By Michael Roberts

In a recent post, I reviewed an important new book by Brazilian Marxist economists Adalmir Antonio Marquetti, Alessandro Miebach and Henrique Morrone. They proposed a model of economic development based on technical change, the profit rate and capital accumulation, on the one hand, and institutional change (ie policies and governments) on the other. Together these two factors could be combined to explain the dynamics of catching up or falling behind.

‘Catching up’ is not happening in the majority of the ‘Global South’

The reality is that, in the 21st century, ‘catching up’ is not happening for nearly all the countries and populations of the so-called ‘Global South’ ie the poor periphery outside the advanced capitalist economies of the Global North. This reality is often denied by mainstream economists and, in particular, by the economists of the international agencies like the IMF and the World Bank.

So it was surprising to find that in its latest World Development Report, the World Bank admitted that most Global South economies are not closing the gap in per capita income or labour productivity with the advanced capitalist economies. In the past, it recognised that there are many very poor countries like those in sub-Saharan Africa that are stuck in desperate poverty. But the Bank’s economists have generally been more optimistic for what it calls the ‘middle-income economies’, those with those with annual income per capita ranging from $1,136 to $13,845 (hardly that ‘middle’ you might say, but let that pass for now).

World Bank’s pessimistic view of the future of ‘middle-income’ countries

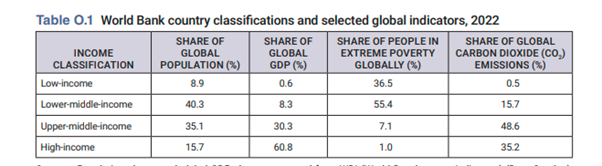

In its latest report, the World Bank takes a more pessimistic view of the future for the 108 countries that it classifies as “middle-income”. They account for nearly 40 percent of global economic activity, more than 60 percent of people living in extreme poverty, and more than 60 percent of global carbon dioxide (CO2) emissions.

This is how the World Bank puts it: “middle-income countries are in a race against time. Since the 1990s, many of them have done well enough to escape low-income levels and eradicate extreme poverty, leading to the general perception that the last three decades have been great for development. But this is because of abysmally low expectations—remnants from a period when more than two-thirds of the world lived on less than a dollar a day. The ambition of the 108 middle-income countries is to reach high-income status within the next two or three decades. When assessed against this goal, the record is dismal: the total population of the 34 middle-income economies that transitioned to high-income status since 1990 is less than 250 million, the population of Pakistan.”

Average annual income growth in these middle-income countries has slipped by nearly one-third in the first two decades of this century—from 5 percent in the 2000s to 3.5 percent in the 2010s. And the World Bank concludes that “a turnaround is not likely soon because middle-income countries are facing ever-stronger headwinds. They are contending with rising geopolitical tensions and protectionism that can slow the diffusion of knowledge to middle-income countries, difficulties in servicing debt obligations, and the additional economic and financial costs of climate change and climate action.”

History of imperialist extraction

Indeed, they are. But who is to blame for that? Clearly, the imperialist countries of the North, which have extracted billions in profits, interest, rent and resources from the South over the last century; which have contributed the most to global warming (see table above); and have conducted wars over control of the South or against any country that opposes their interests. Recent work by Marxist and socialist economists have revealed the size of that imperialist extraction. Guglielmo Carchedi and I did so here; Ricci here; and Jason Hickel here, Tsoulfidis etc.

This is ignored by the World Bank. The explanation for the failure to catch up is down to the middle-income countries failing to adopt the right ‘development strategy’. You see, these countries have relied too long on just trying build up capital stock, which is beginning to ‘yield diminishing returns”. In the language of neoclassical economics, the World Bank economists reckon that “factor accumulation alone is likely to steadily worsen results—a natural occurrence as the marginal productivity of capital declines.”

