By Michael Roberts

This blog was originally published by Michael Roberts on Saturday, 21 September 2024. The original article can be found here.

**************

Today, 21 September, Sri Lanka will hold its first presidential election since the July 2022 popular uprising known as the Aragalaya, which drove the corrupt President Gotabaya Rajapaksa from power. Sri Lanka had entered the most damaging economic crisis since independence from British colonial rule in 1948. After total mismanagement of the economy by Rajapaksa and the hit from the COVID pandemic, in 2021 the Sri Lankan Government officially declared the worst economic crisis in the country in 73 years.

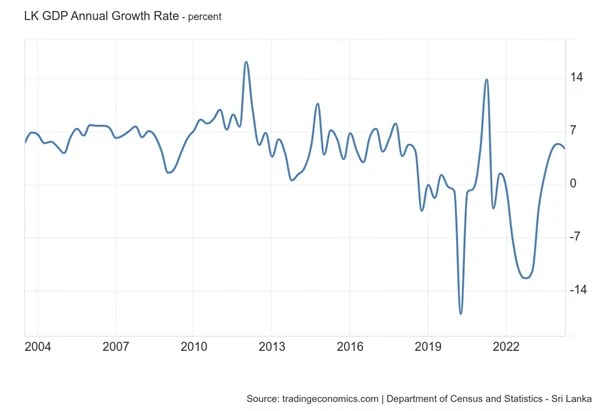

Most foreign debt repayments were suspended after two years of money printing to support tax cuts. The economy contracted 7.8% and the percentage of the population earning less than $3.65 a day doubled to around 25% of the population.

Growing corruption alongside economic difficulties

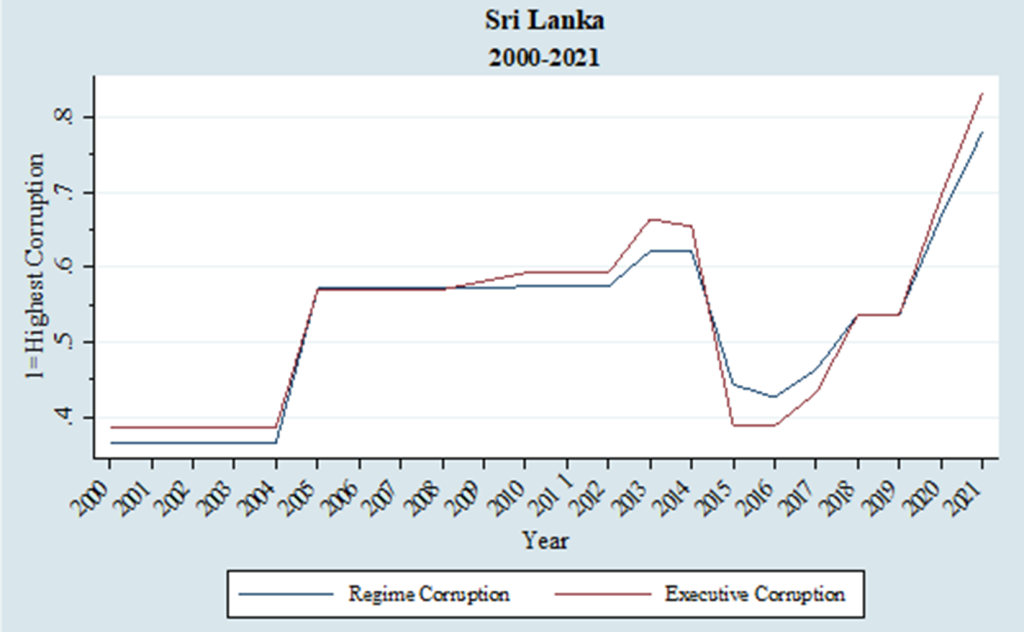

Rising indebtedness and concern over the ability to service its external debt, a sharp deterioration in the country’s ability to export (exports of goods and services which accounted for around 35% of GDP in the early 2000s had collapsed to – and subsequently stayed at – around 20% by 2010), degraded governance, growing corruption (see index below) and slowing growth were the features of Sri Lanka’s trajectory in the last decade and a half.

The ratio of public debt to GDP had jumped to 119% by 2021. External debt that stood at $11 billion in 2005 had surpassed $56 billion by 2020 – equivalent then to 66% of GDP.

