By Michael Roberts

Back last November, the excellent Argentine Marxist economist, Rolando Astarita presented on his blog the case for ‘overproduction’ as the cause of crises under capitalism, denying the role of Marx’s law of the tendency of the rate of profit to fall as being relevant. He argued that Marx and Engels never mentioned the law in relation to crises in their works and in explaining any crises in the 19th century. They always referred to ‘overproduction’. And there was no evidence that a falling rate of profit preceded or causes periodic crises.

This led to reply by Spanish Marxist Daniel Alabarracin in the Spanish online journal, Sin Permiso. Albarracin’s critique is here. Astarita responded, saying that Albarracin’s critique was ‘baseless’ because he (Astarita) did accept that profitability affects capital accumulation. But he did not accept that Marx’s law of profitability was a cause of crises, however. That was down to ‘overproduction’. Astarita’s reply to Alabarracinis is here.

My intervention in the debate

At this point, yours truly waded in.

Now I have always disagreed with the view that ‘overproduction’ is the cause of cyclical crises. For me, overproduction is a description of a crisis or slump, not a cause. I had been having a private correspondence with Rolando on this question of overproduction or overaccumulation as the cause of crises. So I decided to publish my view in Sin Permiso. Here is my reply to Rolando’s arguments. I show this in full below, as it is more accurate than the submission in Sin Permiso which has a few misprints and actually includes a section on Mandel’s views which are not mine, but Rolando’s.

“Dear Rolando,

I was surprised and disappointed on reading your latest post on the causes of cyclical crises in capitalism. I did not realise that you adopted what I consider is the false, outdated and empirically unsupported view that crises under capitalism are caused by ‘overproduction’ and that it has nothing to do with the movement of profitability and profits in capitalist accumulation. This overproduction thesis has been presented by a succession of theorists like Tugan-Baranovsky, Hilferding, Maksakovsky, Moszkowska, and Simon Clarke. I thought this theory had been refuted many moons ago.

First, you claim that Marx never explained cyclical crises by his law of profitability. You back this claim by saying that “when he wrote about the crisis of 1847 he did not mention the law.” Well, that is not surprising as he had not developed the law by then. But you go on to claim that “nor did he do so in passages referring to the crises of 1866 and 1873. And in chapter 17 of volume II of Theories of Surplus Value , devoted to capitalist crises.”

This smacks of the argument presented by German Marxist Michael Heinrich that Marx dropped his law of profitability after 1865 as an explanation of crises because he thought it no longer worked. And yet Engels in his preface to Capital Volume 3 notes that Marx spent some considerable time looking at the relation of the rate of profit to the rate of surplus value in the 1870s (in contradiction to the claim that he dropped the law). Indeed, much of Engels’ preface is about the relation of the rate of profit to the rate of surplus value. If the law had been dropped, why discuss this? And more to the point, why did Engels include three key chapters on the role of the rate of profit in Capital Volume 3?

You say that there is no reference to the law of profitability in Chapter 17 of Volume 2 of Theories of Surplus Value which discusses theories of crisis by classical economists. Well, that is open to debate. Let me give you some quotes from that chapter.

“In capitalist accumulation it is a question of replacing the value of capital advanced along with the usual rate of profit”. This suggests that the rate of profit is very relevant to capital accumulation. And this: “it must never be forgotten that in capitalist production what matters is not the immediate use value but the exchange value and in particular the expansion of surplus value. This is the driving motive of capitalist production” So profit is the motive force of capitalism not production (or thus overproduction). And “the destruction of capital through crises means the depreciation of values which prevents them from renewing their productive process”. It’s the depreciation of value not the collapse of demand that is key to crises and the subsequent recovery.