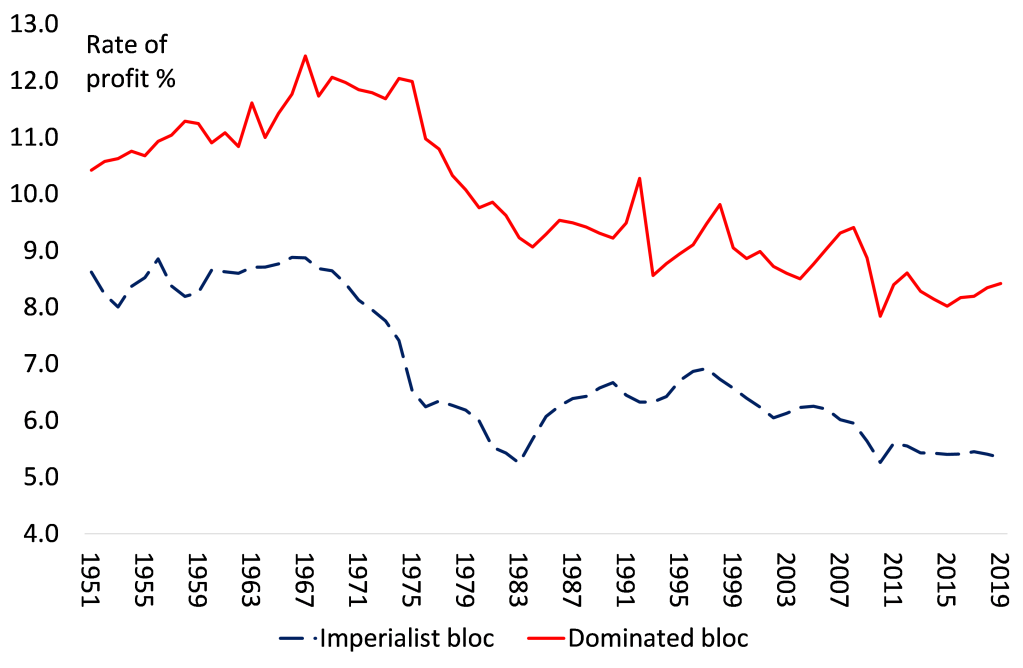

This would be clearer in Marxist terms. Here is how Adalmir Marquetti puts it: “Yes, the World Bank economists recognize that the marginal productivity of capital, the profit rate in the neoclassical tradition, declines due to capital accumulation during ‘catching up’. But it’s the falling profit rate that is the major determinant of decline in capital accumulation and investment. The problem is the profit rate approximates towards the level of the Unites States much faster than labor productivity. Essentially, the middle-income trap is a “profit rate trap”.

How profitability moves in the ‘dominated countries’

Gulglielmo Carchedi and I reached the same conclusion in our book, Capitalism in the 21st century (pp211-213), “in a capitalist economy, lower profitability comes into conflict with productivity growth”. Put in Marxist terms, as these countries try to industrialise, the capital-labour ratio will rise and so will the productivity of labour. If the productivity of labour grows faster than in the ‘leader countries’, then catching up will take place. However, the profitability of capital will tend to decline faster and this eventually will slow the rise in labour productivity. In a joint work by Guglielmo Carchedi and me, using Marxist categories, we found that the ‘dominated countries’ profitability starts above that of the imperialist ones because of their lower organic composition of capital BUT “the dominated countries’ profitability, while persistently higher than in the imperialist countries, falls more than in the imperialist bloc.”

Investment, infusion and innovation

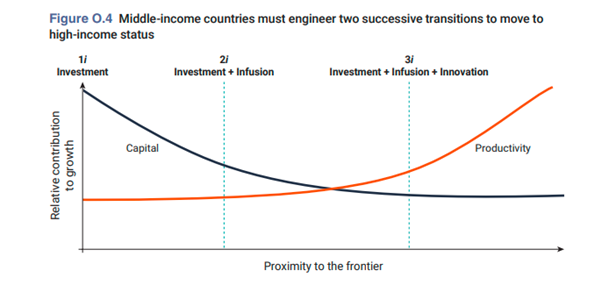

Having recognized the ‘profitability trap’, but in a neoclassical economics format, the World Bank proposes a development solution where the ‘middle-income’ economies will ‘infuse’ better technology from the Global North and then inspire ‘innovation’ by private firms. “In the first, investment is complemented with infusion, so that countries (primarily lower-middle-income countries) focus on imitating and diffusing modern technologies. In the second, innovation is added to the investment and infusion mix, so that countries (primarily upper-middle-income countries) focus on building domestic capabilities to add value to global technologies, ultimately becoming innovators themselves. In general, middle-income countries need to recalibrate the mix of the three drivers of economic growth—investment, infusion, and innovation—as they move through middle income status”. The three Is.

You see, Marx was wrong: these middle-income countries are not condemned to permanent poverty and control by imperialist economies or “that market-based economies would be riddled with a growing concentration of wealth and wracked by crises until capitalism was replaced by communism.” In 1942, in his treatise Capitalism, Socialism and Democracy, Austrian economist Joseph Schumpeter showed the capitalist way out: through ‘creative destruction’. Out of crises can come restoration and growth. Yes, crises of capitalism are painful but they also create conditions for prosperity.

