By Michael Roberts

Inflation, risk of global recession, growing inequality and rising debt for the global south, global warming, war – I could go on. These are the fault-lines exhibited in the world economy in 2022. What is to be done about it?

It is revealing to consider the solutions offered by analysts writing for the IMF in its monthly Finance and Development (F&D) Journal.The new chief economist for the IMF, Pierre-Oliver Gourinchas, kicks off in the June issue of F&D. “Like an earthquake, the war has an epicenter, located in Russia and Ukraine. The economic toll on these two countries is extremely large.” Gourinchas lists the toll. The first impact is on the price of commodities. Second, trade flows have been heavily disrupted, Third, the war caused financial conditions to tighten.

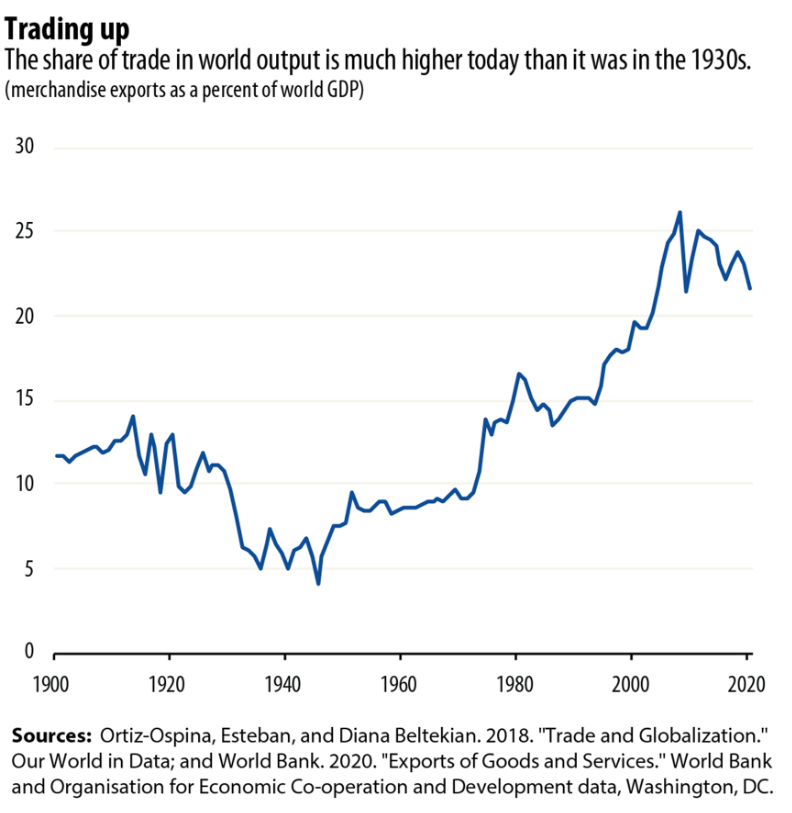

He continues: “the earthquake analogy is perhaps most apt because the war reveals a sudden shift in underlying “geopolitical tectonic plates.” The danger is that these plates will drift further apart, fragmenting the global economy into distinct economic blocs with different ideologies, political systems, technology standards, cross border payment and trade systems, and reserve currencies. “The war has made manifest deeper divergent processes. We need to focus on and understand these if we want to prevent the ultimate unravelling of our global economic order.”

Fault lines in the current economic order

He recognizes that US imperialism will remain the hegemonic power but while: “the dominance of the US dollar is absolute and organic, [it is] ultimately fragile. This is one of the fault lines in the current economic order. How this transition is implemented could have a major effect on the global economy and the future of multilateralism.”

What’s the answer? Apparently, it is the IMF! According to Gourinchas, “this is a world that needs the IMF more, not less. As an institution, we must find ways to deliver on our mission to provide financial assistance and expertise when needed and to maintain and represent all our members, even if the political environment makes it more challenging. If geopolitical tectonic plates start drifting apart, we’ll need more bridges, not fewer.”

