By Michael Roberts

At the end of every year, I attempt to make a forecast on what will happen in the world economy in the next year. Of course, forecasts are wrapped in error, given the many variables involved that drive economies. Weather forecasts are still difficult to make and here meteorologists are dealing with physical events and not (at least directly) with human actions. Nevertheless, weather forecasts up to three days ahead are now pretty accurate. And longer term climate change forecasts have been broadly borne out over the last few decades. So if we consider that economics is a science (albeit a social science), and I do, then making predictions is part of testing theories and evidence in economics too.

Review of predictions made for 2022

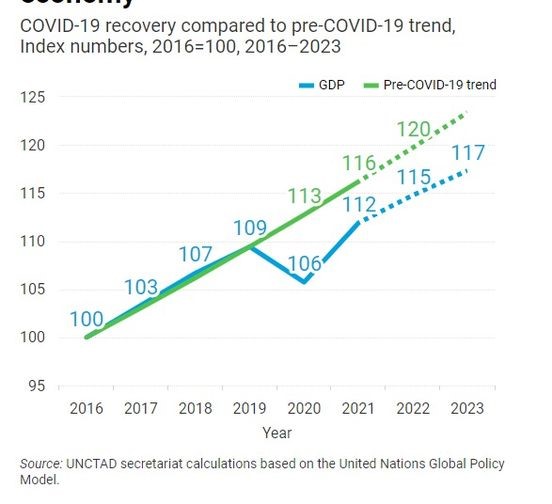

How did the predictions I made last year for 2022 work out? In 2022, the world economy was expected to grow around 3.5-4.0% in real terms – a significant slowing compared to 2021 (down 25% on that rate). Actually, 2022 looks like being worse than that consensus forecast, at just 3.2%. The advanced capitalist economies were expected to grow at less than 4% in 2022 – it now looks as though these economies will only manage 2.4%. The so-called emerging economies were expected to achieve an average 4% rise in 2022 – again a touch too optimistic with the likely result being 3.7%. So the major economies did much worse than in 2021 – and worse than the consensus forecasts. Indeed, the drop in growth in 2022 compared to 2021, was one of the deepest on record.

My own real GDP growth forecast for 2022 was also too high. But at least I recognized why there would be a significant fallback. Last year, I argued that “the ‘sugar-rush’ of pent-up consumer spending, engendered by COVID cash subsidies from fiscal spending by governments and huge injections of credit money by central banks were over.” That was an understatement. As we know, by mid-2022, central banks were engaging in a series of interest-rate hikes that has driven up the cost of borrowing for consumers and businesses dramatically. The reversal from monetary easing (QE) to tightening (QT) was quick and sharp because of the fast rise in inflation rates for the prices of goods, commodities and services globally.

I have discussed the reasons for the inflationary spike and the reaction of central banks in many posts this year. Weak low productivity economies, global supply chain blockages from COVID and the energy crisis, enhanced by the Russia-Ukraine conflict, were the drivers of inflation – not ‘excessive demand’, as the Keynesians argued; or too much ‘cheap money’, as the monetarists argued. As a result, central banks have been powerless to stop inflation, except by destroying incomes, driving up debt costs and so intensifying the likelihood of an outright slump in the major economies in 2023.

Global debt continues to rise

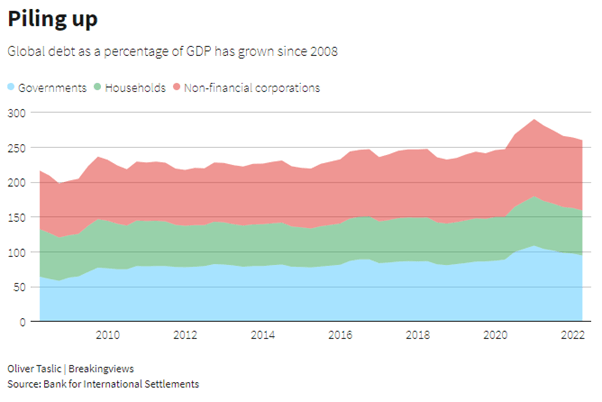

Indeed, last year I expected a global debt crisis to come to a head: “such was the size of corporate debt and the large number of so-called ‘zombie companies’ that were not even making enough profit to cover the servicing of their debts (despite very low interest rates), that a financial crash could ensue.” That has not happened yet in the advanced capitalist economies, partly because of inflation which has lowered the ‘real’ burden of borrowing costs. The global debt-to-GDP ratio will reach 352% by end 2022, according to the latest Global Debt Monitor from the Washington-based Institute of International Finance (IIF). That includes financial sector debt, usually owed within the sector. Excluding that, global debt is over 250% of world GDP according to the BIS.