World Bank cites Chile as a success story

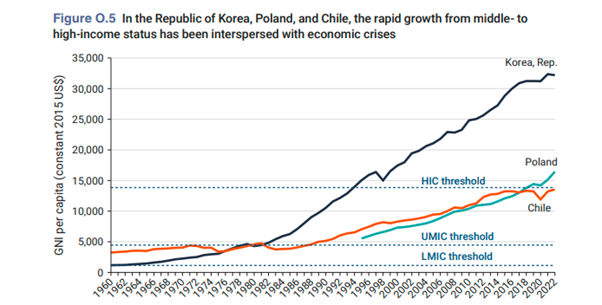

The World Bank economists in their wisdom conclude that “nearly a century later, many of Schumpeter’s insights appear to have been confirmed.” And what do they base that conclusion on, having just explained that the vast majority of poor countries (sorry ‘middle-income countries) are trapped in relative poverty? Well, they turn to a few country case studies that apparently show the way.

In Latin America, there is Chile. The World Bank tells us that, in 2012, Chile became the first Latin American country to reach high-income status. “Chile has grown and diversified its exports since the 1960s, when mining made up about four-fifths of its exports. This share is now about half. Knowledge transfers from advanced economies have been supported by both public and private institutions.” Actually, it then goes on to refer to public investment as the main driver for better technology and diversified exports; through the public Chilean Agency for Exports Promotion (ProChile) and the non-profit Fundación Chile, which promotes technology transfer for domestic ventures.

The World Bank makes no mention of the horrendous military coup in Chile by Pinochet in 1973 that violently removed the Socialist Allende government and killed tens of thousands, laying the basis for increased exploitation of the workforce. Ironically, Chile’s average real GDP growth rate from 1951 to 1973 was 4.3% a year; but after Pinochet and successive pro-capitalist governments it was 4.1% a year. Despite the suppression of labour incomes, Chile’s rate of profit on capital dived to a low in the early 1980s, then rose (as in many other countries) during the neo-liberal recovery period, but has been in decline since the global financial crash and the Great Recession (as elsewhere). So no capitalist success story, really.

