By Michael Roberts

This blog was originally published by Michael Roberts on Saturday, 13 July 2024. The original article can be found here.

**************

The 2024 conference of the Association of Heterodox Economists (AHE) took place this week in Bristol, England. As its name implies, the AHE brings together economists who consider themselves ‘heterodox’ ie in opposition to the main concepts of mainstream neoclassical economics. Heterodox encompasses Marxian, Post-Keynesian and even Austrian school economics. And this 2024 conference heard keynote speeches and had panel sessions with speakers from all these sections.

I heard just one of the several keynote sessions, but I’ll come to that later. First, let me cover my own presentation at one of the sessions.

Profitability and investment

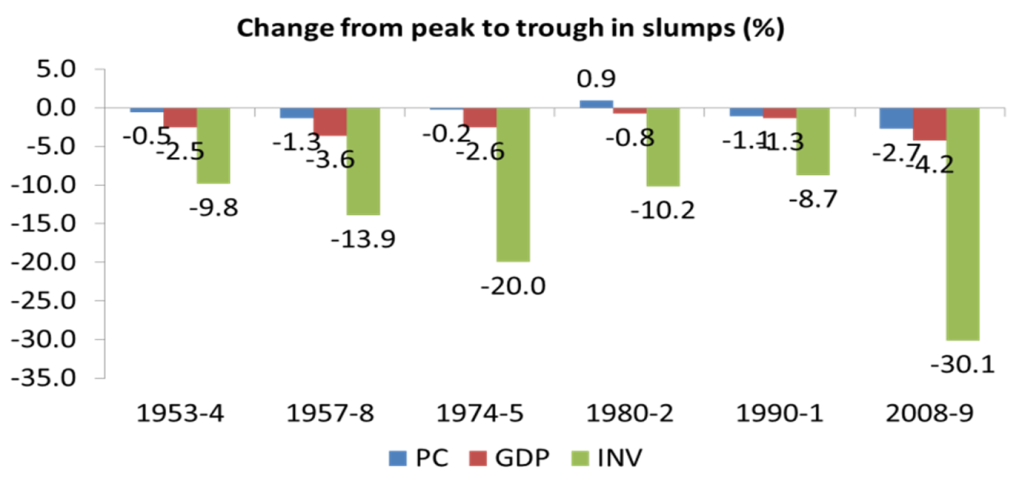

The subject of my paper was Profitability and Investment in the 21st century. In the presentation I looked at the basic cause of cycles of boom and slump in modern capitalism, erupting every 8-10 years on average since the early 19th century. I argued that it was changes in capitalist investment or accumulation that was the ‘swing factor’ in booms and slumps, not personal or household consumption, as claimed by mainstream neoclassical and Keynesian economists.

Investment (INV) was the swing factor in slumps (GDP), while consumption hardly changed (PC).

[ahe1]

But what causes investment to swing up and down? The post-Keynesian view, as expressed by Michel Kalecki in the 1930s, was that ‘investment calls the tune’, which is correct as far as it goes. Take the macroeconomic identity:

National income = national expenditure

which can be decomposed to:

Wages + profits = investment + consumption

Now simplifying further and assume workers spend all their wages and capitalists invest all their profits, then we end up with:

Profits = Investment

This is the Kalecki equation. But which causal way does this macro identity go? Kalecki argued that investment drives profits (which becomes a residual). The Marxian view is the opposite. Profits come from the exploitation of labour and are used to invest and accumulate. In this case, it’s profits that call the tune. And I presented a batch of empirical studies on the relations between investment and profitability, both from the mainstream and Marxist authors, to support that Marxist causal direction of the Kalecki equation.

Profits drive investment

My main conclusions were that the Keynes/Kalecki view that investment drives profits is not correct and the Marxist view that profitability and profits drive investment in a capitalist economy is the way to look at it. This implies that the ‘Marxist multiplier’ (or changes in real GDP relative to profitability) is a better guide to any likely recovery in a capitalist economy than the Keynesian multiplier (changes in real GDP relative to government net spending – dissaving). Again, I presented empirical data to support that. What that implies is that Keynesian fiscal (and monetary) stimulus policy prescriptions are unlikely to work in restoring sustainable investment, growth and employment in a capitalist economy – indeed they could even delay recovery.

Questions from the floor did not oppose my conclusions. But Bill Jefferies again argued that I could not use official investment data to make my case because that data were based on neoclassical concepts of capital stock (I have answered this previously here). Another question was whether the new arms race would lead to an increase in profitability without boosting productive investment and so disconnect the correlations. The answer to that can be partially found in the study on military expenditure by Adam Elveren here. And would the rise of shadow banking ie credit from non-banking firms and also fiscal spending through the rise of industrial strategies by some governments also break the connection between profitability and investment? I saw little sign of that (yet).

