Ireland election: its economic model under threat?

Ireland election: its economic model under threat?By Michael Roberts

This blog was originally published by Michael Roberts on Friday, 29 November 2024. The original article can be found here.

**************

The Repubic of Ireland (this excludes the northern Ireland enclave which is still part of Britain) holds a general election today. Ireland has just 5m people and is part of the European Union and the Eurozone, contributing just 1% of EU27 and 3% of EU GDP.

The current government is a coalition of the two traditional pro-capitalist parties, Fine Gael and Fianna Fail, with the Greens. This coalition has kept out of power the republican nationalist Sinn Fein that wants a referendum on a united Ireland and offers more radical economic measures. The current Taoiseach (Irish PM) is Simon Harris of Fine Gael, which is slightly behind in the opinion polls at 19% of the expected vote, while Fianna Fail and Sinn Fein are polling about 21% each.

Ireland is a favoured location for US investment

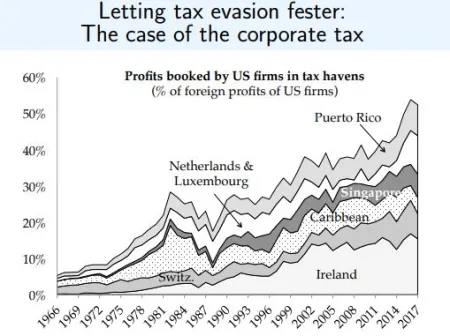

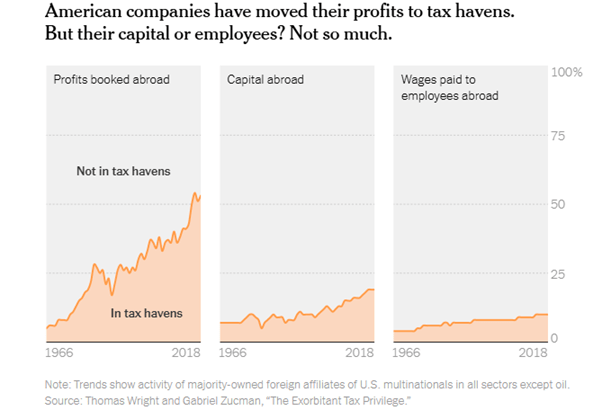

In the 21st century, Ireland became a huge tax haven for high wealth individuals, hedge funds and above all, American multinationals. Ireland remains a leading location for US foreign direct investment (FDI). Some 970 American firms employ more than 210,000 people directly, with a further 168,000 jobs supported indirectly in the supply of products and services. These companies are also responsible for the bulk of corporation tax revenue. This has made Ireland an “outlier” in Europe with more than 25% of tax revenue in the Republic of Ireland coming from corporation tax compared an average figure of less than 10% across Europe.

In 2018, Facebook made $15 billion in profit in Ireland — the equivalent of about $10 million for each of its employees there. That same year, Bristol Myers Squibb recorded close to $5 billion in profit in the Emerald Isle, or roughly $7.5 million per employee, while employment in these companies for Irish workers has been relatively modest and confined to highly-educated or skilled Irish workers.

