By John Pickard

When Boris Johnson announced his Brexit deal in December 2020, a Left Horizons editorial noted that “This is the first ‘free trade’ deal in history that has actually raised tariff barriers”. Although Johnson is in perpetual denial – as he is on most issues – the more that data is collated, the more the baleful effect of Brexit on the British economy becomes apparent.

Last week we had the news that the UK economy is likely to be the worst-performing economy of all of the top G20 countries in the next two years, with the sole exception of Russia, beset by a huge raft of international financial and trade sanctions. Yesterday, we had the news from the Governor of the Bank of England, Andrew Bailey, that the already high rate of UK inflation is likely to persist longer than was first thought (or was first admitted). Then today we have news that the UK trade performance has fallen to its worst since records were started, 67 years ago.

Andrew Bailey warned on Wednesday that “Britain’s economy is suffering more from the energy crisis than other countries with UK inflation likely to stay higher for longer” (Financial Times, June 29), although there was no explanation from him as to why an economy historically so energy-rich should suffer more from a world price shock than other economies without traditional resources of North Sea oil and gas.

According to the Financial Times, Bailey now expects inflation to rise to 11 per cent this Autumn, and his comments “underscore how necessary he and the BoE think it will be for households to suffer financial pain if the UK is to bring inflation, which hit 9.1 per cent in May, to the target level of 2 per cent”. There is no hiding what this throw-away comment means – while profits, share-prices and boardroom pay are all booming, the big majority of the population are expected just to grit their teeth and suffer.

Decline in UK trade to its worst-ever level

A big part of the problem facing British capitalism is the direct result of Brexit and the decline in trade between the UK and its major trading partner, the European Union. That is underscored by the decline in the UK trade performance to its worst-ever level.

“The weak performance of UK exports and a surge in imports” today’s Financial Times article notes, “will add to pressure on the government over the damaging economic effects of Brexit as the official figures corroborate academic studies showing a rupture in UK exports since the new border controls were imposed in 2021”.

“The data showed that the UK’s current account deficit was 8.3 per cent of gross domestic product in the first quarter of 2022, a deterioration from an average of 2.6 per cent across all the quarters of 2021. That was the worst figure on record since quarterly balance of payments data was first published in 1955”.

The figures include an overall 4.4 per cent fall in real exports and a gigantic 10.4 per cent leap in real imports. The chief UK economist at Pantheon Macroeconomics, echoed the previous Bank of England governor, Mark Carney, who, the FT says, “warned repeatedly after the Brexit referendum that the value of the pound depended on the ‘kindness of strangers’”. What will follow from this collapse in trade performance will be a decline of Sterling against other currencies and a further surge in prices of imports. The pound sterling has lost more than 10 per cent of its value against the US dollar over the past year, while remaining broadly stable against the euro (for the moment).

Only Northern Ireland has escaped the Brexit fall-out

The Pantheon economist added, “The adverse consequences of the UK dependence on external finance that stems from the large current account deficit have been clear over the last month, with sterling depreciating sharply as global investors have collectively shunned risky assets”.

In fact, the only place in the UK that has not suffered from an economic Brexit chill is Northern Ireland, precisely because it has remained a part of the EU single market as a result of the ‘protocol’ written into the Brexit deal. Not surprisingly, the protocol is popular among the majority of the population in Northern Ireland.

According to a LucidTalk poll for Queens University, Belfast, “Some 55% of people agree that the protocol is a suitable arrangement — up 8% from a year ago — with 38% disagreeing.” (Belfast Telegraph, June 29). Although three-quarters of those polled in Northern Ireland thought that some EU-UK negotiated agreement could iron out any difficulties associated with the protocol, “57% believe the government is unjustified in taking unilateral action to scrap parts of it”.

That has not stopped Boris Johnson and Liz Truss from playing up to the minority-supported DUP and threatening to suspend the protocol. Why should Northern Ireland escape the economic damage the rest of the UK is suffering?

Johnson’s policy of ‘getting Brexit done’ revolved around his now infamous comment, “F*** business!”. Ever a chancer, a liar and a blusterer, Johnson represents the narrowest and most short-sighted section of the British capitalist class: hedge-fund managers, speculators and financial gamblers and spivs. Their disastrous Brexit policy, built around a toxic mixture of xenophobia and false promises, will unravel even more in the months to come. Johnson has indeed f***ed business, and farming and fisheries and manufacturing, but along with that he is also screwing the living standards of the big majority of the population.

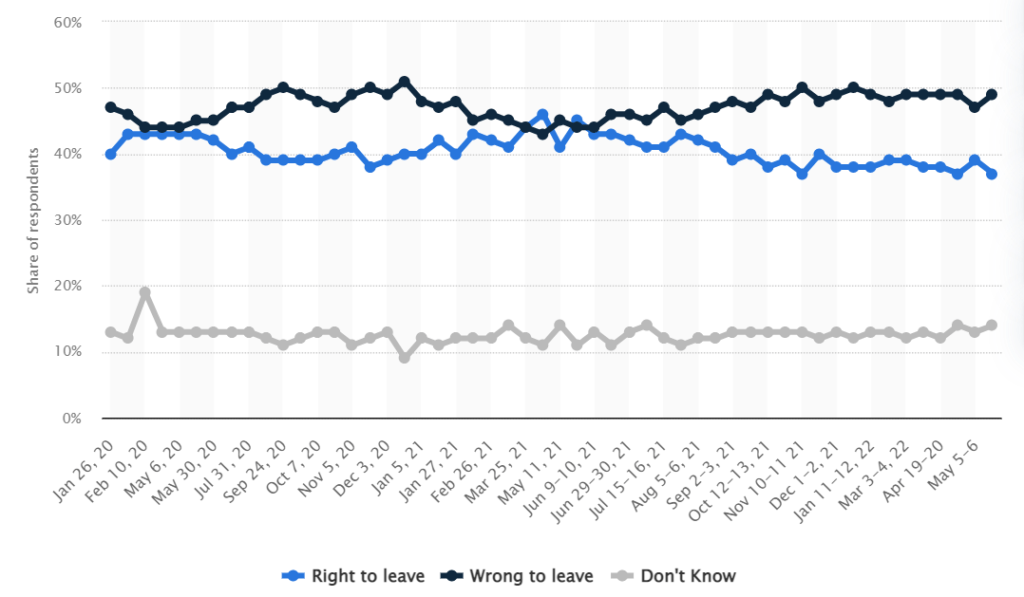

According to polls, a majority now believe that Brexit was a ‘mistake’. It may not be articulated in so many words in by-elections and political debates in the coming months, but the fall-out from Brexit in terms of inflation, cuts in living standards, reduced food and environmental standards, and instability in Northern Ireland (if the protocol is dumped), will all add to the generalised miasma of anger and discontent that now increasingly surrounds Boris Johnson.

In the editorial we mentioned above, Left Horizons also commented in these terms: “There will come a point when the dam will burst, and when it does it will inundate Boris Johnson in waves of protest and anger. It will take Johnson and his Cabinet by surprise, as it will Starmer…” Some of the industrial battles we see taking place today are not explicitly linked to the economic results of Brexit, but they are nonetheless partly caused by it. And that fall-out will get a lot worse before it gets better.