Marx’s ‘capital in motion’ model

Let me now refer to some other interesting papers presented in various sessions (of course I missed many presentations as I could not be in two or three places at once). Takashi Satoh from Ritsumeikan University presented a formal algebraic analysis of Marx’s ‘capital in motion’ model i.e.

M-C-P-C’-M’

where M is money, C is commodities, P is production. Employing labour power in production delivers new commodities with more value C’. Selling these in the market realizes more M’.

Satoh said that this model needed to be modified to take into account the deduction from capitalist profits of dividends and interest costs. Only then could we establish what he called an ‘investment function’ i.e. profits available for investment within Marx’s model. This seemed to me very similar to what Marx called the ‘profits of enterprise’ or the net profit available for accumulation.

Defining exploitation in modern economies

Roberto Veneziani at Queen Mary University, London presented an interesting account of how to define exploitation in modern economies. He opted for the Dumenil-Levy definition: namely that any agent or country that received more in income than it contributed in labour (hours) could be considered an exploiter and those who do not would be exploited. From this definition, Veneziani and colleagues have developed an index of exploitation.

They presented the results of this index at the IPPPE 2021 conference, where they found that “all of the OECD countries are in the core, with exploitation intensity index well below 1 (ie less exploited than exploiting); while nearly all of the African countries are exploited, including the twenty most exploited.” This time the authors correlated the index against surveys on happiness, health and job satisfaction. Not surprisingly, the higher the index of exploitation, those exploited felt less happy, healthy or satisfied with their jobs. The conclusion must be that more exploitation in the world means a happier exploiting class (the few) and a more miserable and ill exploited class (the many).

The role of ‘intangible’ assets

Josephine Baker at the New School for Social Research presented a paper analysing the role of ‘intangible’ assets in capital accumulation. Intangibles are knowledge commodities like patents, software, client lists and so-called ‘goodwill’. Baker relied on the work of Haskell and Westlake from back in 2017 who called the rise of intangibles as the beginning of ‘capitalism without capital’. They reckoned this was changing the nature of modern capitalism. Physical investment was giving way to ‘invisible’ investment.

But I think not. Just read Ed Conway’s book, Stuff matters: “For all that we are told we live in an increasingly dematerialised world where ever more value lies in intangible items – apps and networks and online services – the physical world continues to underpin everything else.” Indeed, Baker’s own empirical analysis in five countries showed that the intensity of intangible investment had not risen in five years.

Patrick Mokre from the Austrian Federal Chamber of Labor revisited the role of ground rent, the Marxist term for the share of surplus value that landowners extract from the profits of productive capitalists by virtue of land ownership. Mokre argued that this value squeeze by landowners was an important factor in the ecological breakdown because it forced capitalists to drive even harder to make profits from farming and forestry etc. See Nature and Rent Chapter 1.4 in our book Capitalism in the 21st century.

Continuing debates about value theory

Value theory was a pervading subject of debate (as usual) at the AHE. Nikolaos Chatzarakis, also at the New School for Social Research revisited Anwar Shaikh’s ‘iterative solution’ to the continued debate over the logical viability of Marx’s transformation of values into prices of production. Chatzarakis decomposed the transformation process by intra-sectors. But I have to say, as he admitted, it still did not deliver Shaikh’s solution as one that worked. Here is my own view of Shaikh’s solution. But the best is to be found in Murray Smith’s book,

We also had the odd theory that Marx’s transformation ‘problem’ can be resolved by adopting the concept of ‘thermodynamic depth’ taken from physics and the properties of entropy. Ben Butler-Cole at the Bennett Institute for Applied Data Science did not convince his audience but at least the theory was an attempted defence of the Marxist law of value that all value comes from production and not from circulation.

The so-called ‘diamond-water’ paradox

That brings me to another session on Marxist economic theory. First, Bill Jefferies from SOAS presented a devastating and very ironic critique of the mainstream utility theory of value, in particular the so-called ‘diamond-water’ analogy that supposedly refuted Marx’s value theory of labour. Jefferies tested the theories of objective cost (Marx) vs subjective esteem (Jevons), as explanations for the fall in the price of diamonds as they become mass produced and finds that reality vindicates Marx’s (labour) cost of production theory.

Karen Helgar Petersen from the Institute of Marxist Analysis argued in her presentation that Marx’s schema of simple and expanded reproduction failed to take into account the role of money and credit. If he had done so, Marx would have had to revise his conclusions about crises in modern capitalism and recognize that it was crises in money and finance that drove production crises, not vice versa. I cannot agree.

