By Michael Roberts

After a relatively strong US real GDP figure for the third quarter of the year, the consensus is that the US will not have a recession this year or next. Indeed, on the contrary, investment bankers Goldman Sachs, not only forecast some economic growth in 2024 but an acceleration for the US economy and for the major economies.

I threw a little cold water on that forecast in a recent post. And not everybody is as confident about the US economy avoiding recession in the next 12 months. Take the view of William Dudley, former New York Fed chief. He commented in the FT: “My view for two years was that we were going to have a recession at some point…. I’ve always thought that once the unemployment rate goes up by more than a certain amount, the chances of recession go up dramatically. That’s the key question right now: does the unemployment rate have to rise to 4.25-4.5 per cent for the Fed to achieve their “final mile” on getting inflation back down to 2 per cent? If you think it does, then a hard landing is highly likely.”

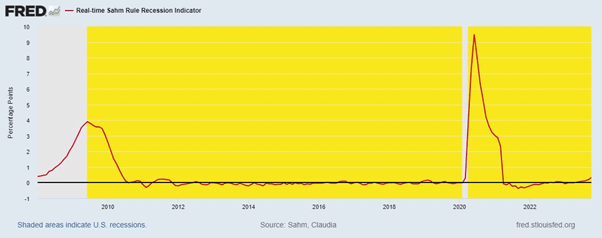

The work of economist Claudia Sahm has gained some prominence

And on that issue, the work of Claudia Sahm, another former Fed economist, has gained some prominence. Sahm reckons that if the unemployment rate runs some 0.5% points above the bottom for three months, it is a very strong indicator of a recession in output. “I have said the whole time that we do not need a recession, but we may get one.” As she put it in the FT: “I developed the Sahm rule in 2019 as a trigger when a recession has started. It’s not a forecast, it’s an indicator. The rule has worked in every single recession since the 1970s and basically everything going back to the second world war — it doesn’t turn on outside of recessions and it doesn’t fail to turn on in a recession. And it shows up early, so it’s highly accurate.” She continued: “the reading on the Sahm Rule in October was 0.3 percentage points and while it has been moving up, particularly in the second half of the year, that level would not yet indicate we are in, or going into, a recession. …. But it is disconcerting — the unemployment rate is going up.”

Even if the US avoids an outright contraction in real GDP in the next few quarters, it is likely that the US will suffer a significant slowdown to almost stagnation next year, with inflation still well above the pre-pandemic average and the Fed’s own target of 2% a year.

What the Purchasing Managers’ Index (PMI) is indicating

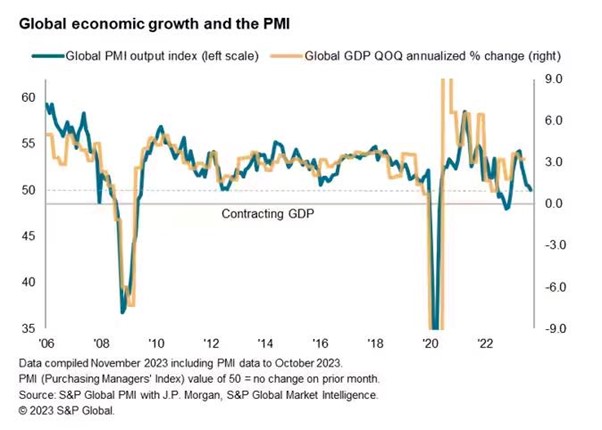

And as for the rest of the major economies, outright recession appears much more likely. Worldwide business activity stalled in October as global PMI hit 50.0. The global PMI is a reliable measure of economic activity in economies – and the 50 mark is the threshold between expansion and contraction. The global PMI has not fallen below 50 since the global financial crisis.