But as I forecast, the so-called emerging economies are facing a major credit crisis – with defaults on debt already happening in Sri Lanka, Zambia, Ghana and others like Egypt and Pakistan on the brink. A very strong dollar through 2022 has made debt servicing of dollar debt for many of the poorest countries virtually impossible. According to the BIS, there is some $65trn of dollar debt owed by non-banks in emerging economies. About half of Low Income Economies (LIEs) are now in danger of debt default. ‘Emerging market’ debt to GDP has increased from 40% to 60% in this crisis. There is little room to boost government spending to alleviate the hit.

The world’s poorest countries are expected to pay 35% more in debt interest bills this year to cover the extra cost of the Covid-19 pandemic and a dramatic rise in the price of food imports, according to a World Bank report. Latin America faces ‘prolonged crisis’ following the pandemic. A UN report on Latin America and the Caribbean warns that nearly 45 percent of youth live below the poverty level. The report by the Economic Commission for Latin America and the Caribbean (ECLAC) found that 56.5 million people in the region were impacted by hunger. An estimated 45.4 percent of people aged 18 or younger in Latin America were living in poverty.

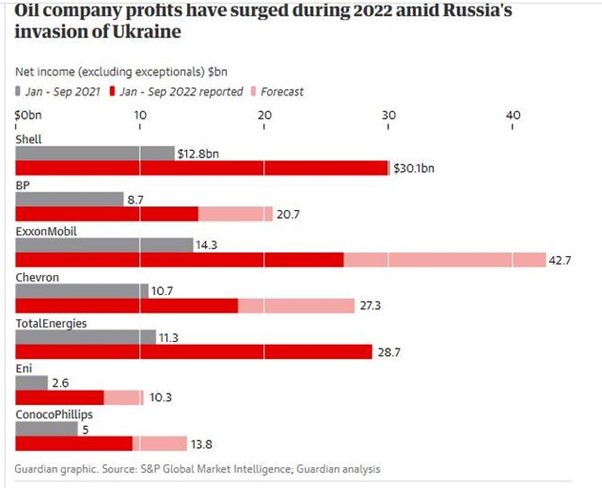

Oil company profits soar whilst debt of poorest countries grows

Contrast that with the huge profits made by the energy producers in 2022. Profits at the seven biggest oil firms soared to almost $175bn.

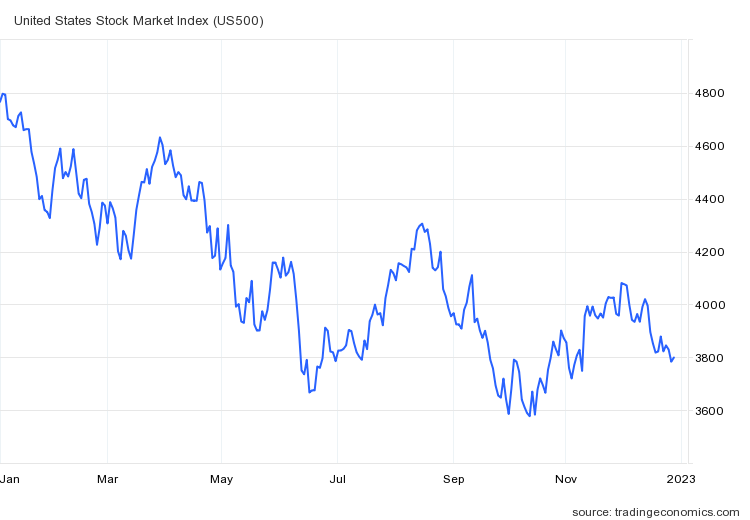

I said in my 2022 forecast that “this year could be the one for a financial crash or at least a severe correction in stock market and bond prices, as interest rates rise, eventually driving a layer of zombie corporations into bankruptcy.” Well, we have not had the crash and the bankruptcies yet, but we have had the severe correction in financial markets. The stock and bond markets of the major economies have plummeted in line with the sharp reduction in growth and the rise in interest rates.

