The attitude of the press to Sunak’s budget this week was largely neutral, typified by The Guardian’s “spend now, pay later” headline. For most workers, however, the Budget is a case of “Pay now and pay more later”, because it does nothing to address the growing poverty and insecurity facing millions.

As another article in Left Horizons has pointed out, the background to the budget is the unprecedented economic collapse as a result of the Covid pandemic – both of which have hit the UK harder than any other large economy. Sunak, who ought to be dubbed “Richy” Sunak, given that his family are among the wealthiest half dozen in the country, might have one eye on promoting economic recovery, but he is turning his blind eye to the desperate needs of millions of the population.

Corporate Tax rise maybe later, Income Tax rise now

The headline measure of the budget is the supposed increase in Corporation Tax. We say “supposed” because it does not apply until 2023, leaving plenty of time for Sunak or his successors to ‘change their minds’ on it. Meanwhile, even what is proposed is completely cancelled out by generous “super-deductions” to big businesses, of an astonishing 130 per cent of their taxes, against any investments they might make.

The government is offering to pay, therefore, for investment that companies ought to be making in any case. By these deductions, Sunak is opening a barn door to more dodgy schemes for big business to fleece the taxpayer. No prizes for guessing what this measure will produce: not a big uplift in investment – a record for which UK business is chronically below other G7 countries – but, instead, a bonanza in company dividends and share buy-backs.

The budget includes supposed proposals to “crackdown on tax evasion and avoidance”, but this is not aimed at the super-rich, who salt their money away in ‘legal’ offshore tax-havens. We have no sympathy for anyone accessing Covid financial support illegally, but these measures are mostly aimed at small businesses like self-employed plumbers, and those unfortunate enough to have to fill in an onerous tax self-assessment form every year.

Tax-dodging on a massive scale

This is the latest in a long line of “crackdowns” and is expected to raise a measly £2.2bn for the government by 2025-26. But meanwhile, the really big tax-dodgers, like multi-national corporations and the super-rich, evade taxes on a gigantic scale. The UK is by far the greatest enabler of tax-dodging across the globe. Two years ago, even the government’s own modest estimates of tax dodging amounted to £35bn.

The problem of tax avoidance is not down to the local corner shop not stumping up enough VAT, or to the electrician around the corner being paid in cash. It is down to big businesses dodging tax and to the many tax havens that are Crown territories or Crown overseas possessions, and which could be closed in a week if the government wished it. The real gap in tax is more like £90bn a year and some estimates have it higher than that.

Nothing to support families in recovery

But while the headline rise in Corporation Tax is put off for two years, the freeze on income tax bands takes effect from this April and will last for five years, until 2026. That means that if pay rises edge upwards with inflation, so the proportion of his wage that a worker pays in income tax will edge up immediately, not in 2023, and it will go on rising for five years.

The Resolution Foundation report on the budget commented, quite correctly, that Sunak’s “focus on firms means he has far less to say about supporting households in the recovery”. It is expected that unemployment will rise significantly in the Autumn, just at the time when the miserly £20 uplift to Universal Credit comes to an end. So, while business faces a possible increase in taxes in two years’ time, many families will face an economic cliff-edge in months.

Already, according to the Joseph Rowntree Foundation, 14 million are in poverty or are on the edge of poverty. Child poverty is a particular issue that ought to concern the labour movement but it is of no concern to this Tory Chancellor. One in four lone parents live in persistent poverty and for many of them, the prospect of a further cut in June is a nightmare. At the same time, the (limited) embargo on evictions is ending and thousands of families are facing having their homes taken away from them by greedy landlords.

Most poverty is driven by low pay

Families with the lowest incomes and with children are increasingly likely to experience destitution in the coming months. Even by 2019, around 2.4 million people experienced destitution, a 54% increase from two years earlier, and this included 550,000 children, again, a 52% increase. One in seven (14%) people experiencing destitution are actually in paid work. The problem of ‘poverty’ is in their case a problem of abysmally low pay. Sunak’s only answer to low pay is to raise the minimum wage by the princely sum of 19p an hour – and that only for the over 23-year-olds – not so much a helping hand as a slap in the face.