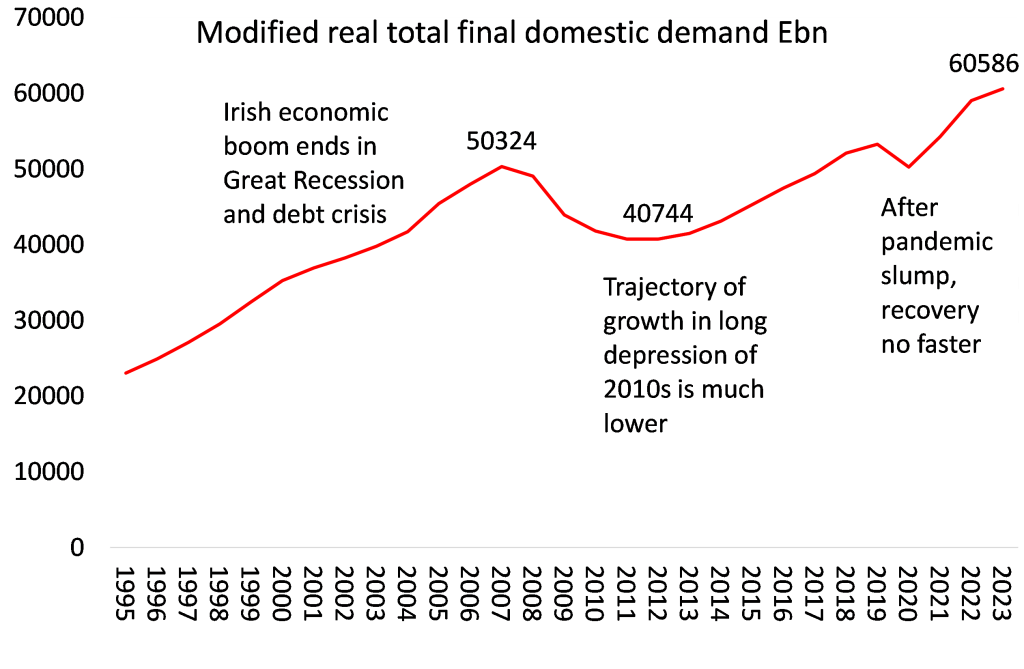

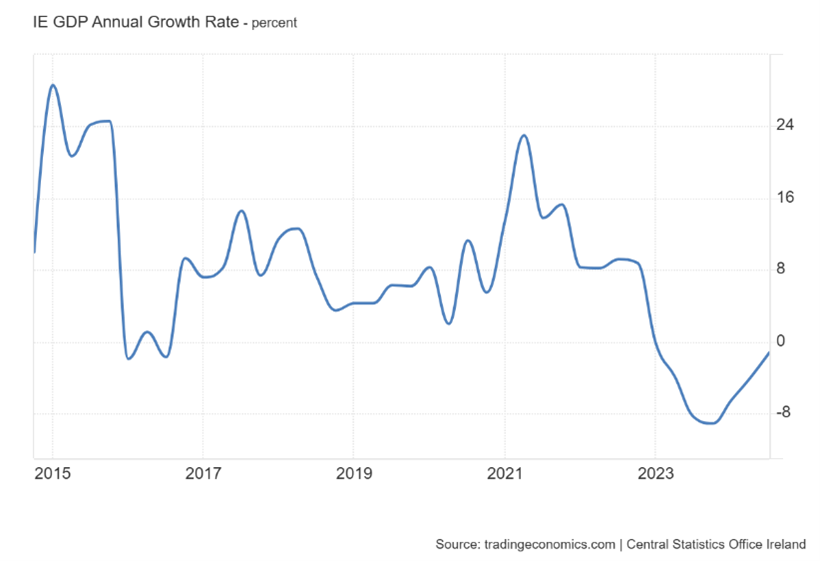

Ireland’s tax haven status, and in a ‘colonial’ relation to US corporates and investors, leads to misleading data on national output growth. While GDP data suggest a massive boom, if the profits of the American companies are stripped out, domestic growth is much less impressive. Indeed, the government has been forced use what it calls modified domestic demand (MDD) as a measure of real expansion for Ireland. MDD strips out American investment in imported intellectual property and aircraft leasing which does not touch the sides of the Irish economy.

