By Michael Roberts

Stock markets rallied in November as inflation rates subsided a little and the US Federal Reserve began to talk of lower interest-rate hikes from hereon. Financial investors are hoping that the Fed is set to ‘pivot’ from tightening monetary policy (i.e. reversing its policy interest rate hikes and stopping selling back its stock of government bonds to reduce liquidity).

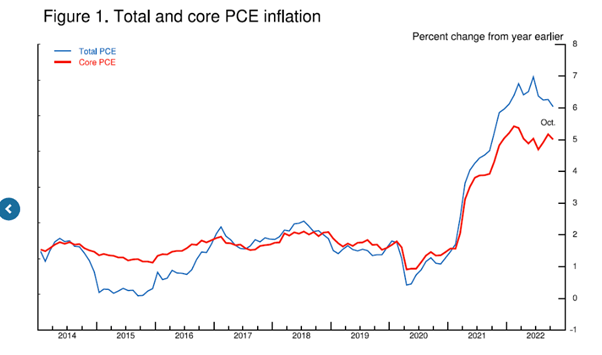

But financial markets are probably getting ahead of themselves. That was made clear by speeches from both the head of the Fed, Jay Powell and the head of the European Central Bank (ECB), Christine Lagarde. Both said that they were determined to crush inflation until it returned to their target rates of 2% a year. In a speech last week Powell summed up his policy in the ‘battle against inflation’. He noted that the 12-month personal consumption expenditures (PCE) inflation rate – the inflation measure that the Fed mostly follows – was still at 6%. And stripping out energy and food prices, the core rate was still around 5%, with no indication of any significant fall ahead.

Powell again spelt out the Fed strategy. Ignoring the fact that it was weak supply (blockages in transport, insufficient skilled staff and low productivity) that has been the main cause of the spike in post-pandemic inflation, Powell continued to argue that hiking interest rates would slow aggregate demand and that would bring inflation down as households and businesses reduced spending growth in the face of rising interest costs on borrowing. But this approach could only mean intensifying the hit to the supply side too – in other words, driving the US economy into a slump. As Powell admitted in his speech, “Slowing demand growth should allow supply to catch up with demand and restore the balance that will yield stable prices over time. Restoring that balance is likely to require a sustained period of below-trend growth.” The words “below trend” mean recession and rising unemployment.

Labour shortage

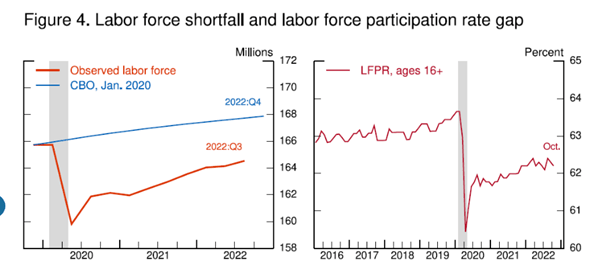

The latest headline employment figures for the US suggested that the labour market, as mainstream economists like to call it, was still pretty tight, as net new jobs in November were much higher than forecast. But the rate of monthly jobs gains has been falling since last April. And Powell had to admit in his speech that employment was still millions below its level on the eve of the pandemic. “Looking back, we can see that a significant and persistent labor supply shortfall opened up during the pandemic—a shortfall that appears unlikely to fully close anytime soon.” Comparing the current labour force with the Congressional Budget Office’s pre-pandemic forecast of labour force growth reveals a shortfall of roughly 3.5m Americans.

So it’s not so much a ‘tight’ labour market caused by strong demand for labour, but instead caused by a large number of working age people not returning to the ‘labour market’. Some of the ‘participation gap’ reflects workers who are still out of the labour force because they are sick with COVID-19 or continue to suffer lingering symptoms from previous COVID infections (“long COVID”). But according to Powell, recent research by Fed economists found that the participation gap is now mostly due to excess retirements ie, retirements in excess of what would have been expected from population ageing alone. These excess retirements account for more than 2m of the 3.5m shortfall.

But health issues have played a role. Many older workers lost their jobs in the early stages of the pandemic, when layoffs were historically high. The cost of finding new employment may have appeared particularly large for these workers, given pandemic-related disruptions to the work environment and health concerns. The combination of a plunge in net immigration and a surge in deaths during the pandemic probably accounts for about 1.5m missing workers.

