By Michael Roberts

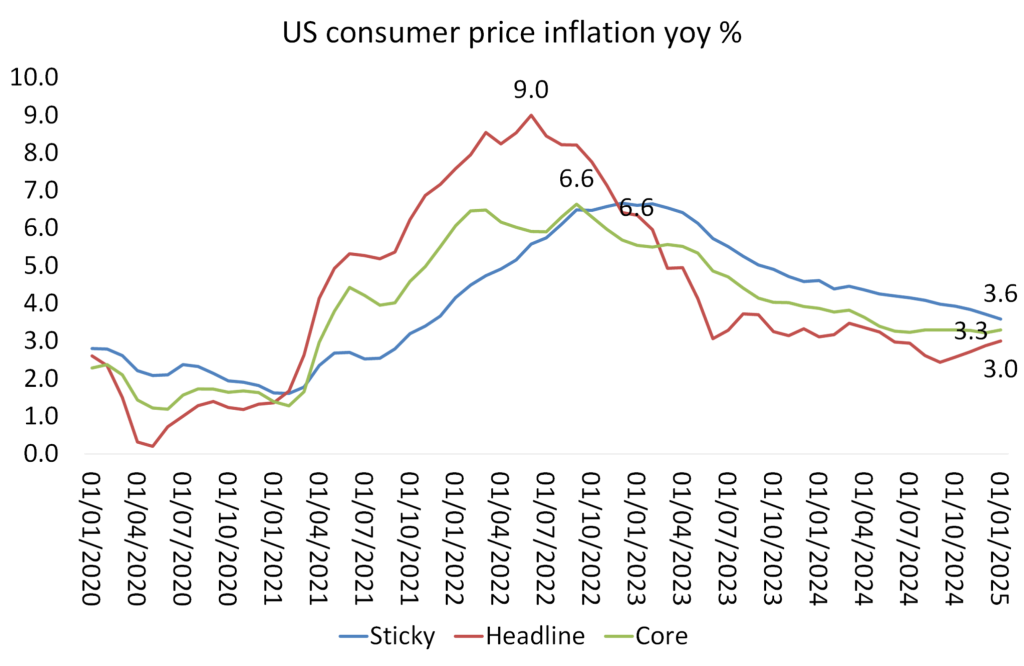

The US consumer price inflation reached 3% year-on-year in January 2025. Energy prices rose for the first time in five months and food price inflation stood at its highest rate in a year. Food prices have leapt back up, as the cost of eggs rose 15.2%, the largest increase since June 2015, driven by an avian flu outbreak that caused a shortage of eggs; and cocoa and coffee prices have rocketed due to bad harvests in the global south, as global warming and climate change causes unpredictable and extreme weather events in growing areas.

Insurance, rents and medical care costs continue to rise

So-called ‘core inflation’ (which excludes supposedly volatile food and energy prices) rose even more, to 3.3%, as insurance, rents and medical care costs continued to rise for American households. Used car prices rose sharply as Americans looked to find cheaper cars than expensive new electric vehicles. And mortgage rates remained at highs not seen since the 1980s. So as the headline inflation has fallen, the core rate has stayed higher.

Then there is the Sticky Price Consumer Price Index (CPI). This is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. So they are thought to incorporate expectations about future inflation to a greater degree than prices that change on a more frequent basis. This measure has remained even higher.

What is clear is that US inflation is not moving any further towards the 2% a year target that the Federal Reserve has set for claiming that the ‘war against inflation’ is won. That’s why the Fed is holding on any further reductions in its policy interest rate, which sets the floor for all borrowing rates.

Economic growth is beginning to falter

Unfortunately for the Fed, US economic growth is beginning to falter. The US economy expanded at an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3. And the economic activity index for the US fell to its lowest level since last April. What was most worrying was the fall in business fixed investment, both in structures and equipment. Fixed investment contracted for the first time since Q1 2023 (-0.6% vs 2.1%), due to equipment (7.8% vs 10.8%) and structures (-1.1% vs -5%).

