By Michael Roberts

John McDonnell, the finance spokesman (‘shadow chancellor’) of the British opposition Labour Party, recently commissioned a report on the state of the UK economy and what is to be done.

McDonnell is characterised in the British capitalist media as a dyed-in-the-wool Marxist and his commissioned report was carried out by GFC economics, founded by Graham Turner since 1999. Turner wrote No Way to run an economy back in 2009 which drew on the ideas of both Keynes and Marx for his analysis of the crisis in global capitalism.

Labour’s report presented by GFC, Financing Investment: Interim report, provides us with a meticulous investigation of the failure of British capitalism to invest productively to deliver better productivity, incomes and employment. The report exposes the failure of the UK banks to direct lending into productive sectors instead into speculative financial and unproductive property assets. Thus, UK productivity performance is extremely poor, R&D spending is low and innovation is limited.

The capitalist sector of the British economy has failed to deliver for the needs of people, although it has delivered higher profits and house prices and a booming stock market. Real disposable income per head has not risen since the end of the Great Recession.

The GFC report echoes what other recent reports on the UK economy have pointed out (Time for Change: A New Vision for the British Economy, the Interim Report of the IPPR Commission on Economic Justice).

Both the GFC and the IPPR show that UK productivity has stagnated since the global financial crisis. Real output per hour worked rose just 1.4% between 2007 and 2016. Within the G7, only Italy performed worse (-1.7%). Excluding the UK, the G7 countries have experienced a 7.5% productivity increase over this period, led by the US, Canada and Japan. In addition, the ‘productivity gap’ for the UK – the difference between output per hour in 2016 and its pre-crisis trend – is minus 15.8%; while the productivity gap for the G7 ex-UK countries is minus 8.8%.

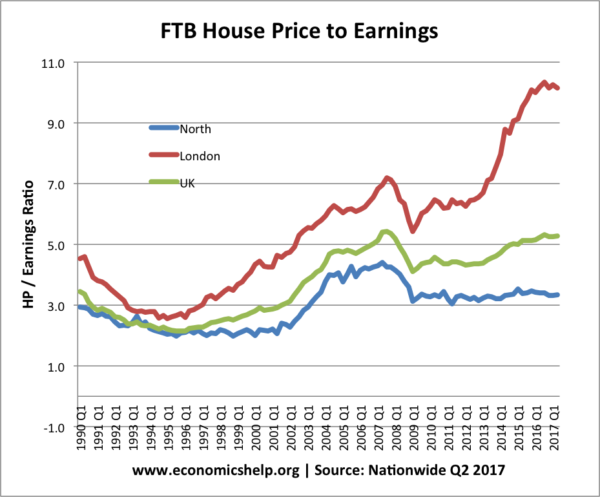

The GFC report confirms that British capitalism is a rentier economy , concentrated on finance, property and business services.

Tony Norfield, in his book The City, reveals the dominant role of finance in the history of British capital. Now this seems to be at the expense of productive sectors like manufacturing and hi-tech. The UK’s output of high-technology industries has fallen by an average of 0.4% year on year over the past ten years. Only Sweden has experienced a bigger decline.

As a result, British workers are increasingly employed in low wage sectors (or self-employed), particularly for those regions outside London and the South East. Britain has a distorted economy, relying on finance over technology and concentrated in the south-east.

Business enterprise R&D also experienced a secular decline relative to GDP during the 1980s and 1990s, dropping from 1.41% in 1981 to a low of 0.96% in 2005. Successive governments have failed to invest in the UK’s long-term future. R&D performed (i.e. undertaken) by the government (including research councils) declined from 0.46% of GDP in 1981 to 0.11% in 2016 (chart 11).27 The UK’s share of government spending is well below the European Union average (0.23%), for example. The UK’s educational performance is mediocre.

The GFC report points out that Britain’s banking sector has dismally failed to support productive sector investment and growth. This is the same conclusion that the report on banking by the UK Firefighters Union (authored by Mick Brooks and myself) reached back in 2013.

As the GFC report puts it: “A dearth of lending to key industries indicates that banks are failing to help UK businesses to invest.” The outstanding stock of loans to smaller companies has dropped from £197.8bn in April 2011 to £165.4bn in October 2017

Instead, bank loans have poured into real estate. The productive sectors of manufacturing, professional scientific & technical activities, information & communication and administrative & support services account for 28.7% of real GDP. But loans outstanding to these four sectors total just £108.82bn, or 5.5% of GDP. This is less than the total of loans outstanding to companies engaged in the buying, selling & renting of real estate (£135.97bn or 6.9% of GDP).

The message from the GFC report’s analysis is that, while the media goes on about the impact of Brexit and austerity on the UK economy, there are other even more serious long-term structural defects in the model of British capital that even an end to austerity or a reversal of Brexit would not overcome.

So what is to be done? The GFC’s interim report says that a Labour government should set up a Strategic Investment Board to coordinate R&D, commercialisation and information flows. This board should be situated outside London and the Bank of England should also be relocated to Birmingham, England’s second largest city. This would concentrate efforts to revive productive industry and rebalance the economy regionally.

Now the latter idea has captured the media headlines, as has the proposal to widen the ambit of the Bank of England to beyond just an inflation target to include growth and employment (similar to the objectives of the US Federal Reserve).

