Private equity: vampire capital

Private equity: vampire capitalBy Michael Roberts

Marx is often famously quoted from Capital that “Capital is dead labour, that, vampire-like, only lives by sucking living labour, and lives the more, the more it sucks.” And Engels also used the simile of “the vampire property-holding class.” In 2019, US Senator Elizabeth Warren also used the image to describe how, “The private equity firms are like vampires – bleeding the company dry and walking away enriched even as the company succumbs.”

Private equity, the modern form of financial investment into and the management of companies and their workforces, is the epitome of this vampire motif. Private equity increasingly dominates the boards of small and large companies.

The operation of the private equity model

Instead of investing in the shares of companies quoted on the stock exchanges and open to public sale and purchase, ‘institutional investors’ (banks, insurance companies and pension funds etc) look to invest in ‘private equity’ companies that, in turn, buy, manage and sell companies. The financial institutions expect to get better returns through private equity than through buying shares on quoted exchanges. And the private equity companies claim they can deliver such better returns.

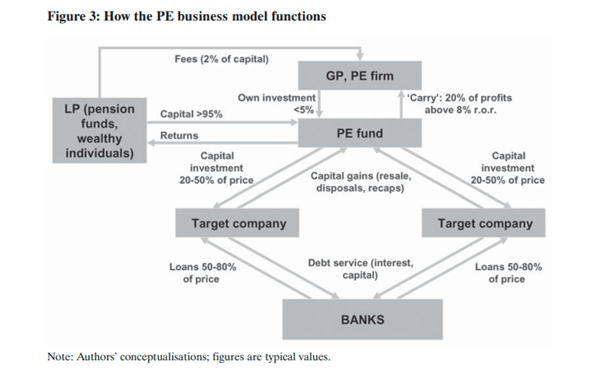

Private equity companies are just that, private. The PE firm is set up by a (usually small) number of individuals or in some cases as an offshoot of a larger financial organisation, such as a bank. These PE firms then launch one or more PE funds. They invest a relatively small amount of their own capital into the fund – typically less than 5% of the value of the fund. Then they look to raise capital. Investors – who provide the remainder of the fund’s capital – are attracted to commit their money by the promise of high returns.

How the earnings are share out

The investors usually agree to tie up their money for a set period of around ten years. They pay the fund owners a management fee (often 1.5-2% a year). They receive the earnings from the purchased target company on its resale and intermittently in the form of dividends and other payouts. Above a threshold rate of return (typically 8%), 20% of the earnings are retained by the private equity partners as so-called ‘carried interest’.

Of the money needed to buy targeted companies only a proportion (normally between 20 and 50%) is provided by the PE fund itself. The rest is borrowed from banks, using the assets of the companies as collateral for the loans. This means that the target companies must produce a stream of revenue (out of profits) with which to service these loans. The PE fund then runs the target companies with the eventual aim of a resale (‘exit’), typically in three to five years. So the target companies must maximise the return to the new owners (the PE fund) over the lifetime of the PE ownership.

Eventually, the bought company is listed (or re-listed) on the stock exchange or a strategic buyer (normally a company in the same sector or even another PE fund) takes over. So apart from the dividends in sweating the company for three years or so, it can be sold at as a capital gain. In doing so, the PE fund also charges the company consultancy and management fees for the sale! So this PE model tries to maximise the surplus value out of company workforce, raises more debt to do so and extracts the maximum return in dividend profits, while reducing productive investment costs to the minimum.

The impact of ‘vampire investment’ on workers

What is the impact of this ‘vampire investment’ on workers and owners? Here is just one example. About 70% of nursing homes in the US are for-profit. They are increasingly amalgamated into larger chains, often owned by private equity. The basic way nursing homes generate cashflow—two out of every three dollars it earns—is through Medicaid. The company Manor Care, for example, had 25,000 beds and was the second-largest nursing home chain in the country by 2017.

In 2011, it was bought by the private equity firm the Carlyle Group, which sold the land on which the nursing homes sat to a company that specializes in being a landlord to healthcare providers. Previously to this, the nursing homes typically owned their land. Carlyle pocketed the proceeds from that land sale, paying off the debt that it had Incurred to acquire Manor Care in the first place. So Manor Care then had to pay rent using its Medicaid revenues, while Carlyle took the profits. But with this new rent burden, Manor Care’s margins contracted. Carlyle then insisted on cutting labour and wages. The quality of care in the homes went into a downward spiral. Lawsuits from relatives spiralled and eventually Manor Care went bust in 2018.

