By Michael Roberts

There is confusion among mainstream economists and policy-makers on whether the major economies are heading for a recession, are already in a recession, or will avoid one altogether. The majority view, at least in the US, is the latter.

This optimistic view argues that, while inflation rates are high, they will start to fall over the next year, enabling the Federal Reserve to avoid hiking its policy interest rates too much to the point where it could restrict investment and spending. At the same time, the US unemployment rate is very low and the ‘labour market’ remains strong. Such a scenario hardly suggests a recession. Who ever heard of a slump where there is full employment, the argument goes.

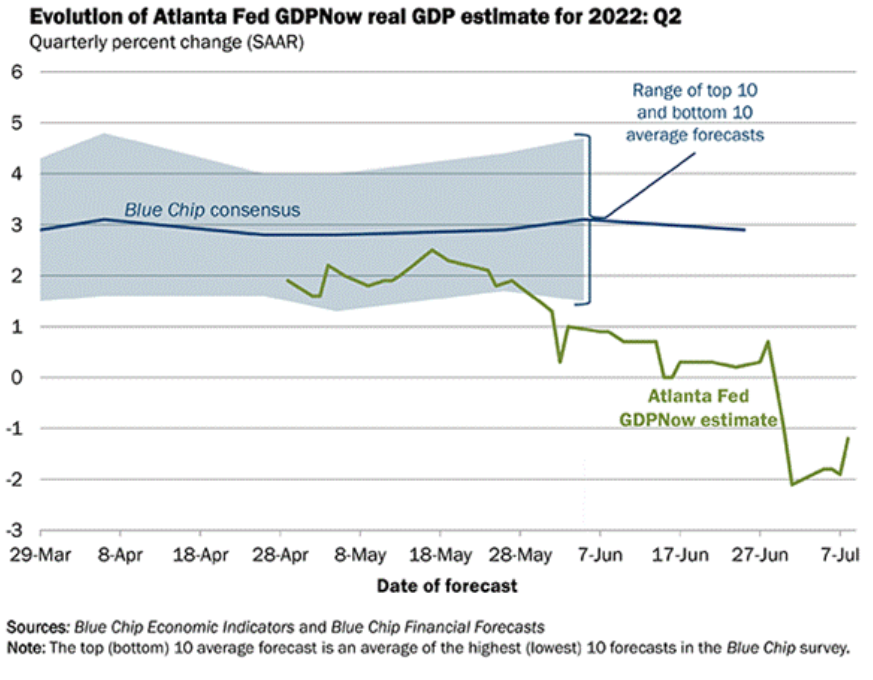

On the other hand, the pessimistic view is that the major economies are already in a slump that will be eventually recognized. If we look at the models that measure various aspects of economic activity, the major G7 economies seem to have contracted in the second quarter of this year. The Atlanta Fed Now model puts US GDP contracting by an annual rate of 1.2%.

Recession and a tighter labour market?

