By Michael Roberts

Amid the searing heat of this European summer, Spain’s citizens go to the polls today to elect a new parliament. Spain (unlike Portugal, Italy or Greece) still has a monarch. And this ‘constitutional’ monarch appoints a government that can command a majority in parliament.

The current government is a minority of Spanish socialists led by Pedro Sanchez and backed by the leftist grouping now renamed Suma and by sundry small nationalist parties from the Basque and Catalan regions. Sanchez has called a snap election, unprecedented in the middle of summer and just before the August holiday break. Why? Because support for his government is crumbling at the seams and he fears that the economic situation could deteriorate further if he leaves an election to later on. Moreover, he aims to gain votes at the expense of the weakening leftist parties within Suma.

However, the latest opinion polls show that the most likely result is a victory for the main pro-capitalist People’s Party (PP) under Nunez Feijoo (former head of the Post Office!) – but this time it will probably be in alliance with the rising ‘extreme’ right Vox party. The PP demolished the Socialists in recent regional elections in Madrid and the Vox made big gains in several other areas and cities. The latest polls show the PP on about 32% of 27m potential voters; the Socialists on 28%; the Suma on 14% and Vox on 13%.

A PP-Vox victory would mean a loosening of regulations on business and the environment. For example, the PP has gained support among farmers by pledging to make it legal to irrigate more land, even if that meant the drying up of rivers in southern Spain. Vox will be demanding more ‘social and cultural’ measures to weaken abortion and gay rights, as well as stricter controls on immigration. And this coalition will apply more severe austerity measures on government spending, particularly social spending and try to introduce further ‘pension reforms’. PP statement: “The party will emphasise economic growth, job creation and prosperity, low taxes – for low taxes means growth, which means better finance for public services. That said, government should be austere and not squander wealth. It must support business and the self-employed instead of attacking them.”

These are predictable policies of rightist parties in Europe and they are winning in Italy and gaining strength across the region. Why? Well, in Spain as in most of the rest of Europe, incumbent governments are being blamed for the disastrous response to COVID pandemic and following inflationary spiral that has hit working people hard.

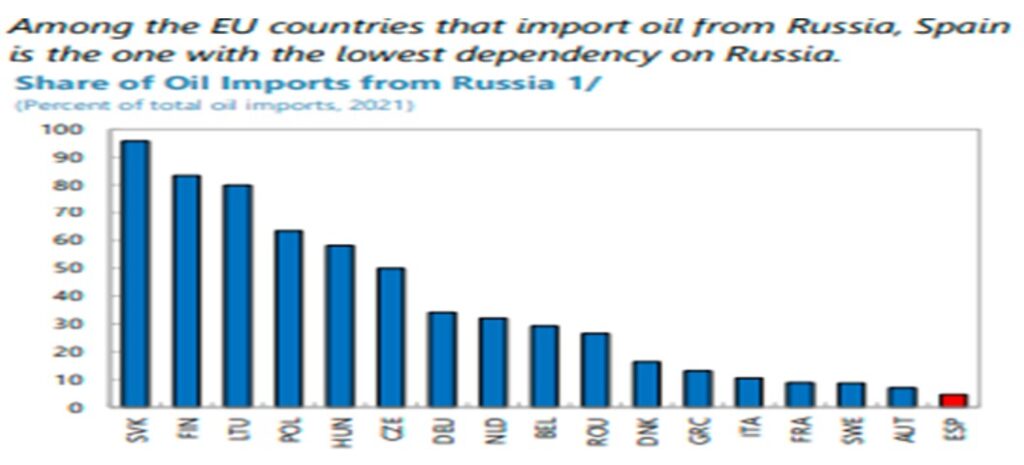

The pandemic lockdowns and deaths were particularly severe in Spain and the inflationary spiral reached double-digits in 2022. And this could hardly be blamed on the Russian invasion of Ukraine. In fact, Spain has the least reliance on energy imports from Russia.

And it has the best base for alternative LNG production.

Inflation was already accelerating before the Russian invasion, driven, as elsewhere, by the supply chain blockages after the pandemic which caused global energy and food prices to rocket – and also the weak recovery in productivity growth that meant goods producers could not meet revived demand and so prices across the board rose. Spain’s inflation rate rose to double-digits, only the UK was worse.