Private equity has become a ‘gold mine’

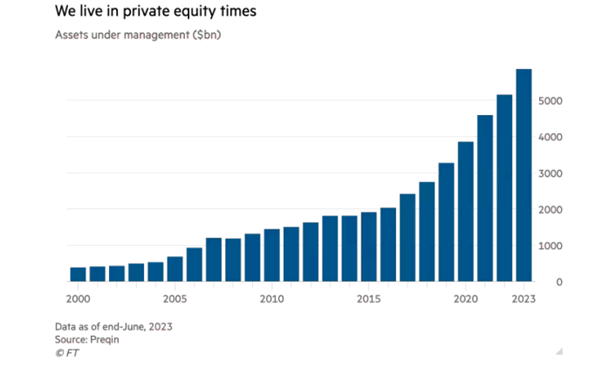

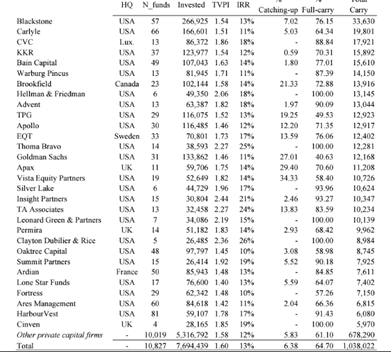

Private equity has been a bonanza for the PE fund owners. As the founder of one large fund put it when he started: “I looked at the capital structure and realised the returns that could be achieved. I said to myself, ‘This is a gold mine’”. Ever since, the promise of eye-watering returns has enticed pension plans, endowments, insurance companies, private banks and business tycoons to invest in PE funds. Today, private equity giants — such as Apollo Global Management, Blackstone and the Carlyle Group — control about $8tn in assets. That’s quadruple what these firms oversaw in 2012. There are at least 18,000 private funds in the US, most investing in middle and lower middle market companies. That figure grew by more than 50 per cent in the last five years. Private equity assets globally have now reached $13tn, according to consultants McKinsey.

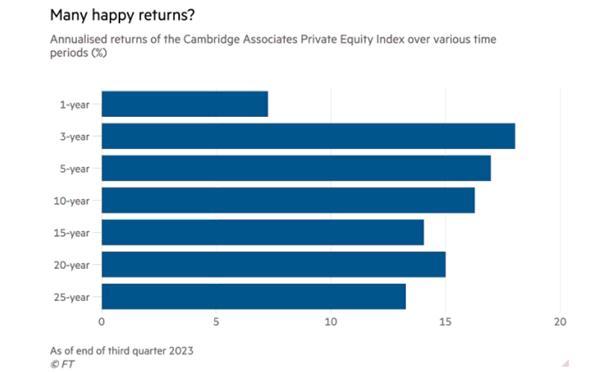

The institutional investors expect to get a better return on their money from private equity than from the stock market. CEM Benchmarking, a Canadian firm that collects data reported by $15tn worth of pension funds, endowments and other sovereign wealth funds, found that the average annual net return of private equity was 4 percentage points higher than on public equities over the past decade.

But this relative gain is disputed by other research. Ludovic Phalippou recently published a paper that reckons the returns are no better than the quoted market. The report shows the median private equity fund earns just over 1.6-times investors’ money over four to five years, which is comparable to the long-term returns of US stocks. He found that in recent years private equity funds offered their investors just about the same return as could be made putting money into broad stock market indices — but with much higher costs, which he figures come to 7 percentage points of gross return in both management and performance fees. And that number does not include the extra monitoring and transaction fees sometimes charged to companies owned by a private equity fund’s investors. So Phalippou reckons that the only people to do well out of investment in PE funds are the private equity tycoons themselves. Phalippou calls it “money for nothing“.

PE ‘carried interest’ taxed lower than standard income

In addition, the largest PE firms in the world have avoided paying income taxes on more than $1 trillion of incentive fees since 2000 alone, by making payments in a structure that subjects them to a much lower tax. Senior employees of private equity advisory firms earn salaries that are subject to standard income taxes, the report states, but they also receive payments “conditional on the performance of the funds they advise: the carried interest.”

Carried interest refers to the share of profits made by private equity fund managers from an investment deal that they have put together. It is taxed at the capital gains tax rate instead of at the income tax rate, which generally means PE owners paying 28% tax instead of 45% tax. This is a stark difference from how publicly traded firms operate. “It shows you the upper bound of what governments could collect if all of the countries in the world coordinated to tax that pot,” Phalippou said in an interview, adding, “once you understand how much money we are talking about, you can understand why private equity is the largest donor to politicians and universities.”