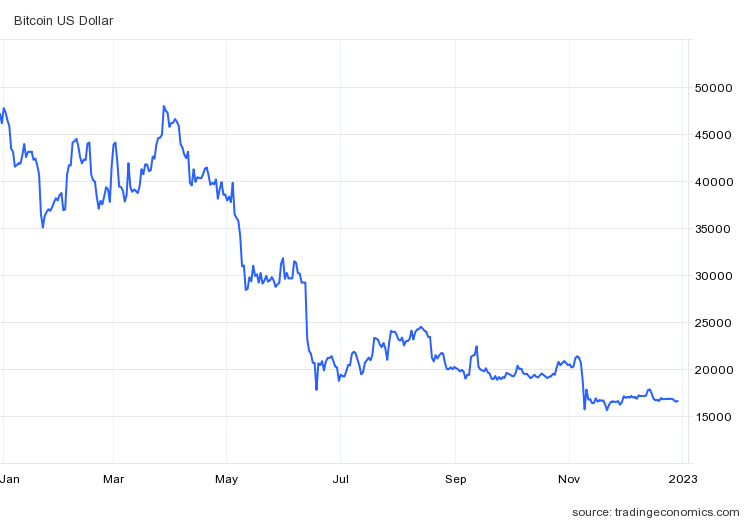

2022 the year of the crypto catastrophe

There were two notable casualties of this tightening of credit and liquidity: the death of cryptocurrencies; and the sharp fall in stock prices of such heroes of ‘tech’ speculation like Tesla and Meta. 2022 has been the year of crypto catastrophe. More than $2trn in notional value has vanished into thin air as the total market capitalisation of crypto tokens has plunged 70 per cent from its peak in November 2021.

Starting with the Tether scandal and ending in the Sam Bankman-Fried’s FTX empire with his arrest on criminal charges, the Ponzi-like crypto craze has been exposed. Speculation is inherent in capitalism, but it increases, as other financial activities, in times of economic malaise and crises, i.e. when profitability falls in the productive sectors and capital migrates to unproductive and financial sectors where the rate of profit is higher. This is the reason for the emergence and rise of the crypto market. What the fall of this market now shows is what happens when investors start to expect a fall in profits from an impending slowdown and even recession in the ’real’ economy.

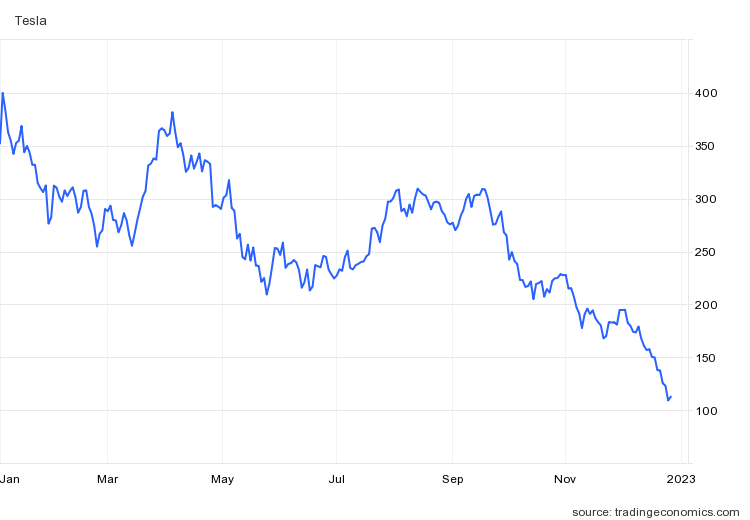

And then there is Tesla and its monstrous head, Elon Musk. The rise in the share price of this ostensibly world leader in electric cars made Musk the richest billionaire in the world. But his fraught purchase of Twitter and the significant downturn in Tesla production and sales have destroyed nearly half his wealth in paper. Tesla was worth $1.2trn in market capitalisation at the beginning of 2022, but now Tesla value has fallen to $400bn, a fall equivalent to the combined current market capitalisation of more than 80 of the smallest companies in the S&P 500 index.

