By Michael Roberts

This blog was originally published by Michael Roberts on Saturday, 1 June 2024. The original article can be found here.

**************

Mexico has its general election this Sunday. With a population of over 130 million, Mexico is among the 15 largest economies in the world and the second-largest economy in Latin America.

Andrés Manuel López Obrador, known as AMLO, has been president since 2018 and so cannot stand again. His party, Moreno, that he formed in 2012, is putting up the former mayor of the capital city, Mexico City, Claudia Sheinbaum. Sheinbaum is facing opposition from Xochitl Galvez, representing a coalition of ‘business-friendly’ parties. The campaigning has now ended and Sheinbaum holds a 21-point lead in the opinion polls over Gálvez.

What progress has been made on crime, corruption and inequality?

AMLO’s presidential victory in 2018 was seen as a shift to the left in the interests of working people in Mexico over the long standing rule of the corrupt and pro-capitalist parties of PRD and PAN. In 2018, AMLO campaigned on three key issues: rising pervasive and daily violence across the country; endemic corruption among politicians and officials; and high and rising inequality between rich and poor.

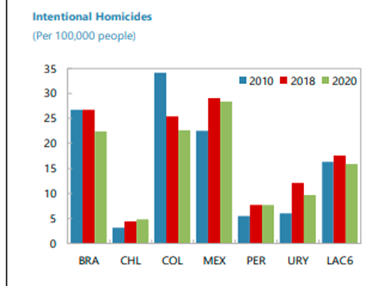

How did AMLO do on those issues? Well, there seems to have been little improvement in violence and crime. ‘Intentional homicides’ have fallen a little since 2018 but are still way higher than in 2010. In 2020, Mexico had the worst record in the top Latin American countries on this measure. But remember this longstanding crime wave is mainly a product of drug cartel wars – and the huge drug export industry is really a consequence of consumer addiction in the US and criminal elements there.

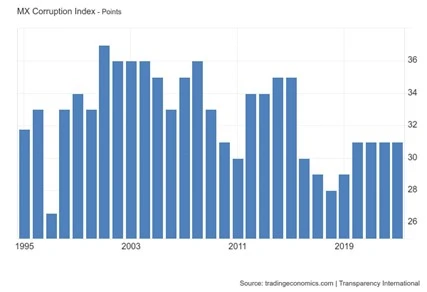

What about corruption? AMLO has stood for being the most incorrupt president that Mexico has had since the 1930s. The corruption index from Transparency International shows that corruption among officials and professions is indeed a little better than in 2018 (the lower the score, the higher the corruption), but still way worse than in the 2000s.

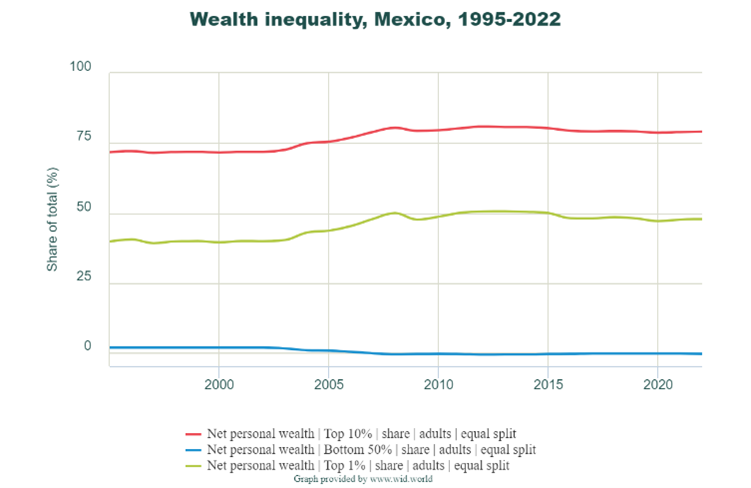

What about inequality of incomes and wealth? Well, according to the World Inequality Database, in 2012, the top 1% of Mexican income earners took 27.4% of all personal income and the top 10% took 64.1%, while the bottom 50% took just 5.4%. The latest figures are for 2022 and they show the top 1% taking 26.8% and the top 10% taking 64.6%, while the bottom 50% had just 6.0%. So there has been no visible improvement in income inequality under the AMLO years.