In the UK, about 3,140 private equity professionals shared £3.7bn worth of carried interest payouts in 2023, according to data gathered by the University of Warwick’s Centre for the Analysis of Taxation (CenTax). The new UK finance minister Rachel Reeves, before she took office said that: “Instead of hitting working people and businesses with tax rises, we should be spreading the burden and creating a fairer system. It’s absurd that the current regime around carried interest means tax breaks for fund managers averaging £170,000 per person…It’s not right that working people and ordinary businesses have been hit by a jobs tax, while private equity fund managers don’t have to pay a penny more on their income, and are in fact handed a tax break by this government as they asset strip some of our most valued businesses.” Since taking office, she no longer refers to PE funds as ‘asset strippers’ and is no longer implementing higher taxes on the funds.

Earnings from investing in PE no higher than from stocks

In sum, PE companies do not deliver better returns over time than investing in the stock market. The nominal returns may appear greater, but only because of huge debt buildup by funds. The model works like this with one large PE fund, KKR. In one purchase of a company at $380mn, KKR put in just $1mn, the rest being borrowed by the company itself to pay for its own takeover! The return is measured against the $1m plus interest on the loan of $380m, not on the total loan.

Then there are the ongoing costs to the investors. Private equity typically charges a 2 per cent annual management fee based on investors’ money committed to the fund, along with a 20 per cent share of the profits over a pre-agreed returns threshold of, typically 8 per cent. This is a huge drag on performance relative to the fractional percentage costs of investing in passively managed quoted equity. Another recent paper by Richard Ennis concluded that there was “no support for the proposition that private equity has added value to pension fund returns in the post-GFC era”.

Despite private equity insisting that they improve companies, Bain’s latest report on the industry estimates that “nearly all the value creation” in private equity owned companies between 2012 and 2022 actually came from revenue growth and multiple expansion. “Margin expansion barely registers,” the consultancy noted drily. That means that PE takeovers did not lead to any appreciable improvement in profitability through better investment and management, but only by squeezing the workforce, leveraging up debt and then selling on. In the most comprehensive study to date, commissioned by the World Economic Forum, it found that PE activity results in larger employment losses than in control groups that adjust for factors such as enterprise size and sector.

PE strips down companies and squeezes workers

The companies that private equity takes over are traded quickly and are usually run for maximum short-term profit. This can mean slicing off many of the elements that make a business robust for workers and customers: a solid pension fund, a host of buildings owned debt-free, generous terms for employees and enough staff to ensure good customer experience. One study by the universities of Harvard and Chicago showed that, on average, during the first two years of owning a company private equity managers cut one in seven staff, reduced wages and raised prices in a process financiers call ‘margin expansion’. Senator Warren says: ‘Washington has looked the other way while private equity firms take over companies, load them with debt, strip them of their wealth, and walk away scot-free – leaving workers, consumers, and whole communities to pick up the pieces.’

Workers lose out, investors make little gain. Only the PE companies suck up more. Hedge fund tycoon Cooperman concludes that PE funds are increasingly a Ponzi scheme: “What you see is that the vast majority of deals currently are being done between private equity firms. One private equity firm will sell to another who is happy to pay a high price as they have attracted a lot of investors. The bulk of deals are like this. I think private equity is a scam. They’re getting very fancy fees for sitting on your money.”

The largest private equity firms

Yet the private equity vampires remain ubiquitous and gorging on yet more surplus value blood. Private equity group Blackstone now has over a trillion dollars of assets under management and employs around half a million people around the world. Of the top 20 private equity companies, 17 are from the US.

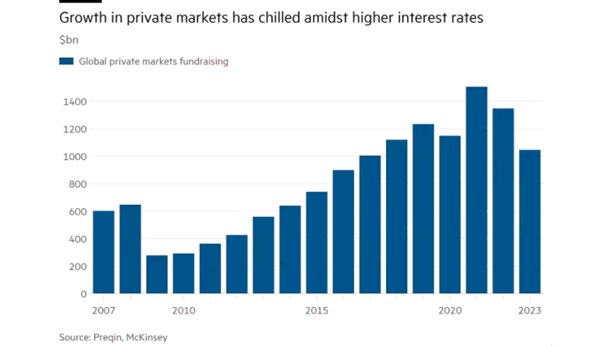

The boom in private markets since the 2007-2009 financial crisis has been huge, mainly relying on very low interest rates to rack up debt on the companies purchased. After central banks around the world slashed interest rates to near zero in response to the 2008- 009 financial crisis, private equity embarked on its longest and most powerful boom. In 2021, the market’s zenith, a record $1.2tn in deals were struck, according to PitchBook data.