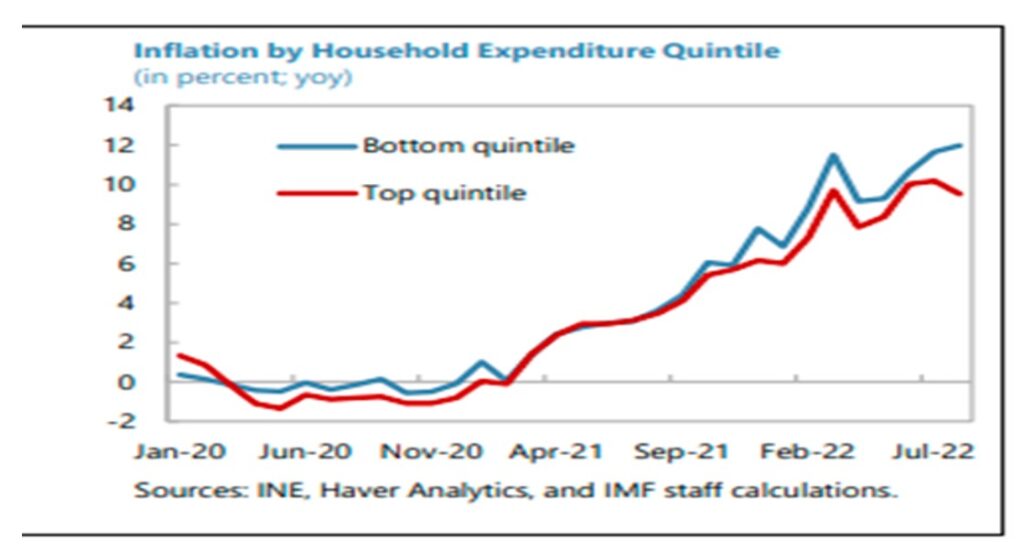

And as elsewhere, average workers’ real wages fell sharply and for the poorer-paid it was even worse. In the OECD, Spain is where real incomes have fallen the most since Covid. Again, as elsewhere, wage rises were not the cause of the inflationary spiral. On the contrary, wage increases failed to match price inflation.

As the IMF put it in its latest report on Spain: “imported energy products accounted for about 75 percent of Spain’s total energy needs in 2020. As a result, soaring international energy prices have translated into a large negative terms of trade shock, with substantial impact on inflation and real national income. The erosion of purchasing power has been more pronounced for poorer households since they spend a larger share of their income on energy and food.” Indeed.

The reality is that, like many other major capitalist economies, workers have paid the price for COVID, the energy crisis and accelerating inflation – and social democratic governments as in Spain have failed to make a difference.

