By Michael Roberts

Last week a US district court granted Sri Lanka’s request for a six-month pause on a creditor lawsuit against the country. Hamilton Reserve Bank holds a big chunk of one of Sri Lanka’s now-defaulted bonds and had been suing it for immediate repayment.

The court decided that there should be a pause in Hamilton’s demand for immediate repayment so that Sri Lanka could arrange a deal with other private sector creditors and bilateral lenders, as well as obtaining new funds from the IMF. The IMF has been unwilling to cough up money as long as it considered Sri Lanka unable to pay back its debt obligations. It is insisting that all creditors agree to a ‘restructuring’ of existing debt before agreeing to new IMF funding (which would also be accompanied by strong ‘conditionalities’ ie fiscal austerity, privatisations etc).

What role is China playing in Sri Lanka’s debt crisis?

The IMF, World Bank and other Western creditors have claimed that what is holding up a rescheduling is China. In turn, China is refusing to agree to a deal unless all other parties are agreed on the terms, and it does not like the terms currently proposed.

In the case of Sri Lanka and many other poor peripheral countries in serious debt distress, it is regularly argued that they are in a ‘debt trap’ caused by taking loans from China to such an extent that they cannot repay them and then China insists on taking over the country’s assets to meet the bill. Indeed, US President Biden reiterated this charge only this week in a speech claiming that the West was ready to help poor countries expand their infrastructure.