Modified Domestic Demand gives a better picture of Ireland’s economy

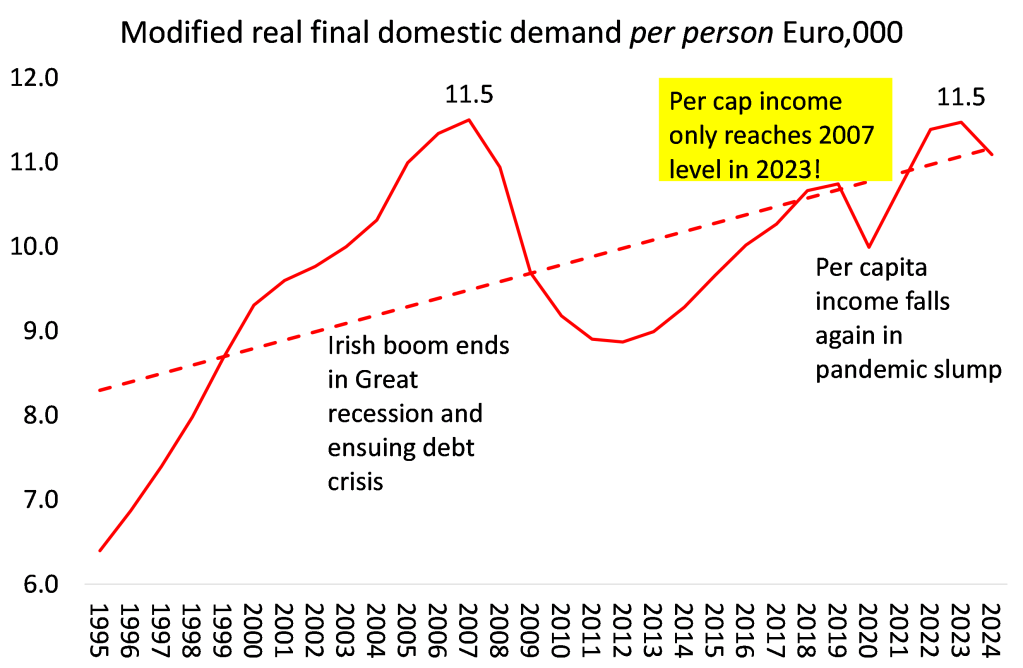

Instead of GDP as a measure, if you consider MDD, you find that Ireland’s economic growth has been much more modest and indeed is slowing. The trajectory of fast growth was halted by the Great Recession of 2008-9 and the subsequent recovery in the 2010s (the decade of the Long Depression in all the major economies) had a much lower growth rate. The pandemic slump then hit Ireland and again, as elsewhere, the growth rate has hardly resumed the trajectory of the 2010s.

This is even more clearly revealed when we consider MDD per person. Average per capita income (MDD) is currently no higher than at the peak of 2007, 17 years later!

