By Michael Roberts

Every January, the World Economic Forum (WEF) convenes in the luxury ski resort of Davos, Switzerland. This year, as usual, some 3,000 people attended from over 130 countries to discuss the problems, challenges and future of capitalism. Around 350 governmental leaders, including 60 heads of states and government, from all key regions (except Russia, China and India) were there, along with many chief executives and oligarchs of the multi-nationals, most arriving in their private jets.

This year, the usual topics of global warming and poverty hardly got a look in. What dominated the thought of the ‘great and good’ in the world economy was AI. The theme of the WEF 2025 was ‘Collaboration for the Intelligent Age’. AI is the buzz thing for the leaders of capitalism; the technology that is going to transform economies with faster real GDP growth and productivity and this will bring prosperity for all – or so the hope is. The WEF launched a report, AI in Action: Beyond Experimentation to Transform Industry, arguing just that, with various caveats. The representatives of the AI leaders gushed. “The technology is moving at an incredible rate,” says Matt Garman, Chief Executive Officer of Amazon Web Services.

Davos proceedings dominated by the impact of Artificial Intelligence

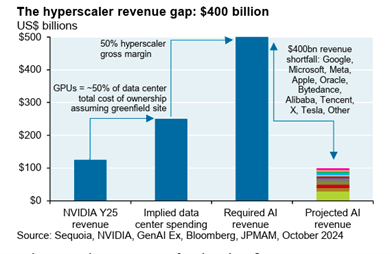

In previous posts, I have discussed the prospect of AI transforming economies over the next decade or so. Suffice it to say now that there is massive expenditure on AI development and the infrastructure involved being made by US and other AI companies to deliver. Companies will need hundreds of billions in new incremental AI revenues to maintain their current margins due to these new outlays. Projections from Lawrence Berkeley Labs show data centre power demand doubling from its current 4.4% of US electricity generation, and Independent System Operators like PJM and MISO are scrambling to add new generation capacity based on what they’re seeing. But that could lead to a revenue gap that reduces profitability sharply – according to a study by JP Morgan.

AI investment is also hiking energy demand. By 2026, the International Energy Agency (IEA) predicts electricity consumption for data centres alone could reach 1,000 TWh – roughly the equivalent to the energy consumption of Japan. So ‘powering the Intelligent Age’ will be a huge task and will have a profound impact on global electricity demand and supply. It comes with wider implications for industries and their decarbonization and net zero goals, with rapidly advancing technologies devouring energy at rates far higher than those seen today. And then as discussed before, there are huge implication for jobs and labour incomes. AI investment could expand 160% over the next two years. As a result, datacentres’ use of water and land could have a serious impact on the environment.

Trump’s energy production plans to feed the needs of AI

Newly inaugurated President Donald Trump addressed the WEF by satellite and wasted no time in telling his audience that the US was going to enter a ‘golden age’ propelled by energy production, AI, deregulation and lower taxes – and countries that might seek to stand in its way better look out.

Trump said the US would need to double its energy production, partly to fuel AI. So he will fast-track the approvals for new power plants, which companies can site next to their plants – something not currently possible under regulations. Companies will be able to fuel it with anything they want, including coal as a backup, “good, clean coal”, because “nothing can destroy coal, not the weather, not a bomb”.

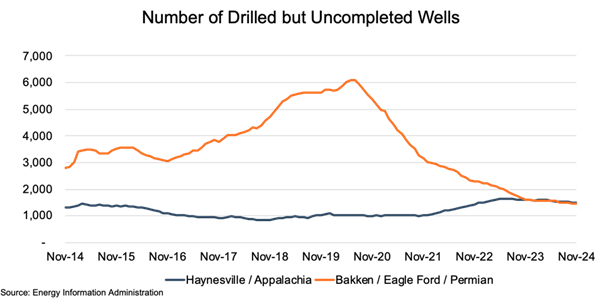

Trump wants to get the oil price down so that energy prices for investment (not so much for households) are lowered. To do this, he wants the US and the world to “drill baby, drill.” Unfortunately for him, that may not happen. Oil pipeline, gas pipeline and transmission line projects in the US have practically ground to a halt as the great shale and fracking revolution in US oil production has started to peter out. According to Goehring & Rozencwajg LLC, a research firm specializing in contrarian natural resource investments, US shale output is ‘in the early innings’ of a protracted decline, with depletion, not market dynamics or regulatory overreach, the chief culprit. They predicted that the explosive production growth triggered by the shale revolution would flatline in early 2025.

US shale oil and gas production on the decline

However, the reality could be worse. According to data by the EIA, shale crude oil production peaked in November 2023 and has declined about 2% since then while shale dry gas production peaked that same month and has since slipped by 1% or 1 billion cubic feet per day.