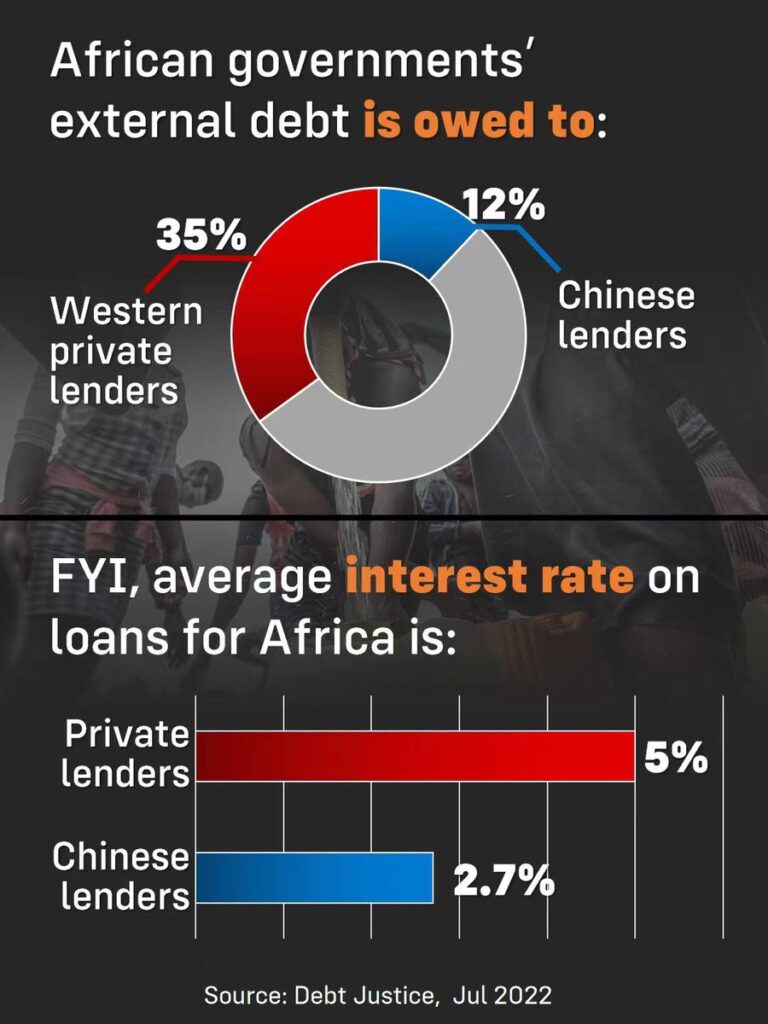

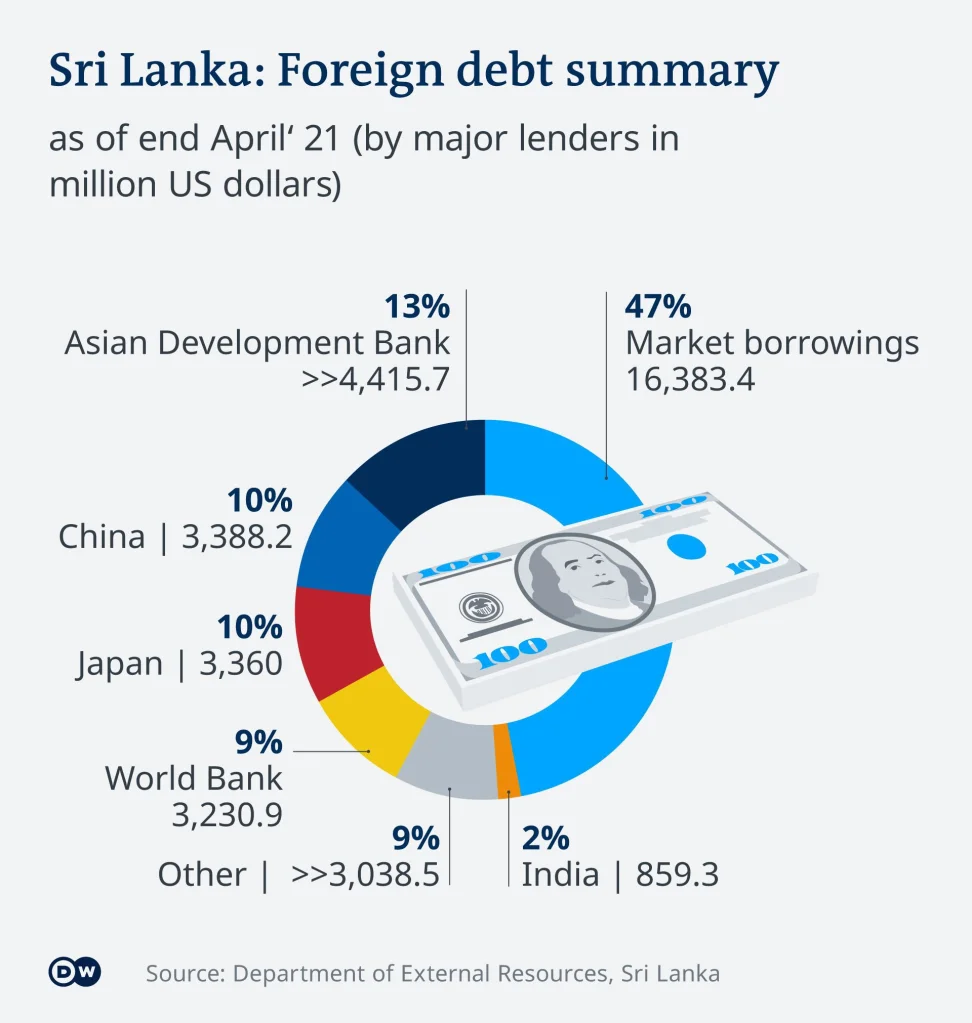

This widespread charge does not hold much water. It leaks badly. First, China is not a particularly large lender to poor countries like Sri Lanka compared to Western creditors and the multi-national agencies.

In the case of Sri Lanka, Japan and the World Bank remained significant lenders at 9-10%, China has 10% too and the IMF’s proportion has shrunk to just 4%, with the UK and Germany accounting for around 1% each. All these official lenders have been replaced mainly by commercial lenders at nearly 50%.

Second, the rise in Sri Lanka’s debt burden was not the result of China’s ‘imperialist’ debt trap, but was caused by the desperate need of the corrupt and autocratic Sri Lankan government. After the 2008 Global Financial Crisis, interest rates fell globally, and Sri Lanka’s government looked to international sovereign bonds to further finance spending.

How debt in Sri Lanka has shot up since the COVID-19 pandemic

But then COVID-19 hit, ravaging the tourism sector, a major source of income. COVID-19 required increased spending and increased imports of health and other products, exacerbating the trade deficit. Foreign currency reserves dropped by 70 percent, meaning less dollars to purchase essential yet increasingly expensive imports including fuel and commodities. To solve this, the government started to ‘print money’ to cover its deficits. Inflation rocketed to 60 percent by June 2022. As the right-wing Chatham House study shows, “Sri Lanka’s debt crisis was made, not in China, but in Colombo, and in the international (i.e. Western-dominated) financial markets.”