Korea highlighted as a successful model

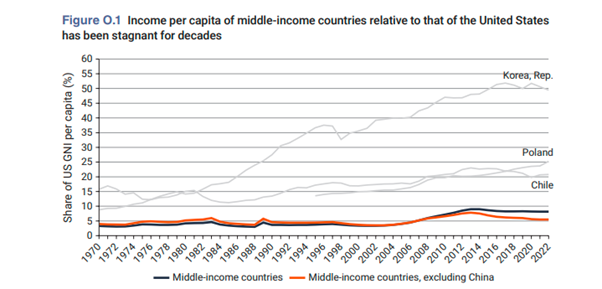

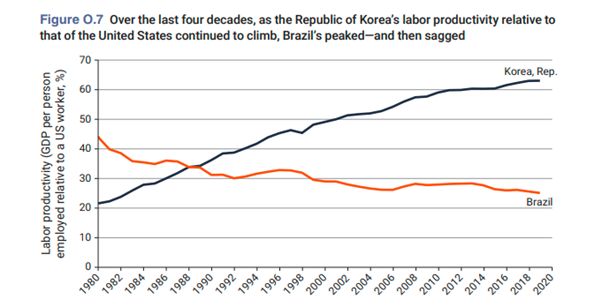

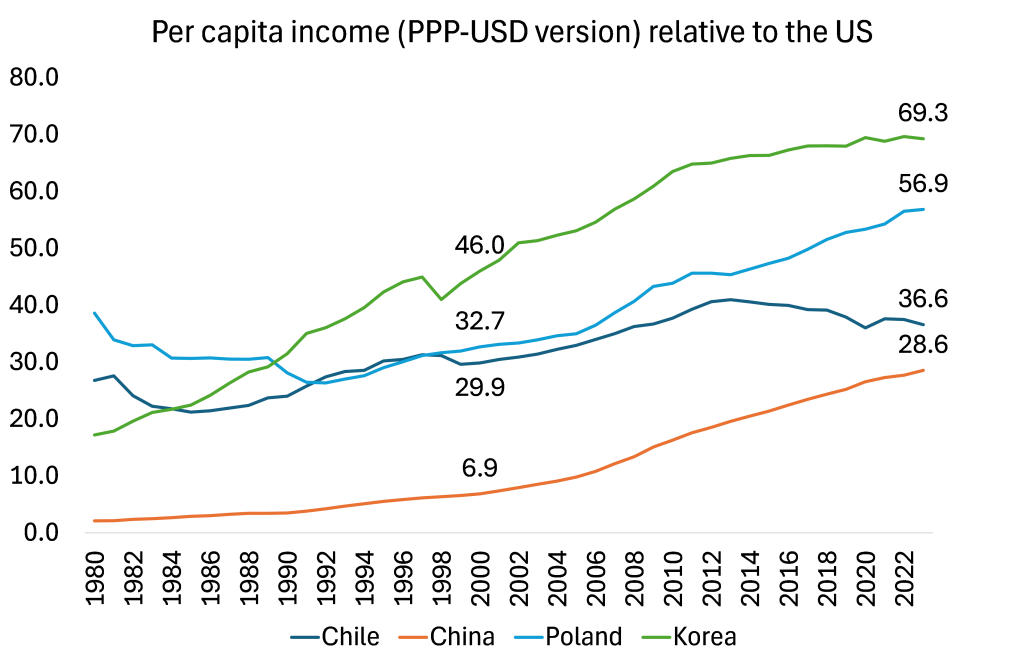

In Asia, the World Bank turns to Korea as its successful development model. This is how the Bank economists put it: “While Brazil was stumbling at home, Korea was racing around the world, making the infusion of foreign technology the cornerstone of domestic innovation. In 1980, the average productivity of a worker in Korea was just 20 percent that of the average US worker. By 2019, it had tripled to more than 60 percent. By contrast, Brazilian workers, who had been 40 percent as productive as their US counterparts in 1980, were just 25 percent as productive by 2018.”

Korea’s success was apparently due to an ‘infusion of foreign technology’. The Bank does not refer to the massive state-led drive to industrialise in the 1980s; or foreign investment by the US to support a capitalist economy as a bulwark against the Soviets and China after the Korean war. And then there was the huge exploitation of the Korean workers by a military regime for decades. This goes a long way to explain the difference between Korea and Brazil’s development; the latter’s industrial strategy being strangled by American capital.

Then there is Poland, the World Bank’s European success story. Joining the European Union with massive subsidies for the farming sector; huge capital investment by German manufacturing; and extensive emigration by unemployed labour were key to Poland’s relative rise. The World Bank puts its coyly: “Educated Poles put their skills to work (skills from the Soviet era – MR) across the European Union, opening another channel to infusing global knowledge into the Polish economy.”

Only Chile, Korea and Poland used to justify the ‘Schumpeter model’

That’s the totality of the World Bank’s success stories based on the ‘Schumpeter model’ of development. And the Bank’s economists are forced to admit that these countries’ move to “high income status has been interspersed with economic crises… the shifts from 1i to 2i to 3i strategies are neither smooth nor linear.”