Raising of minimum wage levels but wealth inequality persists

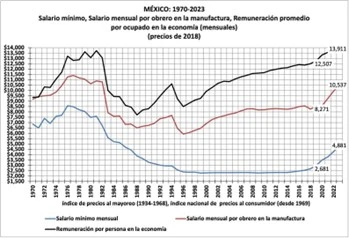

Professor Aberlardo Marina, economist at Universidad Autónoma Metropolitana Mexico, shows that AMLO’s program of raising the minimum wage levels and other social benefits has helped incomes for those at the bottom. In the last six years, the minimum wage increased by 82% and manufacturing wages rose 27%.

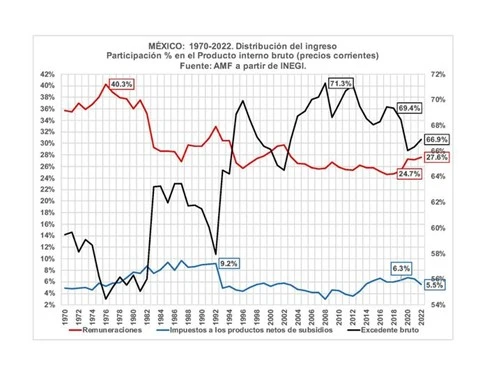

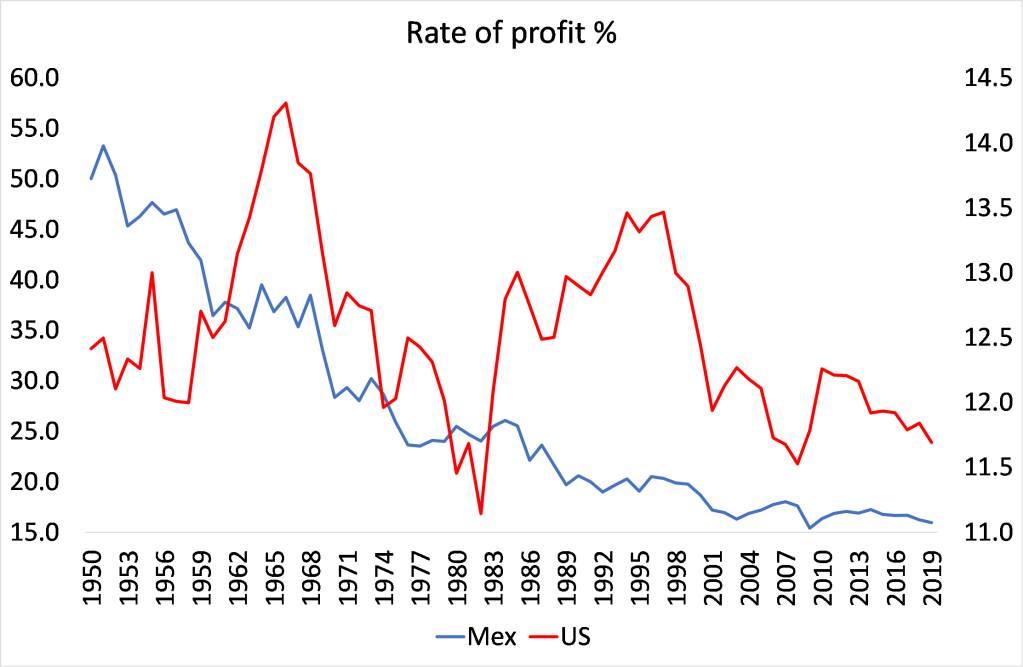

As a result, the share of GDP going to labour has increased from a low under the pro-capitalist Pena presidency at 24.6% in 2012 to 27.6% in 2022, while the profit share has fallen back. But the share going to labour is still way down compared with the 1970s before the onset of neoliberal policies adopted by pro-capitalist governments in Mexico (and globally). Then wage share fell and profit share rose.

When it comes to inequality of wealth, the situation for the majority is even worse. In 2012, the top 1% of wealth holders had 27.4% of all personal wealth in Mexico; the top 10% had staggering 80%, while the bottom 50% had negative wealth (more debt than assets). In 2022, the top 1% had 26.8% of all personal wealth; the top 10% had 79.1% and the bottom 50% still had negative wealth. So again, no visible improvement.