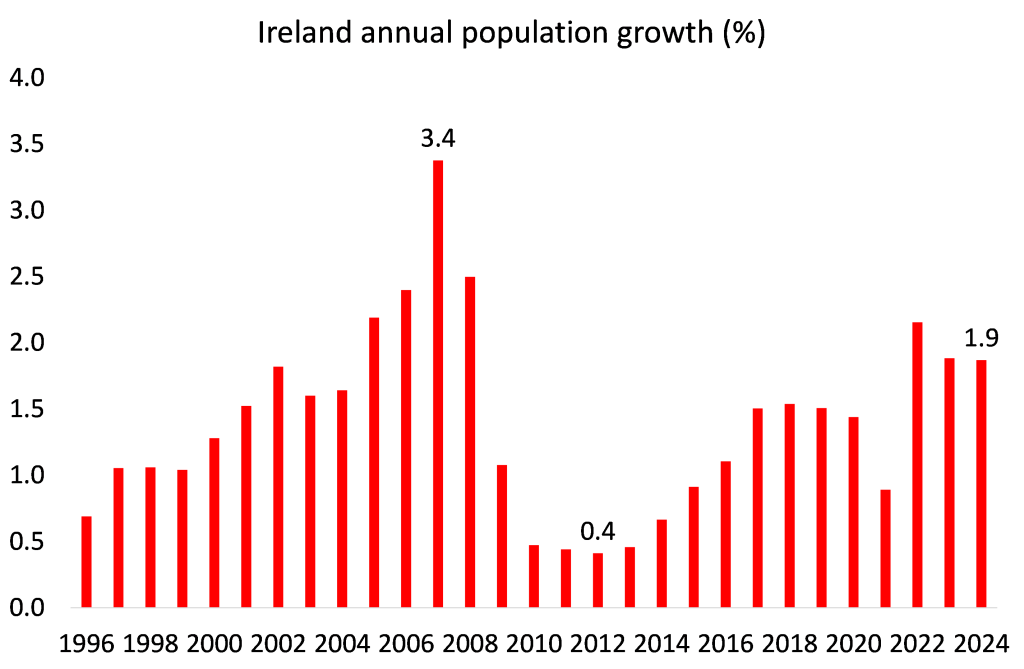

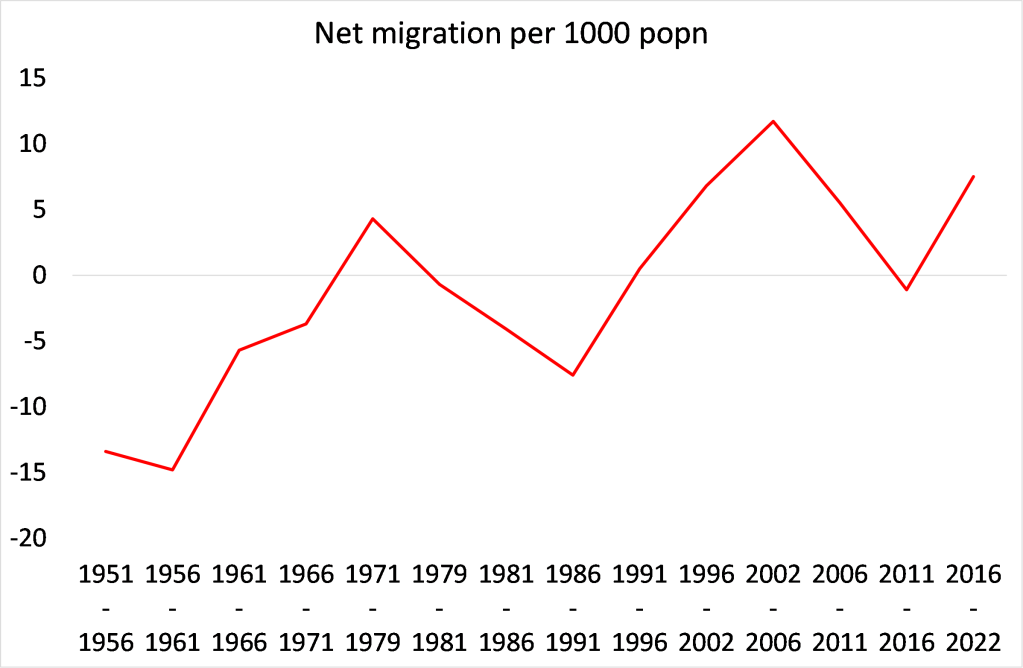

And that’s because much of the rise in output has been achieved by sharply increased immigration – an election issue now. After a century as a country of emigrants, Ireland’s population in 2024 is now estimated to be 5.38 million, rising by 98,700 people in the year to April 2024. This was the largest 12-month population increase in 16 years since 2008, when the population rose by 109,200. And there are 2.7m in employment, up one million since 2000.

The number of immigrants in the year to April 2024 is estimated to be 149,200 consisting of 30,000 returning Irish citizens, 27,000 other EU citizens, 5,400 UK citizens, and 86,800 other citizens including Ukrainians.

The population rise is increasingly concentrated in Dublin, Ireland’s capital, where the proportion of the population has risen from 28.1% of the total in 2018 to 28.5% in 2024 and now has 1.5m people.

Deprivation and sky high private rental costs

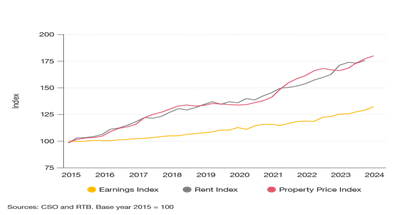

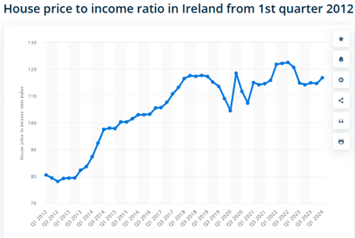

As a result, cheek to jowl with the modern American owned plants in the so-called Silicon Docks area of Dublin, there is an inner city which is one of the most deprived areas of Europe capitals. Homelessness in Ireland is at a record high – with the most recent figures showing 12,600 people were in emergency accommodation in June. The average cost of renting a one-bedroom property in Dublin is €1,800 (£1,550) a month. That places it third among major cities in Europe, just behind Geneva and London, in a study of more than 40 locations carried out by the EU statistics agency Eurostat.

