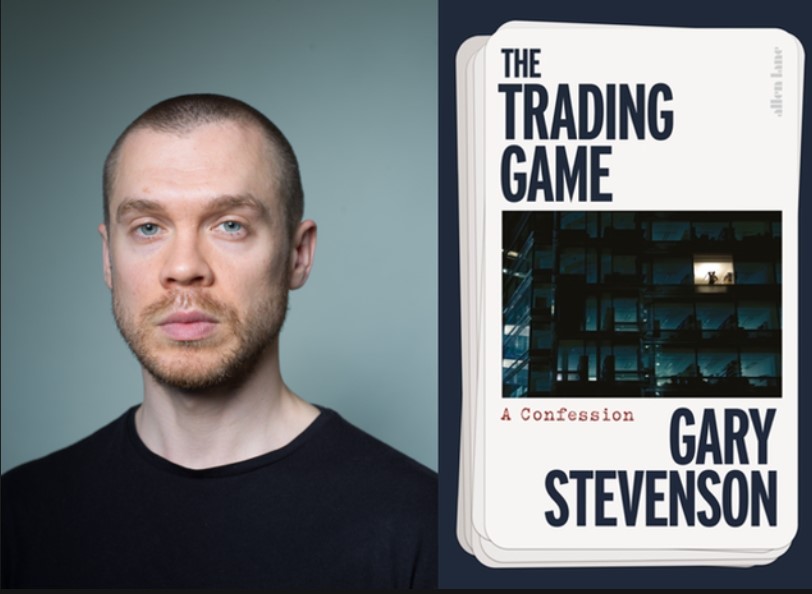

Ray Goodspeed reviews Gary Stevenson’s autobiography, “The Trading Game: A Confession” [2024, Allen Lane]

Gary Stevenson is an increasingly important and influential social media creator on the UK left. His You Tube channel, Garys Economics, which popularises the economic analysis of inequality – and campaigns against it – has increased its number of subscribers by almost six times over the last year, currently standing at 436,000! Yet, in 2011, he was the most successful currency trader for Citibank in the world, and a multi-millionaire. The story of his progression from East London poverty to undreamed of wealth and success, and why he walked away from it in 2014, is skilfully and movingly outlined in this autobiography.

When The Trading Game was published earlier this year, Stevenson’s You Tube channel had already become well-established since it started in 2020, and he was beginning to be noticed by both left and mainstream media, getting invited to discussion panels on television as a “left voice”. But the success of this book has put him and his remarkable story, together with his economic analysis, much more into the spotlight and dramatically increased the number of his supporters.

Stevenson is clear and honest about his motivation as a teenager. Far from fighting for more equality, he wanted to work for a bank, in an office in one of the shiny skyscrapers that were shooting up all over what used to be the East London Docks, and he wanted to get very, very rich, though he actually had little idea of how rich he could become or what that meant.

From a low-paid working class background, with no place even to study properly, he got into a grammar school and he was supremely confident about his abilities in maths. All through the book, Stevenson presents himself as very cocky, or even arrogant about his intellect. Despite being expelled from school, a revealing incident in itself, he worked at passing his exams and got a place at the prestigious London School of Economics.

Intellect alone not enough

But it soon dawned on him that working hard to be the best was not enough in the world he wanted to join. He describes with humour and some bitterness the many different ways in which class background, with all its subtle cultural advantages, as well as having the right contacts, counted for more than intellect alone. His hopes of getting an internship with one of the big banks were fading. It seemed that such posts were not generally handed out to clever kids who sat on the front row in lectures, wearing tracksuits, who asked challenging questions, and whose only ex-curricular activity was a Saturday job in a furniture shop!

[photo-Martin Addison, CC BY-SA 2.0, credit here]

The trading game of the title can refer to the whole currency trading “industry”, but it is also the name of a game that finally gave young Gary his big break. Citibank was giving out a job based on a playing a card game that they felt tested the skills and the nerves of potential traders. A tip-off about this game, giving him advance knowledge of the rules, gave him an advantage, but his account of his victory over his more privileged adversaries is still tense, funny and deeply satisfying.

The whole book is well-paced and accessible and is by turns, exciting, darkly-comic, shocking and poignant, as its “hero” moves from his old life into his new surreal surroundings. One of the most engaging things about Stevenson’s writing is the complete absence of deference, a habit which many working class people find hard to break from. There is no trace of imposter syndrome, even as he moves from poverty to the frenetic trading floor of one of the world’s biggest banks in 2008, aged 21, surrounded by millionaires.

There are some colleagues he admires, but you never feel that he is mixing with his “betters”. He writes savage pen portraits of a succession of over-privileged, lazy, and deeply flawed or damaged characters, and never doubts that he is as good as, or better, than they are. Even when he makes an almost catastrophic mistake, he just learns from it and, in 2011, becomes Citibank’s most successful trader in the world.

What he learned in the aftermath of the great crash of 2008, and what has guided him ever since, was that high rates of inequality are a crucial factor in the analysis of the health of an economy. Mainstream economics looks at people as average consumers in mathematical equations, and neglects or disregards inequality in the distribution of wealth.