By 2016, 61 per cent of the government’s sustained budget deficit was financed by foreign borrowing, with total government debt increasing by 52 per cent between 2009 and 2016. Three-quarters of external government debt was owed to private financial institutions, not to foreign governments. Despite ample warnings about the Sri Lankan economy, foreign creditors kept lending, while the government refused to change course for political reasons. This was the real nature of the ‘debt trap’.

The failure of the Hambantota port project

That brings us to the Sri Lankan port project, the usual issue raised about China’s supposed ‘debt trap’. China did not propose the port; the project was overwhelmingly driven by the Sri Lankan government with the aim of reducing trade costs. To quote Chatham House, “Sri Lanka’s debt trap was thus primarily created as a result of domestic policy decisions and was facilitated by Western lending and monetary policy, and not by the policies of the Chinese government. China’s aid to Sri Lanka involved facilitating investment, not a debt-for-asset swap. The story of Hambantota Port is, in reality, a narrative of political and economic incompetence, facilitated by lax governance and inadequate risk management on both sides.”

In 2022, Rajapaksa was forced out of office after major popular protests but was only replaced by his close supporter, Ranil Wickremesinghe, who despite agreeing to fiscal measures with the IMF, has failed to get its approval to release funds while the debt rescheduling agreement has not been achieved.

Hamilton Reserve Bank, the ‘vulture’ hedge fund demanding full repayment

And it is the obscure Hamilton Bank that is opposed to any agreement and instead is demanding full repayment on its holding of Sri Lankan bonds. Hamilton is what is called a ‘vulture’ fund’, buying up the ‘distressed debt’ of poor country governments at rock bottom prices and then pushing for full repayment at par (the original bond issue price), using the blackmail of refusing to agree to any ‘restructuring’. These vulture hedge funds specialise in sniffing out vulnerable sovereign bonds, amassing a blocking stake, waiting patiently for a broader restructuring to take place, and holding out for full repayment once a country has secured debt relief from other creditors. It’s called being a “holdout”.

The most infamous and successful example of this strategy was by Paul Singer’s Elliott Management which managed to extract $2.4bn out of Argentina in 2016 from the right-wing Macri government. In paying Elliott off, Macri was then able to get the biggest ever IMF fund deal in history, designed to ensure that government’s position in office for a long time – although that payout was squandered and the Macri government fell. The debt crisis goes on in Argentina.

Hamilton wants to follow in Elliott’s footsteps. In a bank presentation, the bank says “suing a sovereign for non-debt payment can be a justified and lucrative business”. So Hamilton is a typical ‘vulture’ fund. The shareholder is a company called Fintech Holdings based, guess where, Puerto Rico. And behind Fintech is a Benjamin Wey, a Chinese-American, who describes himself as a “philanthropist and global financier”. In 2015, he was arrested for fraud, but charges were eventually dropped in 2017 after a federal judge threw out evidence that prosecutors had obtained in a search of his apartment and office. The New York Post dubbed Wey the “Horndog CEO” after he had to pay $18mn to an intern he had sexually harassed (later reduced to $5.65mn).

Hamilton Bank’s directors are not Wey, but Sir Tony Baldry, a former MP and aide to Margaret Thatcher, who is now chair. (For my sins I was at university with Baldry!). The CEO is Prabhakar Kaza, who is a British Conservative councillor. Hamilton is now registered in the tiny Caribbean island of St Kitts and Nevis. And Hamilton is demanding $250m in bond repayment and interest from the Sri Lankan government. The US court has intervened on behalf of the US government and other creditors to stop Hamilton getting its pound of flesh, at least until there is a general restructuring deal that Hamilton will be forced to go along with.

Cuts will be demanded in return for debt rescheduling

Even if Hamilton is thwarted and a deal with creditors is reached, Sri Lanka will still be burdened by a huge debt liability that can only be ‘serviced’ by cuts in the already low living standards of 22m Sri Lankans. The IMF has already indicated it will encourage austerity in Sri Lanka – reducing spending and increasing taxes. Sri Lanka did not seek IMF debt relief in the 1990s or early 2000s for that reason. But now it is either Hamilton or the IMF.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

The featured image is from 2022 and shows people in Sri Lanka queueing up for a long time to fill up their liquefied petroleum gas cylinders. The image is from Wikimedia Commons. Attribution: AntanO – Own work, CC BY-SA 4.0