Yes, Marx’s expanded reproduction schema show that the producer goods sector will expand faster than the consumer goods sector. Otherwise, there would be no growth as in simple reproduction. But contrary to the view of the Russian Bolshevik Maksakovsky that Petersen cites, this disproportion in the growth of the two sectors is not the cause of crises (again see our book, Capitalism in the 21st century pp114-115). As long as average profitability does not drop sharply, that disproportion can continue. Yes, capitalists can divert profits into unproductive activities and hold financial assets rather than invest productively. But that form of ‘hoarding’ from productive investment is really a reaction to the falling profitability of productive investment, not the cause of it. Finance and money are not the drivers of crises. See my analysis of Marx’s reproduction schema and its relation to crises here.

A critique of ‘perfect competition’

Anders Ekelund rightly showed in his presentation that the neoclassical mainstream concept of perfect competition counterposed with imperfect competition and monopoly was a bogus one. Ekelund refers to Anwar Shaikh’s concept of ‘real competition’. As Shaikh puts it: “the capitalist economy should not be viewed as a “perfect” market economy with accompanying “imperfections”, but as individual capitals in competition to gain profit and market share. Monopoly should not be counterposed to competition, as neoclassical, orthodox, and even some Marxist economists do. Real competition is a struggle to lower costs per unit of output in order to gain more profit and market share. In the real world, there are capitals with varying degrees of monopoly power competing and continually changing as monopoly power is lost with new entrants to the market and new technology that cuts costs. Real competition is an unending struggle for monopoly power (dominant market share) that never succeeds in total or forever: “each individual capital operates under this imperative…this is real competition, antagonistic by nature and turbulent in operation. It is as different from so-called perfect competition as war is from ballet”.

By its very nature, capitalism, based on ‘many capitals’ in competition, cannot tolerate any ‘eternal’ monopoly, a ‘permanent’ surplus profit deducted from the sum total of profits which is divided among the capitalist class as a whole. The endless battle to increase profit and the share of the market means monopolies are continually under threat from new rivals, new technologies and international competitors. Profits are not the result of the degree of monopoly or rent-seeking, as neo-classical and Keynesian/Kalecki theories argue, but the result of the exploitation of labour.

Alan Freeman of the Geopolitical Economy Research Group presented an intriguing explanation of why the concept of the transformation of labour values into prices of production and then into market prices cannot be viewed through simultaneous inputs and outputs. Outputs (final commodities) differ from inputs (raw materials and components) not only physically but in time. Output prices will not be the same as input prices and are continually changing even if there is no change in productivity. So Freeman criticized Fred Moseley (see Moseley’s book here) for arguing that market prices oscillate around long-term production prices which act as gravitational force linking prices to labour values. Freeman sees that as an equilibrium theory of the mainstream, rejected by Marx in his temporal approach.

How can heterodox economics influence policy?

Let me finish with the keynote session on Heterodox Economics in Policy, with three speakers aiming to explain how heterodox economics could reach public access and influence policy makers as the world enters a polycrisis in the 21st century. All three speakers represented the post-Keynesian wing of the AHE; a Marxist economic policy speaker was not on the platform.

And I have to say that I did not really learn much from the speakers on how to develop policy based on heterodox economics. Lekra Charaborty, Professor at the National Institute of Public Finance and Policy, New Delhi and International Institute of Public Finance spent her time outlining the failure of mainstream monetary policy to curb inflation leaving the Global South with wrecking levels of interest rates. She proposed ‘counter-cyclical’ fiscal policies that found more ‘fiscal space’ to respond to the climate crisis. And more support for social care so that females can enter the labour force and boost employment. None of this seemed very ‘heterodox’, let alone radical.

Natalia Bracarense, who is now working at the OECD of all places, is undoubtedly a heterodox of the post-Keynesian kind, to quote from a recent paper by her: “John Maynard Keynes, Michal Kalecki and Hyman Minsky have long inspired those who believe that the private sector is unable to maintain long-lasting stability and, even less so, full employment. The remedy relies not in the indirect mechanisms of monetary fine-tuning, but rather on the direct means of fiscal policy.” She offered the possibility of working inside the OECD to achieve progress for such policies. This seemed very optimistic given that she admitted that the top management at the OECD were not accommodating to heterodox ideas and she was not actually working in the economic department, which is full of mainstream economists.

The third speaker was Professor Gary Dymski of Leeds University who is a leading post-Keynesian economist and has been engaged in taking up senior academic posts and in various regional economic bodies in the north of England. He certainly can wield some influence with the new Starmer-led Labour government in the UK. Whether that will lead anywhere remains to be seen.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

A footnote in this article supplies a very good analysis of the economic role of military spending in the modern economy – https://thenextrecession.wordpress.com/2019/11/18/milex-and-the-rate-of-profit/