You refer to the note that Marx makes that “permanent crises do not exist”. But the full quote is revealing: “When Adam Snith explains the fall in the rate of profit from an overabundance of capital, an accumulation of capital, he is speaking of a permanent effect and this is wrong. As against this, the transitory over-abundance of capital, overproduction and crises are something different (my emphasis). Permanent crises do not exist.” So Marx directly refers to the ‘temporary’ over abundance of capital as relevant to crises – overabundance here means relative to profit or profitability, not demand. Even more explicitly, he says: “the transition from the phrase overproduction of commodities to the phrase overabundance of capital is indeed an advance…”

And there is more. He goes on to explain the law of profitability: that if constant capital rises more than variable capital, then the rate of profit will fall. “The rate of profit falls because the value of constant capital has risen against that of variable capital and less variable capital is employed”. ….hence crisis is “a crisis of labour and crisis of capital”. With the rate of profit “decreasing … it is a case of overproduction of fixed capital.”… “Crises are due to an overproduction of fixed capital” (my emphasis).

Marx even makes points against overproduction as a cause: “it goes without saying that it is not be denied that too much may be produced in individual spheres and thus partial crises can arise from disproportionate production” BUT “ we are not speaking here of crisis in so far as it arises from disproportionate production” He goes on: “the limits to production are set by the profit of the capitalist and in no way by the needs of the producers.”

And this next statement is even clearer: “it is the barrier set up by the capitalists’ profit, which forms the basis of overproduction.” …“Overproduction is specifically conditioned by the general law of the production of capital”. And that “accumulation depends not only on the rate of profit but on the amount of profit”. And “accumulation for its part is not directly determined by the rate of surplus value but by the rate of surplus value to total capital outlay, ie the rate of profit and even more by the total amount of profit.”

All these quotes indicate that Marx saw profit and profitability as key to the movement of capital accumulation and it is the overabundance of capital relative to profit that leads to overproduction of commodities ie crises.

This is even more explicitly stated in Capital Volume 3, Chapters 13 to 15, where I think you struggle to deny the role of profitability in causing crises. You say you can only find two vague references to the rate of profit and crises. Are we reading the same chapters? It is very explicit to me. Anybody who reads these chapters can see Marx is directly relating profitability and profits to cyclical crises.

More quotes:

“The periodical depreciation of existing capital offer the means immanent in capitalist production to check the fall in the rate of profit and hasten the accumulation of capital value through the formation of new capital and disturbs the existing conditions within which the process of circulation and reproduction of capital takes place, and is therefore accompanied by sudden stoppages and crises in the production process”. So the rate of profit falls and it is necessary eventually to have a crisis ie a depreciation of existing capital, to restore profitability and resume the reproduction process.

Crises are caused by “an overproduction of capital, not of individual commodities, although over production of capital always includes overproduction of commodities, which is therefore simply over accumulation of capital.” ….“Overproduction of capital is never anything more than overproduction of the means of production which may serve as means of capital.”

There is a moment of absolute over accumulation of capital “when increased capital produces just as much or even less surplus value than it did before its increase…” and again “ultimately the depreciation of the elements of constant capital would itself tend to raise the rate of profit … the ensuing stagnation of production would have prepared within capitalistic limits a subsequent expansion of production. And thus the cycle would run its course anew.” So Marx says the law of profitability produces cyclical crises, which you deny.

“It is overproduction of the means of production only in so far as the latter serve as capital and consequently include a self expansion of value, which must produce an additonal value in proportion to the increased mass”. ……“Capital grows much more rapidly .. to contradict the condition under which this swelling capital augments its value.” Hence the crisis is because “It is a matter of expanding value not consuming it”.

More. “the rate of profit is the motive power of capitalist production. Things are produced only so long as they can be produced at a profit.” That’s why: “The development of the productivity of labour creates out of the falling rate of profit a law which at a certain point comes into antagonistic conflict with this development and must be overcome constantly through crises.” (my emphasis) That’s pretty clear where Marx stands on profitability and crises.

Your interpretation of these chapters is that Marx only shows that a falling rate of profit leads to falling investment growth and thus ‘stagnation’, not cyclical crises. This does not seem to match the quotes above. Moreover, there is the question of the relation between profitability and the mass of profit which you too refer to. This is crucial because it is when the mass of profit turns down, that investment collapses. Marx does not have a stagnation theory similar to Keynes.