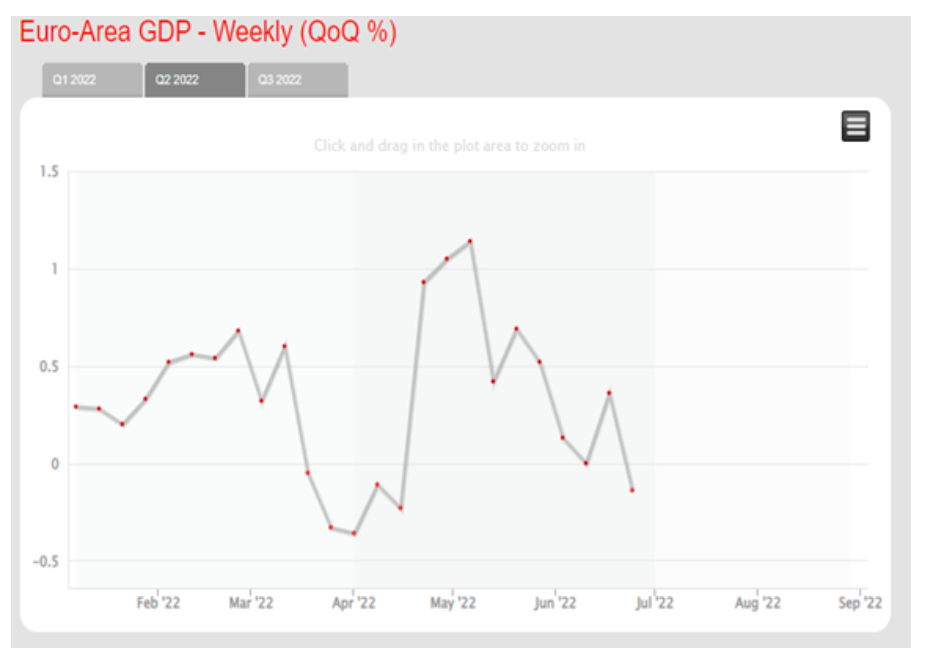

And the Euro-Area weekly tracker also suggesting contraction of about annual rate of 1% there.

Is it possible to have a recession and a tight labour market at the same time? US real GDP fell at a -1.5% annual rate in the first quarter and looks like repeating that in the second. That’s a ‘technical recession’, as it is called. But the unemployment rate is 3.6% near record lows, and 380,000 jobs are being created each month, on average, over the past four months.

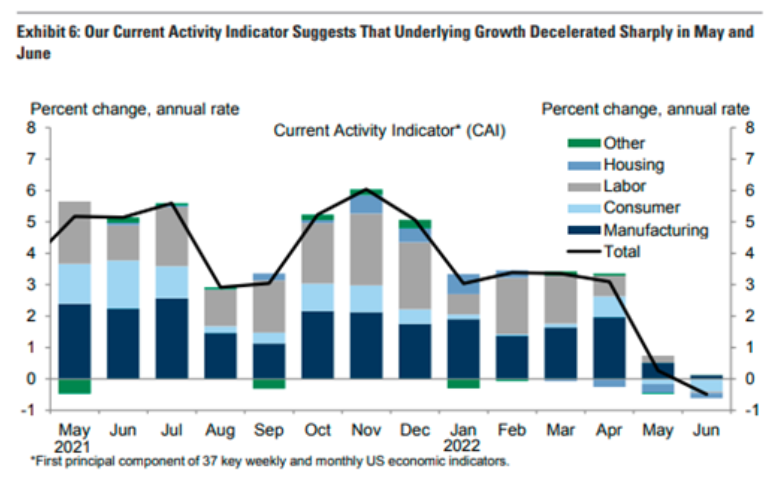

The extremely well-paid economists of the investment bank, Goldman Sachs, try to reconcile these divergent indicators. It is true, they argue, that some GDP tracking estimates now project negative second quarter GDP growth, which would trip the rule of thumb that two quarters of negative growth constitute a recession. But they point out that the indicators on employment, real personal income less transfers, and gross domestic income have all continued to increase.

And they find it “historically unusual for the labour market to be as strong as it is at present even at the very outset of a recession. In particular, nonfarm payroll employment has grown at roughly double the typical pace at the start of past recessions.” Non-farm payrolls have grown at an annualized pace of 3.0% over the last three months and 3.7% over the last six, roughly double the typical pace at the start of past recessions.

But Jan Hatzius, chief US economist at Goldman Sachs, said there is “no doubt that a labour market slowdown is under way”, adding that “job openings and quits are declining, jobless claims are rising, the ISM employment indices in manufacturing and services have fallen to contractionary levels, and many publicly traded companies have announced hiring freezes or slowdowns”.

