By Michael Roberts

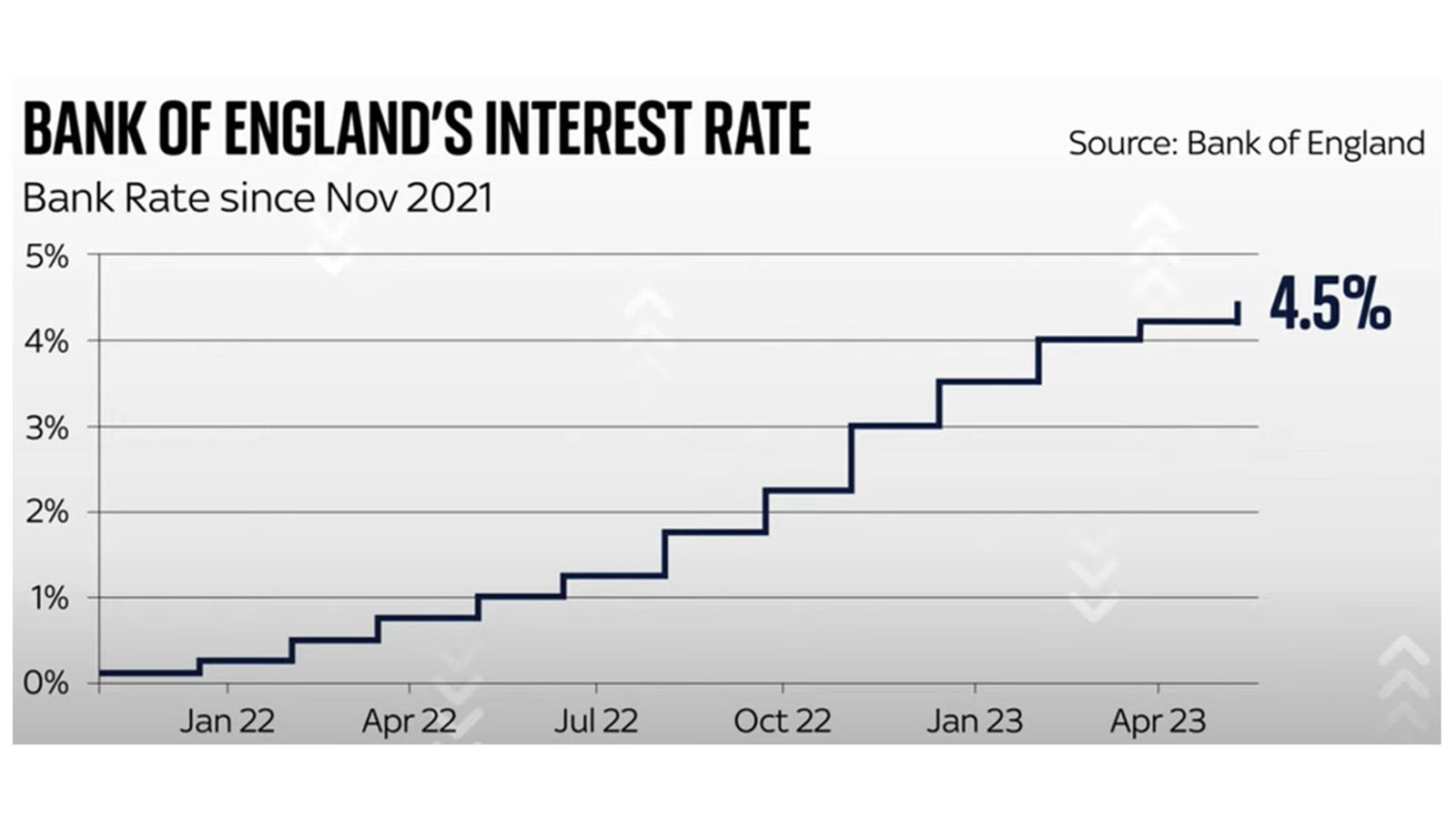

Both the Federal Reserve and the European Central Bank raised their policy interest rate again this week. The Fed rate now stands at its highest in 22 years. The ECB rate has never been as high. The ostensible reason for this is that hiking interest rates until the pips squeak in the economic orange will eventually get the inflation rate of consumer prices down to the (arbitrary) central bank targets of 2% a year.