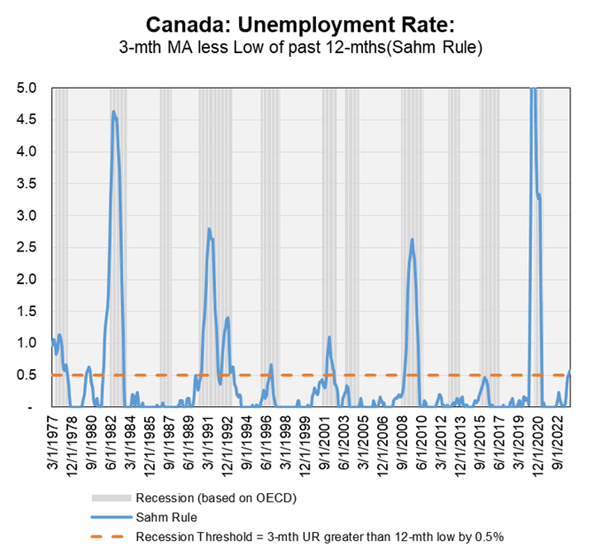

And as shown in my previous post on the US economy, the major developed capitalist economies continued to have a reading below 50 – indicating contraction. Indeed, many advanced capitalist economies are already in recession. The Eurozone economy contracted in Q3. Real GDP fell -0.1%, marking the first contraction since 2020 when the covid-19 pandemic weighed. A ‘technical’ recession looks likely – two consecutive quarterly declines, as Q4 could also show a contraction. Sweden is contracting, Canada is contracting and the latest figure for the UK showed the economy heading into recession. Real GDP was flat in Q3 and Q4 has started very weak. The Bank of England is now forecasting five quarters of zero growth at best. And real GDP growth is still well below pre-GFC (Global Financial Crash) growth trends.

Indeed, Canada has already breached the Sahm rule.

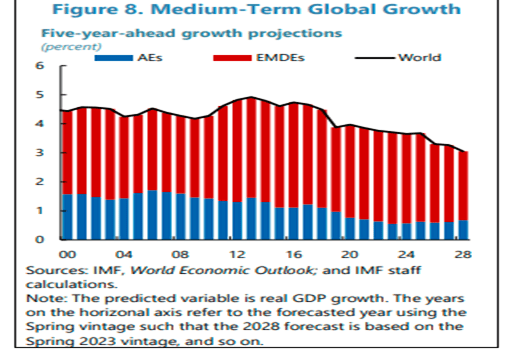

Even if the major economies do not suffer a contraction in output, investment and employment in 2024, the prospects for the rest of this decade are not good. In a report covering the G20 economies (that’s 19 top economies plus the Eurozone), the IMF projects that global growth will slow 3.0 percent in 2023 and 2.9 percent in 2024 from 3.5 percent in 2022 and this includes forecasts for faster growth in China and India next year. The slowdown is particularly pronounced in the European Union where growth is projected to decline from 3.6 percent in 2022 to 0.7 percent this year. Most G-20 emerging market economies other than Brazil, China, and Russia are also expected to experience a slowdown this year.

Debt crisis, food insecurity and slowing economic growth

In previous posts, I have already reported on the debt crisis that many so-called emerging market economies are suffering. The IMF reckons that debt servicing costs are likely to rise sharply and with many poor economies rely substantially on foreign currency denominated borrowing, they are vulnerable to a currency crash.

Meanwhile, the World Food Program estimates that about 345 million people will be food insecure in 2023—almost 200 million more than in early 2020. “High energy prices, particularly natural gas, have contributed to higher food prices and have driven an increased reliance on higher-emission fuels, such as coal, setting back the green transition.” (IMF).

The IMF sums it up: “the medium-term outlook for global growth is at its lowest in decades. The IMF’s five-year ahead global growth projections have steadily declined from a peak of 4.9 percent in 2013 to just 3.1 percent in 2023, lowering the pace of convergence in living standards between emerging market and developing economies and advanced economies, while also posing challenges for debt sustainability and investment in the climate transition.”

What’s the problem? Well, the IMF refers to “monetary policy tightening to curb persistent inflation” (rising interest rates), “fiscal consolidation” (cuts in public spending and higher taxes), and the end of what I have called the ‘sugar rush’ in the post-pandemic recovery in 2021 and 2022.

But what’s the underlying problem? Well, says the IMF it’s “the slowdown of rapidly growing emerging market economies like China, scarring from the pandemic, weak productivity growth, a slower pace of structural reforms, and the rising threat of geoeconomic fragmentation, while demographic challenges from aging are expected to contribute to a slowdown in labor force participation in advanced economies.”

The underlying cause of the slowdown

I’m sure all of these are factors, but they are surface factors. The underlying cause of the slowdown in productivity and world trade, and the increased geopolitical rivalry is to be found in the slowing of productive investment growth in the major economies. What has been keeping growth up so far has been unproductive investment in finance, real estate and now military spending. Investment in technology, education and manufacturing has dropped away. And the basic reason for that is the stagnating and even downward trend in the global profitability of productive capital in the 23 years of the 21st century.