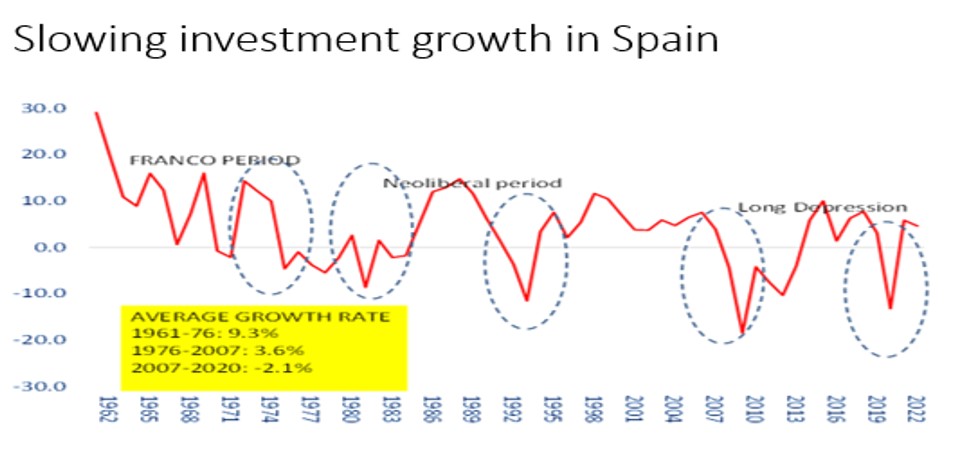

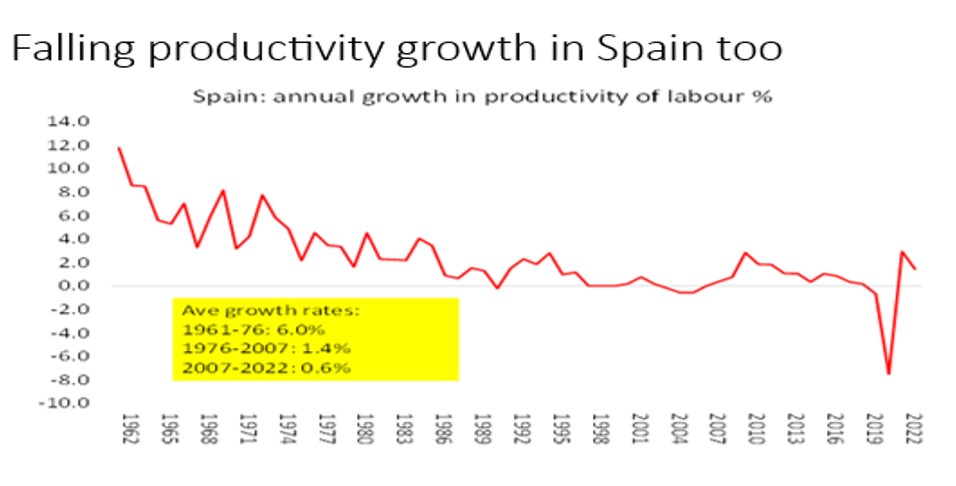

Indeed, Spanish capitalism has followed a trajectory in familiar in Europe. After Spain joined the EU in the 1980s, its much-heralded economic boom saw 3.5% real growth a year. But increasingly that boom was based less on productive investment for industry and exports and more on a housing and real estate credit bubble, particularly in the 2000s leading up to the Great Recession and the Euro debt crisis 2009-2012. As the IMF summed it up then: “The pre-crisis period was characterized by decreasing productivity of capital, measured as output per units of capital stock, both in absolute terms and relative to the euro area average. This is because capital flew to non-tradable sectors, in particular construction and real estate, characterised by higher profitability but lower marginal returns. By contrast, investment in information and communication technologies or intellectual property remained below that of other euro area countries.”

And in the Long Depression decade of the 2010s, Spanish governments applied severe austerity measures on government spending and held down any significant wage rises. This began to break up the Spanish state, with regional governments driven deeply into debt and being asked to make huge spending cuts. That’s why richer regional areas with their own nationalist interests, as in Catalonia and the Basque Country, continue to make noises about separation from Madrid. Any improved profits went into speculation in financial assets or real estate. Productive investment remained weak.

As a result, growth in the productivity of labour, the key to boosting long-term growth and reducing inflation, crawled nearly to a halt.

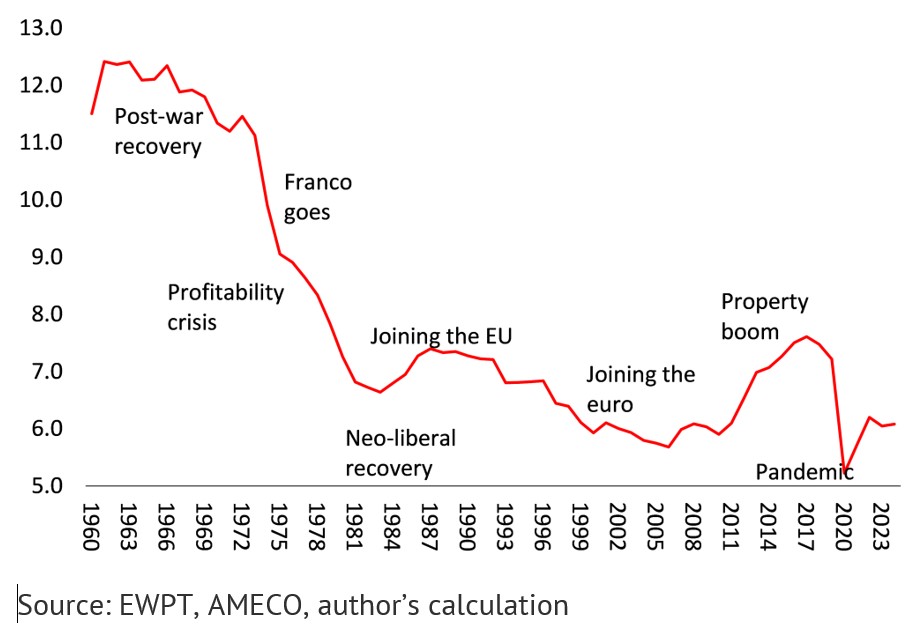

The ultimate reason for the failure of productive investment and productivity growth in capitalist economies lies with the profitability of capital – and Spain is no exception. Every measure of Spanish capital’s profitability reveals the same long-term decline. Here is mine.

