By Michael Roberts

Next week 300 international organisations and 100 heads of state meet in Paris to discuss how “to build a more responsive, fairer and more inclusive international financial system to fight inequalities, finance the climate transition, and bring us closer to achieving the Sustainable Development Goals.” This meeting is in Paris because it is the so-called Paris Club that for over the last 60 years has monitored and managed loans and credit by governments and government-guaranteed private banks to the so-called developing countries – loosely called the Global South these days.

The meeting takes place when the situation for large sections of the Global South in the post-pandemic period is dire. There is much talk in the Global North of rising interest rates causing banking crises and threatening bankruptcies for so-called ‘zombie companies’ overloaded with debt. But this is nothing to the economic and social damage that low-income, high debt countries in Africa, Asia and Latin America are suffering.

It is more than a year since I wrote a post entitled The submerging debt crisis, in which I described the economic stress being placed on small, low-income economies around the world from food and energy inflation, rising interest rates and a strong dollar. Then I identified Ghana, Sri Lanka, Egypt and Argentina. Indeed, back as far as the middle of pandemic in 2020, I highlighted the growing debt disaster for over 30 ‘emerging’ economies, with many of the poorest people on the planet.

The moratorium on debt repayments during Covid is now over

In the pandemic, the IMF and the World Bank agreed a limited moratorium on these countries servicing and repaying their debts. But this was not a cancellation and the moratorium is now over. And there was nothing done by the Paris Club debts or about the huge debts owed to private banks and other financial institutions, which continued to demand their pound of flesh. And since the end of the pandemic, the sharp rise in interest rates on global debt and a strong US dollar (much of global debt is in dollars) have forced yet more countries to the brink of default on payments and into further poverty.