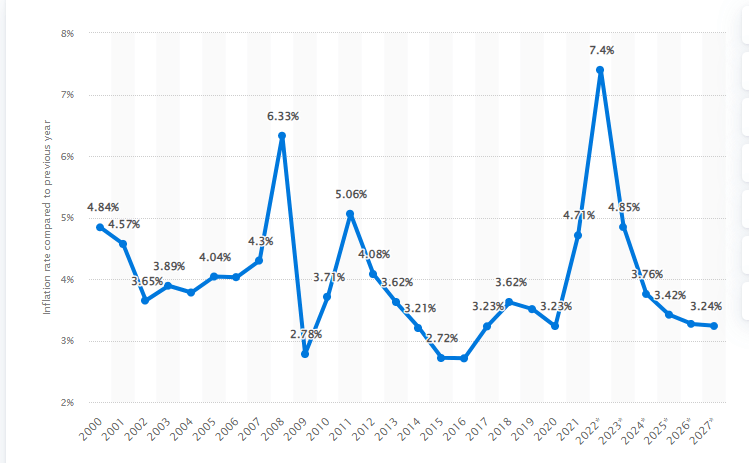

In my 2022 forecast, I reckoned that “the current high inflation rates are likely to be ‘transitory’ because during 2022 growth in output, investment and productivity will probably start to drop back to ‘long depression’ rates. That will mean that inflation will also subside, although still be higher than pre-pandemic.” That was written before the energy crisis really set in and Ukraine conflict started. So inflation rates did not subside in 2022 and on the contrary continued to rise to peaks in November. That did not seem so ‘transitory’.

Inflation to drop but remain historically high

But headline inflation rates are now beginning to fall, as energy and food price rises subside (although remaining at all-time highs). Having reached over 7% as an average in 2022, global inflation could slow to under 5% in 2023 – if still much higher than the 3%-plus average in the 2010s. In that sense, high inflation will prove ‘transitory’ in 2023 (but still higher than pre-pandemic)., if only because the world economy is heading into a new slump only three years after the pandemic slump, which was the deepest and widest in impact in the history of capitalism (some 200 years!).

Never has an impending recession been so widely expected. Maybe that means it won’t happen – given the record of mainstream economic forecasters! But this time the consensus looks set to be right. Sure, there are some forecasters in the US who continue to claim that the US economy with its tight labour market, slowing inflation and strong dollar will avoid a slump. But that is not what all the international forecasting agencies think.

Major agencies forecasting a slump

Take the IMF first. It reckons that global real GDP growth will be just 2.7% in 2023. That is officially not a recession in 2023 – “but it will feel like one”. US growth will slow to 1%; the UK to 0.5% along with the Eurozone, while Germany will go into recession at -0.3%. “Risks to the outlook remain unusually large and to the downside”. And the IMF’s forecast is the most optimistic. The OECD reckons global growth will slow to 2.2% next year. “The global economy is facing significant challenges. Growth has lost momentum, high inflation has broadened out across countries and products, and is proving persistent. Risks are skewed to the downside.”

Then UNCTAD, in its latest Trade and Development report, also projects that world economic growth will drop to 2.2% in 2023. “The global slowdown would leave real GDP still below its pre-pandemic trend, costing the world more than $17 trillion – close to 20% of the world’s income.”

The World Trade Organisation (WTO) joins the other international agencies in forecasting a global slump. “World trade in goods is projected to slow sharply next year under the weight of high energy prices, rising interest rates and war-related disruptions, raising the risk of a global recession”, according to the WTO. Its forecast for global economic growth in 2023 is 2.3% and the WTO warns of an even sharper slowdown should central banks raise interest rates too sharply in their efforts to tame high inflation.

The private sector forecasts recession

The mainstream private sector Peterson Institute forecasts recession for the Eurozone, the US, the UK and Brazil next year, with world economic growth dropping to a low of 1.8%. And the Institute for International Finance (IIF), a research body funded by major international financial institutions, forecasts an even deeper drop in global growth next year. “We forecast global recession in 2023. Adjusted for base effects – likely around +0.3% next year (green) – global growth will be only +1.3%. That’s as weak as 2009, when headline growth was lower (+0.6%), but carryover was -0.7% (yellow). Another ‘Great Recession’.”

So it seems most leading forecasters are agreed – a slump is coming in 2023, even if they hedge their bets on the depth and in which regions. However, some mainstream economists dismiss this slump forecast on the grounds that the world economy will still be growing in 2023. “While the Organisation for Economic Co-operation and Development and International Monetary Fund expect global growth to plunge to 2.2-2.7% in 2023, from 6.1% in 2021, that still leaves the world economy unlikely to shrink for consecutive quarters.” (Jeffrey Frankel). But remember, if global real GDP grows at about 2% next year (that’s for a world economy including the US, fast-growing India and Indonesia and a China recovering from the COVID lockdowns), that means that per capita GDP growth will be just 1%, a rate as low as in the Great Recession of 2008-9.

Can the US escape a slump? In December, US business activity was contracting at its fastest rate since the depth of the pandemic in 2020. The US composite PMI, which surveys business activity, fell to 44.6 in December from 46.4 in November – anything below 50 means contraction and the lower the figure, the faster the fall. This is a clear sign that the US economy is heading into a slump in 2023. JP Morgan economists report that its global manufacturing output index fell in November “to a level rarely seen outside of recessions”. This points to a hard-landing in global factory output in 2023.