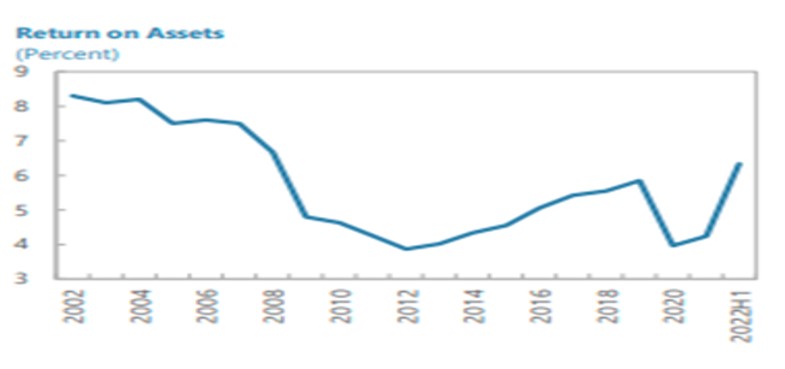

And here is the IMF’s, in their latest report on Spain.

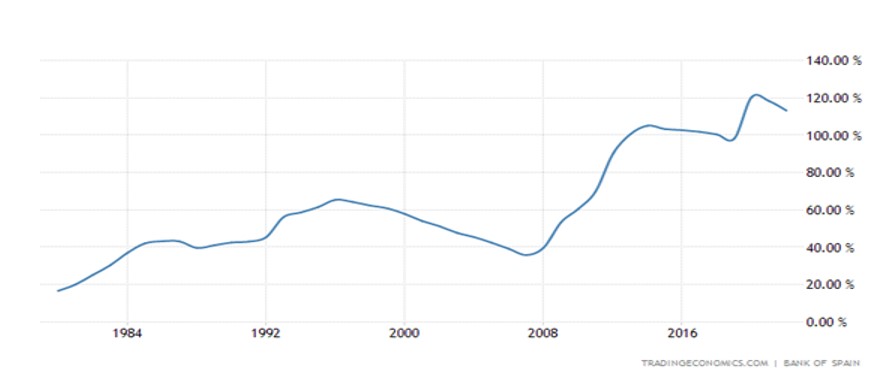

Despite the austerity measures of the 2010s, the COVID pandemic and previous government bailouts of Spain’s reckless banks have driven up government debt to GDP to 113%, with annual gross financing needs even higher than debt-ridden Italy.

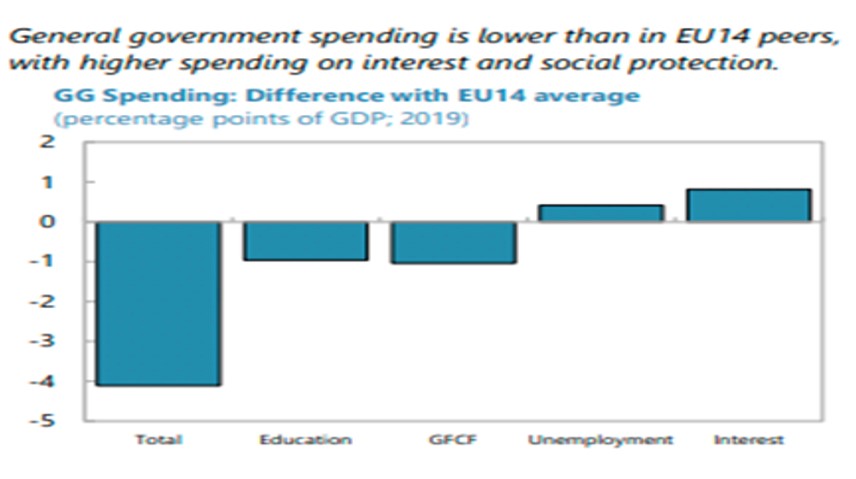

Government spending was lower than in many other EU countries and much went in covering interest payments on existing debt and unemployment benefits, while productive investment in means of production and labour skills fell.

