If there is one thing that can be said for Rachel Reeves’ budget, the first ever by a woman Chancellor of the Exchequer, it was clever. It had enough of a ‘bold’ and ‘radical’ veneer for it to satisfy some critics of Keir Starmer in the labour movement, especially right wing trade union leaders. But it is what went largely unsaid, and the hidden implications for living standards, that will make an impact in the coming months.

Keir Starmer obtained his huge majority on July 4 with a smaller popular vote than in either of the two elections fought under the leadership of Jeremy Corbyn. Nevertheless, those millions who voted Labour did so in the expectation that Labour would bring change, after years of cuts in living standards and declining public services. Reeves’ budget purported to be one for “working people”, one that it will usher in a period of economic growth, but both of these are in great doubt.

At one point in her speech in the House of Commons, Reeves pointedly challenged the Tories opposite on their dismal record on public services, such as allowing record waiting lists in the NHS, presiding over a justice system that is falling apart and over local authority services in a state of near collapse. On the Tory benches she was answered by a stony silence. The Tories did indeed show, over fourteen years of austerity and falling living standards, that they have nothing to offer working class people. But what kind of change do Rachel Reeves and Keir Starmer offer?

Digs at the rich and well-to-do

Some of the digs Reeves made at the rich and well-to-do, although quite small in terms of the overall budget, would have been cheered by Labour activists. Not many workers will have been upset that private jet passengers will have to pay more tax, or that public schools will now have to charge VAT, or that second home buyers will pay higher stamp duty.

Labour activists will also cheer the fact that money is (at last) being put aside for compensation for the victims of the tainted blood and the Post Office Horizon scandals. And retired miners will no longer have the government filching from their pension funds.

Reeves sought to contrast her approach to public services to that of Tory Chancellors, and there were important elements in her budget that workers will have applauded, such as the increase in the national minimum wage and the big increase in spending promised for the NHS (£26bn including capital spending), more for education (including new building), and regional transport. There are important limitations to the NHS measures, as we shall explain, but they will be welcomed.

The proposed increase in the National Minimum Wage, to £12.21 an hour (and for under-20s only £10), will also be welcomed. But we also have to be realistic; this will not make a serious dent on the uncertainties of everyday life for low-paid workers. When the minimum wage was introduced by the previous Labour government, it was a ‘safety net’ to catch a relatively small number of workers. But today, for three million, especially young workers in catering, hospitality and the gig economy, it has become the norm, and it is still disgracefully low.

Higher employers’ National Insurance

Rachel Reeves has made much of the boast that ‘broader shoulders’ are carrying the greater burden of higher taxes. Additional costs for business, in the form of higher employers’ National Insurance payments, form the bulk of the extra taxes being raised. But as the Resolution Foundation points out – and Reeves herself has subsequently admitted – “three quarters of employers’ NI increase will be passed on as lower wages”. It will be workers and consumers, in other words, who will suffer from the NI increase, not shareholders’ profits.

It is thoroughly disingenuous for Rachel Reeves to argue, as she did in an email to Labour Party members today, that she made sure “that working people don’t face higher taxes in their payslips”, because the continued freeze on Income Tax thresholds – going right through to 2028 –guarantees precisely the opposite.

That freeze has meant that many low paid workers are having to pay income tax for the first time. According to the Institute for Fiscal Studies, by 2028, two-thirds of the adult population will be paying income tax, compared with only 58 per cent before the freeze started. Even many skilled workers, who might be better paid, are finding themselves in a much higher tax band. “Many people traditionally considered middle-earners”, a Financial Times report suggests, “are now paying the higher tax rate of 40 per cent levied on income above £50,270”.

Implementing austerity to ‘prevent’ austerity

Whatever gloss Rachel Reeves and Starmer choose to put on this budget, workers will judge the government in the coming months on their household spending and income. And they will not be materially better off as a result of this budget.

Although Keir Starmer has claimed that government economic policy is aimed at “preventing” austerity, he uses a strange, twisted logic – one that suggests he is implementing austerityto “prevent” austerity. How else can workers interpret the decision to cut winter fuel payments for millions of pensioners? Why has he kept children in poverty by maintaining the two-child benefit cap and the overall benefit cap? How can a paltry uplift in the Minimum Wage do anything substantial compared to the much higher living costs coming down the line?