This policy is based on the theory that accelerating inflation was being caused by ‘excessive demand’ by consumers (workers). So raising interest rates, by increasing the cost of borrowing (mortgages, consumer credit and loans to firms), will slow down spending and investment sufficiently to bring ‘demand’ back into line with ‘supply’.

Continuing differences over the cause of this period of inflation

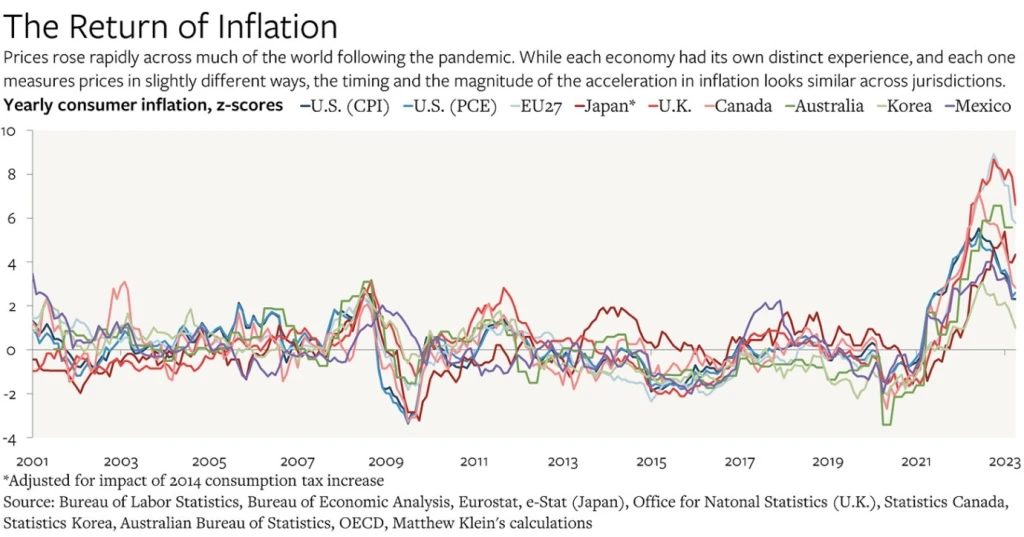

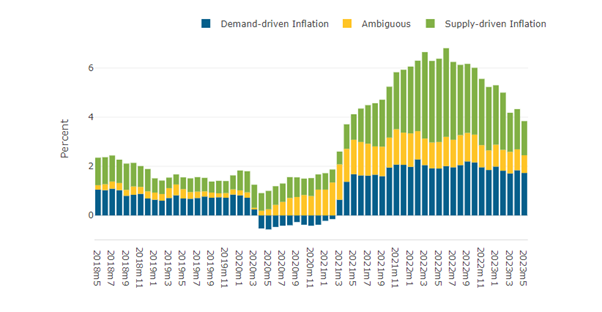

As I and many others have argued, this theory is full of holes. It assumes that the cause of inflation is excessive demand and not insufficient supply. The latter side of the price equation is ignored. And yet the evidence on the causes of the inflationary spike since the end of the pandemic slump clearly shows that it was a supply ‘shock’ (the word used by the mainstream to describe anything disturbing the supposed harmony of supply and demand in a market economy).

After the pandemic, global production was slow to recover as healthy labour was in short supply and international trade and transport was clogged with obstacles. As a result, in particular, basic commodities (food and energy) rose sharply in price, driving up import prices for most countries.