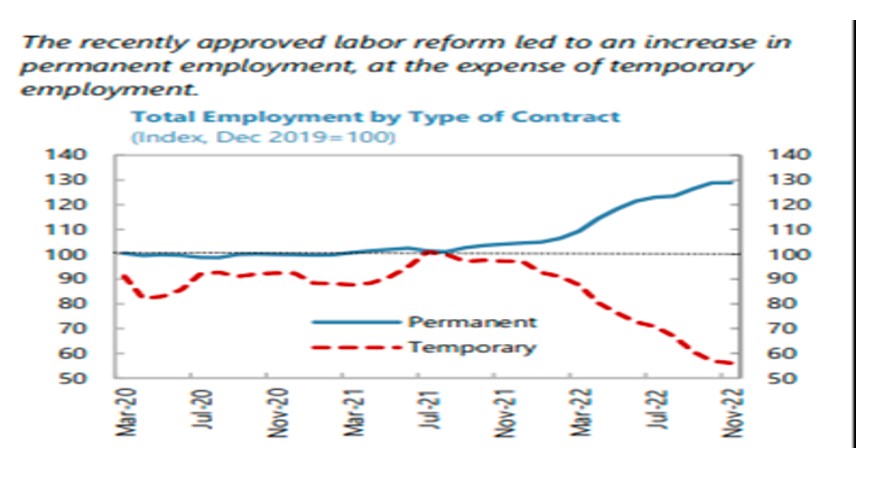

Some things did change under the Sanchez government. In particular, reform of the labour market led to an increase in permanent jobs, particularly for the youth, where unemployment and temporary and precarious work had dominated.

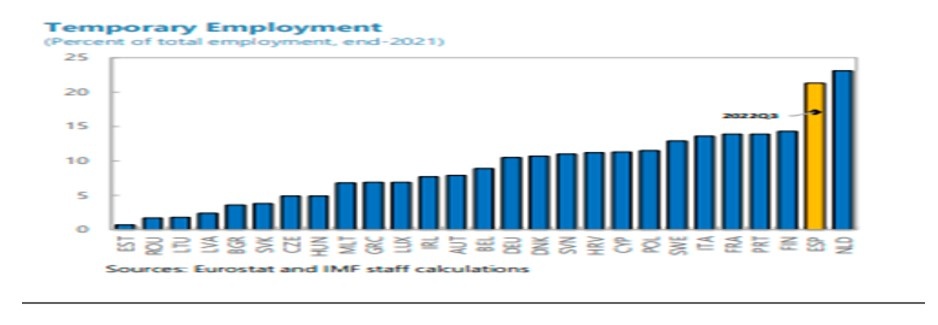

Despite the recent progress, Spain remains among the EU countries with a largest share of temporary employment.

What economic challenges face the new government? Well, the latest inflation figures show that Spanish inflation has fallen to under 2%, the first euro area country to achieve the ECB target. But that hides the core inflation rate (which excludes food and energy) which is stll around 6% a year. That means the hit to workers real incomes will continue.

Spain’s economy is likely to grow by less than 2% this year (probably closer to 1%), with little change next year – and that assumes no global slump in the next 12 months. Everything depends on getting and using the huge funding for investment being offered by the EU under the so-called Recovery and Resilience Plan (RRP). The funds from the EU could total €70 billion or 5.5% of 2022 GDP cumulative to 2027, so putting about 1% pt of GDP extra in investment. The next government is relying on this to keep the capitalist sector going while also imposing new austerity measures to get government budget deficits and debt down. Meanwhile the ECB will continue to hike interest rates and borrowing costs for households with mortgages and small businesses with loans.

The IMF is keen that it does so: “In the context of tightening financial conditions and high public debt, a moderate domestic fiscal consolidation in 2023 would help contain inflation and boost investors’ confidence. A sustained multi-year gradual consolidation will be needed to put debt on a firm downward path. An early formulation of credible medium-term plans would help build the necessary social consensus. Additional measures should offset the increase in pension spending resulting from the 2021 reform.“

Spanish households are highly exposed to rising interest rates, given the high concentration of variable-rate mortgages (about 75 percent of total outstanding). Higher interest rates are also set to increase small firms’ financial burdens. The IMF reckons that the share of debt of vulnerable so-called ‘zombie’ firms (i.e., those with interest coverage ratios below one) could reach levels last seen in 2013 once loans with longer maturity reprice fully.

