By Michael Roberts

This blog was originally published by Michael Roberts on Saturday, 29 June 2024. The original article can be found here.

**************

France votes over two rounds on June 30 and July 7 in a snap parliamentary election called by President Macron after his party suffered a heavy defeat in the June EU Assembly elections. France has two rounds of voting: if a candidate gets 50% of more in the first round, he or she is elected. If not, then in the second round, the top two candidates fight it out. A survey released by pollster IFOP found the National Rally (NR) leading all other parties with the support of 35% of voters. The New Popular Front (NFP), a leftist alliance of socialists, communists and greens, came in second with 30% and President Macron’s centrist Ensemble was third with 20%.

If those results hold, no party will amass enough votes to meet the 289-seat threshold for an absolute majority in the 577-seat lower chamber, the National Assembly. Macron’s party is already governing without a majority after its poorer-than-expected showing in the last 2022 legislative elections, forcing it either to seek out coalitions to pass legislation or use a presidential edict to bypass the Assembly without a vote.

Under France’s constitution set up by President de Gaulle in the late 1950s, Article 8 says the president appoints the prime minister. Macron would be expected to offer the job to the leading parliamentary group. But as that is likely to be the National Rally, Macron may seek to form a coalition of other parties. Actually, the NR party leader Jordan Bardella has said that he would not accept being prime minister if his party does not get an outright majority.

So the scene is set for either paralysis or possibly a financial crisis as foreign investors and French big business run for cover if the NR should gain an outright majority. The Financial Times is worried. “At best, a parliament dominated by the political extremes would plunge France into a period of prolonged instability. At worst, it would lead to the adoption of spendthrift and nationalistic policies that would swiftly provoke an economic and social crisis in France.”

France is split three ways politically

Basically, France is split three ways politically. One-third backs a pro-EU, pro-capitalist France as represented by the ‘centrist’ Macron; one-third backs a nationalist, anti-EU, anti-immigration France as represented by Le Pen’s NR; and one-third backs a socialist pro-labour France as represented by Melenchon and the newly formed NFP.

France is a key G7 economy, now the seventh largest in the world with 68m people, representing around one-fifth of the Euro area GDP. But its former imperialist global past has been reduced to exerting control over French-speaking West Africa (that dominance is now seriously under threat) and trying to control the EU in alliance with Germany.

In manufacturing, France is one of the global leaders in the automotive, aerospace and railway sectors as well as in cosmetics and luxury goods. It has a highly educated labour force and the highest number of science graduates per thousand workers in Europe. Its services sector is large, led by tourism (France has the largest number of tourist visits in the world) and financial services. Additionally, France is one of the world’s largest exporters of farm and agricultural products and is renowned for its wine, spirits and cheeses. The French government provides significant subsidies to this sector and France is the largest exporter of farm products in Europe. France is linked closely to its largest trading partner, Germany, which accounts for more than 17% of France’s exports and 19% of total imports.