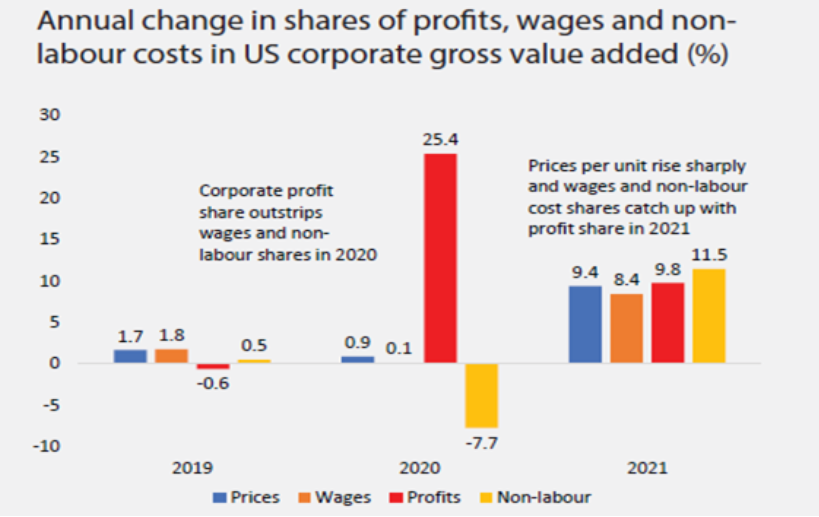

That suggests that unemployment is a lagging indicator in judging when a slump comes. Indeed, that would be in line with a Marxist analysis of slumps. First, profitability declines, particularly in the productive sector, then profits in total. This leads to a fall in investment by companies and then the laying off of labour and a reduction in wages.

48% chance of a recession next year

The GS economists admit that the battery of economic indicators that they look at are now suggesting the negative in the latest months. GS concludes that there is a 30% probability of entering a recession over the next year, but a 48% probability of entering a recession by next year – in other words, it’s more or less likely by 2023, but not yet. For them, “we do not have a recession in our baseline forecast, but we continue to expect well below consensus growth and do see heightened recession risk.”

As I have referred to in several previous posts, if the government bond ‘yield curve’ inverts, it is a relatively reliable indicator of a future recession. The ‘yield curve’ measures the difference between the interest rate earned on a government bond that has, say, a ten year life or maturity and the interest rate on a bond of say just three months or a year. Normally, somebody who invests in a longer term bond expects a higher interest rate because their money won’t be paid back for a longer time. So the yield curve is usually positive ie the rate on the longer term bond is higher than on the short term bond. But sometimes it goes negative because bond investors are expecting a recession and so put their money into longer-term government bonds as the safest way to protect their money. So the yield curve ‘inverts’.

When that happens and the curve stays inverted, recession seems to follow within a year or so. The US government bond yield curve for 10yr-2yr is now inverted. The last time that happened was in 2019 when the major economies seemed to be heading for a slump anyway, just before the COVID pandemic.

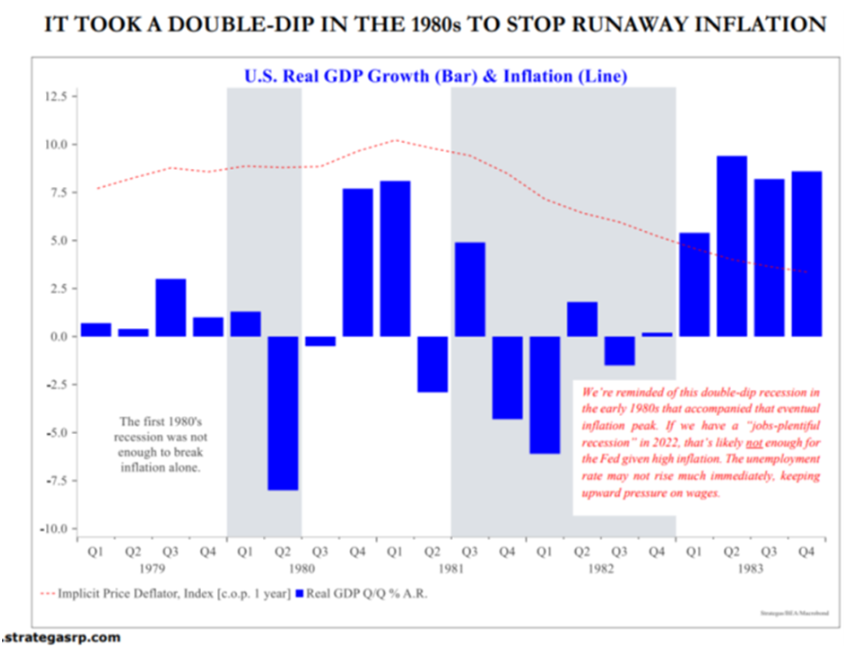

The frightening thought for the US economy is that if inflation rates stay high and unemployment stays low, then it may take two recessions to kill inflation and smash jobs, the ultimate aim of the Fed and the authorities. That’s what happened between 1980-82 – a double-dip recession.