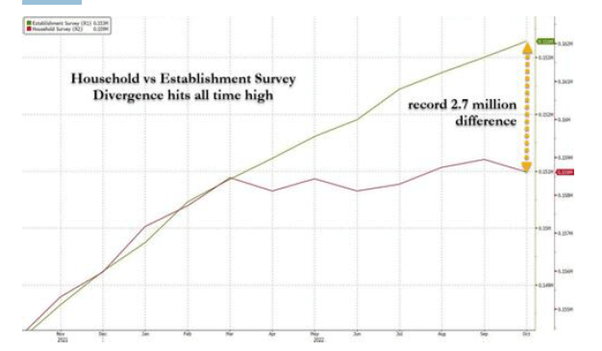

Contradictory results from employment surveys

Moreover, there is a weird discrepancy between the jobs increases measured by the so-called establishment survey and the household survey, the latter asking people if they have a job or not. According to the establishment survey, there has been an increase of 2.7m jobs since last March. But according to the household survey, the increase is just 12,000! Something wrong here.

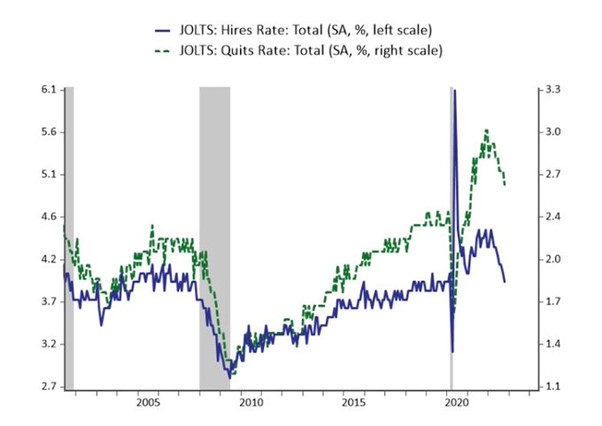

And when we look at other employment surveys, like the so-called ADP measure of private sector employment, we find that there was a fall of 100k jobs in manufacturing and construction in November, while the official establishment survey claims an increase of 35k. Moreover, the new jobs are mostly part-time. Since last March the US has lost 398K full-time employees offset by a modest gain of 190K part-time employees, while a whopping 291k workers were forced to get more than one job over the same period. So there has been no change in the number of people actually employed in the past eight months, but due to the deterioration in the economy, more people are losing their higher-paying, full-time jobs and being forced into much lower-paying work. Another measure of the jobs market is the JOLTS data on hiring and firing. They point to a rapidly cooling labour market too: both job hiring and quitting rates are now falling.

So it’s not wage push in tight labour markets that is driving inflation and it is not ‘excessive demand’ either by households or businesses spending. It remains a supply problem, particularly in energy and food. As a result, the Fed’s policy of determined rate hikes will have little effect on inflation rates. Instead by driving up costs of credit, the economy will topple over and inflation will eventually subside and be replaced by higher unemployment and bankruptcies. Remember what arch-monetarist Paul Volcker said when he was asked whether ‘shock therapy’ hikes in interest rates that he applied as Fed chair in the late 1970s would work. Volcker replied: “yes, through bankruptcies”.

Inflation is a problem of supply

I have shown in previous posts that inflation is primarily a supply-side story ie the failure of capitalist production to respond to the opening-up of economies after the pandemic slump. That is why the monetarist solution of rate hikes and tighter monetary policy and the Keynesian solution of wage restraint will have little effect on inflation – until recession comes.