GDP growth steadily reducing

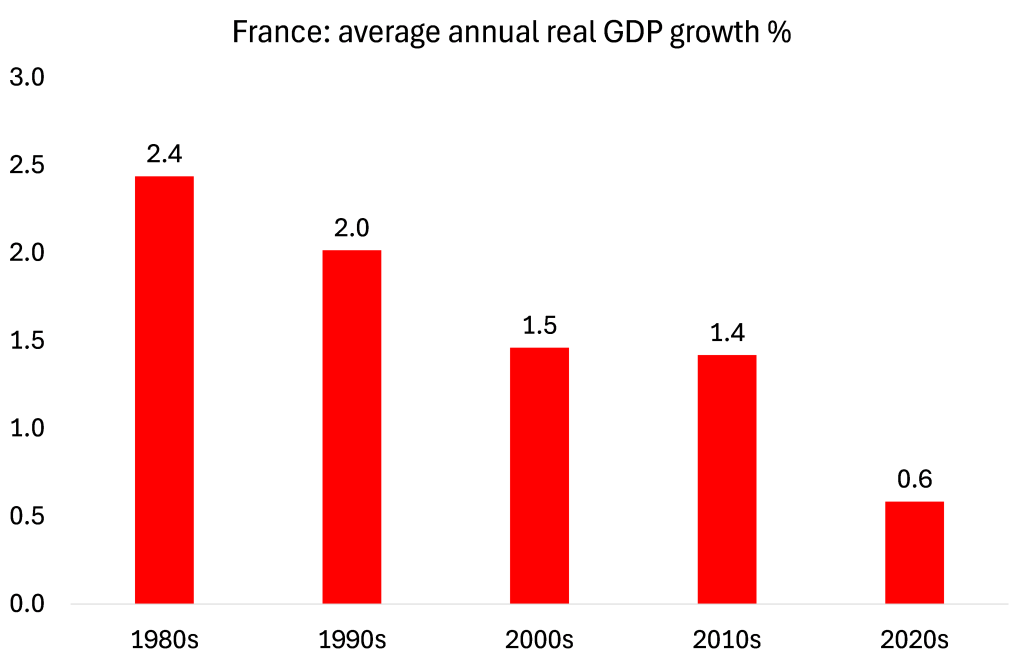

Similar to many western European nations, France has experienced poor real GDP growth. Annual real GDP growth has been steadily falling over the last 40 years. And now in the 2020s, it has virtually ground to a halt.

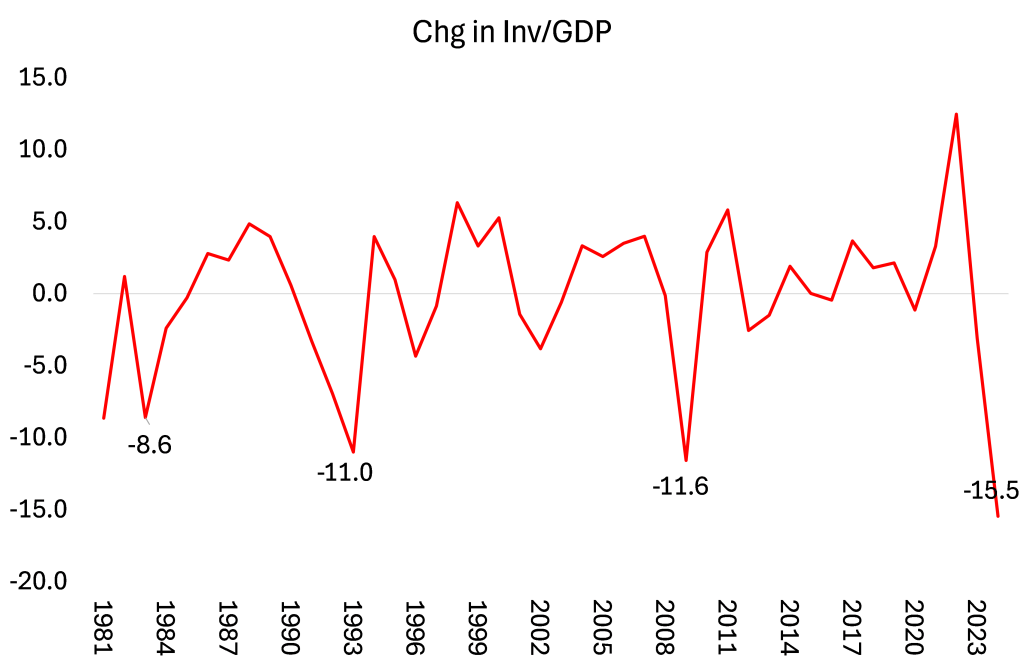

The French economy has followed the same pattern as the other G7 economies in the 21st century: slowing economic growth in the 2000s, then the Great Recession, followed by even weaker growth in the 2010s, along with slowing investment growth and stagnating productivity. The investment to GDP ratio has been volatile, falling sharply in successive recessions, but currently suffering a record fall.

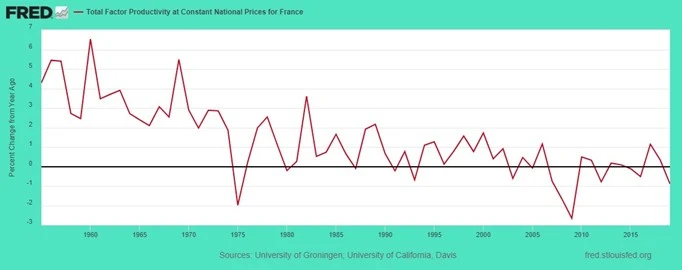

Slowing productive investment growth generally leads to stagnating labour productivity and France is increasingly affected. Indeed, total factor productivity (a measure of the impact of ‘innovation’) is now falling absolutely.