Concentration of wealth

However, the syphoning upwards of vast sums by the elite results in serious asset inflation in the prices of gold, stocks, buildings, land, housing, shops and factories as well as in a wide range of “luxury goods” – increasingly concentrating wealth in fewer and fewer hands and putting even basic house ownership beyond most people on average incomes. Most people then reduce their spending and the economy stagnates. When everyone else expected the economy to bounce back, he looked at family members and people he knew and realised that they had no spare cash to spend and that the economy would not recover.

So Stevenson “bet” huge amounts of currency, billions, on there not being a recovery, and therefore no increase in interest rates. He was right, and made enormous profits for the bank and millions for himself in bonuses. And he did so the following year, and the next and the next, and he got richer and richer, way beyond his wildest teenage dreams, by betting on the ever-increasing poverty of people like those he knew and grew up with. And yet his sudden acquisition of such (to him) unimaginable wealth became just another problem that he had not been prepared to deal with and which brought him no real happiness.

The subtitle of the book is “A Confession” and it honestly portrays the gradual toll this addictive gambling on other people’s misery took on his mental health, and then on his relationships. When he finally suggested to a colleague that they should do something about this desperate state of affairs, to actually try to solve these economic problems in the real world, he was met with bewildered laughter, and a suggestion of more currency trades. The bank simply sent him to Japan. The emotional final part of the book deals with his breakdown and how he slowly, and against great corporate resistance, manages to extricate himself from this poisonous situation and embrace freedom.

The book ends in 2014, but I would very much enjoy a sequel. Having escaped from Citibank, with the vague ambition to make a difference in the real world, he took a further MPhil degree in economics at Oxford University, from which he emerged equally unimpressed. Despite his negative experiences in currency trading, he still has a certain swagger about his ability to make money by being right about his economic predictions, and he is amusingly scathing about most academic economists, and especially media economics correspondents, who seem to suffer no consequences at all for being consistently wrong.

If traders are wrong, they risk losing money, sometimes huge amounts. Stevenson implies that all the really good economists are making money working for banks, not pontificating, inaccurately, on the ten o’clock news. In fact, he still trades himself, betting his own money on the accuracy of his forecasts and using the money to fund his activism.

Covid and inequality

He has worked with the US organisation “Patriotic Millionaires” which, despite the bizarre name, campaigns for wealth taxes. But it was the Covid pandemic of 2020 that led him to start his You Tube campaign. He predicted that the sudden injection of hundreds of billions of pounds of money simply “printed” (or electronically created) by central banks, though initially awarded to working people as furlough, would lead a further intensive concentration of wealth.

Ordinary people paid all of their furlough payments to the wealthy, spending on essentials like food, on rent, energy costs or other bills and on paying off mortgage debt. The rich were not spending on luxury or non-essential items, so there was an unprecedented accumulation and concentration of money in their hands, enabling them to purchase a much greater share of assets, including houses, and simultaneously preventing working people from doing so. And most of that wealth created an annual passive income from interest and dividends of millions or even billions of pounds, adding another upwards loop to the spiralling inequality.

[click link here to see the channel]

Stevenson highlights all of these issues in videos of ten minutes or so which act as a way of presenting economics in an accessible way, designed to give people the tools to understand and resist. He is very informal, passionate and charismatic, delivering his lines in an accent and clothes that have barely changed since he was an East End teenager, even though he is often filming from his flat, high in a gleaming modern block, over-looking Canary Wharf and the bank-owned skyscraper he used to work in.

While he is patently sincere in his efforts to build a political movement in favour of a wealth tax, I always have the feeling that he is naïve and seriously under-estimates the struggle necessary to achieve that and the level of fierce resistance from the capitalist class that he will encounter. He correctly fears that failure to address the inequality in society will lead to a rise in the far right. To that end he has tried to engage with senior Labour politicians to persuade them but, unsurprisingly, has so far been unsuccessful! Only the Green Party has adopted his wealth tax proposals in detail, thereby earning his vote at the last election. To achieve the level of social change needed to rectify the problems he has identified would need a mass movement for change, and would also need to challenge the power and control of the capitalist class.

Stevenson jokes that he is routinely accused of being a “Communist” but he says that bringing capitalism to an end is such a large and long-term goal that he feels calling for it would detract attention from what he sees as an immediate and achievable goal of a wealth tax. However, I believe that his analysis has flaws that actually lead him away from an outright “anti-capitalist” position. This is because he focuses not on the creation of wealth, but merely on its distribution.

Though he analyses the inequality in ownership of assets, he neglects completely the most important asset in the hands of the wealthy – the means of production, ie the ability and the funds to employ and exploit others in order to make profit. He sees inequality in what we buy and from whom, such as paying bills, rent or buying food and clothes but he misses the greater inequality in the creation of profit in the process of production. We are not just exploited as customers or tenants, but as workers. This leads him to tacitly accept capitalism as the best method of creating wealth, provided that the wealth can be shared out more equally.

But inequality is not a problem or a glitch with capitalism, it is an essential feature. Creating greater profits by continually squeezing more out of working people is the whole point of its existence. Figures like Gary Stevenson play an important role in detailing the appalling consequences of inequality, and in building greater public awareness in an engaging and popular way, but I hope he can be convinced to use his talents to help to end capitalism and build support for a socialist alternative.