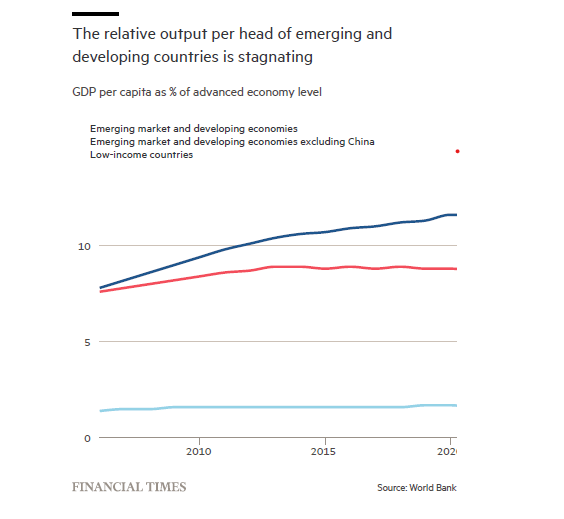

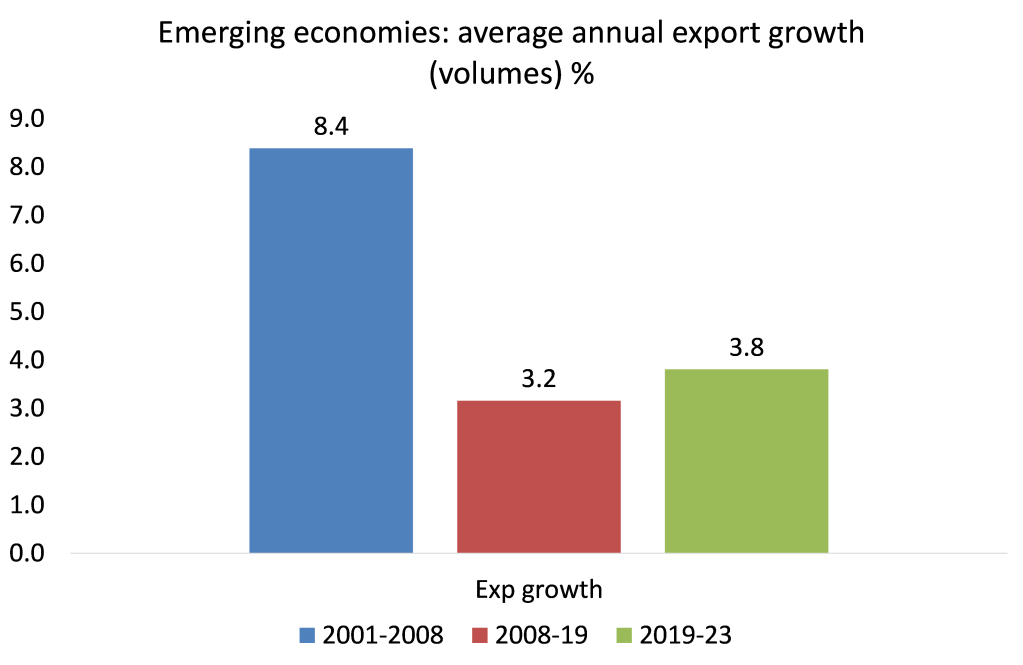

Most poor countries depend on selling raw materials and agricultural products or assembling manufacturing parts for the North. That means export revenues are vital to national income. But world trade growth has fallen away, particularly since the Great Recession of 2008-9 and even more since the pandemic. The volume of world trade grew at an average rate of 5.8% a year between 1970 to 2008, while GDP growth averaged 3.3%. But in the Long Depression of 2011 to 2023, average growth of world trade was a mere 3.4% a year, while global GDP growth averaged just 2.7%. Indeed, real GDP per head for the Global South, excluding China, has stagnated relative to advanced capitalist economies.

The reduction in world trade growth is particularly hard on ‘emerging’ economies. Export growth in the Global South economies has fallen by more than half the rate achieved prior to the Great Recession. And this measure includes China, the world’s largest exporting economy.

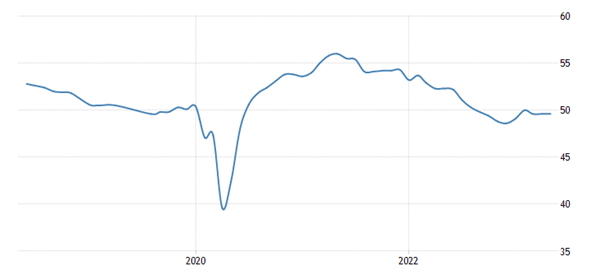

World trade growth in the first quarter of 2023 now stands at -0.9%, following a decline of 2.0% in the final quarter of last year. Most regions showed a decline in merchandise trade during the most recent two quarters, signalling a further drop in goods trade, according to CPD. And now there is a global manufacturing recession.

Global manufacturing PMI (anything below 50 is recession)

The World Bank’s latest Global Economic Prospects paints a dire situation for many poorer economies. It says that the UN’s 2030 anti-poverty development goals are now “well off course”. The world’s poorest countries are expected to pay 35% more in debt interest bills this year to cover the extra cost of the Covid-19 pandemic and a dramatic rise in the price of food imports. More than an extra $100bn will be spent by the poorest 75 countries, many of them in sub-Saharan Africa, to cover loans taken out mostly over the past decade.

A growing proportion of poorer countries’ income will go on debt repayments

Debt payments are consuming more of government spending in poor countries when they were already struggling to provide education and health services. Wars and extreme weather events linked to the climate crisis are more likely to cause distress in low-income countries than elsewhere because of scanty social safety nets. On average, the poorest countries spend just 3% of GDP on their most vulnerable citizens – compared with an average of 26% for other economies.

Economic growth in developing economies other than China will fall from 4.1% in 2022 to 2.9% in 2023. World Bank chief economist Gill said: “By the end of 2024, per-capita income growth in about a third of EMDEs will be lower than it was on the eve of the pandemic. In low-income countries – especially the poorest – the damage is even larger: in about one-third of these countries, per capita incomes in 2024 will remain below 2019 levels by an average of 6%.” Fourteen low-income countries are already in, or at high risk of, debt distress, up from just six in 2015. As many as 21 countries are vulnerable.

Let’s just consider a few of those debt disasters.