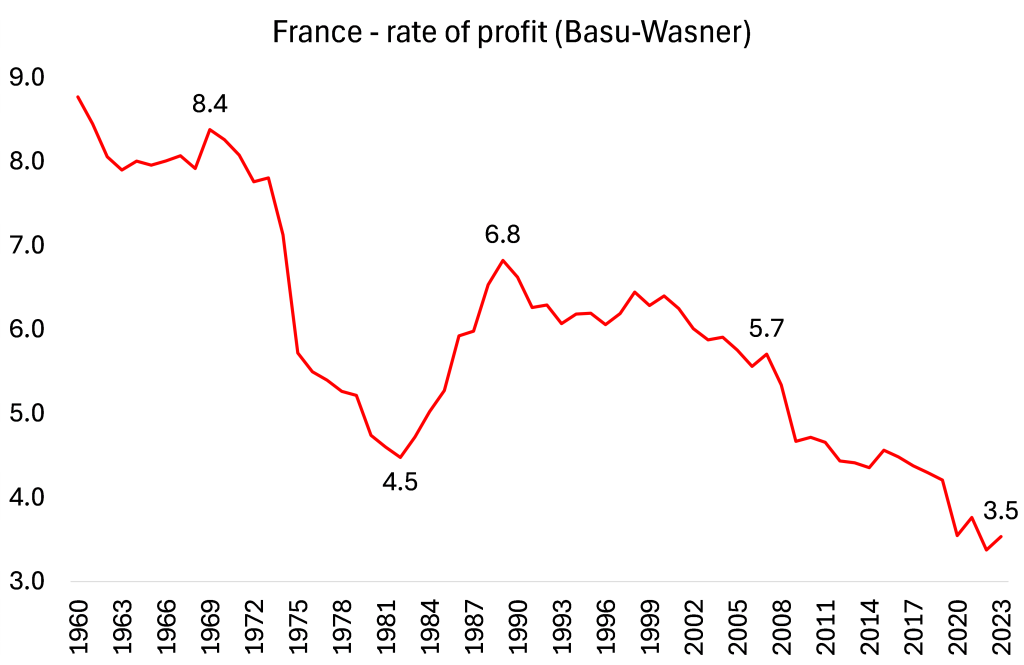

As always, behind this relative stagnation lies the falling profitability of capital. French capital’s profitability started to decline sharply at the beginning of the 21st century (the advent of the euro) and gathered pace after the Great Recession. My calculations suggest that average profitability is now at an all-time low after a fall during the COVID pandemic slump.

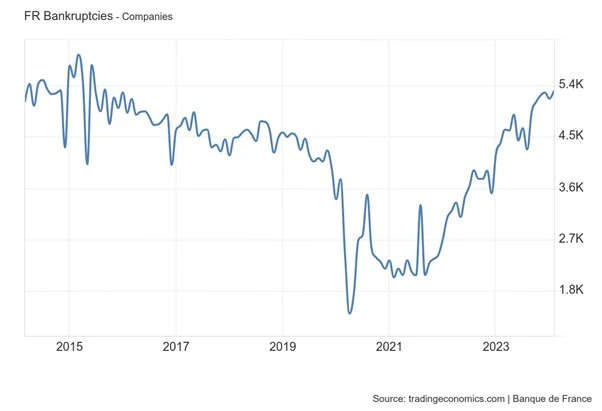

No wonder corporate bankruptcies are rising fast since the pandemic.

Manufacturing continues to contract. The HCOB France Manufacturing PMI fell to 45.3 in June 2024 from 46.4 in the previous month (a score of 50 means stagnation). This marked the 17th consecutive month of contraction in France’s factory activity.