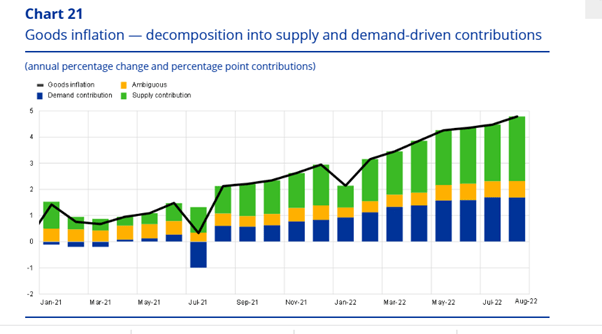

Let me add some support for this supply-side argument from the horse’s mouth, as it were. Philip Lane of the ECB published a detailed analysis of inflation last week. That analysis shows that it is rising non-labour input costs and higher profit markups that have generated accelerating inflation in food, goods and services sectors over 2021-2022. “It seems clear that both the energy shock and the pandemic cycle (at both domestic and global levels) have exerted upward pressure on input costs and, in some categories, also facilitated an increase in markups.” So it’s raw material costs and profit mark-ups.

And any improvement in inflation rates in the last two months has been due to some subsidence in supply bottle-necks and in energy and food prices. In a new report, some American heterodox economists conclude that inflation rises have been concentrated in some key ‘systemic’ sectors like energy, food and housing. And these sectors are price-inelastic when it comes to interest-rate hikes. “We argue that in times of overlapping emergencies, economic stabilization needs to go beyond monetary policy and requires institutions and policies that can target these systemically significant sectors.”

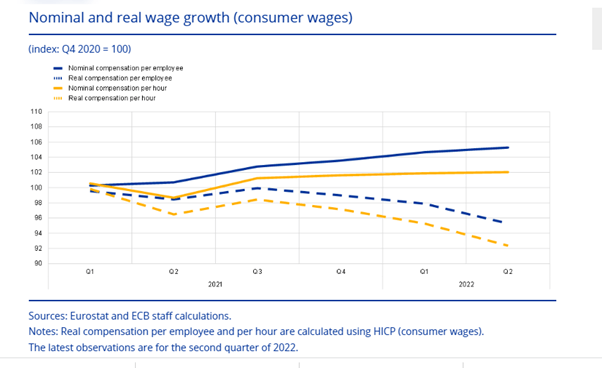

Real wages plunge in Europe

Meanwhile, real wages in the Eurozone continue to plunge.

In posts during the pandemic slump, I argued that economies may well suffer permanent ‘scarring’ from the collapse in production and investment in a slump even deeper and more widespread than the Great Recession of 2008-9, if lasting less in time. Just like ‘long COVID’ has affected the lives of millions since the end of the pandemic, so has the pandemic slump weakened capitalist accumulation and productivity growth to new lows. As another Fed member, Lisa Cook pointed out, “over the first three quarters of 2022, productivity in the business sector has recorded a disappointing decline of 3¾ percent at an annual rate. Payroll employment in the private sector has continued to increase, yet gross domestic product (GDP) has done little more than move sideways, resulting in an outright decline in labor productivity.”

And another Fed member Lael Brainard is concerned that this low productivity, high inflation scenario will continue despite the monetary efforts of the Fed: “it is the relative inelasticity of supply in key sectors that most clearly distinguishes the pandemic- and war-affected period of the past three years from the preceding 30 years of the Great Moderation…a combination of forces—the deglobalization of supply chains, the higher frequency and severity of climate disruptions, and demographic shifts—could lead to a period of lower supply elasticity and greater inflation volatility.”

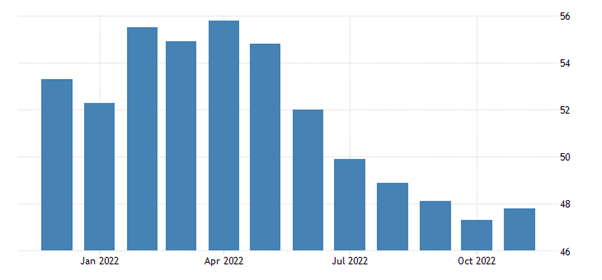

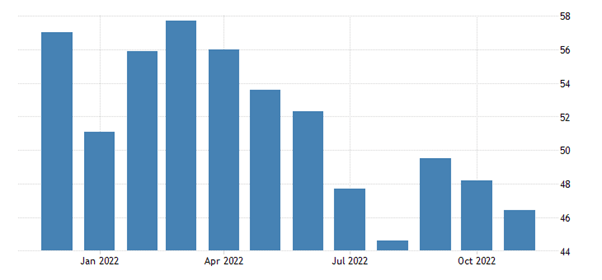

Indeed, the world economy is not only not returning to the pre-pandemic trends in real GDP growth, investment and employment (which were weak enough), but worse, it is heading into a new slump. The business activity indexes (PMIs) in most of the major economies are at ‘contraction’ levels (ie under 50).