Growth is worse in the UK

It was much worse in the UK, where, although the inflation rate dropped a touch to 2.5% a year in December, it is expected to have hit 2.8% yoy in January. Indeed, the Bank of England is now forecasting that inflation will rise to 3.7% yoy by year-end! The BoE will probably still cut its base rate again as it has no alternative but to try and help the UK’s very weak economy from continuing to stagnate. The BoE now predicts that the British economy will only grow by 0.75% this year, down from its previous forecast of 1.5% just three months ago.

A similar story in the Eurozone

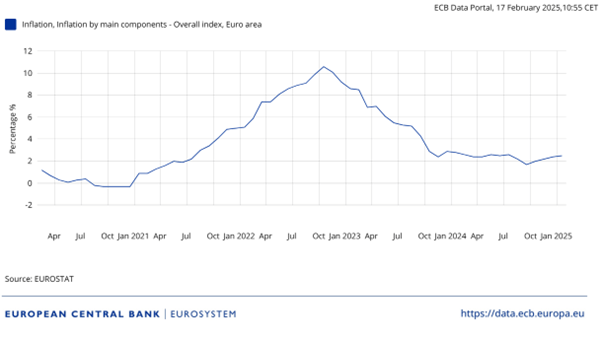

As for the Eurozone, the annual inflation rate rose to 2.5% yoy in January, the highest rate since July 2024, driven primarily by a sharp acceleration in energy costs. The core rate stayed at 2.7% yoy. So EZ inflation is still above the ECB target and rising. Nevertheless, the ECB still hopes that its 2% a year target will be met by “the end of the year”.

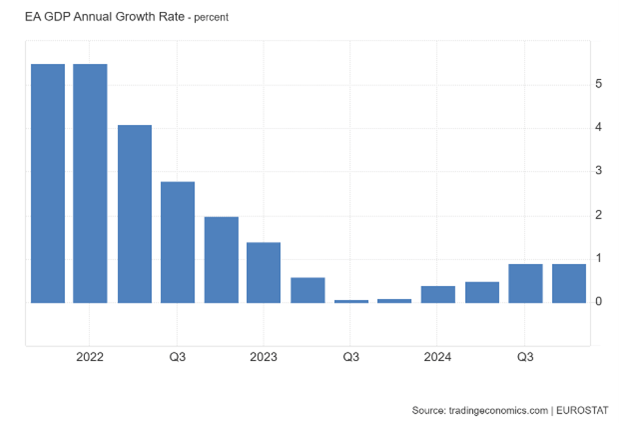

In the meantime, the Eurozone is stagnating ie little real GDP growth.

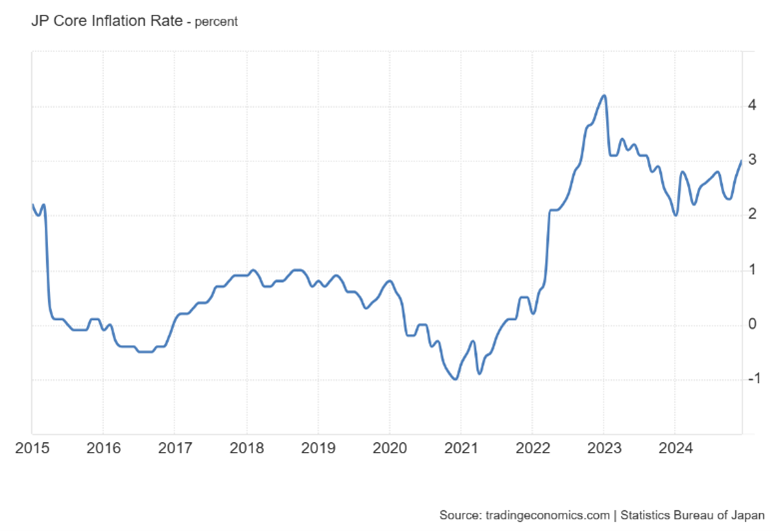

Inflation is now big in Japan

The annual inflation rate in Japan jumped to 3.6% in December 2024 from 2.9% in the prior month, marking the highest reading since January 2023. Food prices rose at the steepest pace in a year. The core rate also hit 3%, the highest rate since August 2023. Japan has been noted in the past for non-existent inflation. That’s all changed.