Struggling small companies are prey for the vampires

Economic slumps provide fresh blood for these vampires as small companies struggle in recessions. In 2008-9 slump and in the pandemic slump, private equity firms announced ‘approaches’ to more than twice as many listed companies as they had ever done previously. And private equity company, Bain Capital’s managing partner John Connaughton commented: ‘One of the most productive periods for us was after the global financial crisis.”

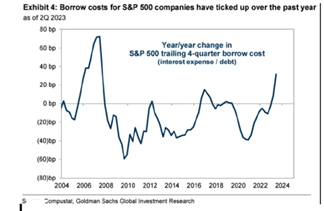

But now a series of rapid interest rate rises since 2022 has dried up much of the fresh blood that vampire PE funds need and many private-equity-backed companies are saddled with large debts and face much higher interest costs. Default rates are picking up and lenders are increasingly taking control of creditor companies at the expense of equity owners.

In recent months, KKR, Bain Capital, Carlyle and Goldman Sachs have lost control of several businesses that they backed. Brian Payne, an analyst of private equity deals at BCA Research, says “The risk of capital loss is higher than it’s ever been, even when you go back to the 2007 or the 2008 vintages. The longer the higher-rate environment persists, the higher the risk of capital loss.”

Private equity drawdown vehicles usually have seven to 10-year lives. So the consequences could play out over several years as funds struggle to raise successor funds, if unable to persuade their existing investors to pony up again. Less money raised will lead to lower fee income. Some funds may just decide to throw in the towel and wind down.

Private equity has increased company debt levels

In the meantime, the private equity vampires have infected whole swathes of companies with debt. A recent Gartner survey found that 24% of small-cap and midcap businesses have far greater debts than their earnings before interest, taxes, depreciation and amortization (EBITDA). Thirty-seven percent of small-cap, midcap and large-cap companies say that interest payments account for more than one-fifth of their cash flow. Furthermore, the number of companies that admit missing debt payments surged by 80% from 2022 to 2023.

Over the last two decades, the vampires of private equity have gorged themselves on the profits of labour in the companies they have sweated, while avoiding sharing those profits with their investors or with governments through taxation. They engage in various forms of ‘financial engineering’ to increase their gains. And in doing so, they have leveraged key sectors of the economy into huge debt, at the expense of productive investment. Now rising debt servicing costs are adding to the risk of a major financial crash, acting as a stake through the heart of many of these vampires.

From the blog of Michael Roberts. The original, with all charts and hyperlinks, can be found here.

Why nations succeed or fail: a Nobel cause - By Michael Roberts Daron Acemoglu, Simon Johnson and James A Robinson have been awarded the Nobel (really the Riksbank prize) in economics “for studies of

Why nations succeed or fail: a Nobel cause - By Michael Roberts Daron Acemoglu, Simon Johnson and James A Robinson have been awarded the Nobel (really the Riksbank prize) in economics “for studies of TV review: the 1984 plot to kill Margaret Thatcher - By Mark Langabeer, Hastings and Rye Labour Party member The BBC recently broadcast a programme on the attempt by the IRA to assassinate Margaret Thatcher

TV review: the 1984 plot to kill Margaret Thatcher - By Mark Langabeer, Hastings and Rye Labour Party member The BBC recently broadcast a programme on the attempt by the IRA to assassinate Margaret Thatcher October 1944: Baltic States re-occupied by Soviet Union. - The latest in a series of articles by Andy Ford on 80-year anniversaries of WW2 events in the USSR and Eastern Europe. ******** From September

October 1944: Baltic States re-occupied by Soviet Union. - The latest in a series of articles by Andy Ford on 80-year anniversaries of WW2 events in the USSR and Eastern Europe. ******** From September Measuring Global poverty - This article is from Michael Roberts’s blog The Next Recession and can be seen here. [featured photo from https://pppp.my/extreme-poverty.html] ******** To track progress towards its

Measuring Global poverty - This article is from Michael Roberts’s blog The Next Recession and can be seen here. [featured photo from https://pppp.my/extreme-poverty.html] ******** To track progress towards its USA – why did the dockworkers’ strike end? - By Richard Mellor in California This was a question some workers asked me and it’s a good question indeed. Firstly, they didn’t end the strike

USA – why did the dockworkers’ strike end? - By Richard Mellor in California This was a question some workers asked me and it’s a good question indeed. Firstly, they didn’t end the strike