The ECB now reckons the Eurozone economy is already in a recession, with output contracting in this current quarter and in Q1 2023. But it hopes the recession will be “relatively short-lived and shallow”. Even if that were the case – and I doubt it – Eurozone real GDP growth is forecast at just 0.5% next year and annual growth will remain under 2% a year for the foreseeable future.

Massive hit to real wages

Whether the major economies go into an outright slump in 2023 or just avoid it is only an issue to discuss for economists. Either way, it has dire consequences for the livelihoods of the millions in the Global North and the billions in the Global South.

The UK’s Financial Times summed it up. “As we reach the end of the year, it’s hard to argue 2022 has been a good one for workers. Labour shortages have persisted and wage growth has picked up quite strongly in some countries like the US and the UK. But pay hasn’t kept up with surging prices. As a result, global wages fell in real terms this year for the first time since comparable records began, according to the International Labour Organization. Labour’s share of global income has also declined, by the ILO’s calculations, as productivity growth outstripped wage growth by the biggest margin since 1999. In the UK, a decade of stagnant wage growth before the pandemic is now set to be followed by the steepest fall in household living standards in six decades, according to official forecasts.”

In the US, the average decline in real wages was just over 2 percent year-on-year in the third quarter of 2022. In Europe, Germany and Spain saw even more pronounced declines in purchasing power, with real incomes falling by just over 4 percent and 5 percent, respectively, nationwide. Real wages in the Eurozone have fallen by 8% since the end of the pandemic slump in 2020. In Germany, real earnings have plunged by 5.7% in the last year, the largest real wage loss since statistics began.

The question to be asked is why the major economies are dropping back into a new slump after such a short time since the COVID slump. In previous posts, I have highlighted two factors (two blades of ‘scissors’ which are about to close and cut output and investment). The two factors are slowing and even falling profits and the rising cost of servicing record high debt.

As I have shown before in previous posts in some detail, that, contrary to claims by mainstream politicians, central bank governors and economists, there is no ‘wage-price’ spiral. Wages are not driving prices up. Indeed, it’s profits that have risen sharply as a share of value since the pandemic. But as we come to the end of 2022, low productivity growth, still rising prices of raw materials and components and increased unit labour costs, are eating into profit margins. Falling profit margins will eventually lead to lower profitability and even a falling mass of profit. And falling profits is the formula for an eventual investment and production slump.

US suffers three quarters of productivity decline

Productivity growth continues to fall in the US. Q3 2022 saw a -1.4% yoy fall, making three consecutive quarters of yoy decline, the first such instance since the deep slump of 1982. So even though wages are rising at only just over 3% compared to US inflation of 8% plus, falling productivity is starting to squeeze company profits, as labour costs per unit of output rose by over 6% yoy.

In the US, corporate profits fell in Q3 2022, according to the latest released data. Total profits fell 1.1% compared to the previous quarter. Indeed, non-financial corporate profits fell nearly 7% on the quarter. Non-financial corporate profits have slowed to 6.4% yoy. The profits contraction has started as wages, import prices and interest costs are now rising faster than sales prices. Profit margins (per unit of output) have peaked (at a high level) and unit non-labour costs and wage costs per unit are rising as productivity stagnates. The post-pandemic profits bonanza is over.

That’s one blade of the scissors of slump. The other blade is the rising cost of borrowing. Many corporations are debt-loaded and heading for trouble as borrowing costs rise and banks tighten liquidity. Remember the large number of what are called ‘zombie companies’ that do not get enough profit to cover even their debt servicing commitments; and also ‘fallen angels’, those companies which have borrowed too much to invest in risky assets that now face blowing up. Maybe those bankruptcies that were put off in 2022 as inflation spiralled will emerge in 2023.

Investor behaviour signals a coming slump

While central banks and governments are reluctant to admit a slump is coming, especially in the US, financial investors are not so sanguine. Another strong and reliable sign of impending recession has been the so-called ‘inverted bond yield’ curve. An inverted bond yield curve is when the yield on long-term bonds (10yr) is lower than short-term interest rates (3m or 1yr). I have explained why this is a good indicator of a coming slump in various posts. Currently, the US bond yield curve is really, really inverted, which really, really predicts a recession. All four of the other times this curve broke below the zero line, a recession followed in short order.

So for a change, it seems that the consensus will be proven right and the world economy will see a sharp drop in real GDP growth with many major economies going into recession – with all the dire consequences for the living standards of the many. After ‘the cost of living crisis’ will come the crisis of living.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.