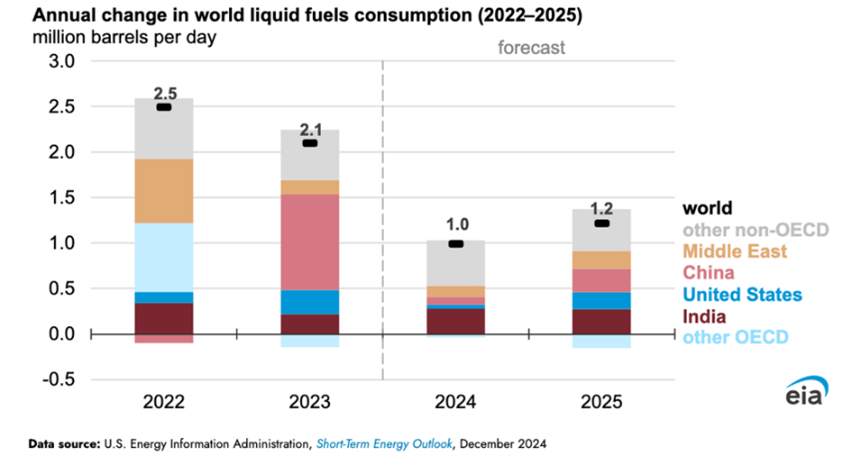

What might save Trump’s demand for lower oil prices despite supply growth fading is that global demand growth for oil products is also dropping. Demand growth was hacked nearly in half in 2024 compared to 2023.

Lower energy prices could be important for Trump’s policies if it meant that inflation keeps falling and stays low. The problem is that, right now, the opposite trend is the case. The US headline inflation rate was rising in the last part of 2024, driven by a turn in energy and food prices and some underlying ‘sticky’ components like car and health insurance, rents and hospitality costs. The Federal Reserve is not winning the war against inflation.

Looking beyond the core inflation statistics

Jack Rasmus has pointed out that the official US estimate of the rise in the price level for American households since 2020 is around 24%. But that number does not properly account the rise in prices for many basic food staples like bread, milk, eggs, chicken, etc. that have risen 30-40% since 2020. The true cost of shelter (home prices, rents) has risen even more. The prices for homes nation-wide are up 39% according to the Shiller home price index. But households’ mortgage costs—i.e. what households actually pay out of their monthly budgets— are up 113%! US official price indexes like the CPI do not include mortgage interest rates. Mortgage inflation due to rising interest costs has thus risen far faster and higher at 113% than the 39% for the price of buying a house. The inflation for shelter (houses and rents & related costs) is even higher if home insurance costs, home repairs, and other fees that define ‘shelter’ in government statistics are included.

Interest rates on credit cards rose from 16% to 24%, bank auto loans roughly doubled to 9% on average for car purchases, while student loans surged to 6.8% and more. “When interest inflation is properly accounted for—along with increases in local government property and other taxes, fees, and other charges not considered by the government’s Consumer Price Index—the true inflation experienced by US households since January 2021 is easily 35%-40% and therefore much higher than the official CPI number of 24%.”

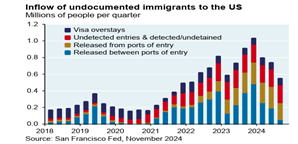

And then there are Trump’s plans to hike tariffs on imports, not just on producer goods from other countries, but also in key consumer sectors. That is very likely to put upward pressure on prices for households, unless the US dollar keeps rising in exchange value compared to other currencies. But that may not continue. Trump is demanding that the Federal Reserve cuts rates in 2025. If the Fed concedes, the dollar may fall as inflation rises – a conflict of outcomes for Trump. However, there are increasing indications that the Fed, still hoping to win the war on inflation, will hold interest rates where they are, despite Trump’s pressure, especially as Trump’s planned tariff hikes and deportations of undocumented migrant workers would push up prices and labour costs for US industry.

Trump’s plan to deport undocumented migrant workers

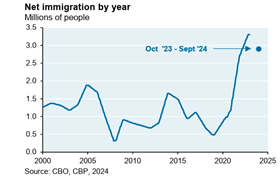

According to Vice President Vance, the Trump Administration plans to deport roughly 1 million undocumented workers per year. The current number of undocumented workers in the US is estimated at 11.7 million, but the rate of increase is falling.

Deportation programme could cost the economy $88 billion per year

The Immigration Council estimates that a deportation programme could cost $88 billion per year if implemented. And as I have pointed out before, net immigration has been crucial to US economic growth in recent years. Cutting that back, the PIIE estimates, would lead to a real GDP decline of 1.2%-7.4% by 2028, with similar declines in employment as a result. Probably, however, deportations will not reach that level and ‘legal’ immigration of skilled workers will continue at some pace under Trump.