You refer to Thomas Weisskopf that if the LTRPF is a theory of crises, it must also be a theory of accumulation. Sure, and such a theory is clearly there in Marx. For capitalists to accumulate, they will increasingly invest in constant capital relative to variable capital. And as Marx’s law of value says that only labour power can create new value, there will be a tendency for the rate of profit to fall. And if profitability does fall, then accumulation growth will eventually slow or even collapse. This links Marx’s general law of accumulation in Capital Volume 1 with the LTRPF in Volume 3.

You want the relationship between overproduction and crises to be ‘clarified’. Marx’s law does that. As the rate of profit falls, eventually it can cause a fall in the mass of profit. There is an overaccumulation of capital expressed as an overproduction of commodities at existing prices. That overproduction is resolved by a depreciation of capital (both constant capital and labour) and which includes the wastage of commodities. Thus it is an overaccumulation of capital that causes an overproduction of commodities. Overproduction of commodities is thus a description of crisis, but not the cause. As you say; “crisis (is not) due to underaccumulation or underinvestment, but rather overaccumulation or overinvestment.” But that means overaccumulation relative to profitability or profit, not ‘demand’.

The overproduction thesis assumes that supply and demand are independent of each other. That is certainly not Marxist theory (see the Preface to the Contribution). The mismatch between supply and demand is the outcome of the crisis, not the cause. A question can be asked here. If supply is in line with demand, can a crisis of production materialise? Marx’s law of profitability says that it can and will because crises are not caused by a mismatch of production over demand, but a mismatch between the accumulation of capital and profit.

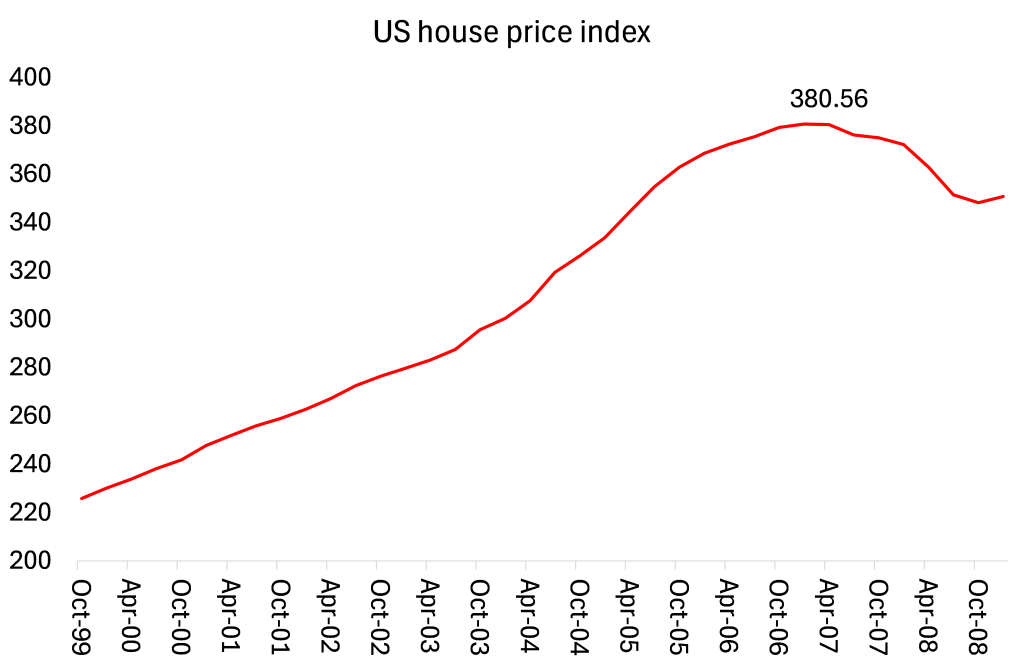

You claim that it was overproduction prior to 2007 that caused the Great Recession of 2008-9. Your evidence was “signs of a glut in the market in 2006 – millions of unsold homes, falling prices, late mortgage payments.” Really, in 2006? Home prices continued to rise throughout 2007 and only peaked in early 2007.