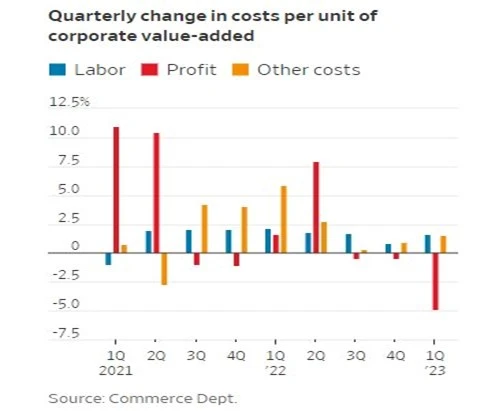

In addition, multi-national food and energy producers took advantage of the supply blockages to raise prices and increase profits (and to some extent, lever up their ‘mark-ups’ on costs). In addition, the Russian invasion of Ukraine added another accelerator to price rises. We now know that it was profits that made the largest contribution to price rises in the last two years, not wages. There was no ‘wage-price ‘ spiral as the central bankers claimed as one reason why interest rates had to rise; on the contrary, it was profit-price spiral.

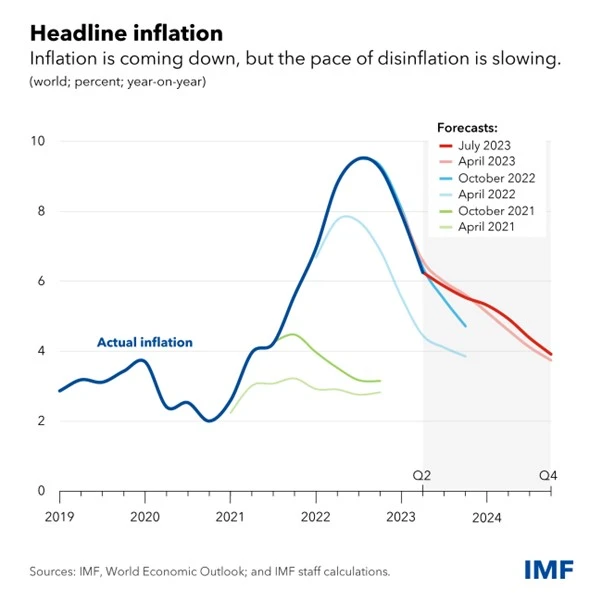

But here is the rub. Despite the huge rise in interest rates, and with more to come, consumer price inflation is still not back to anywhere near 2% a year. At his press conference this week, Fed chair Powell said that the Fed’s 2% target would not be reached before 2025! It is more likely that the US economy will have been driven into a slump before then.

Current trends in inflation

Yes, so-called headline inflation has been falling fast as food and energy supply improved and prices for these essentials dropped back. The US inflation rate has fallen back to 3% a year and Spain’s even below 2%. The IMF reckons that global inflation will drop from 6% a year now to 4% a year, but not until the end of 2024. But the pace of reduction is likely to slow because so-called ‘core’ inflation rates, which exclude food and energy, and in effect measure ‘underlying’ or ‘domestic’ inflation of prices in an economy, have remained ‘sticky’, i.e well above the 2%.

In short, central banks continue to hike interest rates despite the failure of this policy to have any significant effect on the prices of goods and services, despite claims to the contrary. I am reminded by the claim by central banks back in the 2010s that they needed to keep interest rates near zero or even below in order to boost ‘demand’ and avoid inflation going under 2% or even into deflation. This is the current policy of the Bank of Japan. Despite huge dollops of money injection (quantitative easing) and zero interest rates, price inflation refused to reach the 2% targets in the major economies (and has not succeeded in Japan now). Instead, there was a credit-fuelled boom in stock and bond prices. Now the situation is in reverse.

Mainstream economics ploughs on regardless

Despite the abject failure of monetary policy to affect inflation rates, mainstream economics continues to claim that it does and there is no alternative to raising interest rates. Take Noah Smith, a prolific mainstream economics blogger. Smith claims that the 2% inflation target will soon be met in the US. He bases this on measuring inflation rates in the most inflationary sectors. But right now, ‘core’ inflation remains close to 5% a year.