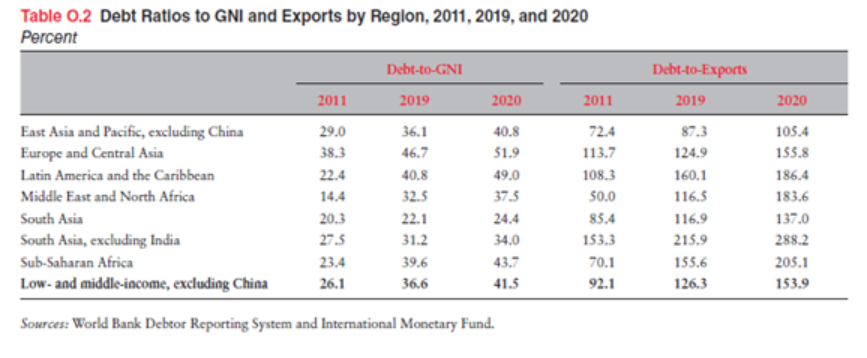

This is an ironic conclusion, given the record of the IMF in squeezing down growth and public spending and living standards in so any countries over the last 40 years in the interests of ‘reducing debt and fiscal probity’. The IMF failed to alleviate the rise in poverty for millions from the COVID slump and still offers no effective program to relieve billions of people living in countries with huge debts. Not a word from Gourinchas about cancelling those debts. The IMF is less a bridge over the global fault-lines and more a contributor to more fissures.

In another piece, Nicholas Mulder, the author of The Economic Weapon: The Rise of Sanctions as a Tool of Modern War, explains how the sanctions being imposed by ‘the West’ on Russia and also those already on China have serious consequences globally particularly for poor countries: “sanctions have global economic effects far greater than anything seen before. Their magnitude should prompt reconsideration of sanctions as a powerful policy instrument with major global economic implications.”

Sweeping sanctions against Russia

Sweeping sanctions against Russia have combined with the worldwide supply chain crisis and the wartime disruption of Ukrainian trade to deliver a uniquely powerful economic shock. Additional sanctions on Russian oil and gas exports would magnify these effects further.

Again, what’s the answer? Well, of course, ending the Russia-Ukraine conflict is the first that springs to mind. But that alone will not stop the spread of sanctions (trade, technology and finance) as weapons of war are now being used by the imperialist bloc against any nations who resist the interests of that bloc.

Mulder says that it is in the interest of the well-being of the world population and the stability of the world economy to take concerted action to counteract the spill-overs of sanctions on Russia. A number of policy adjustments could help. First, advanced economies should focus on long-term infrastructure investment to ease supply chain pressures, while emerging market and developing economies should make income support a priority. Is any of that happening?

Second, advanced economy central banks should avoid rapidly tightening monetary policy to prevent capital flight from emerging markets. This solution flies in the face of the interest rate hikes being pursued with vigour by nearly all the major central banks in order to ‘control inflation’.

Third, looming debt and balance of payments problems in developing economies can be tackled through debt restructuring and increases in their allotments of the IMF’s Special Drawing Rights, a type of international reserve currency. Debt restructuring, let alone cancellation, is being ignored by the IMF, which still demands its pound of flesh.

Countries lacking vaccines during Covid

Fourth, humanitarian relief should be extended to distressed economies, especially in the form of food and medicine. Tell that to poor countries lacking vaccines during COVID and now facing food famines.

Fifth, the world’s major economic blocs should do more to organize their demand for food and energy to reduce price pressures caused by hoarding and competitive overbidding. How is that to be achieved when food distribution globally is controlled by a handful of monopoly trading companies?

Mulder’s solutions are in the interests of the well-being of the global population, but not in the interests of big capital, finance, fossil fuels and corporate profits. He concludes: “Unless such policies are put in place in the next few months, grave concerns about the world economic outlook for 2022 and beyond will be justified.” But there is fat chance of any of these measures being agreed globally, let alone ‘put in place’.

Then there is global warming and climate change: Tharman Shanmugaratnam is senior minister in Singapore and chair of the Group of Thirty (the new international banking forum). In his article in F&D, he is concerned that cutting off Russian gas supply to Europe and elsewhere may be very costly to millions, but he reckons that it also offers an opportunity to move towards the reduction of fossil fuel emissions to reach net zero by 2050. But even that seems unlikely given the sharp increase in coal production to compensate for gas supply reductions and the expansion of degrading shale oil production in the US.