It is through a government decision, for example, that renters in the social housing sector will have to pay increases in rent above the rate of inflation for a number of years. It is a moot point whether or not the government can persuade the big building companies to build enough social housing – experience tells us otherwise – but it is disgraceful that current renters should have to pay over the odds for new house-building. Then there is the decision to raise the cap on minimum bus fares to £3. These two examples alone strike particularly hard at the poorest-paid workers.

All working class households are also going to have to pay higher energy costs in the coming months. And the water companies, which have ripped off consumers to line the pockets of shareholders (while pouring sewage into rivers, streams and lakes), are going to be allowed to increase their charges, again, above the rate of inflation.

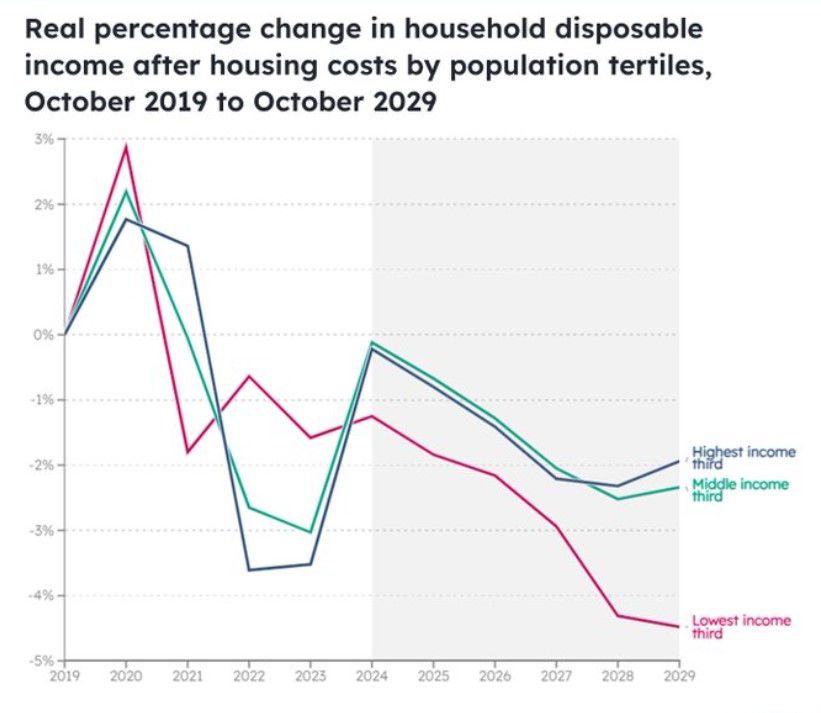

By 2029, living standards will have stagnated for over twenty years.

Taking all of these factors and the budget into account, the Resolution Foundation, in its budget assessment, suggests that “average earnings (when deflated by CPI) are forecast to end up in 2029 just shy of where they were in 2008”. We should be clear what this means – living standards will have stagnated for over twenty years!

And the situation for low paid workers and those on benefits (who are going to face more harassment over welfare payments) is likely to be much worse than the average. A very meagre rise of just 1.7% to benefits next April will not keep up with the inflation rate that Reeves herself is predicting. The Joseph Rowntree Foundation has predicted “The average family will be £770 worse off in real terms by October 2029 compared with today (October 2024)”.

We should also question to what extent the new spending on services is likely to solve the problems of local authorities and the NHS. The extra spending on the latter falls far short of what many experts believe was necessary to restore the NHS to its pre-2010 position. As the BMA has points out, if NHS finances had continued to increase at the historic (pre-2010) rate – instead of flat-lining when the Tories came to office – the NHS would now be better off by £362bn, not £26bn. UK health spending will still lag behind those of similar countries like France and Germany.

Left Horizons has argued that wealth taxes per se are not the answer to failing British capitalism, but how many workers would complain if those who are easily able to pay higher taxes were made to do so? Yet despite calls from nearly all of Labour’s affiliated trade unions, and other sections of the Party, not to mention many economists, Reeves has shown that she is only prepared to put modest extra burdens on the rich and super-rich – like higher Capital Gains Tax– when a wealth tax alone could probably raise £25bn a year. Closing overseas tax havens which are under British jurisdiction could potentially save a lot more.