Smith claims that mainstream economic policy has worked. He dismisses modern monetary theory as failing to explain inflation; or the hyperinflation theory of cryptocurrency enthusiasts. He reluctantly admits that “supply chain collapses, increased deficits, and the oil price spike all probably did contribute to the inflation of 2021-22.”

But he rejects the ‘greedflation’ theory of inflation that claims it is all due to greedy monopoly companies using market power to hike prices. As Smith says: “When greedflation proponents say that profits “caused” inflation, they typically just show that both profits and prices rose in 2021-22. But that’s correlation, not causation; it could easily just be that supply and demand shocks drove prices higher, and that companies merely reaped a passive windfall from that, without any change in their behavior or market power. When we look at changes in markups (which are closely related to profit margins), we see that these weren’t correlated with price changes at the industry level.” Indeed, on all these theories, Smith has a point.

So which theory got it right? Smith claims “the answer is a bit surprising: It was good old mainstream macroeconomics.” By hiking interest rates and cutting budget deficits, ‘excessive demand’ has been curbed and, low and behold, inflation is falling while unemployment has stayed low and recession has been avoided. Smith says triumphantly, “it looks like the Fed and Congress, with an assist from falling oil prices, have pulled off the most elusive and sought-after Holy Grail of macroeconomic stabilization — the costless disinflation. And even if the economy does cool off a little bit in the months to come, it would still be in the Goldilocks region of a soft landing. You can’t really ask policymakers — or macroeconomic theorists — to do any better than that!”

Fault lines in mainstream economic theory

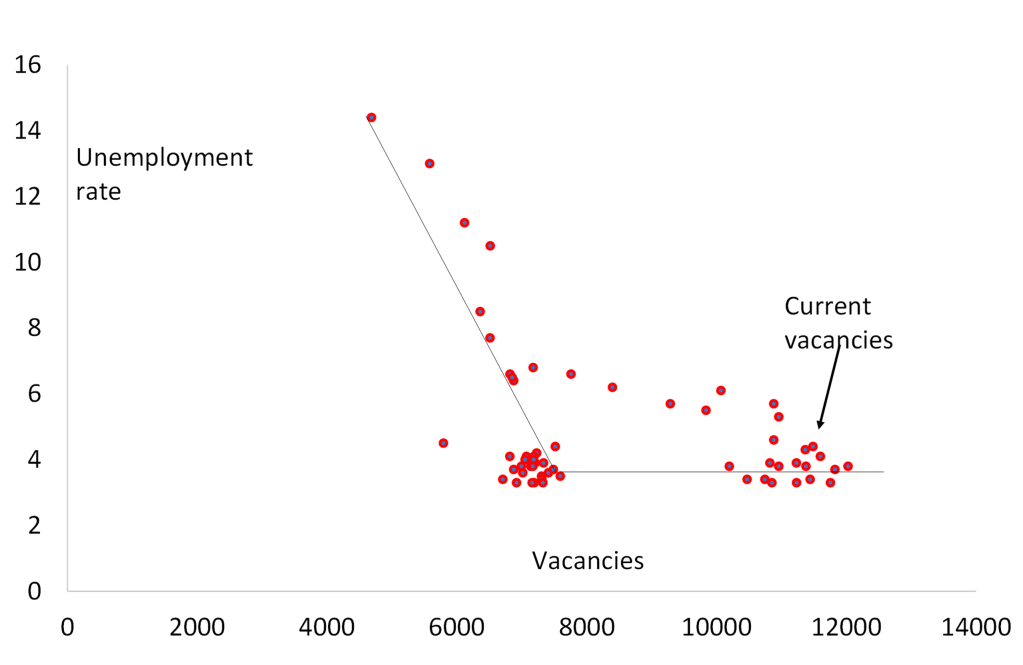

But the fact that inflation is falling and unemployment has not risen in the major economies is really an indicator of the faultlines in mainstream economic theory. If money supply growth is reduced or ‘excessive demand’ is forced down by rising interest rates, then unemployment should rise, according to mainstream theory. But instead, the Phillips curve (the mainstream theory of a trade-off between inflation and unemployment) has remained flat and the so-called Beveridge curve (where job vacancies fall and unemployment rises) has taken on an ‘elbow-shape’ – namely vacancy rates have risen, but unemployment has been unmoved.