The IMF reports that “developing economies face large financing needs to meet their development goals and invest in climate action—to the order of $3 trillion in additional annual spending by 2030 for emerging market economies excluding China—but many have limited policy space following multiple shocks.”

The IMF points out that “capital has generally not flowed freely from advanced economies to emerging market and developing economies where returns on capital tend to be relatively higher.” The imperialist bloc of countries have reduced capital exports; instead they are taking capital and profits out of the peripheral economies. “Despite some reversal after the GFC, uphill capital flows from emerging market and developing economies to advanced economies reemerged in 2022. Going forward, a prolonged tightening of global financial conditions could trigger broad-based capital outflows from vulnerable emerging market and developing economies.”

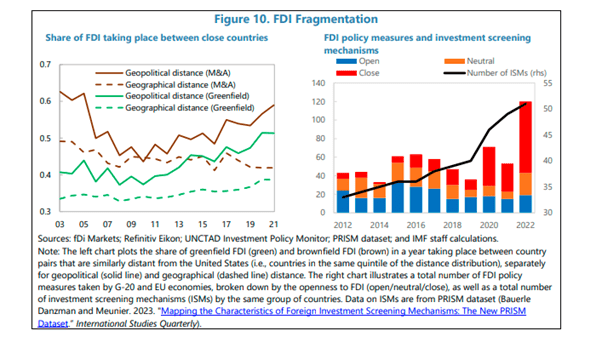

Foreign Direct Investment (FDI) fragmentation

‘Friend-shoring’ is the name of the game, where companies in the so-called global north switch their investment to “countries that share similar geopolitical views” and away from their supposed enemies like China or Russia or ‘non-aligned’ countries.

Capitalism is failing to deliver on its own objectives, namely faster real output growth, higher investment and above all higher profitability of capital. What can be done? The IMF wants ‘structural reforms’. What are these ‘supply-side’ measures? The IMF wants more ‘labor market flexibility. That might mean more women in jobs but it also means weaker trade unions and an end to protective labour laws and rights ie more exploitation.

Utopian hopes of the IMF on ‘debt sustainability’ and clean energy investment

The IMF wants “fiscal consolidation” That means higher taxes and lower public spending in order to restore ‘debt sustainability’. It wants more clean energy investment “to deliver on climate commitments”. And “increased multilateral cooperation to help address global challenges and prevent further fragmentation.” But these proposals are wild utopian hopes, given the increased spending on fossil fuel production and rising global temperatures. Multilateral cooperation on ‘debt resolution’ for indebted poor countries is not happening, let alone any cancelling of the ‘odious debt’ forced on such countries.

On the contrary, the IMF is still enamoured of what it calls ‘financial globalization’ which “by facilitating greater cross-border capital flows—has contributed to economic development around the world.” This is not only because foreign investment might help poor countries (and we have seen that this is dubious) but also “capital flows may bring indirect benefits by imposing discipline on macroeconomic policies” – in other words it can be used as blackmail to stop national governments introducing measures to stop ‘financial globalisation’.

Indeed, the IMF admits that “despite the crucial benefits of financial globalization, it also exposes countries to certain risks, particularly in times of crisis. Capital flows can fuel the buildup of systemic vulnerabilities in the form of currency and maturity mismatches. Excessive capital flow volatility and vulnerability to sudden stops and reversals can be particularly severe in countries with weak monetary policy credibility. Greater integration into global financial markets also exposes an economy to spillovers from the global financial cycle, which can dampen monetary policy effectiveness, as policymakers lose control over domestic interest rates.” Exactly! Ask Africa, Latin America and South Asia.

IMF ‘reforms’ offer no solution

Another ‘reform’ advocated by the IMF to boost capitalist growth is to reduce “inefficiencies associated with state-owned enterprises” (ie privatise); “lower regulatory barriers to entry” (less regulation and trade barriers) and increase “access to finance to foster business dynamism” (let the banks rule).

The climate change reform for the IMF is carbon pricing, a market solution to reduce emissions that so far has been a total failure. The IMF hopes for “careful international coordination, and consideration of international spillovers.” But don’t hold your breath for anything coming out of the upcoming COP28 international climate conference.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

The featured image is a screen capture from an interview with Claudia Sahm on the Bloomberg TV Youtube channel.