Japan’s monetary authorities have been trying to get inflation up on the grounds that this will boost economic growth (a weird theory). Yet Japan’s real GDP in 2024 was up only 0.1% compared to 1.9% in 2023, although the economy did pick up a little in the last quarter, driven mainly by exports.

So in the major economies, there is an increasing whiff of stagflation ie low or zero growth alongside rising price inflation. And this is before the inflationary and growth hit that could come if Trump implements his import tariffs and government spending cuts measures over this year.

The US stock market does not seem worried

So far, financial investors in the US stock market seem unworried. Even the recent Deepseek launch that undermined the value of AI investments made by the US tech giants has been seen through. After an initial fall, the US stock market price index is again close to a new high. It seems that financial investors are not convinced that Trump will implement all his threats on tariffs and they like Musk’s trashing of government departments to get a ‘smaller state’. And they are confident that Trump will go through with more tax cuts on corporate profits and high-income earners.

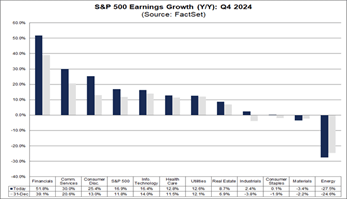

Most relevant is that corporate earnings are still growing. S&P 500 earnings growth for the fourth quarter of 2024 is estimated to have risen 15.1% from a year earlier, based on data compiled by LSEG. FactSet reckons that earnings growth could be even higher at 16.9%, the highest year-over-year earnings growth rate reported by the index since Q4 2021. It will also mark the sixth consecutive quarter of year-over-year earnings growth for the index.

Media tech giants account for the majority of the growth

This earnings boom is driven by the banking sector which is making good profits from high interest rates and corporate borrowing deals. And of course, the other sectoral winner is communications, with the media tech giants accounting for about 75% of S&P 500 earnings growth in 2024. The so-called Magnificent Seven drive US stock market prices, and the US stock market drives world markets.

But earnings growth for these titans will likely fall back this year, given the huge spending on AI capacity that they have committed to. And most important, for the vast majority of US companies, those outside the burgeoning banking, social media and tech, things are not so great. S&P 500 free cash flow per share hasn’t grown at all in three years. Some 43% of the Russell 2000 companies are unprofitable. At the same time, interest expense as a % of total debt of these firms hit 7.1%, the highest since 2003. US corporate bankruptcies have hit their highest level since the aftermath of the global financial crisis as elevated interest rates punish struggling groups. At least 686 US companies filed for bankruptcy in 2024, up about 8 per cent from 2023 and higher than any year since the 828 filings in 2010, according to data from S&P Global Market Intelligence.

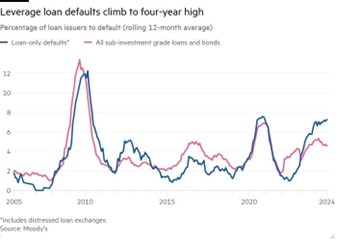

Companies defaulting on high yield loans

US companies are defaulting on junk loans at the fastest rate in four years, as they struggle to refinance a wave of cheap borrowing that followed the Covid pandemic. Because leveraged loans — high yield bank loans that have been sold on to other investors — have floating interest rates, many of those companies that took on debt when rates were ultra low during the pandemic and have since struggled under high borrowing costs in recent years.