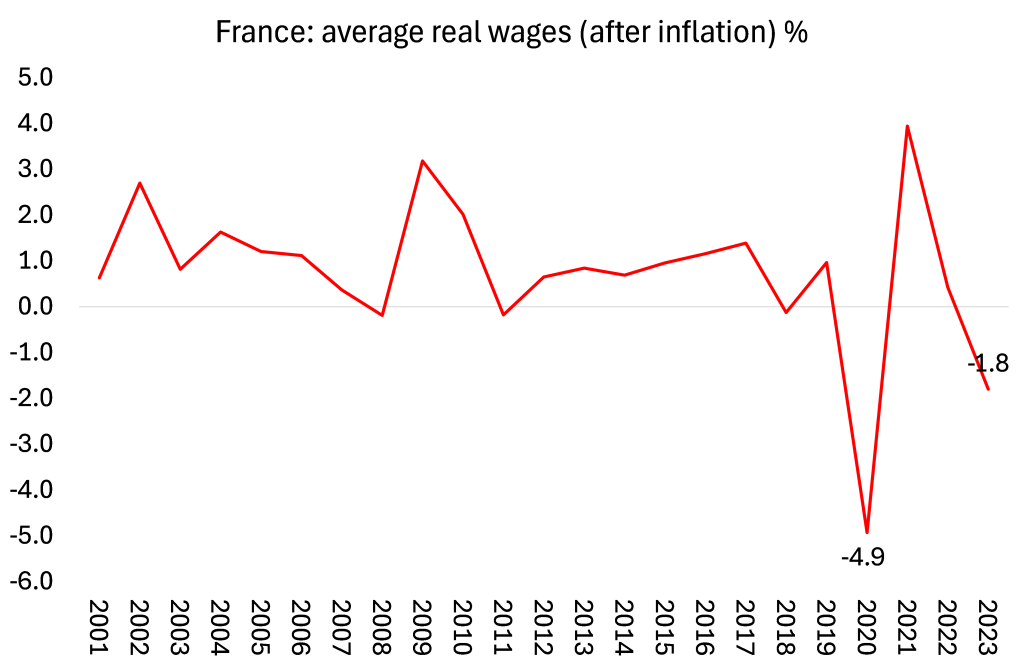

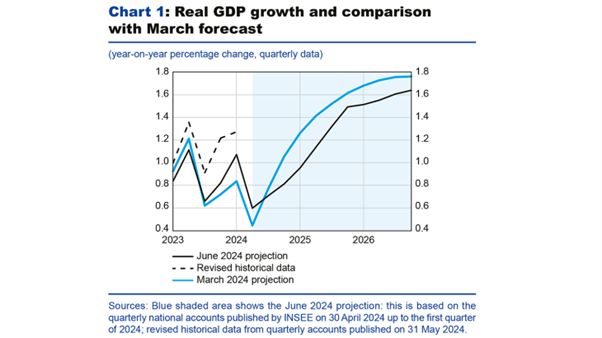

Even the Banque de France in its latest report had to admit that “economic activity in France is set to remain subdued in 2024 (0.7% annual growth) after a significant slowdown in the second half of 2023.” Poor productivity growth and high inflation has meant that real wage earnings have fallen – again as in many other G7 economies. Average real wages are still nearly 3% below 2019 levels.

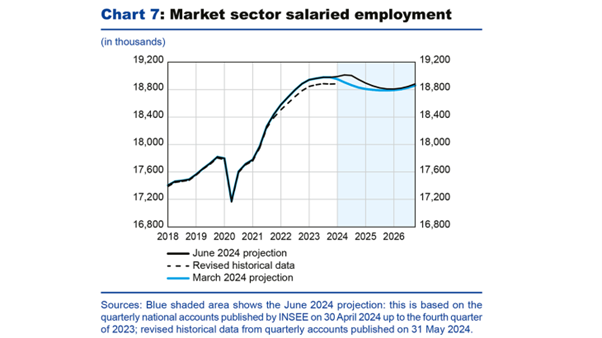

And employment growth has stopped.

Banque de France admits that in 2024 “business investment is likely to be penalised by relatively sluggish activity, as well as by financing costs and lending conditions.” The BdF mentions the geopolitical disaster that the Ukraine war has meant for France (and even more for Germany), which has kept inflation rates up and GDP growth down. It even expects a larger slowdown in nominal wages than it expected at the start of 2024 and “we cannot rule out the possibility of another downward surprise on business productivity, which could reinforce the dynamics of unit wage costs and give rise to additional inflationary pressure.”

Growing inequality of income and wealth

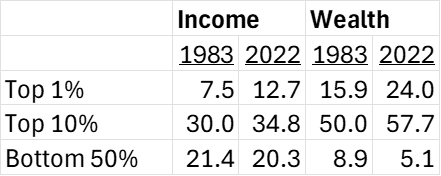

The decline in average real incomes in the last four years only adds to the inequality of incomes and wealth in France. Although inequalities of income and wealth in France are not nearly so extreme as in the US, they are still grotesque. Indeed, inequality has worsened in the last 40 years. In 1983, the top 1% of income earners took 7.5% of all personal income, 10% took 30% and the bottom 50% received just 21.4%. By 2022, the top 1% took 12.7% (an over 60% increase), while the top 10% share rose to 34.8% and the bottom 50% share fell to 20.3%.