So the rising cost of living and lack of affordable housing are key election themes. While average hourly earnings increased by 25% between 2019 and 2024, the gap between earnings and housing costs has widened significantly and is forecast to continue to do so. The Central Bank of Ireland estimates that 52,000 homes will need to be built per year out to 2050. This is an increase of 20,000 units per annum relative to the 2023 figures. In the 12 months to July 2024, 12% of property purchases were by non-occupiers – that means buy-to-let owners seeking to make profits from renting.

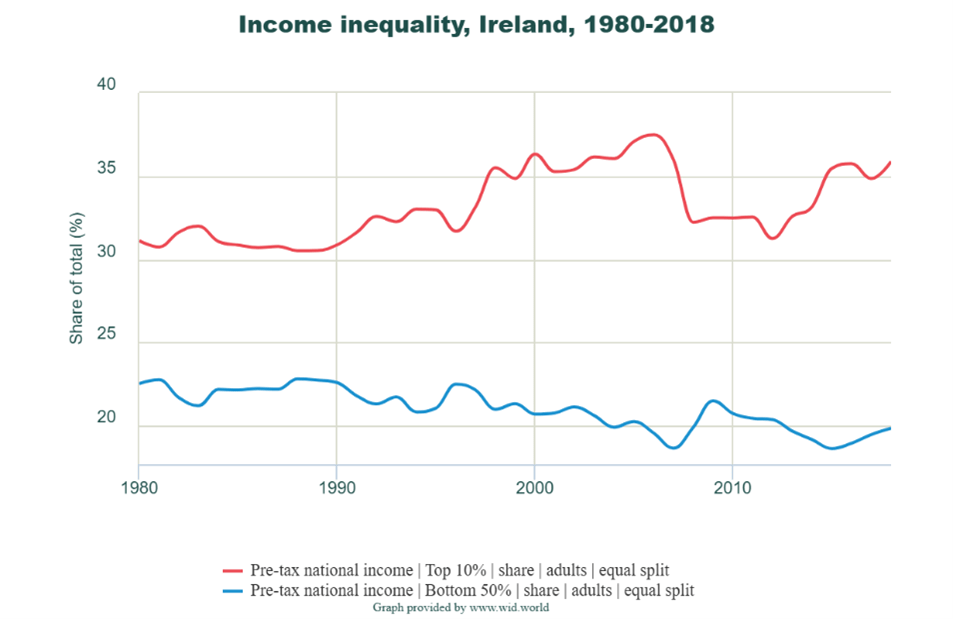

Indeed, inequality of incomes in Ireland remains extreme, with the top 10% of earners gaining more share of total income (from 30% in 1980 to 35% in 2018), while the share going to the bottom 50% has fallen to just 20%.

As usual, inequality of wealth (ie ownership of property and financial assets net of debt) is even worse. The top 1% of wealth holders in Ireland have 23% of all personal wealth and the top 10% have 66%, while the bottom 50% have no net share as they owe more than the own (-3.4%)!