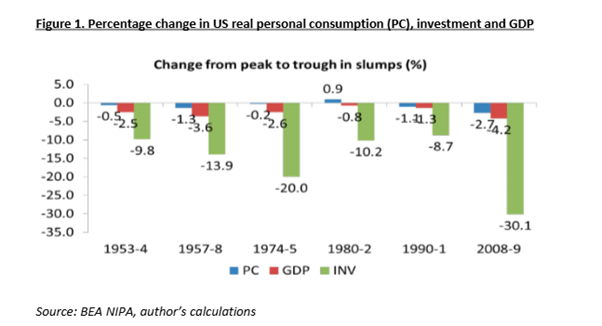

In the last six recessions since WW2, personal consumption fell less than GDP or investment on every occasion and did not even fall in 1980-2. Investment fell by 8-30% on every occasion.

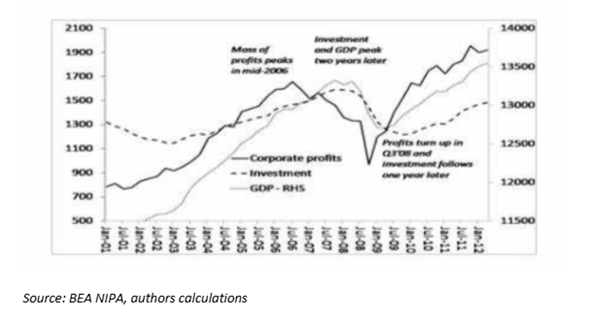

If the fall in GDP is to be an indicator of ‘overproduction’, then that did not happen in the Great Recession until well after the fall in profitability, the mass of profits and investment. And the recovery began first with a rise in the mass of profits and investment and only GDP after that.

You want any theoretical explanation of crises to be based on empirical data. “For example, if it is claimed that the crisis is caused by a long-term fall in the rate of profit, due to the increase in the organic composition of capital (OCC, constant capital/living labour ratio), the fall in the rate of profit and the progressive increase in the OCC must be evident.”

Well, there is a wealth of evidence by Marxist economists to show that. What surprised me is that you cite only two studies, Weisskopf from 1980 (!) and Brenner from 1996. And then there is Jose Tapia’s excellent paper from 2017 – which shows a clear connection between profits, investment and crises, with the causal direction from profits to investment to GDP.

Instead, I can cite a host of empirical work showing the movement in the rate of profit in the US and in many other countries that support Marx’s law, both in the tendency for the rate of profit to fall and also its connection with investment and crises of production. You do not reference the works by Mandel, Shaikh, Tsoulfidis, and others (including me) that have theoretically and empirically substantiated this theory.

Running the risk of neglecting some important works, I mention those of Duménil and Lévy (1993, 2002), Basu and Manolakos (2010), Paitaridis and Tsoulfidis (2012), Roberts (2016), Tsoulfidis and Paitaridis (2019), M. Li (2020) for the USA; Webber and Rigby (1986) for Canada; Reati (1986b), Cockshott et al. (1995), Li (2020), Alexiou (2022) for the UK; Reati (1989) for France; Reati (1986b), Tutan (2008) for W. Germany; Edvinsson (2010) for Sweden; Lianos (1992), Maniatis (2005, 2012), Maniatis and Passas (2013), Tsoulfidis and Tsaliki (2014, 2019) for Greece; Izquierdo (2007) for Spain; Mariña and Moseley (2000) for Mexico; Yu and Feng (2007), M. Li (2020) for China; Li M. (2020) for Japan; Jeong (2017), Jeong and Jeong (2020) for S. Korea; Maito (2014), M. Li (2020), Roberts (2020) for the world economy. And there is Trofimov (2020). Sergio Camara (Mexico,) Peter Jones (Australia), Themis Kalogerakos (on the US) and Murray Smith on Canada and the US. And just this year we have a new book by Mejorado and Roman on profitability and the US economy (which I shall review shortly).