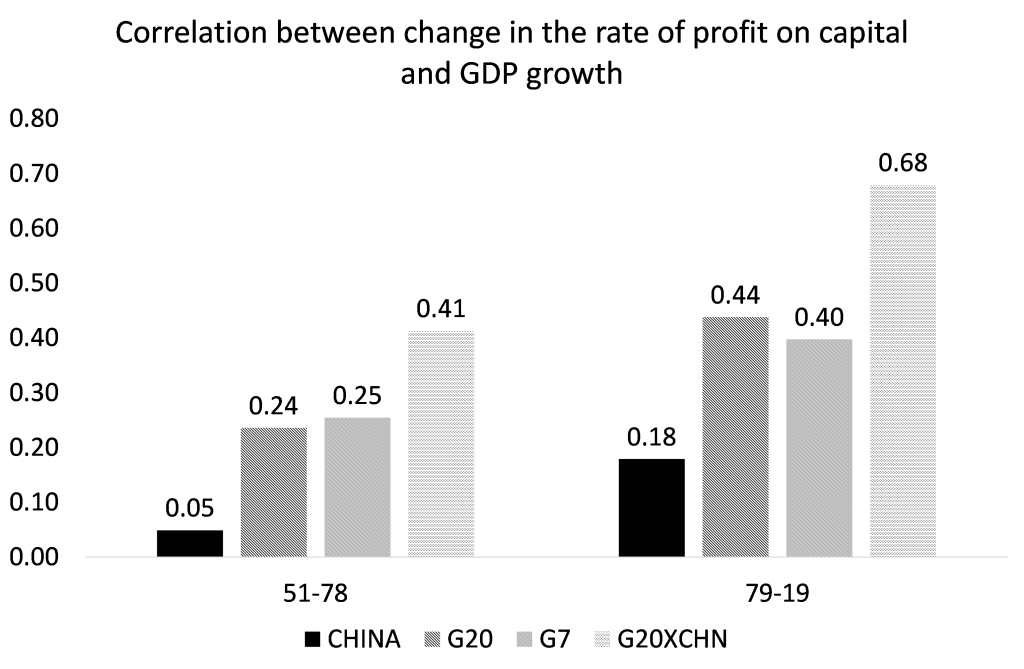

There is no mention of the ‘elephant in the room’ to the World Bank’s development model: China. Why did China, one of the poorest countries in the world in the 1950s, jump quickly to ‘middle-income’ status by the 1990s and continue to close the gap with the advanced capitalist economies in the 21st century? Why have countries like Vietnam and even Laos also followed successfully the Chinese model of development? The World Bank economists say nothing on this. As Marquetti points out: “Our book includes a figure showing that China, Vietnam, and Laos maintained high investment levels despite declining profitability. This is a fundamental condition for catching up.”

World Bank fails to mention growth of Chinese economy

The World Bank ignores the Chinese development model of state-led investment, state funding of infrastructure and technology based on national plans with targets, where the ‘profitability trap’ of the middle-income economies does not apply. In our book, we show that there has been minimal correlation between changes in profitability and real GDP growth in China compared to other economies, particularly ‘middle income’ ones. China did not suffer crises in production and investment from falling profitability, as did the World Bank’s favourites.

The World Bank economists ignore the role of state investment and planning. Instead, the Bank wants to create “markets globally contestable, reduce factor and product market regulations, let go of unproductive firms, strengthen competition, deepen capital markets”.

How has China performed against the World Bank’s chosen three?

But which development model is likely to succeed? Schumpeter based on crises and profitability; or Marxist, based on public ownership and planning? We can redo the Figure from the World Bank at the beginning of this post to include China and so compare the progress of the two models ie China versus the success stories of the World Bank (just three, remember).

We find that Chile’s ‘catching-up’ has actually stopped, with its ratio of per capita income to the US falling from 29.9% in 2000 to 28.6% now. Korea’s has been levelling off (at a high level) in the last decade. Poland started at the highest ratio to the US at the end of the Soviet era, fell drastically, but then picked up after joining the EU. Poland’s per capita ratio to the US rose over 74% from 2000. But that compares with a staggering 314% rise in China’s per capita income ratio to the US.

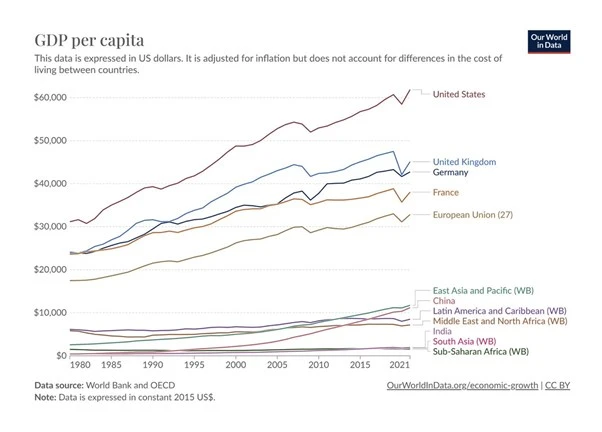

GDP per capita in the South massively below that in the North

Indeed, if we look at the Global South as a whole; it is not catching up with the Global North. With the exception of China, there is growing divergence rather than convergence.

Moreover, there is no mention of inequalities of wealth and income within the middle-income countries and they have been rising since the 1980s in particular (see the World Inequality Database).

Pessimistic conclusion in the World Bank report

The World Bank report ended with the observation of arch neoclassical economist Robert Lucas who likened the development strategy that led to spectacular economic growth in Korea to the making of a “miracle.” The report concluded: “given the changes in the global economy since the time that Korea was a middle-income economy, it would be fair to conclude that it would be a miracle if today’s middle-income economies manage to do in 50 years what Korea did in just 25. It might even be miraculous if they replicated the impressive achievements of other successful countries such as Chile and Poland.” Indeed, it would be a miracle.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.