Ireland suffers a slump in 2023

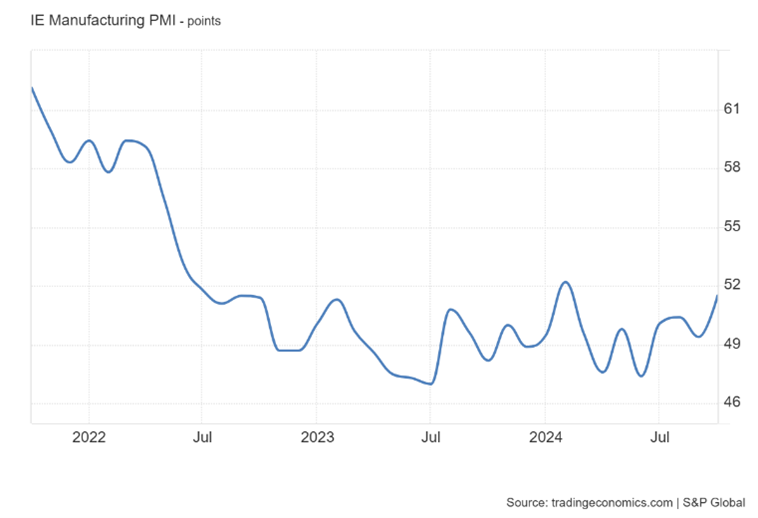

Last year, Ireland’s economy slipped into recession on the back of a slump in the American multinationals’ exports (even the MDD measure showed only a 0.5% rise). That shows how dependent Ireland has become on US multinationals, with that sector contracting for the first time since 2013. Things look little better in 2024 as business investment drops.

As elsewhere in Europe, Ireland’s manufacturing sector has been contracting (scoring below 50 on the PMI economic activity measure).

The Irish government was recently forced to tax multinationals like Apple more than they wanted, to meet EU tax regulations and they also had to raise their corporate tax rate to 15%. Ironically, as a result, the government is now flush with extra revenue (E14bn alone in back taxes from Apple). Tax revenues are set to create a surplus over government spending of E65bn by the end of this decade.

Private sector cannot solve the housing problem

How will it be spent it, if at all? Suggestions include setting up a sovereign wealth fund to invest, along the lines of Norway’s and a fund for infrastructure. As PM Harris says: “There are clear areas where it would merit consideration around infrastructure, housing and other areas where there are constraints.”

Indeed! The problem is that Ireland’s private sector construction industry is totally inadequate to build more homes to meet any reasonable target to deal with the housing crisis. And of course, no state-owned housing corporation is being advocated with training for skilled construction workers.

And then there is Trump. He could be a serious threat to Ireland’s future attraction for American corporate investment with his talk of making America great again by getting US firms to operate at home. Trump plans to match the US corporation tax rate to Ireland’s now 15% and to slap tariffs on goods manufactured abroad in a bid to lure companies back home.

The risk posed by Ireland’s dependence on the US multinationals

PM Harris has said the country could lose €10bn in corporate tax if just three US multinationals were repatriated to America under a hostile Donald Trump administration. Ten multinationals account for 60% of Ireland’s corporate tax receipts, with Microsoft, which books some global as well as EU revenues through Ireland, thought to be the single biggest contributor. MAGA could mean the end of Irish economic growth model.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

China’s growth challenge - By Michael Roberts This week the Fifth Plenum of the Chinese Communist Party Central Committee is taking place. The plenum is to discuss the progress of

China’s growth challenge - By Michael Roberts This week the Fifth Plenum of the Chinese Communist Party Central Committee is taking place. The plenum is to discuss the progress of Was a successful treatment suppressed? - by Harry Hutchinson, member, Labour Party Northern Ireland. A successful treatment for Covid-19 has been known for some time and although not a cure, results

Was a successful treatment suppressed? - by Harry Hutchinson, member, Labour Party Northern Ireland. A successful treatment for Covid-19 has been known for some time and although not a cure, results No debt, no landlords! - By Richard Mellor in California There is a popular post on the internet, stating correctly that the pandemic has demonstrated three things. One is that

No debt, no landlords! - By Richard Mellor in California There is a popular post on the internet, stating correctly that the pandemic has demonstrated three things. One is that US election will be a watershed - The presidential election next week will be a watershed in modern in US politics. Whichever way the vote goes, it is the beginning of the

US election will be a watershed - The presidential election next week will be a watershed in modern in US politics. Whichever way the vote goes, it is the beginning of the Bolivia, Nigeria, Chile, Thailand… - By Richard Mellor in California In 1938, two years before he was assassinated by a Stalinist agent, the Russian revolutionary and Marxist, Leon Trotsky wrote

Bolivia, Nigeria, Chile, Thailand… - By Richard Mellor in California In 1938, two years before he was assassinated by a Stalinist agent, the Russian revolutionary and Marxist, Leon Trotsky wrote