Inequality of wealth (net personal wealth) is, as usual in all major economies, much worse. In 1983 the top 1% of wealth holders owned 15.9% of all personal wealth in France, the top 10% had 50% and the bottom 50% held just 8.9%. By 2022, those inequalities got even worse. The top 1% of wealth holders now had 24% (over a 60% increase), the top 10% now owned 57.7% and the bottom 50% saw their share of personal wealth fall to just 5.1% (a 48% decline).

In its latest report, the Observatoire des Inégalités paints a picture of a country where gaps in income levels and living standards between the most affluent and the least affluent are widening. The minimum living standard gap of the richest 10% has remained around 3.28 times higher than the maximum living standard of the poorest 10%.

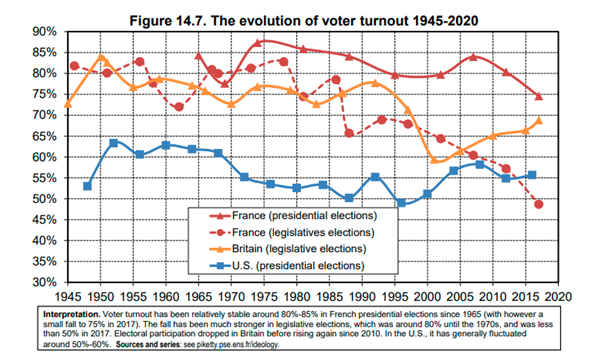

Voter turnout for Assembly elections has dropped over the years

This weekend election is not for the presidency, which remains the most powerful force in the constitution. Emmanuel Macron is in that office until May 2027. The National Assembly has limited powers, although the government and Assembly does set the budget and direct economic policy. But given what has happened to living standards and public services in France under successive governments, no wonder enthusiasm for the Assembly elections has waned.

In 2018, the voter turnout was less than 50% for the first time, compared to a near 65% in early 2000s. National Rally may become the biggest party in the Assembly after the weekend, but the real winner will be the No vote party.

A National Rally majority would spook the markets

If National Rally gains an outright majority, this will probably spook financial markets for a while. That’s because what worries big business and the financial sector is ‘uncontrolled’ government spending and rising public debt. National Rally plans to help (small) business with lower taxes. NR would cut the pension age back to 60 years, reversing Macron’s recent forced rise to 64 years. NR claims it will increase benefits to the old and to children, while keeping the working week at 35 hours and overtime tax-free!

NR’s economic policy is thus anathema to French capital and attractive to French labour, but it is combined with racist and nationalist measures. Muslims and other immigrants would lose rights to work in various public posts and their relatives could be deported. NR leader Bardella says that immigrants have nothing to fear from his government “as long as they behave themselves”.

Big business is hoping that NR will be tamed in government and by the threat of ‘market discipline’ as debt costs rise. They look to a repeat of the very acceptable role adopted by Italy’s’ ‘hard right’ PM Meloni, who has fitted nicely into all the policies of EU Commission and NATO. In practice, under the NR, there will be no real attack on the hegemony of French big business. NR policies in a capitalist France with its low growth and profitability are utopian. Neither the needs of labour nor capital will be met.