The Beveridge ‘curve’ is not a curve but an elbow.

This suggests that it is not ‘excessive’ demand or ‘excessive’ money supply growth that caused inflation, as mainstream theories argue, but something on the ‘supply-side’. Indeed, supply factors have been much more important, as the San Francisco Fed analysis shows.

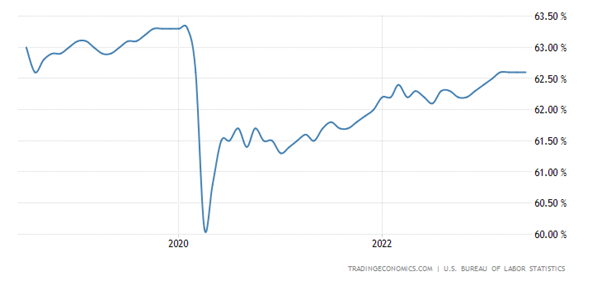

The reason for low unemployment also lies with the ‘supply-side’. In the US, there has been a significant increase in ‘early retirement’ as older workers decided not to return to the labour market after the pandemic; and in the US and the UK, for example, the hit to the health of many workers from ‘long COVID’ and also the lack of medical treatment for other ailments during the pandemic has meant a huge drop in labour supply.

US labour force participation rate

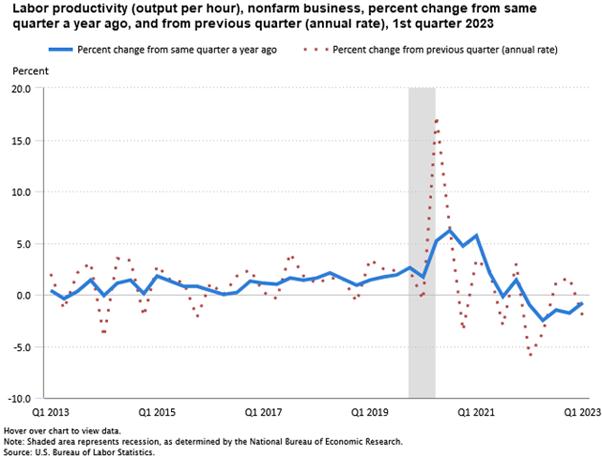

And the productivity growth of the existing labour force has been historically low in all the major economies. Many skilled workers have left the labour market for good to survive on their pensions; while employers, rather than invest in labour-saving technology, have simply tried to raise production with more labour. As a result, productivity growth has slumped. That means any wage rises that workers achieve tend to drive up labour costs per unit of production.

That keeps inflation rates ‘sticky’, assuming the companies can pass on rising labour costs into price rises. They were able to do that during 2021-222, but now that is increasingly difficult and corporate profit margins are falling back.

US corporate profits are now falling. According to FactSet, for Q2 2023, the blended earnings decline for the S&P 500 is -7.1%, the largest earnings decline reported by the index since Q2 2020 (-31.6%). And much of the high profits and stock market gains have been confined to the seven large tech stocks – up 58% so far this year compared to just 4% for the other 493 stocks in the S&P 500 index.

Claims that inflation has been beaten without causing a slump

The view, as expressed by Noah Smith, is that the battle against inflation is won without the major economies slipping into a slump. Central banks will soon be able to stop raising interest rates and the major economies, particularly the US, will have ‘soft landing’ and then resume some measure of steady economic growth alongside modest inflation that means rising living standards for all. This ‘Goldilocks’ scenario of economies that are not ‘too hot’ nor ‘too cold’ is the consensus view of financial investors. As a result, the US stock market is booming and reaching new post-pandemic highs.

But the economic data don’t really support the consensus. It’s true that US real GDP growth picked up in Q2, according to first estimates, rising at an annual rate of 2.4% compared to 1.8% in Q1. This appears to have been driven by an exceptional burst in business investment, mainly in transport equipment. That will not be repeated in the second half of 2023.

