By Michael Roberts

Economic growth

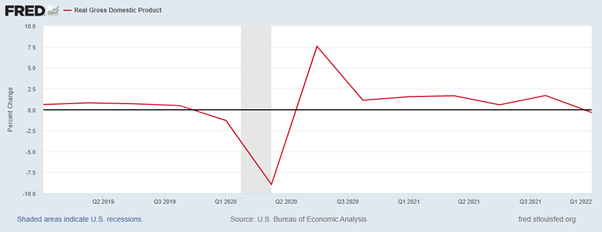

The US economy unexpectedly contracted by 0.4% in the first quarter of 2022, compared to the previous quarter, due in large part to a decline in inventories and exports. Consumer and business spending continued to grow however, suggesting that activity still has some momentum.

Chart 1 – US real GDP quarterly change %

Growth in the euro area slowed to 0.2% in the first quarter. The Italian economy contracted, the French economy posted 0% growth and Germany grew by 0.2%. China’s growth slowed in Q1 to 1.3% compared to 1.5% in Q4 2021. But the economy is still growing, despite the severe COVID lockdowns in key cities. Korea also slowed to 0.9% in Q1. Other countries like the UK and Japan are still to report Q1 growth.

And going into Q2, JP Morgan economists’ global manufacturing output PMI tumbled 2.4% points in April to its lowest level since June 2020. Global factory output for April is looking grim. At 48.5, the global manufacturing PMI points to an outright contraction of 0.8% in the three months through April. Given the tracking for February and March (0.35%m/m on average), the latest PMI points to a nearly 3% collapse in factory output last month.

Business returns

US corporate quarterly results were poor. Apple warned that supply chain disruption due to COVID-19 meant it was likely to struggle to meet consumer demand this quarter, affecting up to $8bn in revenue. Amazon reported a 3% fall in online sales in the first quarter of the year, pointing to an easing of the pandemic-driven boom on online retail. And Meta, formerly known as Facebook, reported its slowest revenue growth in a decade, reportedly as businesses cut discretionary advertising spending.

Chart 2 – Amazon stock price $

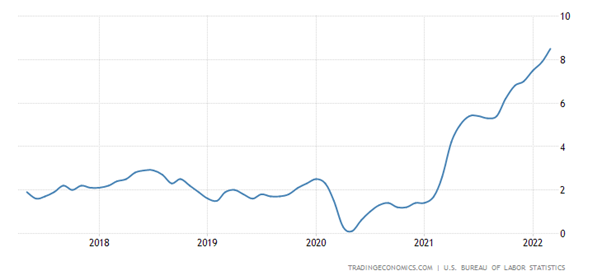

Inflation

Alongside the growth slowdown, inflation continued to accelerate in the G7 economies. US inflation hit 8.5% and counting. US employment costs rose by 4.5% in the year to the first quarter, the fastest rate in 21 years. Euro area inflation accelerated to 7.5% in the 12 months to April, beating March’s record high of 7.4%. Netherlands inflation rose to 9.7% year on year. Both Brazil and Russia experienced double-digit rates. And even Korea and Australia reached 5%.

Chart 3 – US CPI inflation yoy %

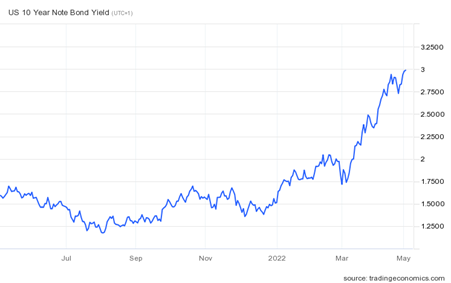

Interest rates

Both the Fed and the Bank of England are set to hike rates by at least 0.5% points this week with likely further hikes during the rest of the year. The Reserve Bank of Australia hiked its policy rate for first time in eleven years. These hikes and the prospects of more are driving up lending costs as indicated by the US Treasury bond yields reaching 3% for the first time in three years; while mortgage rates rose, threatening to reverse the US house price bubble (US home prices are up 34% since the beginning of the pandemic). The Bloomberg global aggregate bond index has fallen by over 11% this year.

Chart 4 – US ten-year government bond yield (%)

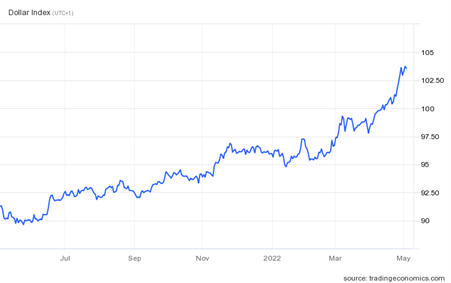

Currencies

With the US Fed planning a series of hikes and with worries about the global economy and war, the US dollar hit a twenty-year high against a basket of advanced economy currencies. The Chinese renminbi recorded its largest one month fall on record following growing concerns over future growth in the country and expectations of rising US interest rates. A strong dollar and rising interest rates are increasing the risk of default by a range of poor countries in the Global South.

Chart 5 – US dollar index against other currencies

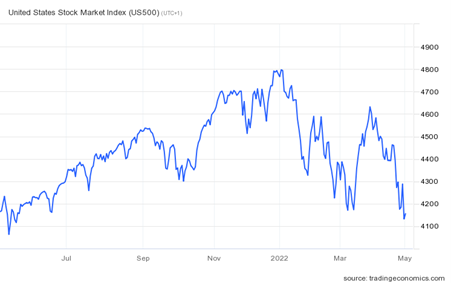

Financial assets

In the US, the real return on equities averaged 9.2% a year between December 1981 and December 2021, far outstripping growth in average real earnings of 0.5% a year and overall GDP growth of 2.7%.

But now things are changing fast. Global equity markets have fallen over 11% since January. Chinese equities and European stocks have seen larger declines with China suffering from renewed lockdowns and Europe vulnerable to the fallout from the war in Ukraine and disruption to the supply of Russian energy. The American equity market has a heavy exposure to technology. Shares in Facebook and Netflix have fallen 44% and 65% respectively this year after announcing declining user or subscriber numbers. Shares in Apple, Google and Amazon have also declined. Apple warned that supply chain problems and factory closures in China could cost the business $8bn in the current quarter.

Chart 6 – US S&P 500 stock index

In summary: slowing growth, rising inflation and interest rates, falling financial returns; rising risk of defaults on loans; and war.

See my report ‘Forecast for 2022’. https://thenextrecession.wordpress.com/2022/01/01/forecast-for-2022/

That forecast was republished on the Left Horizons website in January. See here.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.