In short, as the Resolution Foundation makes clear, “it will not feel like a recovery for millions of households”. The cancellation of the £20 uplift “will leave the basic level of benefits at its lowest level since the early 1990s” The poorest household, as a result of this measure, face a 7 per cent fall in income in the second half of 2021-22. The poorest families will fill the chilliest economic winds, but, according to OBR forecasts, household incomes overall will fall next year by 0.4 per cent, even though GDP is expected to rise.

By the middle of the next decade, according the Resolution Foundation, earnings are set to be 4.3 per cent lower in real terms (equivalent to £1,200 per year) compared to pre-crisis forecasts. Workers will be paying now and will only pay more later.

Free ports will be ‘free’ of workers’ rights

We live in a society where the majority of those in poverty are in work and the insecurity and uncertainty of their lives are set to get worse, as a result of this budget, not better. There is currently a rash of employers trying the ‘fire and rehire’ tactic of slashing workers’ wages. There is not a flicker of interest in these issues on the Tory front benches.

The Budget announcement about ‘freeports’, with named locations for the first time, is short on detail and long on hype. But we can be sure can the name ‘free’ ports will not be wrong. These will be industrial and commercial zones that will be ‘free’ of workers’ rights, ‘free’ of health and safety regulations and ‘free’ of normal taxes and business rates. They are an unmitigated bribe for businesses to open (or, more likely, re-locate) on the most generous possible terms, while giving every assurance that labour costs will be minimised.

One notable omission from the budget were public services. There is not the slightest intention on the Tories part to halt, much less restore the already-planned cuts for local government and other public services. In public service spending as a result of this crisis even in the likes of social care, they have actually reduced such spending by £4 billion a year compared to previous plans.

Miserable 1% offered to NHS staff

This is in addition to the £12 billion cut in the Autumn Spending Review, meaning that those ‘unprotected’ public services like transport and local government, will fall by £2.6 billion in the next financial year. By 2024-25, spending per capita in these services will be almost one-quarter lower than in 2009-10. So much for ‘ending austerity’. So much for ‘levelling up’.

Adding more insult to more injury, in the days after the Budget it has been revealed that the government are recommending a miserly 1% rise in pay for NHS workers, in other words, set against inflation, a wage cut. Despite throwing tens of billions of pounds in juicy contracts to their pals and associates, they apparently cannot ‘afford’ to pay nurses and health workers more than this.