Yes, the rate of profit can fall and the mass of profit can still be rising, as it was in 2006 just before the Great Recession. But eventually that situation cannot last. The answer to your question on why a small fall in the ROP from 11% to 10% might or might not trigger a crisis depends on the change in the mass of profit. You say, why would capitalists stop investing if they could even make a larger mass of profit even if the profit rate falls? The answer is that they would not, but eventually the mass will fall if the rate keeps falling. This was main argument of Henryk Grossman, rather than whether the mass of profit was insufficient for the capitalist to consume and invest at the same time.

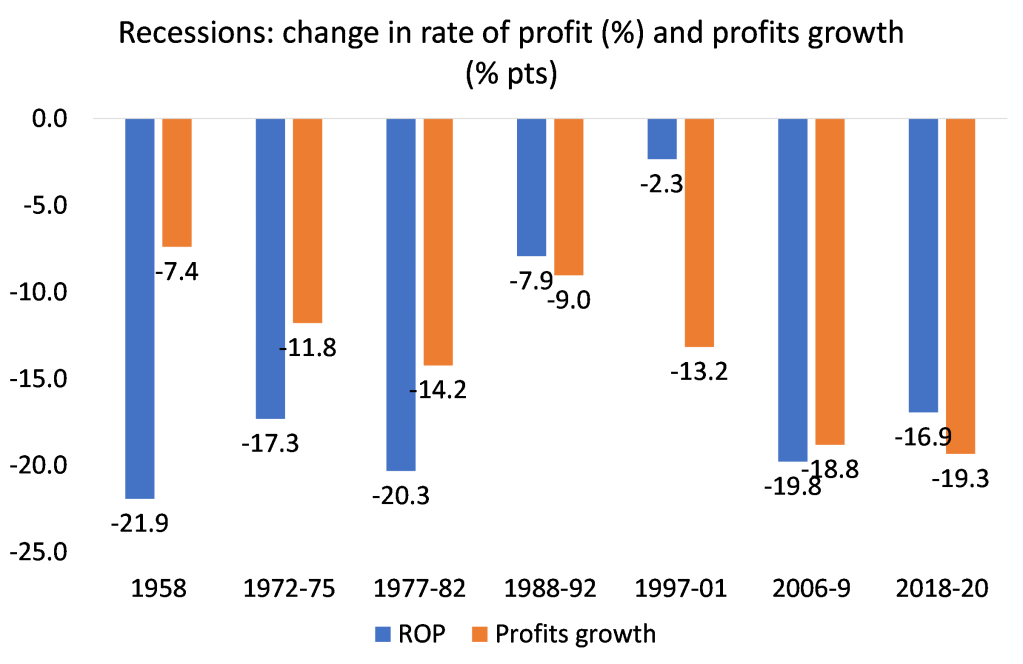

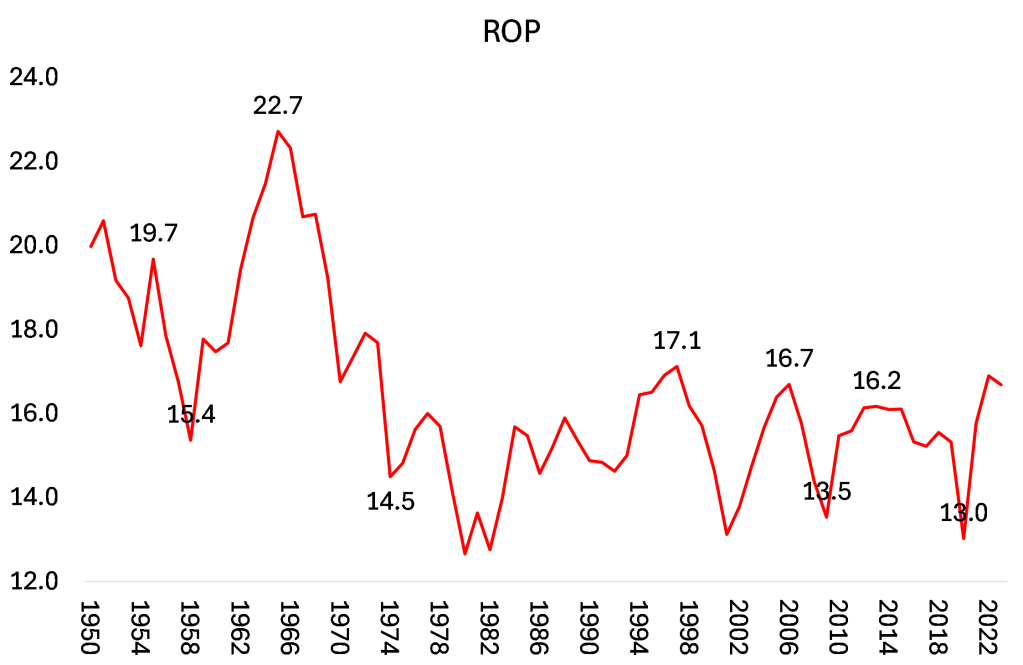

You say: “If the cause of cyclical crises is in the LTGT, there should be empirical evidence of a progressive fall in the profit rate due to an increase in the COC in the years, or in the decade, prior to the outbreak of the crisis. But this is not observed in the crises that occurred in the last 100 years.” You cite the out of date and inadequate work of Brenner for your argument that the ROP does not fall before crises. But there is much better evidence from many later sources (as cited above). I cite just one more: Carchedi in our edited book World in Crisis p46. I could also cite the very latest evidence provided in that new book by Mejarado and Roman (as I say, to be reviewed by me shortly). And here is graph from my own work. The rate of profit falls and so does the mass of profit in the period before slumps in the US.

You say that between 1920 and 1929, in the US, there is no clear tendency for the profit rate to fall that could explain the crisis of 1929-1933. But there is. See my book, The Long Depression pp 52-54, with graphs showing that the ROP in the US started falling as early as 1924. And see also my blog here.

You say that “If we consider the crisis of 2007-2009, the profit rate had an upward movement from 1983 to 2006. There is no way to fit these data into the explanation of these crises by a gradual fall in the profit rate.” Yes there is: actually the US ROP in 2006 was lower than in 1997. Here is the very latest calculation of the US rate of profit in the non-financial sector from the excellent new Basu-Wasner database.

