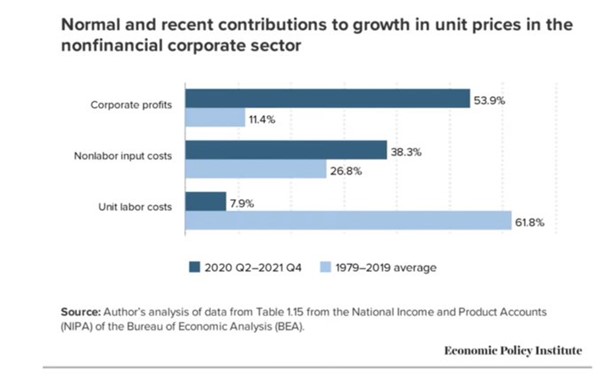

It’s true that profit rises have made the largest contribution to price rises in the post-pandemic period.

But monopoly or oligopoly cartels have existed since the development of mature capitalism and there has been an increasing degree of concentration of capital, as Marx predicted. But that has not always been followed by accelerating inflation. Indeed, from the early 1990s up to the Great Recession and beyond, inflation rates in the major economies fell and central banks were puzzled at their inability to get inflation up to their target rates.

The monopoly mark-up theory

The mark-up theory of inflation is not born out by the evidence. As James Crotty put it: “the constant-mark-up Kalecki model of profit determination” used by post-Keynesian hero Minsky “is evidently unsatisfactory.” According to Crotty: “The bulk of evidence demonstrates that there is significant cyclical variation in the mark-up and the profit share”. In other words, the ability of corporations to raise prices and gain more profit share varies according to the rate of expansion in the economy. Before the pandemic slump, corporate profits made up only 11% of changes in unit prices (see graph above). That means we need to look for the causes of inflation in the trajectory of the capitalist economy, not in monopoly mark-ups per se.

So if accelerating inflation is not caused by excessive money supply (monetarist) or by wage cost-push (Keynesian); or even by monopoly mark-ups (post-Keynesian), what does cause it? What is the Marxist theory of inflation? In earlier posts, Guglielmo Carchedi and I have attempted to develop a Marxist model. In the upcoming Historical Materialism conference in London, I shall expound on this in a morning session on Saturday 12 November, with a proper paper to follow.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.