Eurozone PMI and US PMI

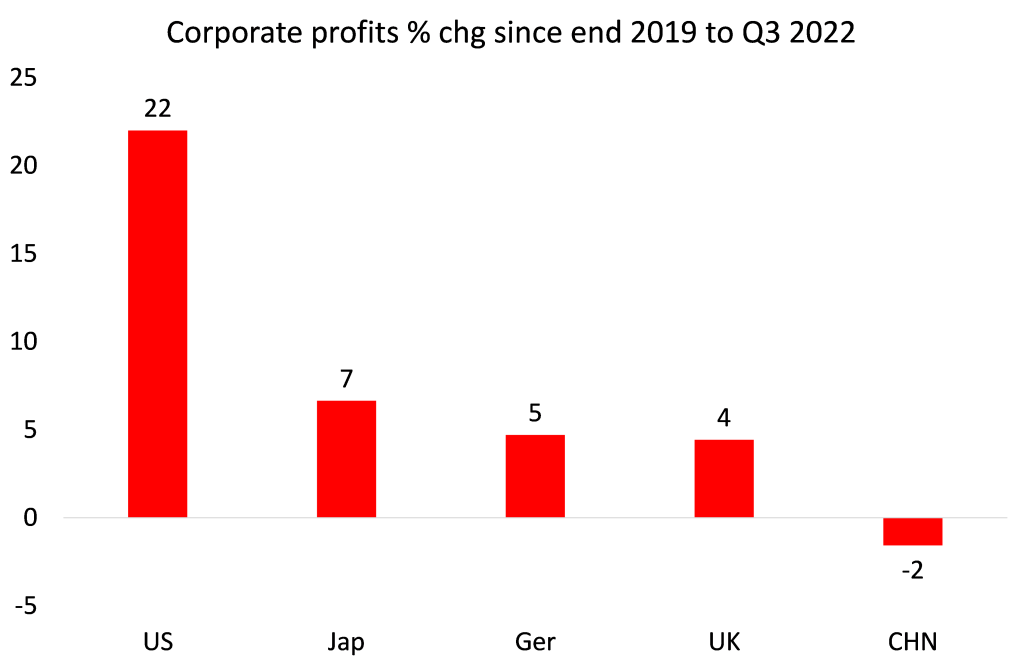

Corporate profits in the major economies are now heading south for the first time since 2016 – in an environment where the cost of borrowing is rising fast (mortgage rates, bond yields, loan charges etc). Global corporate profit growth has slowed to just 4.5% year on year (yoy) in Q3 2022. US corporate profits have risen by far the most since the start of the pandemic to date (up 22%), but they peaked in the middle of this year and fell absolutely for the first time in the latest quarter. Japan, Germany and the UK corporate profits have risen no more than 4-7% over the same period, while China’s enterprise profits are now lower than at the end of 2019. Indeed, Japanese and German corporate profits are down nearly 15% this year to date, while the UK’s are stagnant.

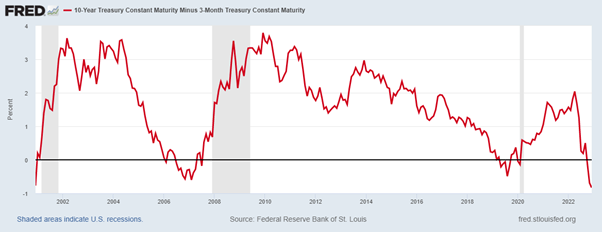

Inverted bond yield curve is a sign of an oncoming recession

One of the most reliable indicators of an oncoming recession is the so-called inverted bond yield curve. That’s where the rate of interest on long-term bonds (ten-years) falls below the rate of interest on short-term loans (3 months or 2 years). That should not happen if an economy is growing ‘normally’. Then the interest charged on long term bonds would be higher because you get the loan for a longer time. The yield curve inverts only when central banks raise short-term interest rates and investors rush to buy long term bonds because they fear a recession coming.

Well, the US yield curve remains strongly inverted.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.