Indeed, before every major recession in post-war US, the ROP started falling in advance – as in my graph above.

You say that “As for the crises that occurred between 1825 and 1913, although there are no statistics on the long-term evolution of the profit rate, some of the major references in historical studies of the cycle, such as Lescure (1938) and Mitchell (1941), do not establish a connection between the crises and an eventual long-term fall in the profit rate.” Again, this is not correct. See the ROP series provided by the Bank of England and developed in my work on the UK rate of profit in the book already cited, World in Crisis, p183 onwards.

You say “it is difficult to explain the cyclical weakening of investment by the LTDTG.” Well, I think the above discussion on the relation between the rate of profit, the mass of profit and investment shows that not to be correct. And Tapia, in his paper of 2017 that you cite and in his subsequent papers, shows the clear causal connection between profits leading to investment. Again, Tapia’s updated paper is available in our book, World in Crisis, p78 onwards. Your alternative ‘possible sequence’ merely shows that as the rate of profit falls, capitalists will continue to accumulate and produce more and so increase the mass of profit to compensate. But that cannot last, and when the ROP falls to the point where the mass of profit starts to decline then a cyclical crisis emerges.

As you say, Marx argues that the decline in the rate of profit “necessarily provokes a competitive struggle” (p. 329, vol. 3) and not vice versa. So the position of Smith and Brenner that it is the competitive struggle that lowers profitability is not Marx’s and is also empirically incorrect. It is the falling rate of profit that provokes the competitive struggle and eventually provokes a slump in investment and production. And the falling rate of profit is not caused by a competitive ‘squeeze’ or rising wages, but by the rising organic composition of capital that outstrips the counteracting factors like the rise in the rate of surplus value. That is Marx’s law.

