Letter from Mark Langabeer, Hastings and Rye Labour member

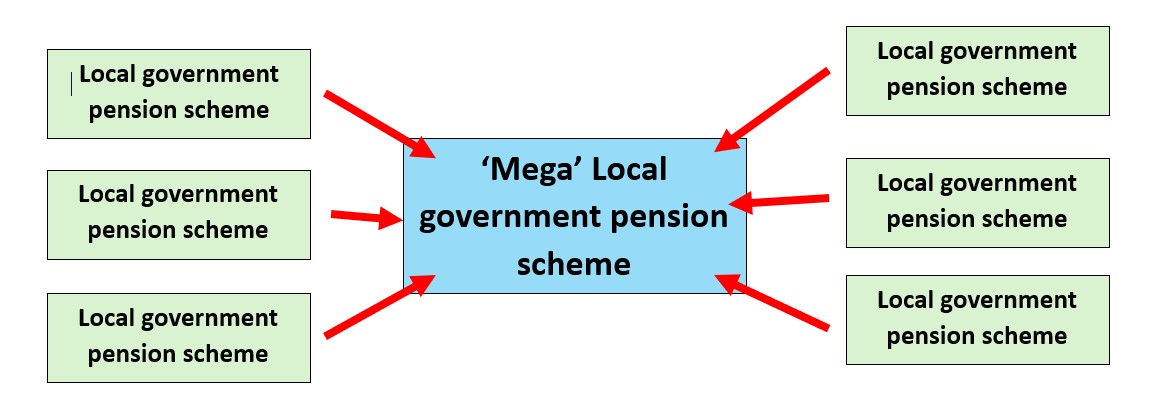

Rachel Reeves recently announced changes to public sector (local government) pension schemes. She wants to roll all the different pensions into a small number of large ones. We are told that it would mean greater levels of investments could be achieved, but what worries me is that the Tories also support the principle behind these proposals.

The public sector have what are described as defined benefit schemes. The best ones were based on a 1/60 scheme, which meant when your retire you would have accrued two thirds of your wage if you had done 40 years of service. In the private sector, most schemes are what are called money purchase schemes, meaning your pension would depend on how good the investments have been. Under defined benefits schemes, it is the employer who takes the risk. With money pension schemes, it is the staff who bear all the risks. That’s why the right-wing media bang on about so- called ‘gold plated’ pensions in the public sector – just because they were better.

Ultimately, all pension schemes depend on investment in private companies and government bonds and during the 1980s some pension schemes accrued such surpluses that the employers decided to operate pension ‘holidays’, which meant that for a period of time they would not contribute towards the funding of the schemes.

Surpluses used to improve pensions

I recall, the Transport and General union (now part of UNITE) threatening legal action against London Transport over surpluses taken from the scheme, and eventually, LT agreed to use half of the surplus for better pension benefits. Since then, the picture has been more mixed. In times of recession, or worse, slump, share values and dividends can collapse and this can result in pension deficits and then shortfalls would need to be covered by either employers or the members in the scheme. The bigger the scheme, the bigger the risks of running a larger deficit.

In my opinion, the relevant trade unions should insist on consultation, before any merger of local government pension pots, to make sure that pension benefits are not reduced and that if surpluses occur, they should be used to improve the schemes. Deficits should be paid by the state, not the members in the schemes.

There is also the issue of managing the newly-merged ‘mega pension’ pots. Most schemes are run by trustees, appointed by management, but there are often positions available for employees, who may be elected by pension scheme members or those already retired. The unions must insist on trusteeship with equal representation with those who manage the scheme.

Reeves hopes that her merger proposals would also apply in the private sector. Good luck with that one. The previous Labour government introduced auto-enrolment of pensions because many private companies simply had no pension provision. In my opinion, the same provisions should apply to the private sector, and if these demands are not met, the unions should refuse any merger of pension funds and threaten industrial action if any mergers are imposed.