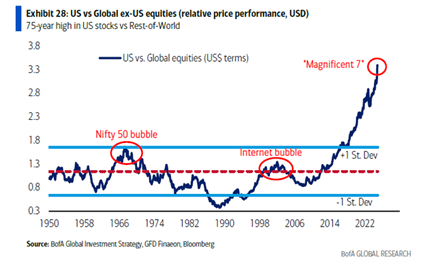

Stock markets are well out of line with real profits

And when you strip out inflation from stock market prices and US corporate earnings, it reveals how far out of line the US stock market is compared to the real profits being made in the productive sectors of the US economy (that’s excluding financial profits). This is a graph compiled by Marxist economist, Lefteris Tsoulfidis.

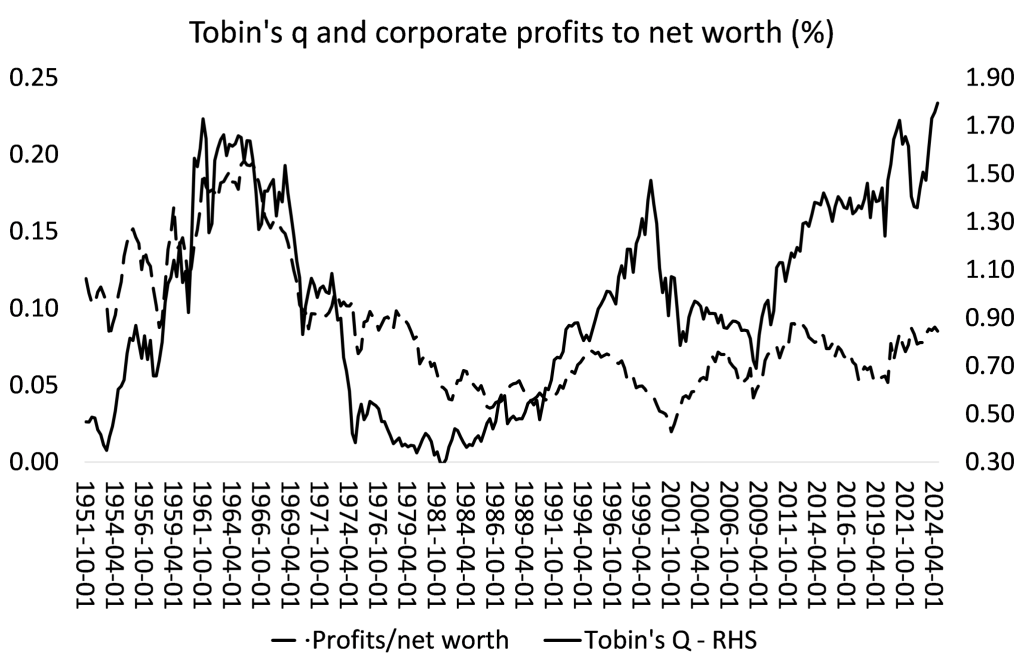

I have also compiled a similar measure to compare the stock market value compared to profits in the US corporate sector. Tobin’s Q is the ratio of stock market value divided by the book value (ie the value of their assets as recorded in the accounts of the companies quoted on the stock market). Then I have measured corporate profits relative to the net worth of company assets. Tobin’s Q is at a record high ie the stock market value is way out of line with corporate assets. And corporate profits relative to company assets are relatively low.

To repeat what Ruchir Sharma, chair of Rockefeller International, said recently. He called the US stock market boom “the mother of all bubbles”. Let me quote: “Talk of bubbles in tech or AI, or in investment strategies focused on growth and momentum, obscures the mother of all bubbles in US markets. Thoroughly dominating the mind space of global investors, America is over-owned, overvalued and overhyped to a degree never seen before. As with all bubbles, it is hard to know when this one will deflate, or what will trigger its decline.”

The signs of stagflation – a recipe for a financial crash

The major economies are exhibiting signs of stagflation. That means interest rates could stay high, while economic growth goes missing. That is a recipe for an eventual crash in financial markets.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.