The LTRPF is not a law of stagnation (as you argue) but a law that explains cyclical crises. According to Marx, this law is not in and of itself capable of generating crises. In fact, the fall in the rate of profit can be slow enough and still the economy can keep expanding for many years. What the analysis requires is a cause for the crises from the ‘possibility’ of crises to pass to the ‘actuality’ theory of crises. Such a cause is offered by Marx in the trajectory of the mass of realized surplus value (profits); as the rate of profit declines, there is a point at which the mass or real net profits stagnate and thereafter even falls. This is what can be called ‘Marx’s moment’ or the point of ‘over-accumulation’ (see Shaikh, 1992; Tsoulfidis, 2006). At this tipping point, the capitalists abstain from investment and the system spirals down into a crisis.

You reject this view on the grounds that this absolute overaccumulation is only a “theoretical possibility” and would only happen because of a rise in wages squeezing profits. And you add that “we do not see that a general theory of capitalist crises can be derived from this hypothetical case. Nor do we know that such an “absolute overproduction” of capital has occurred in any country.” Well, I don’t think Marx saw absolute over accumulation as just a theoretical possibility or a hypothetical case, but as the logical consequence of his law in relation to crises. And again there is plenty of evidence (as above) that absolute over accumulation, as indicated by a fall in the mass of profit before crises, happens.

You say that your “position is that the tendency of capitalism to overproduction is logically prior to the question of whether the rate of profit tends to fall.” In my view, Marx says the opposite with a clear logical sequence to explain that and, since Marx, many Marxist economists have provided a wealth of empirical evidence to back Marx’s law as the underlying cause of regular and recurring crises in capitalism.

And finally, we get to your true position – namely a complete denial of what Marx wrote in Chapters 13 to 15 of Volume 3: “explanations of cyclical crises due to the increase in costs (wages, raw materials, interest rates) can also be stated without the need to refer to any long-term law of variation in the profit rate.” If that were correct, I assume you would remove those chapters from Volume 3, perhaps also because Engels distorted them to justify the law – this is the charge of Heinrich and other New Reading revisionists. You have previously reduced Marx’s law to one of a stagnation rather than a crisis theory and then you now go on to accept the neo-Ricardian Okishio theorem that refutes of the very logic of Marx’s law completely. You appear to ignore the refutations of Okishio by many Marxist economists since Okishio presented it (including Okishio himself in stepping back from his original arguments).

You say that “It is not clear why the rate of profit will fall in the long run with increasing productivity. “ Gosh! That is the very basis of the law that derives from Marx’s general law of accumulation in Volume One that capitalists invest more technology over labour to boost productivity and gain advantage over rivals; to Volume 3 where he shows that in doing so the rate of profit tends to fall and comes into contradiction with the rise in productivity. It is the basic contradiction of capitalist accumulation, denied by the mainstream, by Keynesians, by Piketty et al – and now by you?

You say “the value of the commodity that makes up the constant capital will fall in proportion to the increase in productivity, and the rate of profit will not fall. This is a key problem in the law formulated by Marx.” Yes, one of the counteracting factors would be the cheapening of constant capital through increased productivity. But that counteracting factor cannot overcome the law eventually. You rely on Okishio’s ‘complex goods’ to argue this. But the rise in constant capital over variable capital (within the value of the commodity) and in price terms is a self-evident feature of modern capitalist growth and empirically verified in many places and by many scholars. You have to admit that and you do: “Of course, this criticism does not deny that, in the long term, there is an increase in constant capital per worker due to the development of productive forces.” And yet you try to deny it.

You finish with a musing about whether the LTRPF might instead be a secular theory showing the ‘ultimate limits’ to the capitalist mode of production. Well, the LTRPF as a cyclical crisis or ‘ultimate end of capitalism’ theory is not necessarily contradictory. Yes, there is no ‘permanent crisis’, but also the long-term decline in the ROP shows that capitalism has a limited economic life – indeed it is increasingly past its sell-by date.”

Here is Rolando’s reply to me as published in Sin Permiso.