That’s the US economy, where the recovery from the COVID slump has been greatest among the major economies – although that is not saying too much. The situation is much worse in stagnant Japan (see my recent post) and in Europe where the Russia-Ukraine crisis portends a major energy crisis. Indeed, the war and the sanctions on Russia look like triggering a slump in the Eurozone of major proportions.

As winter approaches, demand for gas will rise

Already, Russian gas exports are down by one-third from a year ago and only 40% of the Nord Stream1 pipeline capacity is being used. As winter approaches, demand for gas in Europe will double, causing a serious shortfall for industrial production and heating homes. That alone could contract the Eurozone economy by 1.5-2.8% of GDP, according to some estimates. And rocketing natural gas and oil prices would drive up the inflation rate even more into double-digits by mid-winter.

The main pipeline for Russian gas to the EU through Ukraine is currently down for ten-day maintenance. But if Russia decides that it and the Nord Stream1 pipeline are not to be brought back online – fully or in part – things could get a lot worse.

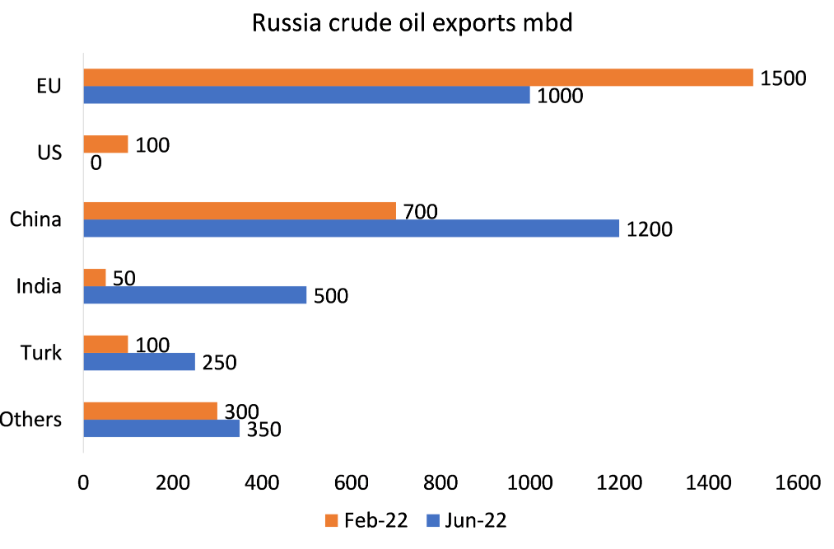

Russia now sells more oil than before it invaded Ukraine. So Russia’s current account surplus is likely to be over $160bn (more than 3.5 times the previous year), with more oil sold to China and India to compensate for the drop to Europe.

But what could trigger an even a deeper recession in Europe and globally would be if the G7/NATO countries go ahead with their plan to introduce price caps on Russian oil. The only way the G7 sees how to bring down oil prices and deprive Russia of oil revenues to finance its war is to price cap Russian oil. The cap would presumably be set between the cost of producing Urals (say $40/bbl) and its current discounted sale price of $80/bbl.

This plan is not going to work, however. Countries like India, China, Indonesia and a raft of others are not going to join a cartel that punishes themselves whether they like Russia or not. Given that the supply and demand balance in global oil markets is very tight, knocking out whole or part of Russian output will raise global prices sharply. And Russia could well retaliate by halting all oil exports to either the EU or all participants in the cap scheme.

Moreover, the scheme of using shipping insurance to enforce the cap on Russian cargoes will mean that both Russia and some consuming states will set up their own state-sponsored insurance schemes (as China did with Iran and as the Russian National Reinsurance Company is doing for Russian shipping now).