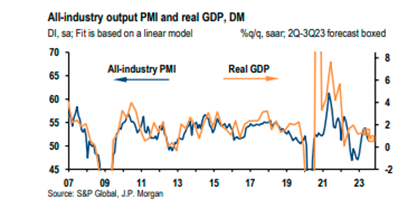

The latest economic activity indexes (called PMIs) for July (the beginning of Q3) show that the major economies were slowing significantly, with the Eurozone contracting outright. Australia was also in recession and Japan, the UK and the US were slowing towards zero expansion. Manufacturing everywhere has already been contracting, but now the services sector was also slowing down. The US economy has been the strongest and even there the US index fell back. Excluding the pandemic period, the global PMI is now at its lowest level since the ‘mini-recession’ of 2016 (blue line).

Indeed, the US Conference Board Leading Economic Indicator (LEI) forecasts a recession in the US before the year is out. The LEI fell again in June, “fueled by gloomier consumer expectations, weaker new orders, an increased number of initial claims for unemployment, and a reduction in housing construction,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. The LEI has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the run up to the Great Recession. “Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead.” The Conference Board forecasts that the US economy is likely to be in recession from Q3 2023 to Q1 2024.

Globally, there is already a trade recession. The annual growth rate of global import volumes turned negative late last year and remained negative in 2023. This trade recession is a feature of the Long Depression (my term), which has been putting downward pressure on global trade growth for more than a decade now. In the ten years to 2020, the average rate of global trade growth fell below that of global GDP growth: this was the first decade since the second world war for which that statement holds true.

A banking crisis on top of a trade recession

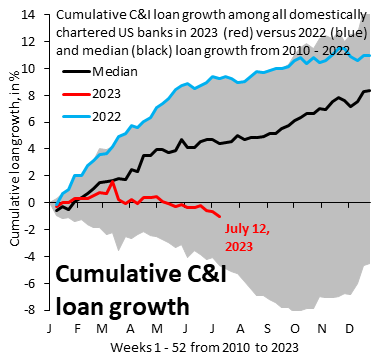

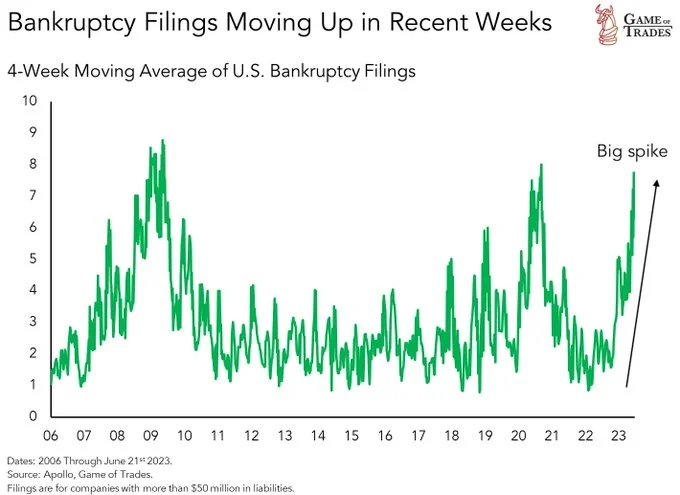

And the banking crisis that emerged last March is still on the horizon again, as rising interest rates drive down the demand for loans and corporate bankruptcies rise. US bank lending to commercial and industrial sectors has started to contract. And loan growth in the Eurozone is at a 20-year low. That will eventually squeeze investment.

Indeed, corporate bankruptcies have spiked in the last few weeks.

US consumer prices inflation dropped sharply in June to 3.0% year on year (yoy) and ‘core’ inflation, which excludes food and energy prices, also fell back to 4.8% yoy. These figures took the inflation rate back to 2021 levels. But this has not been achieved by central bank monetary policy pushing down ‘excessive demand’ but through slowing growth, particularly in manufacturing and trade. What’s going to bring inflation down further is not more rate hikes but a recession.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.