Strings attached to 2023 IMF bailout

With Rajapaksa driven from power by a popular revolt, the ruling orders managed to get Ranil Wickremesinghe into the presidency. He immediately applied for an IMF bailout which was eventually agreed in March 2023. The IMF loaned $3 billion to the country as part of a 48-month debt relief program. The first tranche of $330m was released soon after with an additional $3.75 billion expected to follow from the World Bank, the Asian Development Bank and other lenders.

As usual, the IMF has imposed strict austerity measures on the Wickremesinghe administration in return for the bailout. Pensions have been cut, income taxes have been hiked 36% and subsidies on food and other essentials have been removed. Electricity bills rose 65%. As elsewhere, inflation has subsided in the past year, but prices are still up over 75% since the crisis of 2021. And the Sri Lankan rupee is still more than one-third weaker against the dollar than before the crisis.

And the government wants to privatise state-owned enterprises like Sri Lankan Airlines, Sri Lankan Insurance Corporation and Sri Lanka Telecom. This has triggered a fresh wave of protests. “The government should not put the burden of the reforms on the salaried class and middle class who are already affected by the economic crisis,” said Anupa Nandula, the Vice President of the Ceylon Bank Employees Union.

Severe poverty and hunger

The World Food Programme estimates that 8 million Sri Lankans – more than a third of the population – are “food insecure”, with hunger especially concentrated in rural areas. Almost half of all Sri Lankan families spend about 70% of their household income on food alone. “Many families from the middle class have now slipped below the poverty line,” said Malathy Knight, a senior economist with private think tank Verite Research. The World Bank says: “Poverty is projected to remain above 25% in the next few years due to the multiple risks to households’ livelihoods.” Young people are desperate to leave the island. Over 300,000 left in 2022 alone; many skilled workers like doctors, paramedical and IT professionals.

According to the World Inequality Lab, the top 10% of Sri Lankans take 42% of all income and own 64% of all personal wealth; the top 1% have 15% of all income and 31% of all wealth. The bottom 50% of Sri Lankans have just 17% of all income and only 4% of all personal wealth!

The World Bank estimates that Sri Lanka’s economy shrank by 9.2% in 2022, contracted by a further 4.2% in 2023, with a slight recovery (1.7%) this year. Manufacturing has finally come out of recession in the last few months.

The candidates for the presidency

President Wickremesinghe hopes to win the election as the candidate of the traditional conservative party, the United National Party (UNP). He faces Sajith Premadasa, who leads the Samagi Jana Balawegaya (SJB) party that broke with the UNP in 2020. Premadasa favours a mix of ‘interventionist’ and free-market economic policies and would stick with the IMF-imposed economic programme.

But the real surprise is the rise of Anura Kumara Dissanayake, a longtime opposition figure and leader of the People’s Liberation Front, or JVP. The JVP is now leading in the polls. The JVP is now the leading formation in the National People’s Power (NPP) a leftist political alliance. Dissanayake has vowed to renegotiate terms of the IMF programme. “The implementation of the IMF programme has caused significant hardship for the people.” He has also pledged to scrap Sri Lanka’s presidential system and return to the British-style parliamentary democracy, which existed until 1978.