Poverty levels worse than the Latin American average

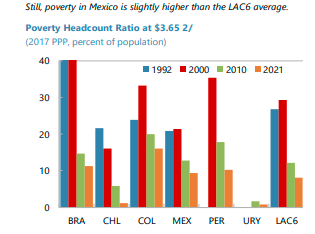

And when we look at poverty ratios, although the ‘extreme poverty’ rate (earning less than $2.15 day) has fallen under AMLO, lifting 8.8 million Mexicans out of poverty – a big gain – Mexico still has a greater share of people living on less than $3.65 a day than the Latin American average.

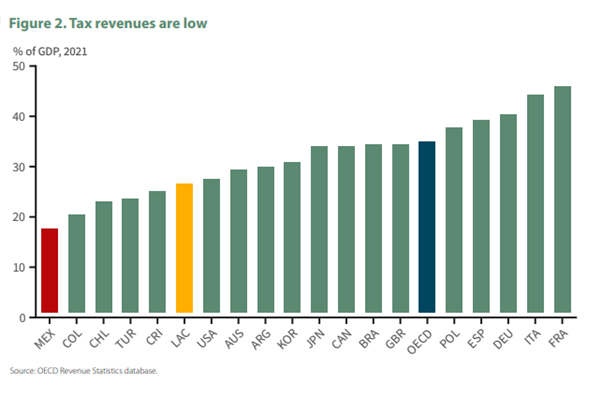

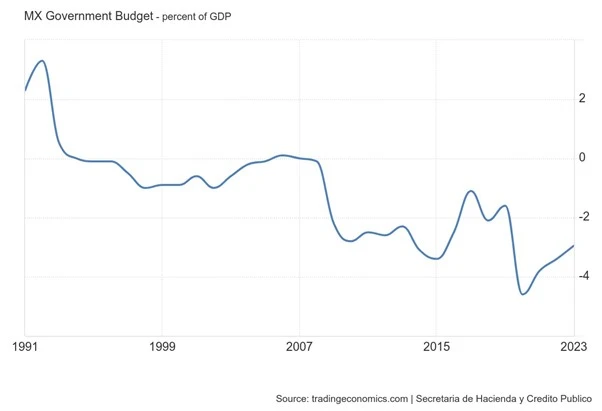

Mexico has the lowest tax-to-GDP ratio in the OECD. The rich are not paying much in tax…

… forcing the government to run large budget deficits and borrow more to finance welfare spending and public services.

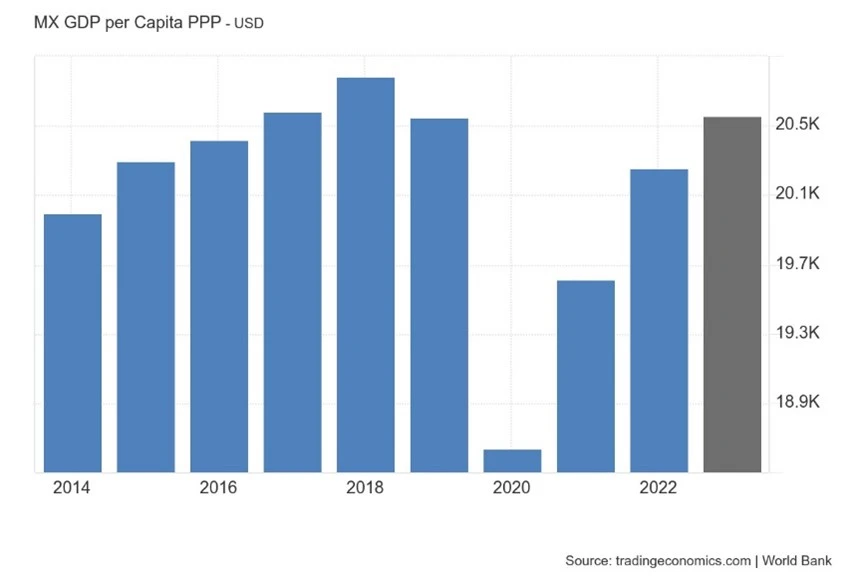

Limited economic growth

Besides these issues, what is the state of the Mexican economy? Over the last three decades, Mexico has underperformed in terms of growth. Its economic growth has averaged just above 2% a year between 1980 and 2022, limiting any progress in convergence relative to high-income economies. Indeed, since the pandemic, the average real GDP growth rate has been just 0.7%, although in 2020 and 2023, following the rebound after the pandemic, the economy expanded by over 3% each year. Stripping out population increases, we find that Mexico’s per capita GDP is still lower than in 2018.