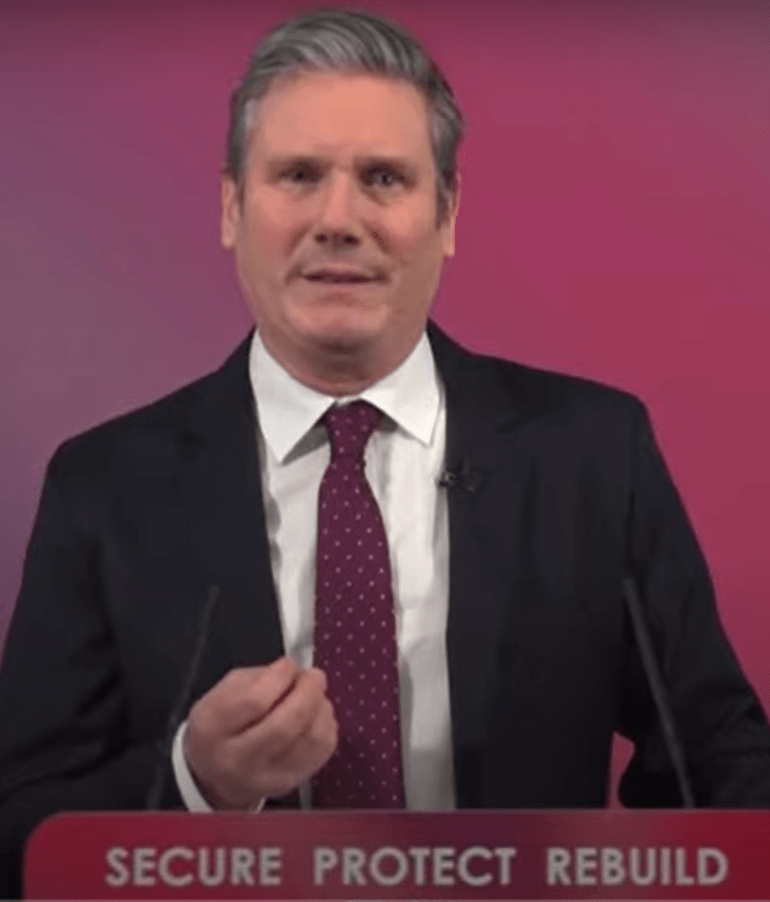

Unfortunately, as has been the case with so many other issues in the recent past, Tory policies have seemed so much worse because of the dismal opposition of Labour in parliament.

Keir Starmer said, correctly as it happens, that Sunak was “dragged — kicking and screaming” into the decision to extend the uplift in UC. What he didn’t say, of course, his that he himself had to be dragged “kicking and screaming” into supporting the raise in Corporation Tax. Only weeks ago, he was against all tax rises. Labour’s priority, he said then, would “always be financial responsibility.” He has only done a u-turn on Corporation Tax because of widespread unrest, even within the right wing of the party over this stance.

We have catalogued many times the shift of the Labour leadership to the right and particularly Starmer’s abandonment of the “ten pledges” he made during his leadership bid. These are some of the pledges made by Starmer in his Labour leadership bid:

Starmer’s empty promises from leadership campaign

*Increase income tax for the top 5% of earners, reverse the Tories cuts in corporation tax and clampdown on tax avoidance

*Abolish universal credit and end the Tories cruel sanctions regime.

*Put the Green New Deal at the heart of everything we do.

*Public services should be in public hands, not making profits for shareholders

Once he became leader, there has not been a peep coming out of him or Labour’s front bench on these commitments. What he did not say, because it would not have won him the leadership at the time, is that his fundamental economic outlook is little different to the Tories themselves.

What Labour needs to do is to base itself on are the day-to-day needs of working-class people, the overwhelming majority of the population. It is not outrageous or in any way ‘extreme’ in the modern age for Labour to demand an end to poverty, to homelessness, to low pay and unemployment.

What Labour should be fighting for

As a response to Sunak’s Budget for the Rich, Labour ought to be demanding, as a minimum:

*An end to Universal Credit and the provision of a decent level of support for the unemployed, at least equivalent to a living wage

*An end to poverty wages and an increase in the statutory living wage to £15 an hour.

*An end to fire and rehire policies aimed to cut wages.

*An end to rent poverty! No family should pay a huge proportion of income in rent. Rent controls should be linked to average wages. Municipalisation of large landlord companies. A ban on evictions.

*No financial support, but nationalisation of firms threatening to lay off workers. Labour’s slogan must be ‘Work or full pay’ for all workers.

*The cancellation of all private out-sourcing and PFI contracts in the NHS, to pay for a significant pay-rise for all NHS staff.

*The nationalisation of care-homes and their incorporation into local authority and NHS control

*The immediate restoration of local authority and NHS cuts so that there are adequate finances to manage a crisis.

*All workers quarantined, including self-quarantined, must be guaranteed normal, full pay.

*In the event of any lockdowns or quarantines, that rents, mortgage payments and utility bills must be suspended (not just postponed) for the duration.

Labour languishing in opinion polls

The Labour Party is languishing behind the Tories in most opinion polls now. Despite fleecing the public purse through lucrative contracts for their cronies and mates, despite the worst Covid death rate in Europe and the steepest economic collapse, the Tories are riding high. The two words that explain this paradox are “Keir” and “Starmer”. A Labour leadership that is neither ‘Labour’ nor a ‘leadership’ has to go.

Socialists must fight in the party for MPs, councillors and representatives at all levels, but above all for a leadership, that puts itself fundamentally on the standpoint of ordinary working people. This Budget was a sick joke, a prelude to more sacrifices and more pain for the Many. Labour has to start offering something different or suffer the consequences.