But that’s it. The question to be asked is whether setting up an investment board and moving the Bank of England is in any way sufficient to raise productivity and growth and boost real incomes, education, training and decent jobs. The GFC report comments that “Existing banks left to their own devices may struggle to change. Politicians and regulators have failed to prepare the existing banks for the challenge posed by a new era of technology. They have not ensured that banks play their part in supporting the growth of new businesses. Instead, banks have entrenched their focus on unproductive lending.” But there is no call for public ownership of the major five banks, let alone the key strategic industries in the productive sectors. That would surely be needed if any plan for investment and innovation could be effectively implemented. If the capitalist sector remains dominant, then the state investment bank will be insufficient.

Worse, even the less than radical policy of a state investment bank has been greeted with hostility by the big investment banks in the finance sector. Morgan Stanley, the American investment bank, reckoned that a Corbyn-led government would be a disaster for British capital. As it put it: “For much of the past 30 years and more, a change of government ultimately had a relatively limited impact on the UK equity market, as policy settings didn’t change too dramatically. However, this may not be the case if we see a Labour government take power under its current leadership, given its very different policy approach.” In other words, up to now, a Labour government has been no threat to the established order, but a Corbyn government could be. “It is certainly plausible that the Labour party could ultimately moderate some of its more radical policy ideas; the alternative could be the most significant political shift in the UK since the end of the 1970s.”

Corbyn responded by agreeing with Morgan Stanley that it was right to regard him as a threat, pointing out that it was the likes of Morgan Stanley who were the same “speculators and gamblers who crashed our economy in 2008”… Nurses, teachers, shop-workers, builders, just about everyone is finding it harder to get by, while Morgan Stanley’s CEO paid himself £21.5m last year and UK banks paid out £15bn in bonuses,” Corbyn said.

But, ironically, some of Corbyn’s economic advisers went out of their way to argue that Labour’s investment plans were not damaging at all to big business. Indeed, they could help capitalism save itself. Ann Pettifor, director of Policy Research in Macroeconomics (PRIME), a Keynesian think tank and author of a recent book advocating ‘breaking the power of bankers’ through the injection of more money credit with people’s QE, wrote that the GFC report shows that business could prosper under a Corbyn government.

Pettifor reckons that “Labour’s public spending plans will boost investment, with contracts that largely benefit the “timid mouse” that is the private sector. In other words, the “roaring lion” that is a government backed by a central bank, will, under Labour, at last take action to stimulate a private sector that has significant spare capacity; one not yet fully recovered from the catastrophic impact of the great financial crisis and that still lacks confidence.”

In other words, more public investment and BoE monetary support can help Britain’s capitalist sector get going and deliver on investment and growth. Thus, we are back with the same old Keynesian reformist view that capital just needs a helping hand from government, not its replacement. As Marxist economic blogger, Chris Dillon commented, “The difference between Marxists such as me and social democrats such as Ann is, I suspect, that we are more sceptical than she is of governments’ ability to fix capitalism.” Moreover, as Geoff Mann showed in his recent book, Keynesian policy prescriptions dominate labour movement thinking because they appear to offer a way out short of a revolutionary transformation.

As usual, the question that is not asked is why British capital does not invest enough to boost productivity. Yes, it is partly because the UK is a rentier economy that aims at unproductive parasitic accumulation of surplus value from others. And yes, it is partly because British business in particular has preferred to employ young and cheap immigrant labour in ‘precarious’ employment of zero hours, short-term, temporary and part-time contracts rather than invest in training long-term staff. It’s been a cheap short cut to more profits. But that shows the basic contradiction of capitalism. Capitalist production is for profit not for need; for profitability, not productivity.

And profitability in the productive sectors of the British economy remains low relative to before the Great Recession and even back to the 1990s. Profitability reached in peak in 1997. Since then, overall profits have risen in nominal terms by about 60%. But despite the credit boom of the early 2000s and the recovery since the Great Recession, profitability (ie profits per the stock of capital invested) remains below that peak. As a result, British capital has invested in financial assets or hoarded cash in tax havens or invested abroad rather than in the UK.

A National Investment Board will do little to alter that. As I have argued before, the ratio of investment in the capitalist sector compared to the public sector is 5 to 1. The NIB could raise public investment as a share of GDP by 1%. But An investment strike by capitalism will not be compensated for by a government-led investment programme that just adds 1-2% of GDP in investment when the capitalist sector invests over 15% of GDP. And the latter will not be touched. Contrary to the view of Keynesians like Ann Pettifor, the chair of JP Morgan, the US investment bank put it: “I would put quantitative targets on things that are under governments’ control and national GDP growth is not,” Dr Frenkel said. “As much as you’d like to jump 5 metres without a pole you will not be able to.”

Surely the obvious conclusion from the defects of British capital exposed by the GFC report is that the major banks and strategic sectors of the British economy (transport, pharma, aerospace, autos, telecoms and utilities) need to be brought into public ownership to make any investment plan really work in delivering higher productivity and good secure wage jobs?

Yet that is not the programme (yet) of the Labour leaders. If a Corbyn-led Labour government should come to office in the next year or few, it will be faced with the wrath of the right-wing media and the likes of Morgan Stanley, but without the economic programme to defeat them.

December 19, 2017

For the full article, with charts and graphs, go to: https://thenextrecession.wordpress.com/2017/12/19/labours-interim-report-on-the-uk-economy/