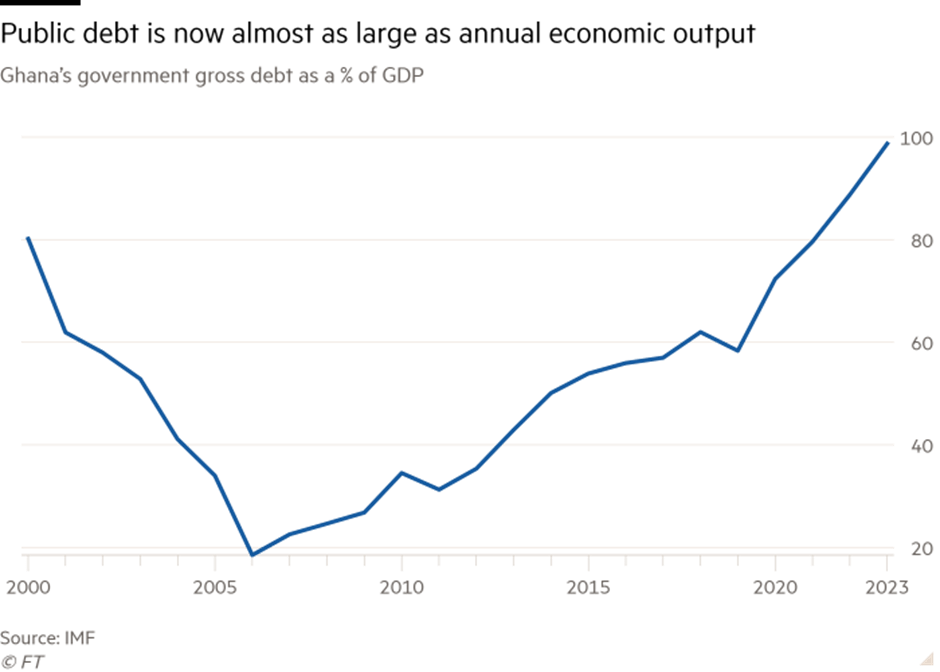

Ghana

Ghana has long been considered a success story and a model for African development. It is a major producer of gold and cocoa and has one of the region’s highest GDP per head. But the government has now been forced into a $3bn IMF bailout when it defaulted on its debts last December. The government borrowed heavily to insulate the economy from the effects of the pandemic. As a result, public sector debt went from 62% of GDP in 2020 to more than 100% last year. Debt servicing now takes up about 70% of government revenues.

Ghana found itself shut out of international debt markets as concerns grew over its ability to repay what it owed. Now, in order to get the IMF funds, domestic lenders ie local banks, must accept a loss on their loans. But Ghana also has to get foreign lenders to take a ‘haircut’ on the $34bn in debt and that won’t be easy. Private lenders are responsible for 60% of the face value of Ghana’s external debt, but the high interest rates they charge mean they are responsible for 75% of debt payments. These lenders won’t take any haircuts without a fight. The Ghanian government has stopped borrowing any more and is imposing severe spending cuts on public services, such as they are. Taxes are being hiked – but this will only affect those in ‘formal’ employment. Most people work ‘informally’ with cash and many companies evade tax altogether. Corruption is rife.

Nigeria, Lebanon and Pakistan

Nearby Nigeria is also deep in trouble. Africa’s largest country is riven with internal wars, endemic corruption and waste of energy revenues. Foreign direct investment has dropped to its lowest levels in nine years: from $3bn in 2015 to $468mn. An extra 13m Nigerians are predicted to fall below the poverty line between 2019 and 2025.

Lebanon is a country that still has no government a year after national elections, with only a caretaker administration in place, and has been without a president for seven months. The former central bank governor is accused of corruption, money laundering and embezzlement. The Lebanese pound has lost more than 98% of its value against the dollar since 2019, while annual inflation climbed to 269% in April.

Over in Asia, a hugely populated country (230m), Pakistan, is in a deep political and economic crisis and is now turning to the IMF for a bailout. The country has $126bn in external debt and must repay $80bn of this over the next three years. The rupee has lost 50% of its value compared to the US dollar. FX reserves to cover payments are down to just $4.5bn. GDP is falling. The country has been hit by earthquakes and floods and is being run by the military, which sucks up much of government spending. Inflation is at an all-time of high of 38%.