The intention of the budget, Reeves argued, is to promote investment. It may be a laudable aim to increase investment in infrastructure and public services, especially the NHS. But the manner in which this is being done is completely counterproductive and will in the end cost government and cost workers. As Marxist economist, Michael Roberts, explains, Rachel Reeves’ somewhat optimistic forecasts are actually for very modest economic growth.

UK investment the poorest of the G7 economies

The real custodians of the British economy – the shareholders of banks, finance, industry and big business in general – have the poorest investment record of any of the major G7 countries, but that is not out of ‘malice’ or short-sightedness; it is a product of an economic system based on profit. Money goes to where the most profit can be made. If that is in overseas investment, into offshore equities, into take-overs or property speculation, then so be it.

If Rachel Reeves can succeed in increasing badly-needed investment in infrastructure, it will only be if it promises tens of billions in rich rewards for business, like the Private Finance Initiative did during the 1997-2010 Labour government. PFI to this day is still a huge burden on local government and on the NHS, costing tens of billions in continuing payments to the private sector.

Ferocious behind-the-scenes lobbying by business interests made sure that Corporation Tax, which is still historically low at 25%, will be unchanged for this parliament. Likewise, the tax dodge that private equity firms use – so-called “carried interest” – was only nibbled by Reeves, after representations were made by the finance sector.

Carried interest is a way of classifying income as capital gains and this, according to a Treasury analysis, is a big loss to the Exchequer as “3,000 dealmakers shared £5bn in carried interest in the 2022 tax year — or £1.7mn each on average”. (Financial Times, April 2, 2024). This £5bn a year loophole was largely ignored by Reeves.

But this single example of pressure and the effects of lobbying will be nothing compared to what will happen in the coming years. Even though Reeves has adjusted her fiscal ‘rules’, the additional government borrowing will translate in the long run into higher interest payments for government debt. Just as the ‘market’ imposed itself dramatically on the short-lived government of Liz Truss, the financial and banking sector will seek to force Reeves to cut back on borrowing – and spending – in the next four years.

This budget, more than any conference speeches or manifesto promises, shows that the underlying economic assumptions of Rachel Reeves are the same as the Tories. Despite the hype about “ending austerity” and restoring public services, Rachel Reeves and Keir Starmer believe that the ‘market’ system must be preserved at all costs. There is not, and nor will there be, any attempt to go beyond the motive of profit when it comes to major decisions in the management of the economy, including investment in public services and infrastructure.

Continue haemorrhaging support for Labour

What will be the end result of this Labour budget in political terms? In a nutshell, working class voters will judge the government by the effect on their own modest ‘budgets’ – on their household income and expenditure. The Resolution Foundation says bluntly that “the immediate outlook for real pay is far from rosy and, after this Budget, has worsened”. That can only mean one thing: the continued haemorrhaging of support for Labour, and at an increasing rate.

The cut in winter fuel allowance has already made this government’s honeymoon the shortest on record. In opinion polls, support for Labour, and Starmer personally, are bumping along the bottom. We can see in local council by-elections up and down the country – where Labour is losing to Greens, Reform UK and even the Tories – straws in the wind for the future. While some of these budget measures will be welcomed by voters, it is still likely that Labour will lose support on an even greater scale if it continues to follow the present course, and may well lose hundreds of council seats next May.

Between the right wing trade union leaders and the Labour leadership, there is little but sweetness and light at the moment. But that will change, as trade union members remind their leaders that their living standards are still in peril, whatever Reeves and Starmer spout. Workers in the NHS will remind their union leaders that there is no change, or promise of it, to them being badly overworked and underpaid.

Trade union members working for local authorities will be wondering what will happen to their living standards and the services they provide. More than three hundred local authorities are in some degree of financial stress, eight have gone bust and eighteen are in receipt of some form of emergency financial aid. The crisis of local authority finance was not addressed by Reeves. Indeed, the Institute for Fiscal Studies argues that “Taxes may need to rise even further in just two years if Reeves is to find an extra £9bn a year to avert cuts to public services later in the parliament”.

As carefully as Rachel Reeves has fashioned her first budget this week, therefore, the rhetoric and hype will collide with cold reality in the coming months. As the crisis of British capitalism impacts on working class households, we will see how much support the Chancellor and the Labour leader can retain within the labour movement.