Investments pay for themselves many times over

To convert the world economy from its current path to one that achieves net-zero carbon emissions by mid-century would cost $25trn in infrastructure investment. Shanmugaratnam says: “Measured from a societal perspective (my emphasis), these investments pay for themselves many times over, given that fossil energy use costs more in external damages than it adds value to GDP.” So Shanmugaratnam wants to invest in what he calls ‘public goods’: “we have to invest at significantly higher levels, over a sustained period, in the public goods needed to address the world’s most pressing problems.

“We must make up for many years of underinvestment in a wide range of critical areas—from clean water and trained teachers in developing economies to upgrades of an aging logistics infrastructure in some of the most advanced economies. But we also have the opportunity now to spur a new wave of innovations to tackle the challenges of the global commons, from low-carbon construction materials, to advanced batteries and hydrogen electrolyzers, to combination vaccines aimed at protecting simultaneously against a range of pathogens.”

Yes, sounds great. But two things spring to mind here. Why has there been so much ‘underinvestment’ in such ‘critical areas’ up to now? Shanmugaratnam offers no explanation, but the evidence (expounded many times on this blog) shows that it is the failure of the capitalist sectors of the world economy to invest because profitability in ‘productive investment’ has been in long-term decline, particularly in the 21st century. Capital has instead gone into financial and property speculation, driven by low or near zero interest borrowing rates.

Private capital backed by public money

Time for a change says Shanmugaratnam: “We must now reorient public finance, in partnership with philanthropic capital where possible (! – MR), toward mobilizing private investment to meet the needs of the global commons (my emphasis). So the answer is to rely on private capital backed by public money to get the capitalist sector to invest.

That approach has been tried over and over again and clearly failed. Yet Shanmugaratnam persists with this solution (as he must): “almost half the technologies needed to reach net zero by mid-century are still being prototyped. Governments must put skin in the game to leverage private sector R&D (my emphasis again), and promote demonstration projects, to accelerate the development of these technologies and bring them to market. Besides getting to net zero on time, they should aim to spur major new industries and job opportunities.”

He recognises correctly that: “the social returns to protecting the global commons will typically be far in excess of the private returns” and “Developing and producing vaccines at scale for the next pandemic is a strong illustration of the point. A project to immunize the world’s population even six months earlier will save trillions of dollars and countless lives.” In which case, why not turn to the public investment? Well, no, instead this “makes a strong case for the public sector to share risks with private investors.” God help the public sector then.

Shanmugaratnam calls for global coordination: “the additional international investment required to plug major global gaps in preparedness, with contributions fairly distributed across countries, will not only be affordable for all but also enable us to avoid costs that would be several hundred times larger if we fail to act together to prevent another pandemic. The longstanding aversion to collective investment in pandemic preparedness reflects political myopia and financial imprudence, which we must overcome urgently.”

Indeed! But what is Shanmugaratnam’s answer? The usual one: the World Bank “must pivot more boldly toward mobilizing private capital, using risk guarantees and other credit-enhancement tools rather than direct lending on its own balance sheet.” Exactly what the World Bank has been up to for decades, using public money to fund private capital schemes.

Deep economic interconnections between nations

As for global coordination to achieve these social tasks, Shanmugaratnam says that “a more effective multilateral system will require fresh strategic understanding between major nations, most important, between the United States and China, as the world shifts irreversibly toward multipolarity.” Given the latest NATO summit, which aims to surround and ‘contain’ China as an enemy of the West, global coordination is clearly off the agenda.

Shanmugaratnam is clear: “We can be under no illusion that an integrated global order, with its deep economic interconnections between nations, will on its own assure us of peace. But economic interdependence between the major powers, save for sectors impinging on national security (! MR), will make conflict far less likely than in a world of increasingly decoupled markets, technologies, payment systems, or data.” But how can there be ‘economic interdependence’ in a world dominated by an imperialist bloc, led by the US, aiming to work against those major economies that resist its interests (China, Russia and even India)?

Private capital has failed to reduce poverty and inequality – on the contrary. It has failed to invest in the infrastructure and technology to raise living standards globally and reduce carbon emissions – on the contrary, fossil fuel production and profits continue to rise. It is clear, even if the IMF experts do not admit it, that public investment for common good should replace capitalist investment for profit to meet the needs of the many and to introduce the technology to reduce emissions and expand vaccines And fossil fuel companies need to be brought under public ownership and control and phased out. Global coordination is impossible while imperialist powers dictate the terms. Peace and imperialism is an oxymoron.

From the blog of Michael Roberts. The original can be found here.