Dear Michael:

You write: “First, you claim that Marx never explained cyclical crises with his law of profitability. You back this up by saying that “when he wrote about the 1847 crisis he did not mention the law. Well, that is not surprising since he had not developed the law by then. But you go on to claim that “neither did he do so in the passages referring to the crises of 1866 and 1873. And in chapter 17 of volume II of Theories of Surplus Value, devoted to capitalist crises, he made no reference to the LTGT.”

First question : Marx mentions the 1847 crisis again in several passages in the drafts of Capital, when he had already elaborated the LTDTG. It is a fact that he does not explain the 1847 crisis by the tendency law of profit.

Second: In Chapter 17 of Volume II of Theories of Surplus Value, Marx does not even mention the LTDGT. This is despite the fact that the entire chapter is primarily devoted to explaining why the capitalist system tends towards crises of overproduction. To be more precise, if Marx had explained the crises of overproduction (of which the one in 1847 is an example) on the basis of the LTDGT, he would have had to show that, within a period of approximately 10 years, the organic composition of capital should have increased so much that, despite the increase in relative surplus value (due to the increase in productivity) and the relative cheapening of constant capital (for the same reason), the rate of profit would have fallen. With the addition that this would not have been enough, because in addition to demonstrating the fall in the rate of profit in the ten-year cycle due to the LTGT, he would have had to show why this fall would have caused the crisis. And for this to be a general explanation of the crises he witnessed, the same phenomenon should have occurred, every 10 years, in the crises of 1836, 1847, 1857, 1866, 1873. But this did not happen.

Third: I do not understand why no attention is paid to Anti-Dühring. Marx undoubtedly knew this text. He never questioned it. He never presented an alternative based on the LTDTG to Engels’ explanation of the crises of the 19th century.

Fourthly, I have quoted at length from passages and passages in the private correspondence of Marx and Engels on the crises of overproduction. In none of these exchanges do I find that they explain the crises of their time due to the LTDTG.

Fifth: I find the argument “you are not right because what you say was said by, for example, Hilferding” inappropriate. I will develop this topic in another post.

Sixth: I insist on the need to differentiate between crises of underconsumption and crises of overproduction. Marx and Engels were critical of the underconsumptionist approach (typical of bourgeois reformism) to overproduction.

Hug. Rolando

And Rolando replies to a recent comment on his blog as follows:

“I still think that cyclical crises are not explained by the law of the tendency of the rate of profit to fall. For this reason Marx and Engels did not explain the crises of 1836, 1847, 1857, 1866, 1873, 1882-4, 1890, by that law. It is striking that Roberts, and others who share his position, do not say why Marx and Engels did not explain those crises by the LTGT:

In the same way, the 1929-1933 crisis in the USA, or 2007-2009 (as I show in the note) are not explained by the LTGT.

I do think that the fundamental motor of capitalist accumulation is the valorization of capital. It is nonsense to maintain that, if the LTDGT does not explain the crises, the rate of profit (i.e. the valorization of capital) does not play a role in the dynamics of capitalist accumulation and crises.”

My comment:

I think we have answered Rolando’s argument that Marx and Engels did not refer to the law of profitability in explaining those crises (see the quotes of profitability and crises mentioned in my reply above). And actually there is good evidence that the crises of 1929 and 2008 were preceded by falls in the rate and mass of profit which I also presented in my reply above – Rolando ignores this evidence.

But let’s just say that Rolando is right and Marx did not reckon his law of profitability provided any cause for periodic crises and it was all down to ‘overproduction’ of supply exceeding demand in the market. Then I would have to say that Marx was wrong. He should have stuck to the logic of his law of profitability as it provides the most compelling case for the cause of crises, backed by the best evidence compared to ‘overproduction’, which excludes the role of profitability in crises in an economy driven by the profit motive!

As Rolando says, it is nonsense to suggest that profitability does not play a role in changes in investment or accumulation. But he then argues that it does not play a role in causing slumps. I argue along with many others that movements in profitability provide the underlying or ultimate cause of periodic crises and provide both theoretical and empirical evidence to support that. The overproduction theory does not explain periodic crises and has no empirical support.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.