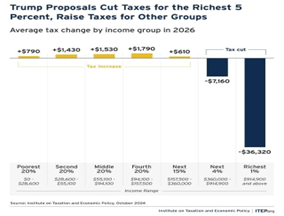

Cuts in public service spending to allow tax cuts for the rich

Trump’s domestic policies are much clearer to follow. He wants to make significant further cuts in income tax and corporate profits tax, while at the same time cutting back government spending, particularly at the federal level – classic neoliberal ‘trickle down’ economics.

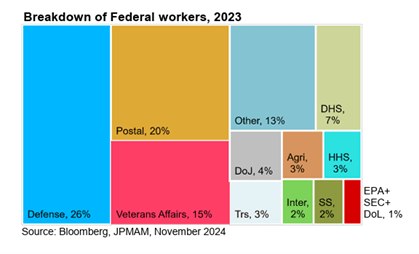

Obstacles to slashing government spending

Cutting government spending won’t be so easy as legions of neo-liberal governments have found. US government ‘discretionary’ spending is already slashed to ribbons. Welfare, medicare etc are ‘entitlement’ spends, much more difficult to reduce. Trump’s new cutting Tsar, Elon Musk, will find that the only areas he can cut are in defence spending! Federal employment of 3m people is at its lowest level as a share of US employment in 85 years (~2%). Within Federal workers, the largest employer is the Dept of Defence (excluding active military) followed by the Postal Service and Veterans Affairs. Musk’s most likely targets, the Environmental Protection Agency, Securities and Exchange Commission and the Department of Labour combined account for less than 1% of federal workers, while the Department of Education accounts for just 0.14%.

Trump demands that NATO members double defence spending

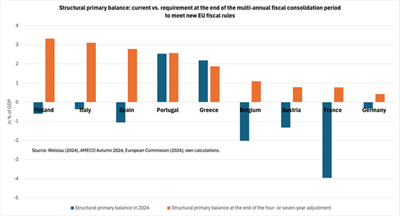

Talking of ‘defence spending’, in his Davos speech, Trump came back to his regular demand that European governments start paying for their own defence and to support Ukraine. He said he would demand that NATO members pay 5% of their GDPs in defence, more than doubling the current average. Such a shift in spending towards the military would be crippling for Europe’s public finances, when national governments in the EU are supposed to invest more on climate control and AI digitisation, while at the same time achieving primary fiscal surpluses over the medium run to meet EU fiscal rules.

Nevertheless, Trump ranted on about how Europe’s “regulatory regime” treated America “very badly” and “very, very unfairly with the VAT taxes and all of the other taxes they impose”. Europe’s regulation of US tech firms takes billions from Apple, Google and Facebook, he said. Europe doesn’t buy US farm products or US cars, but instead sends cars to the US by the millions. This results in “hundreds of billions of dollars of deficits” with the EU, so “We’re going to do something about it.”

EU puts its hopes in private capital and deregulation

All this made the Davos speech by EU Commission President Von der Leyen particularly feeble. She recognised that Europe was falling behind the US in new technologies investment.

“To sustain our growth in the next quarter of the century, Europe must shift gears.” She announced that the European Commission is about to present a roadmap to growth, called the Competitiveness Compass. What will this roadmap advocate for the ‘existential challenge facing Europe (Mario Draghi) and given Trump’s plans to trash Europe’s economies? It’s not more public investment, but instead a reliance on EU-wide private capital finance.

“Europe needs a deep and liquid capital market.” You see, European companies cannot raise the funding they need, “because our domestic capital market is fragmented” ie too small. What’s the answer? The Commission wants to create a European Savings and Investments Union – “with new European saving and investment products, new incentives for risk capital and a new push to ensure the seamless flow of investment across our union.” So it’s more money for financial capital and more profits for investors.

The second policy move is to deregulate European industry: “too many firms are holding back investment in Europe because of unnecessary red tape.” The European single market still has too many national barriers, so Europe needs one single set of rules.

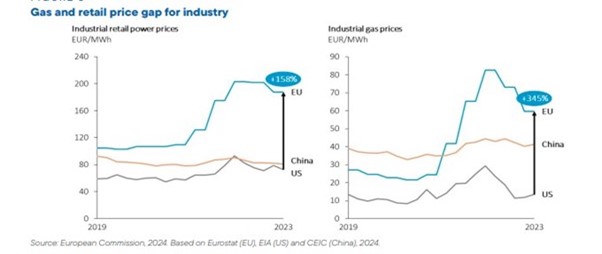

Oil and gas prices have risen fast in Europe

The third policy is to lower energy costs. You see, Russia cut off Europe’s energy supplies (!) and so costs have risen. And now the US provides over 50% of our LNG supply. Der Leyen admitted that “households and businesses saw sky-high energy costs and bills for many are yet to come down. Now, our competitiveness depends on getting back to low and stable energy prices.”