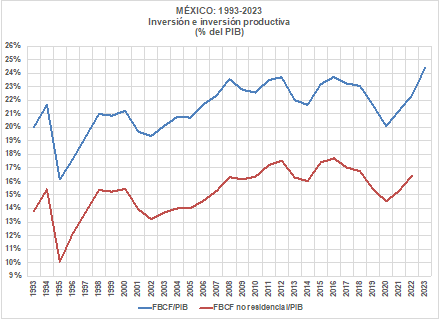

Over the decades, Mexico’s capitalist sector has failed to deliver on productive investment and thus on productivity growth. Professor Marina shows that productive investment (ie excluding construction of homes and real estate) has never been higher than 17% of GDP and has fallen under AMLO’s presidency. And there was stagnation during the Long Depression of the 2010s.

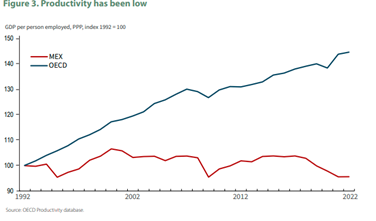

Productivity levels are lower than ten years ago, although there has been some recovery since the pandemic.

The reason that Mexico’s capitalists are not investing productively, despite a high profit share and low taxes, is that the profitability of Mexican capital has been in secular decline and so productive investment has been rejected in favour of real estate and financial speculation. And much of the profitability has ended up in American companies.

US capital dominates the Mexican economy

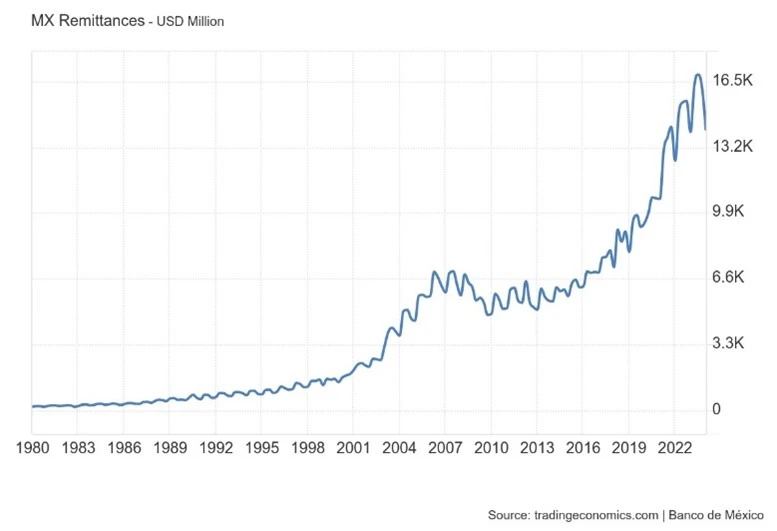

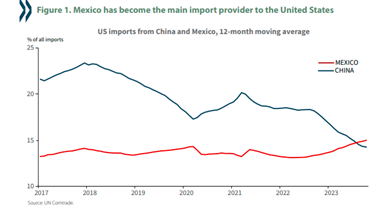

Mexican capital is dominated by American capital. Since becoming part of NAFTA (the free trade area of the US, Canada and Mexico), then renamed the US-Mexico-Canada (USMCA) trade agreement as imposed under Trump, Mexico’s economy increasingly depends on exports to the US and investment from the US companies to take advantage of Mexico’s cheap labour. Exports have been booming, up over 11% this year. On the other side of the equation, remittances by Mexicans working abroad (mainly in the US), have rocketed to 4% of GDP.

More recently, with the US applying trade sanctions against Chinese goods, Mexico has increasingly become a ‘third party’ conduit for Chinese imports into the US.

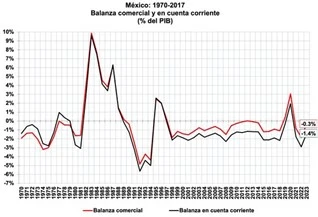

All this has helped Mexico’s external accounts. In 2023, goods trade was virtually in balance and the overall current account deficit was only 1.4% of GDP.