The economic programme of the New Popular Front

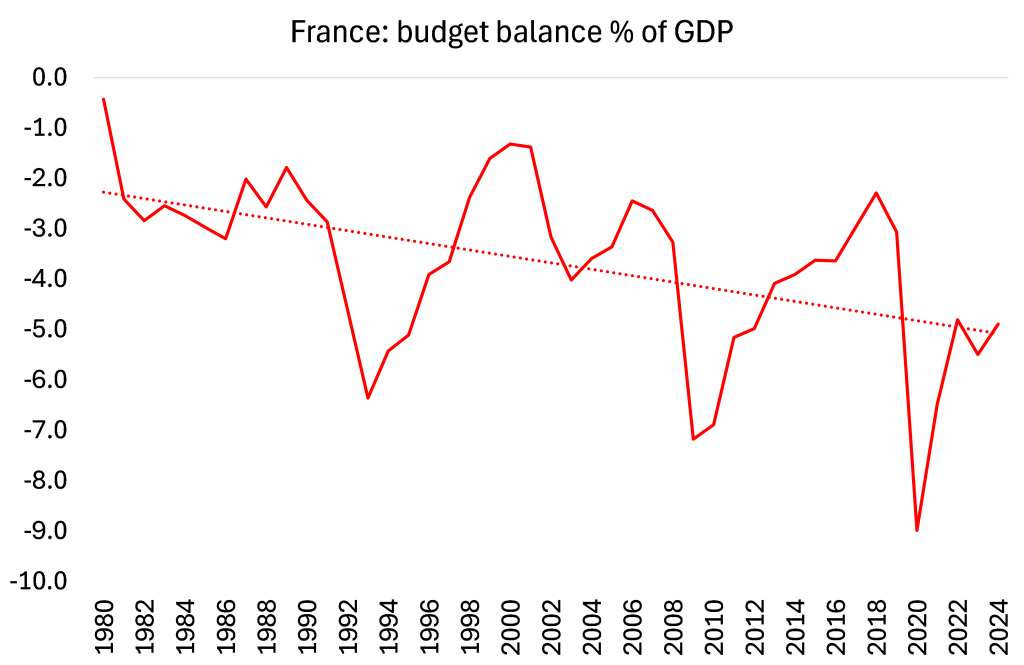

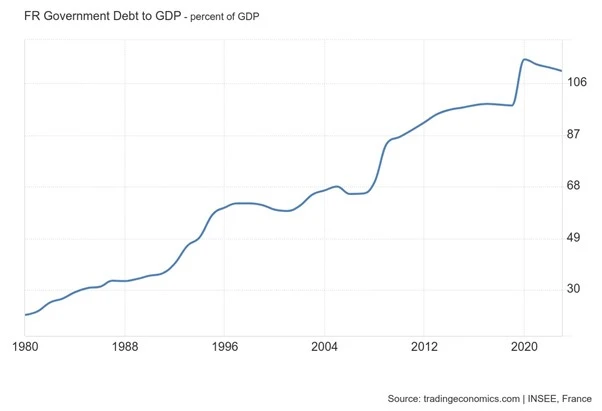

When we turn to the NFP, we find a similar utopianism, even if it is trying to promote the interests of labour over capital. Its economic program is a 100-billion-euro economic stimulus plan funded by government borrowing and some nationalisation in sectors such as the motorway network. The NFP would increase public spending, raise minimum and public sector wages, freeze prices of key essentials, increase taxes on the wealthy, create jobs to reduce the unemployment rate to 6% and also, like the NR, cut the retirement age to 60. But big business and finance do not want government spending to rise. For them, austerity is necessary. You see, the French government budget deficit is widening.

And this is driving up government debt to exceed the agreed limits under Eurozone fiscal rules.

This must be stopped. But what the economic apologists for French capital ignore is why the government deficits and debt have risen. It is not because of ‘excessive’ government spending on welfare and benefits etc; it is because France, like other G7 economies has suffered a series of financial crashes and slumps so that the public sector has had to bail out the private sector. And slow growth in output, investment and incomes has reduced tax revenues and increased public spending relative to GDP. The solution is not austerity but planned public investment through control of the strategic sectors of the French economy to increase output, investment and incomes.

French capital would opt for NR over the NFP

But such policies would be very frightening for French capital. So it will opt for the racist NR government over the leftist NFP – no surprise there. Take the view of Olivier Blanchard, a French mainstream economist and former chief at the IMF. Both the NR and Left programs are bad news, but for him it is the program of the NFP that is worse, despite the racist, anti-immigrant policies of the National Rally. Why?

Well, you see there are two sorts of left programs. There is “a social democratic one that tries to equalize chances and redistribute without destroying the incentives to create and produce“. (By this Blanchard means capitalism is maintained). And then there is “a revolutionary one, which goes much further, is nearly confiscatory in nature” Shock, horror! Blanchard: “as a social democrat, I believe in equalizing chances, in improving education, in redistributing income from the rich to the poor”, but the NFP program “can only lead, like many of its predecessors, to economic catastrophe.”

Macron’s big gamble

In his usual quixotic hubris, Macron is gambling that, in calling the election, along with the help of the media and mainstream opinion, he can frighten enough voters not to vote for the ‘extremes’ of right or left, and so restore the political stability of French capitalism. If the polls are right, that gamble will not pay off.

The mainstream and official economic forecasts try to put on a brave face and expect France to come out of its stagnation and recover modestly in 2025.

But this is based on hope more than expectation. And now French capital faces political paralysis at best or a damaging hit at worst.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.