Argentina

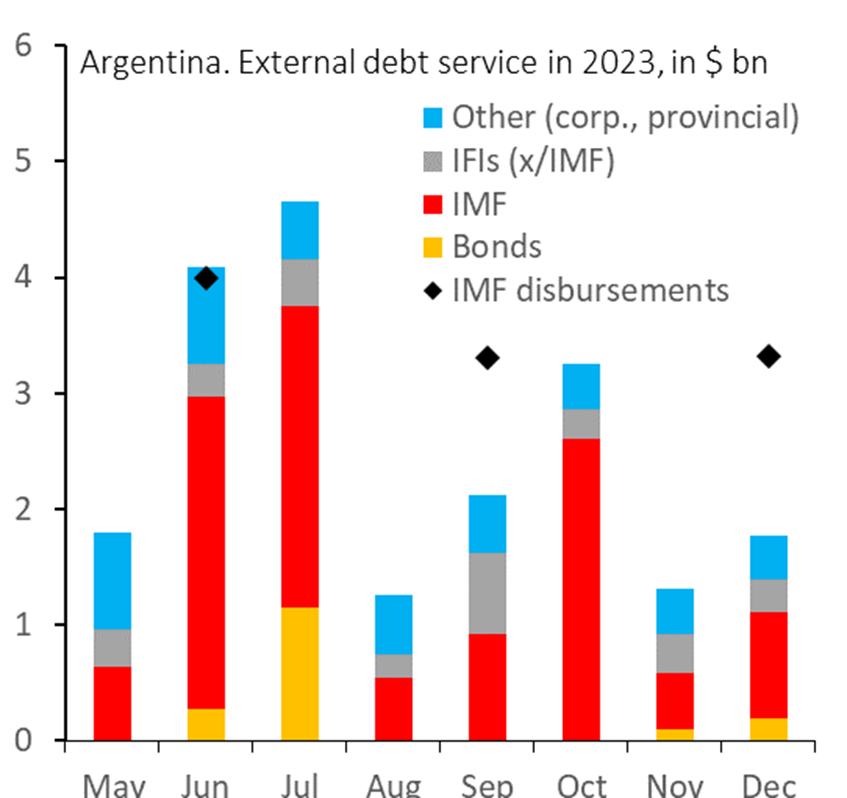

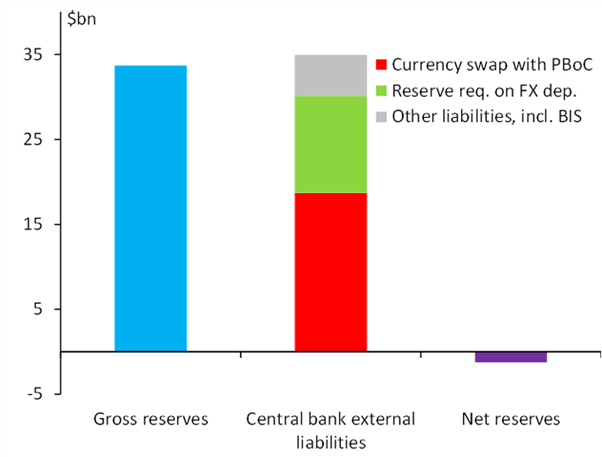

Then there is Argentina, one of the better-off ‘emerging’ economies. The economy is locked into chronic hyperinflation and debt. It has been forced yet again to go to the IMF for more funds to pay back what it already owes to it. The country faces big debt repayments this month and next.

And FX reserves have run out. Argentina’s net reserves turned negative in May.

Sri Lanka

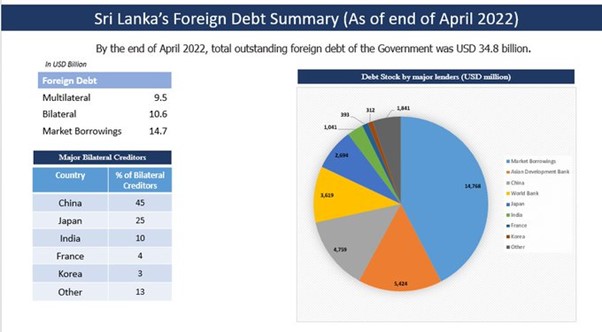

The Sri Lanka debt nightmare in 2021 culminated in mass protest and the fleeing of the then president from the country. But the debts remain. Much has been made of the debt owed to China, claiming that China is the problem by driving poor countries into a ‘debt trap’. But just 14% of Sri Lanka’s foreign debt is owed to China, while 43% is owed to private bondholders (largely Western vulture funds like BlackRock and banks like Britain’s HSBC and France’s Crédit Agricole). Another 16% is owed to the Asian Development Bank (over which the US has significant influence) and 10% is owed to the World Bank (dominated by the US as well). So “multilateral” debt really means debt owed to US-dominated institutions.

What is to be done? Clearly, the first immediate measure is to cancel the huge debts built up by these poor countries. The debts are the result of a weak world capitalist economy; corruption and mismanagement by local governments; and the rapacious squeeze on the resources and revenues by foreign lenders.

The fundamental issues behind the Global South debt crisis

There is a significant concentration of holdings by a few major external creditors. Back in the 1990s the top-five external creditors accounted for 60% of total external credit to low-income countries and consisted mainly of multilateral and Paris Club creditors. As of end-2021, the concentration of the top-five external creditors had further increased, accounting for 75% of total external credit to LICs. And the share of debt owed to the private sector has approximately doubled from 8% to 19%. So if the IMF, World Bank and just a few key creditor countries agreed, the debts of the poor countries could be removed. Will the Paris meeting do anything about this? I doubt it.

Then there is the longer-term issue: the continual exploitation by the imperialist bloc, through their multi-national companies and financial institutions, of the labour of the Global South with the connivance of domestic corporations and governments of the local elite. Without a total restructuring of the world economy towards collective ownership and planning under workers governments, the debt misery will continue.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.