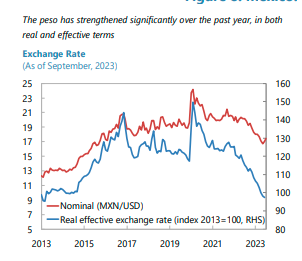

This kept the peso relatively strong against the dollar, rising from MXN19.2/USD in 2018 to MXN17.8/USD in 2023 – although the peso is still down 30% since 2012.

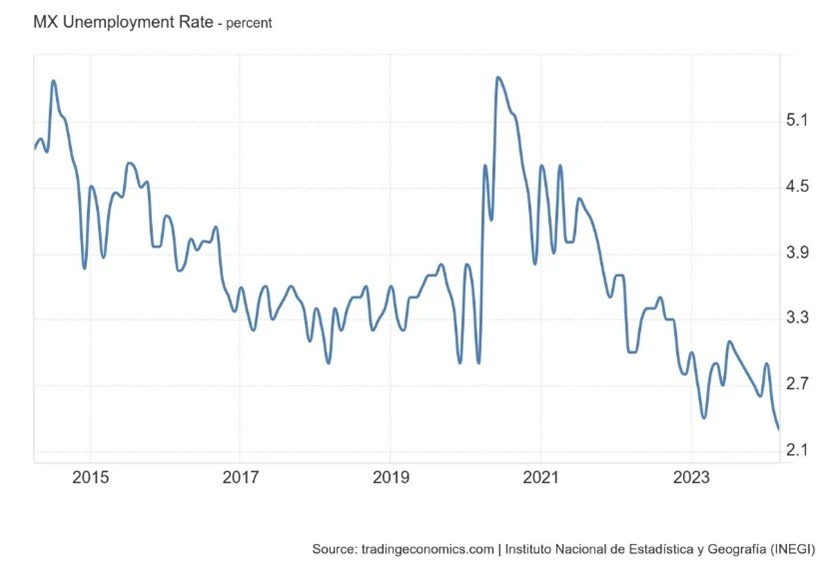

Stronger growth in the last two years has got the official unemployment rate down to new lows, although the high rate of ‘informal’ (casual) jobs hides the reality of employment in Mexico.

But the economy is not looking so good from here. Sheinbaum will face major challenges. The US economy is slowing down from the ‘sugar rush’ burst after the end of the pandemic and the end of Biden fiscal stimulus. If Trump is returned as president in 2025 and imposes his plan for widespread tariffs and restrictions against all imports, Mexico may be hit hard.

Meanwhile the domestic economy is getting weaker. Industrial production was down 3% in March, the first decline since 2021. Manufacturing activity surveys reveal that the sector is contracting. And retail spending by Mexican households is also declining. Real GDP growth is set to slow to under 2% in 2024.

AMLO’s presidency improved the lot of the bottom 50% of Mexicans. However, the fundamental problems of a weak economy, underinvested by capital, of extreme inequalities of income and wealth, of high levels of corruption and crime (with drug cartels running free), have not been resolved.

Limitations of a Keynesian programme

The problem is that AMLO’s programme was fundamentally Keynesian, aiming to use public investment to ‘prime the pump’ of private investment. He continued to rely on the capitalist sector to deliver rather than putting the public sector and planning in charge by taking control of the banks (mainly foreign), the state oil company PEMEX and the major multi-national operations within Mexico. Such a radical transformation would have provoked a vicious response from domestic capital and US imperialism (such has been applied to Venezuela). So AMLO and Sheinbaum are not prepared to go down that road.

If over the rest of this decade, the world economy slows or goes into recession and Mexico cannot export its way out of such a crisis, pressure will be on Sheinbaum to apply ‘fiscal austerity’ to reverse the gains made by labour under AMLO. When Lula in Brazil gave way to Dilmar Rousseff as president, a similar situation to Mexico now, the downturn in the world economy in the 2010s forced Rousseff to adopt pro-capitalist measures, eventually leading to her downfall through impeachment by Congress. Sheinbaum will need to avoid a similar fate as Mexico’s first woman president.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.