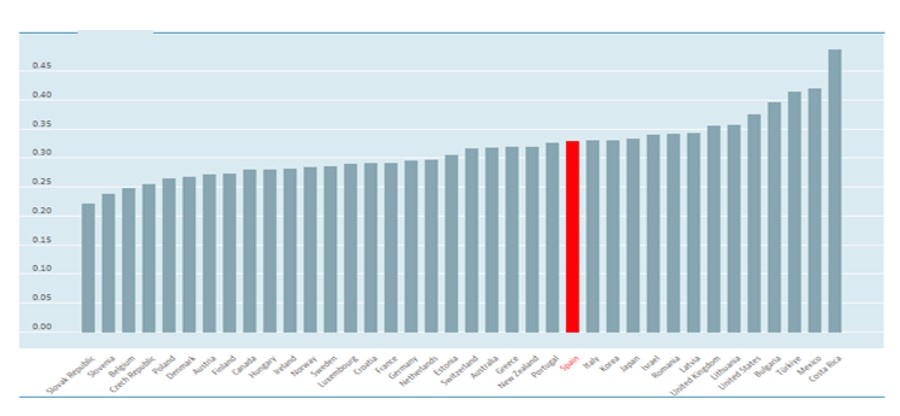

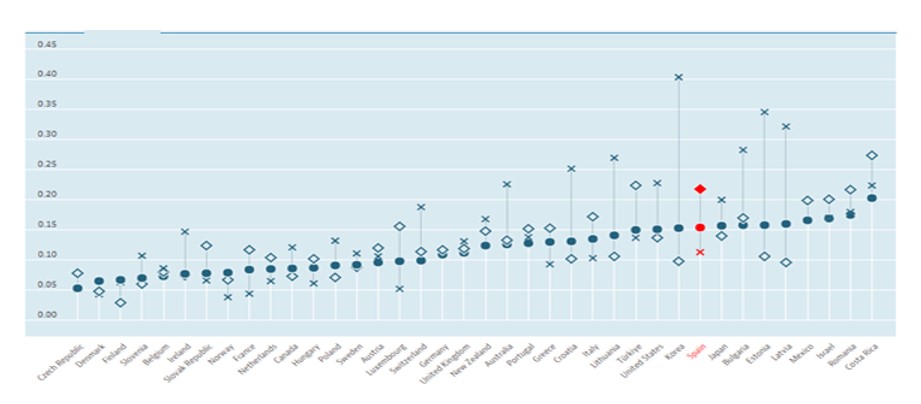

And remember, the underlying inequalities in income and wealth in Spain, again as elsewhere, have only got worse in the last 30 years. At present, Spain is one of the most unequal nations in Europe, and income inequality in the country is forecast to grow in the near future. Gini inequality ratios:

And Spain’s poverty rate at 15% (the poverty rate is the ratio of the number of people (in a given age group whose income falls below the poverty line taken as half the median household income of the total population) is also among the highest in Europe.

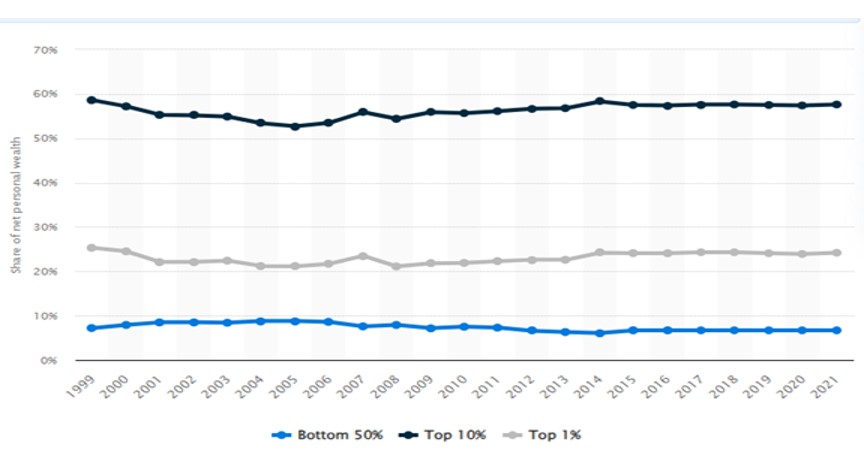

The top 1% of Spanish households have 25% of all personal wealth and top 10% have 60%, while the bottom 50% have less than 7%. And these ratios are unchanged in 20 years.

Any new right-wing government will only make things worse for Spanish working people. But they may still come into office because of the failure of the social democratic government before it.

From the blog of Michael Roberts. The original can be found here.