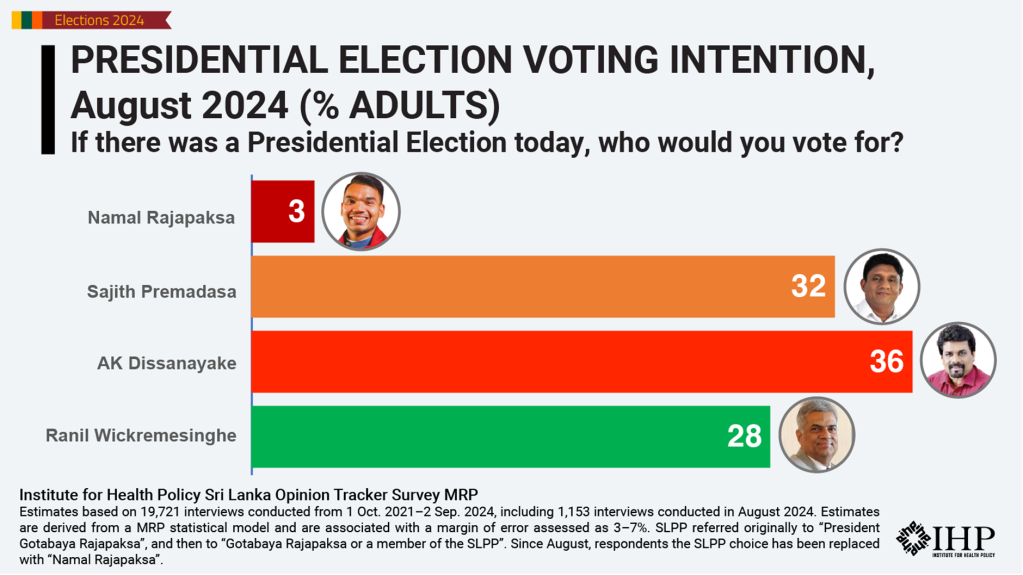

But none of the four major party presidential candidates have the support of a majority of the voters. NPP/JVP leader Dissanayake leads with 36% of all adults followed by SJB leader Sajith Premadasa with 32%, President Ranil Wickremesinghe with 28% and Namal Rajapaksa (from the Rajapaksa family!) with 3%.

Dissanayake is strongest among the youth with a majority (53%) supporting him and among Sinhala voters (42%). The most affluent third of voters (38%) support Wickremesinghe. In contrast, Premadasa leads among the poorest third of the 17m voters (40%). Given that Sri Lanka’s election vote is based on proportional representation, everything will depend on second and third preferences. That will probably work against the JVP which holds only three seats in the current parliament anyway.

The challenge of a weak economy and massive debt

Whoever wins faces a mighty challenge in rectifying the collapse of this small island economy. Sri Lanka’s GDP is about $80bn. From 2003 to 2019, average growth was 6.4% a year, well above its regional peers. This growth was driven by the growth of non-tradable sectors, ie construction and transport. Apart from tourism, that did not raise enough foreign currency to fund massive spending that the Rajapaksa government launched to maintain its political power. Economic expansion started to slow in 2019 and then the COVID pandemic pushed the economy into a deep recession from which it has hardly recovered. To meet its obligations to the IMF and foreign creditors, years of austerity and reduction in living standards lie ahead.

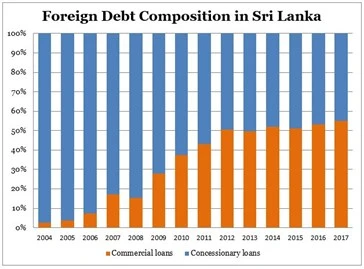

One of those foreign creditors is China. Western media claim that it is China that has forced Sri Lanka into crisis through a policy of debt trap, by lending it more than it can pay back and then getting it to default, so acquiring control of the assets – the most famous example being the Hambantota Port project. But this is a myth. Only a little over 15% of Sri Lanka’s foreign debt is owed to China and most of that is in the form of concessionary loans. Most is owed to commercial creditors from the West and from India. Unlike concessionary loans obtained to carry out a specific development project, these commercial borrowings do not have a long payback period or the option of payment in small installments and rates are higher.

The true story of the Hambantota Port project can be found here.

Western economists call for privatisation

Economists from the London School of Economics reckon the answer to Sri Lanka’s economic crisis is to privatise its unproductive state sector. It’s true that the Rajapaksa government milked the assets of the state companies for their own enrichment. “SOEs have been attractive to politicians for the ability to distribute resources, jobs, contracts and other benefits for themselves and their coteries. This has certainly been the case in the Rajapaksa era.”

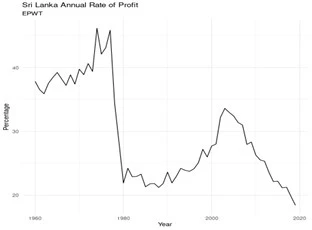

Numbering between 420 and 520, these state companies have generally performed badly, making substantial losses. SOE productivity has declined substantially in the past decade, with their average cost of labour being around 70% higher than in private (ie state employment pays better). In addition, total SOE debt has climbed steadily from around 6.5% of GDP in 2012 to over 9% in 2020. But Sri Lanka’s capitalist sector is little better. Productive investment is very low and that’s because profitability has collapsed since the early 2000s.

Sri Lanka is a stark example of the debt crisis in so many Global South economies, especially since the end of the pandemic. The answer is not IMF-imposed austerity measures and privatisations, but the cancellation of the foreign debt, along with public investment into restoring the state-owned companies and reviving industry based on new technologies and on the highly educated skills of many Sri Lankans. But don’t hold your breath.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

The featured image at the top of the article shows an anti-Government protest in Sri Lanka on 13 April 2022 in front of the Presidential Secretariat. The image is from Wikimedia Commons. Attribution: AntanO – Own work, CC BY-SA 4.0