How is this to be done? With more ‘clean energy’ from renewables and new technologies, like fusion, enhanced geothermal and solid-state batteries; but not by more public investment but by mobilising “more private capital to modernize our electricity grids and storage infrastructure.”

So Europe’s answer to Trump is to rely yet more on US energy imports; to hope that the private sector will invest in new technologies because Europe will ‘deregulate’; and the financial sector will lend more for investment rather than speculate in financial assets. I leave you to judge how likely it is that this strategy will succeed.

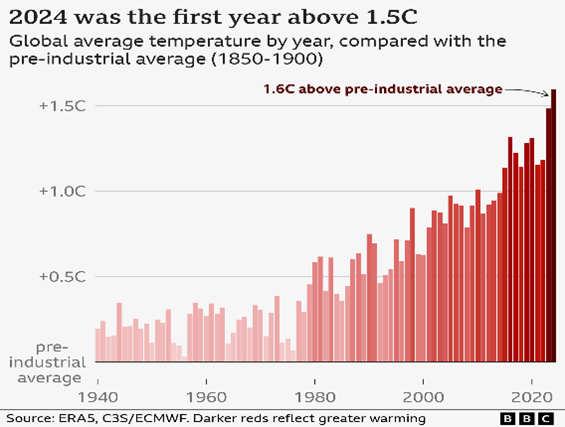

US and European leaders all failing to tackle the climate crisis

The future, as painted in Davos by Trump and Von der Leyen, is one of more barriers to trade between countries; and more deregulation so that bankers and industrialists can do what they want, whatever the damage to consumers safety and rights and whatever the impact on the environment and the climate. Von der Leyen said that the Paris Agreement on climate targets was vital to maintain (even though its target limit was passed in 2024), while Trump has taken the US out of the agreement (again). More to the point, relying on the private sector to deliver on increased investment in technology and climate control to turn the world economy around will prove, yet again, to fail.

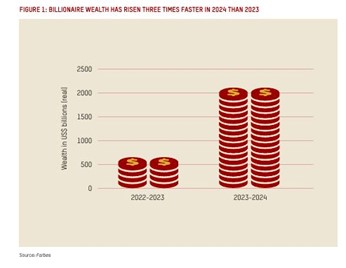

Meanwhile, inequality of wealth and incomes around the world continues. Every year at Davos, Oxfam presents a damning report of inequality and every year the attendees at Davos generally ignore it. This year Oxfam economists found that “billionaire wealth has risen three times faster in 2024 than 2023. Five trillionaires are now expected within a decade. Meanwhile, crises of economy, climate and conflict mean the number of people living in poverty has barely changed since 1990.” The report pointed out that most billionaire wealth is taken, not earned – “60% comes from either inheritance, cronyism and corruption or monopoly power.”

Massive growth in billionaire wealth

The wealth of each of the richest 10 men has grown by almost US$100 million a day in 2024 on average. “Even if you saved US$1,000 daily since the first humans, 315,000 years ago, you still would not have as much money as one of the richest ten billionaires. If any of the richest 10 billionaires lost 99% of their wealth, they’d still be a billionaire.”

UK finance minister Rachel Reeves also rolled up to Davos. At a breakfast event on the second day, someone asked Britain’s chancellor how she felt about “wealth creation” – was she relaxed, in a Blairite sense? “Absolutely,” Reeves replied. “Absolutely relaxed.” Apparently, the grotesque level of wealth in the Oxfam report and openly shown by the oligarchs attending Davos did not worry her. She reminded me of a previous Labour minister in Tony Blair’s government, Peter Mandelson (now ironically UK ambassador to Trump’s US), who once infamously said that he was “intensely relaxed about people becoming filthy rich”… “if they paid their taxes” (which, of course, they hardly do).

False optimism of world financial leaders

IMF chief Kristalina Georgieva was also at Davos, of course. She reminded a select group of global political, business, and civil society leaders of Keynes’ words from a 1930 essay, written against the backdrop of the Great Depression, the rise of communism and fascism, and national and international despair. She loves quoting Keynes. This time she quoted: “I predict that both of the two opposed errors of pessimism which now make so much noise in the world will be proved wrong over time: the pessimism of the revolutionaries who think that things are so bad that nothing can save us but violent change, and the pessimism of the reactionaries who consider the balance of our economic and social life so precarious that we must risk no experiments.” Apparently, there is a middle way of optimism that does not require revolution, but does require change.

Keynes wrote this after a speech to his students at Cambridge urging them not to accept Marxist critiques and remain optimistic that capitalism would take humanity forward. What followed after 1930 was a deep depression in the major economies, the rise of fascist and Nazi forces, WW2 and the holocaust. Let’s hope that Georgieva’s reference to Keynes does not herald a repeat of that in the 2030s.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.