Oil price cap may drive price up to $200 a barrel

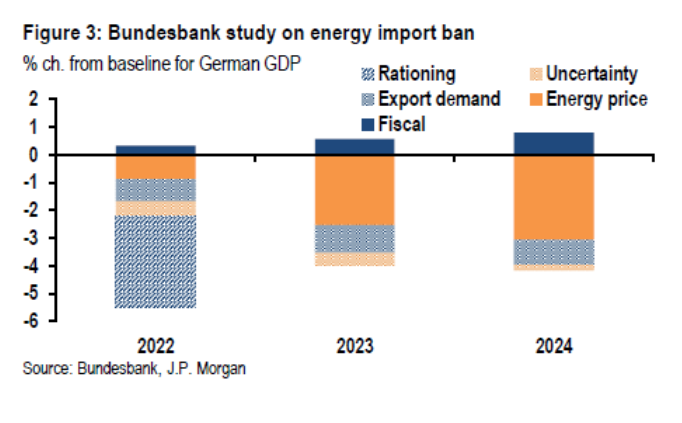

Far from forcing Russia to submit to NATO demands, any oil price cap is more likely to drive the oil price to near $200/bbl. That would trigger a global slump. The German central bank, the Bundesbank, reckons that real GDP in Germany could plunge as much 4-5% pts from its previous growth rate.

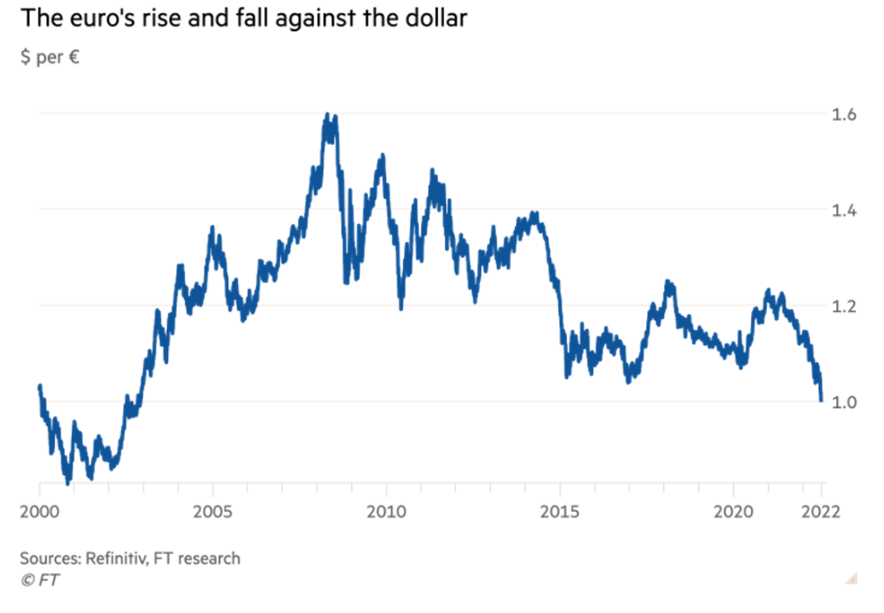

No wonder the euro has dropped to near parity with the US dollar in foreign currency markets, its lowest level since 2002.

Record high energy prices, fast-rising interest rates and collapsing profit margins among most companies (down 6% in the last year) spell a recession. See my post: https://thenextrecession.wordpress.com/2022/06/10/the-scissors-of-slump/

Central banks are currently planning to raise their ‘policy rates’ by about 2-4% pts over the next year. That’s not much compared to the hikes made to control inflation back in 1979-81. But inflation was much higher then. It will probably still be enough to stop borrowing for productive investment and for household spending. Mortgage rates will jump to squeeze the housing market.

Most important, rising global interest rates will likely provoke yet more debt crises in the Global South. Total debt in these poor countries is already at a record high of an average 207% of GDP. Government debt, at 64% of GDP, is at its highest level in three decades, and about one-half of it is denominated in foreign currency, and more than two-fifths are held by foreign investors who could pull out. About 60% of the poorest countries are already in, or at high risk of, debt distress. Already this has led to the collapse of the Sri Lankan economy and the removal of the corrupt government there.

And as I have outlined in many previous posts, corporate debt in the major advanced countries is also at a record high, with as much of 20% of companies getting profits below the cost of servicing that debt – the so-called ‘zombie’ companies. This remains a ticking time bomb for a corporate debt meltdown. And the countdown is ticking closer to zero.

From the blog of Michael Roberts. The original can be found here.